Like a freight train getting in motion, the euro also looks to be starting its move. This is not without consequences, as we're keeping a close eye on the breach of several key chart features - that would make us pounce on the opportunity like a tiger. What else do we see across the currencies? For instance, our AUD/USD position continues doing well. See the rich details below.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7113; the downside target at 0.6935) ; the downside target at 0.6925)

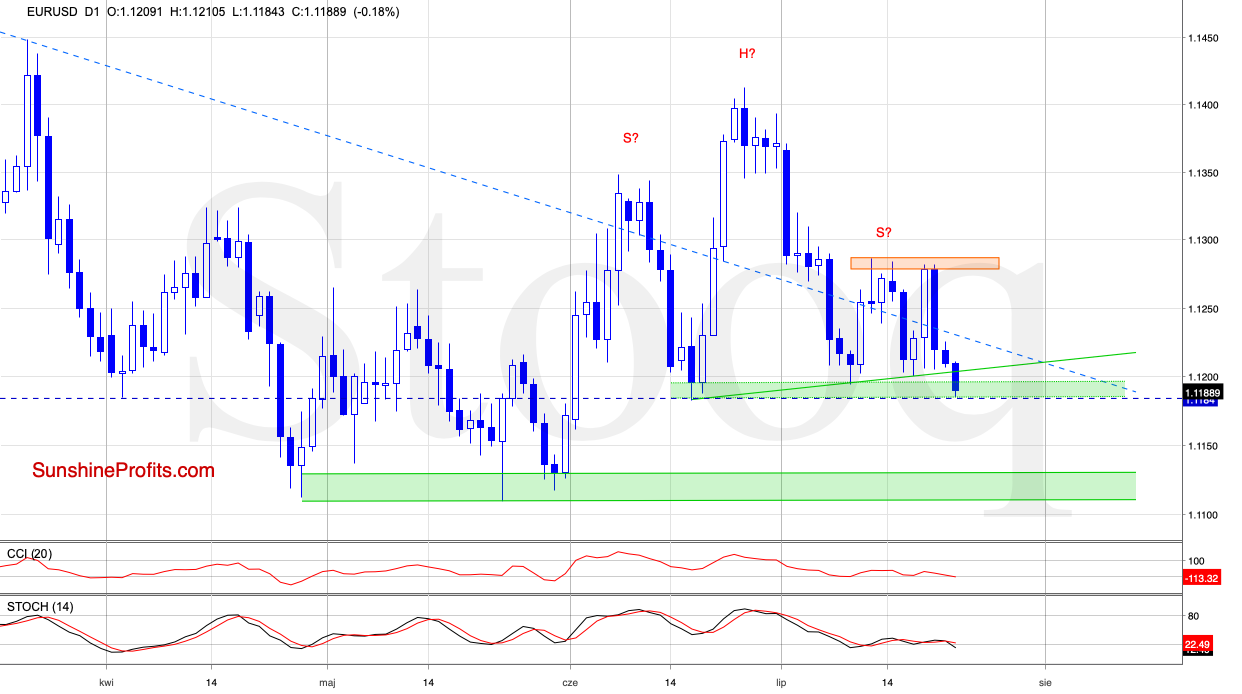

EUR/USD

The first thing that catches the eye on the above chart is the breakdown below the green support line. This line also serves as the neckline of a potential head and shoulders formation. This is a bearish development, suggesting further deterioration.

However, bearish price action will be more likely and reliable only if the pair closes today's session below this green line, with the bears taking the exchange rate also below the green support zone based on the previous lows. Until then, another rebound from this area - similarly to what we have seen in recent weeks - can't be ruled out.

Please note that should we see a daily close below the above-mentioned supports, we'll likely reopen short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

GBP/USD

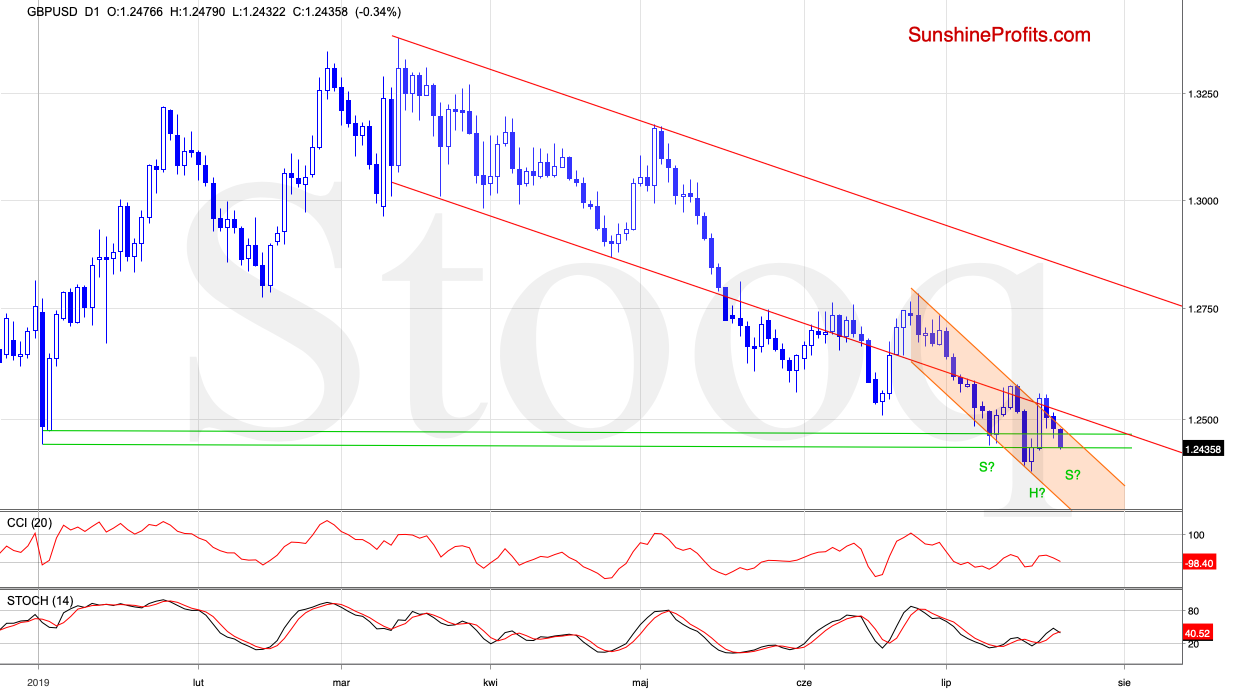

We wrote these words in our Friday's commentary regarding the Thursday's upswing:

(...) The bulls pushed the cable even higher yesterday, testing the previously-broken lower border of the declining red trend channel. Although this is a positive development for the buyers, we have already seen similar price action earlier this month, and the way it resolved to the downside.

Back then, the bulls didn't manage to hold gained ground, and another decline followed. Should the bulls be unable to close the day above this declining lower border, the probability of another bearish resolution increases. The pair would then likely retest the area of both green horizontal support lines, or even visit this week's lows.

GBP/USD has indeed moved lower after its tiny intraday breakout above the lower border of the declining red trend channel has been invalidated. In process, the pair also invalidated the earlier breakout above the declining orange trend channel. This doesn't bode well for higher values down the road.

Earlier today, the pair tested the green support area marked with two green horizontal lines, suggesting that a test of last week's lows is just around the corner. Should the bulls however stop the bearish onslaught, the possibility of a reverse head and shoulders formation arises - it would carry consequences only if GBP/USD breaks above the recent peaks and both borders of the above-mentioned channels, however.

Trading position (short-term; our opinion): No positions with are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

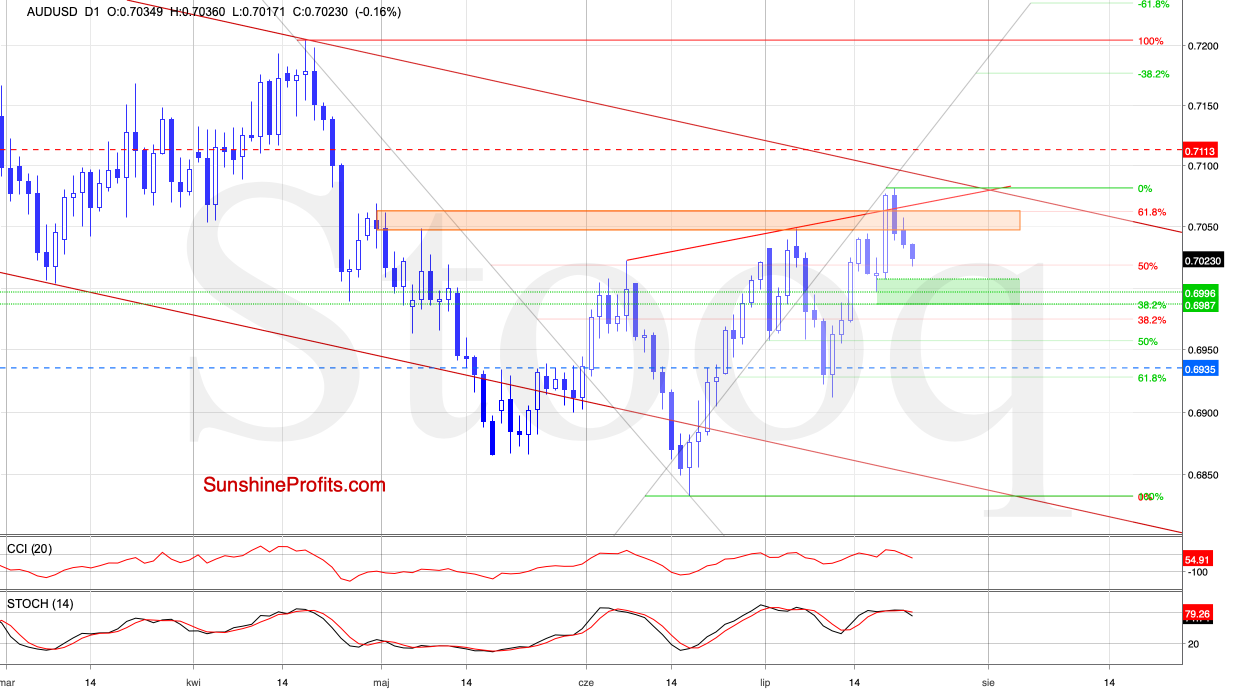

AUD/USD extended losses in recent days, making our short positions even more profitable. As the pair came back below the orange resistance zone and invalidated Friday's breakout above this area, further deterioration is probably just around the corner. This conclusion is supported by the sell signals of the daily indicators.

Should the situation develop in tune with the above scenario, AUD/USD will as a minimum test the green support area based on the 38.2% Fibonacci retracement and last week's low (at around 0.6987-0.6996) in the coming days.

Trading position (short-term; our opinion): Already profitable short positions with a stop-loss order at 0.7113 and the next downside target at 0.6935 are justified from the risk/reward perspective.

Summing up the Alert, EUR/USD is in the process of breaking below important supports, and should we see the bears closing the day below them, we'll consider opening short positions. AUD/USD downswing continues, and the daily indicators together with the invalidation of recent breakouts support a downside move. Therefore, the short position is justified. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist