So, where next for the Old Continent's leading currency? Its position is precarious, and a focus of today's Alert. In the hunt for more profits, we've shortlisted two new opportunities - new trading decisions may not lagging too far behind. Let's dive into the setups.

In our opinion, the following forex trading positions are justified - summary:

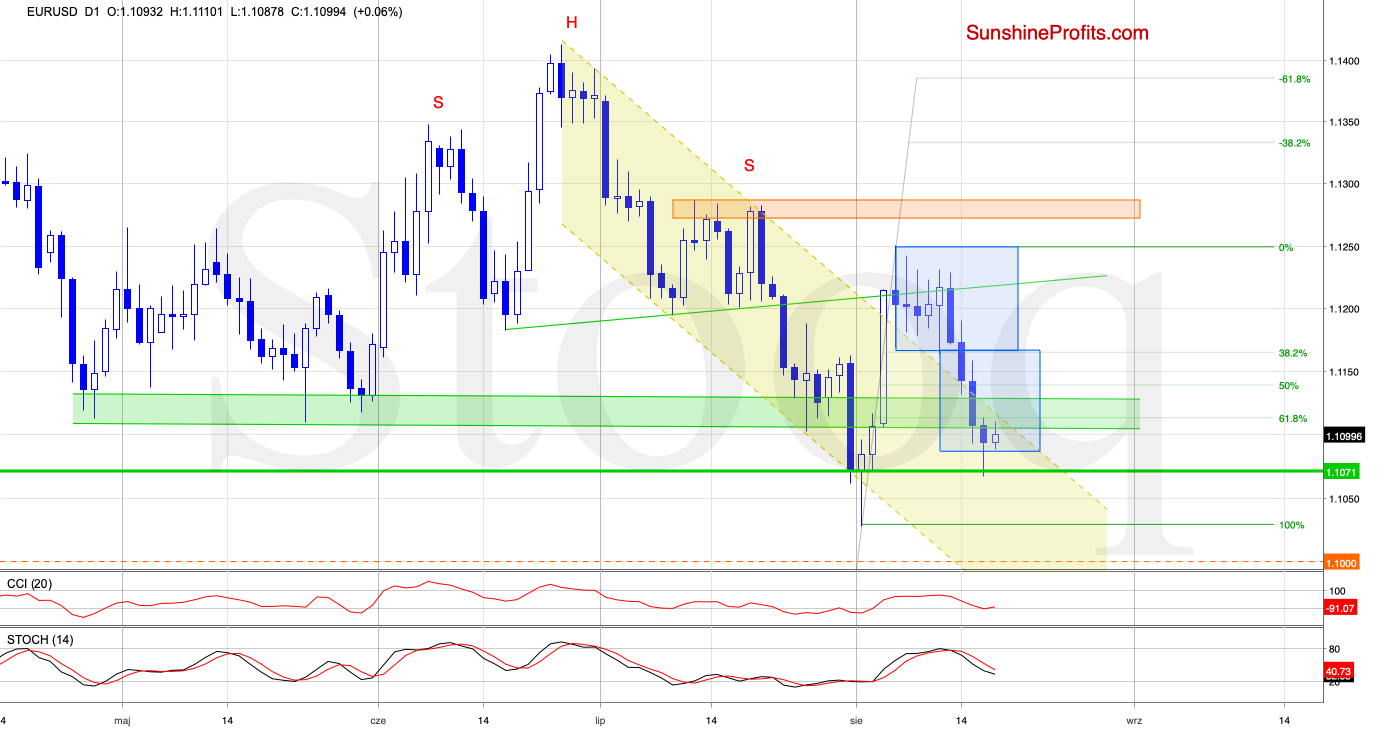

EUR/USD

EUR/USD broke below the green support zone on Friday, and tested the green support horizontal line based on the late-July and early-August daily opening and closing lows.

Thanks to this drop, the pair also slipped to the area where the size of the downward move corresponded to the height of the previous blue consolidation, which encouraged the bulls to act.

The pair rebounded and closed Friday's session above the green line, invalidating the earlier tiny intraday breakdown below this support. This positive event triggered further improvement earlier today and EUR/USD came back to the previously-broken green area.

Testing this resistance could merely be a verification of the earlier breakdown below it - especially when we factor in the sell signals of the daily indicators.

As long as the pair is trading below this zone, another attempt to move lower can't be ruled out. Should we see such price action, the sellers could test the early-August intraday low or even the psychologically important 1.1000 this week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

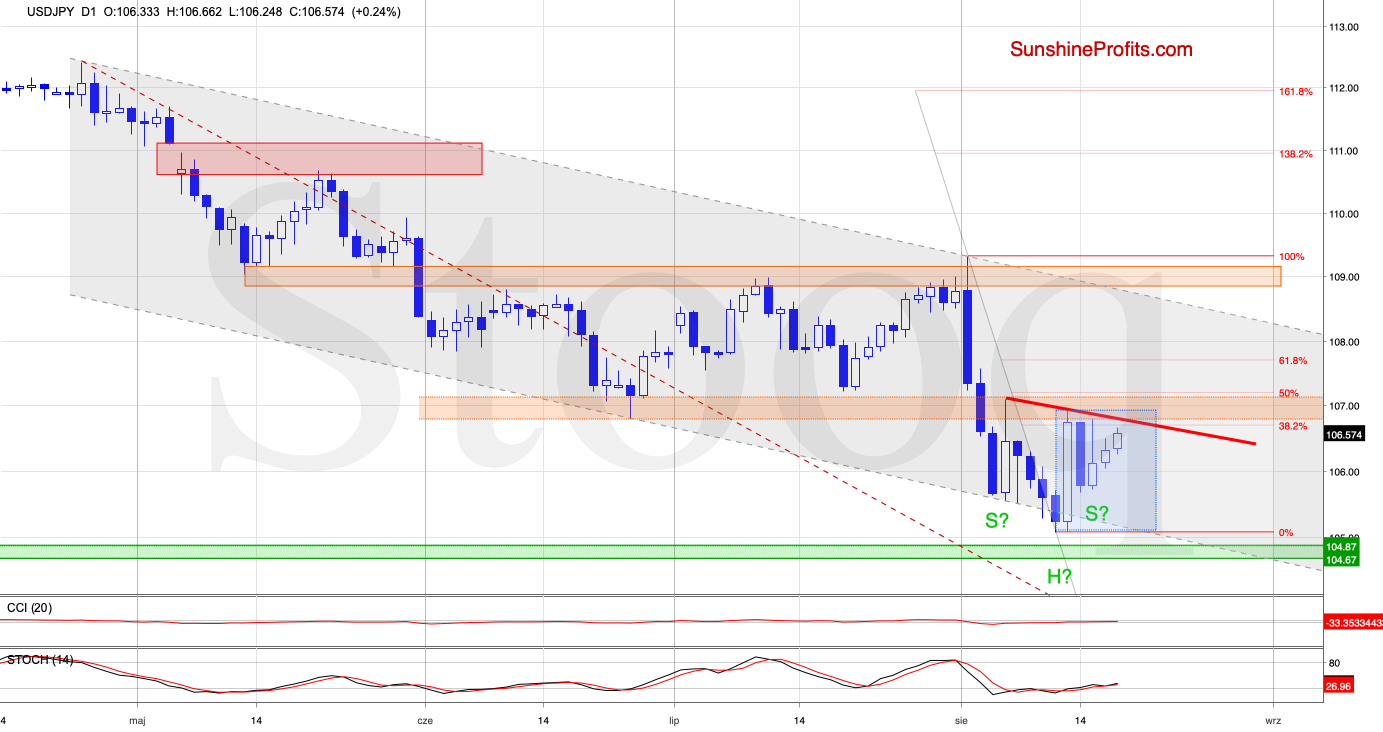

USD/JPY

USD/JPY pulled back after unsuccessful attempt to break above several resistance levels. The bulls were stopped by the previously-broken June lows, the earlier peak and the 38.2% Fibonacci retracement. The bulls didn't give up however, and took the exchange rate higher in recent days.

Earlier today, we saw another upswing. It suggests that we'll see a test of the red declining resistance line based on the previous peaks soon. This resistance could be a neckline of a potential reverse head and shoulder formation - successful breakout both above the neckline and the above-mentioned orange resistance zone could open the way to the north.

Additionally, the current position of the daily indicators suggests that the bulls are likely to see them flash buy signals in the very near future. This increases the probability of an upward move in the coming days. Should we see USD/JPY breaking above these resistances, we'll consider opening long positions.

Nevertheless, as long as there is no breakout above the orange resistance, a bigger move to the upside is not likely to be seen and opening any positions is therefore not justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

Although USD/CHF extended gains in previous days, the overall situation in the short term hasn't changed much. The exchange rate is still trading inside the blue consolidation between the green support zone and the orange resistance area reinforced by the 50% Fibonacci retracement.

As long as there is no breakout above these nearest resistances, another bigger move is questionable - but should we see bulls' strength and such a breakout, we'll consider going long.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the euro opened on a weak note on Friday, yet stabilized later in the day. While the bulls attempted to move higher earlier today, their gains have shortly evaporated. We keep watching USD/JPY and USD/CHF for signs of the bulls' strength and a break above their respective resistances in order to possibly open long positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist