It looked like the currencies are taking a breather yesterday. It looked like they're digesting recent moves. Instead, we've seen quite an action across the board. It's that interesting and serious in its implications that it has made us take action to profit on these moves. Have we just used a plural, as in "moves"? Indeed, we're talking more than one promising opportunity here.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (20% of already existing positions) (a new stop-loss order at 1.1219 and the next downside target at 1.1075)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions) (a new stop-loss order at 0.7070; the next downside target at 0.6960).

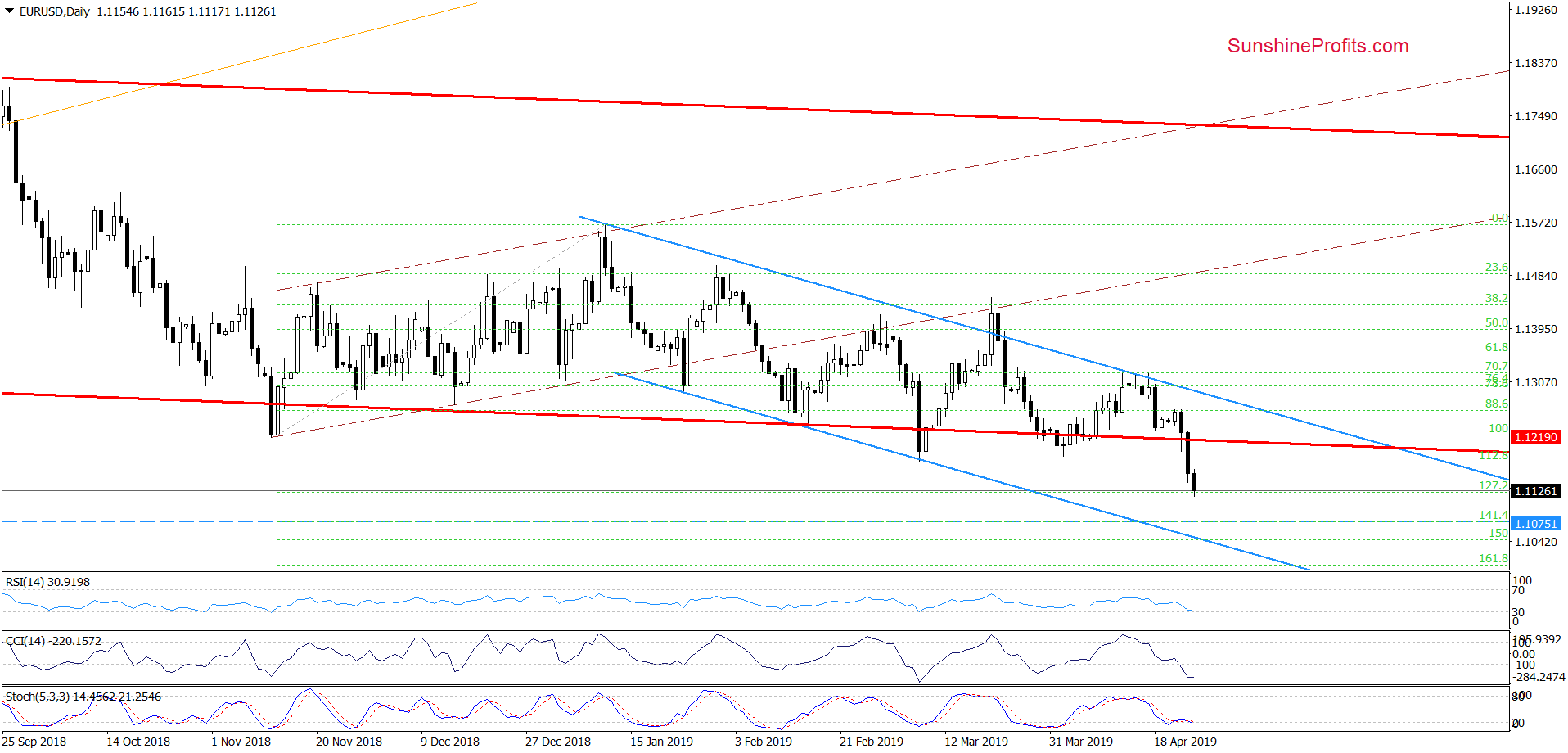

EUR/USD

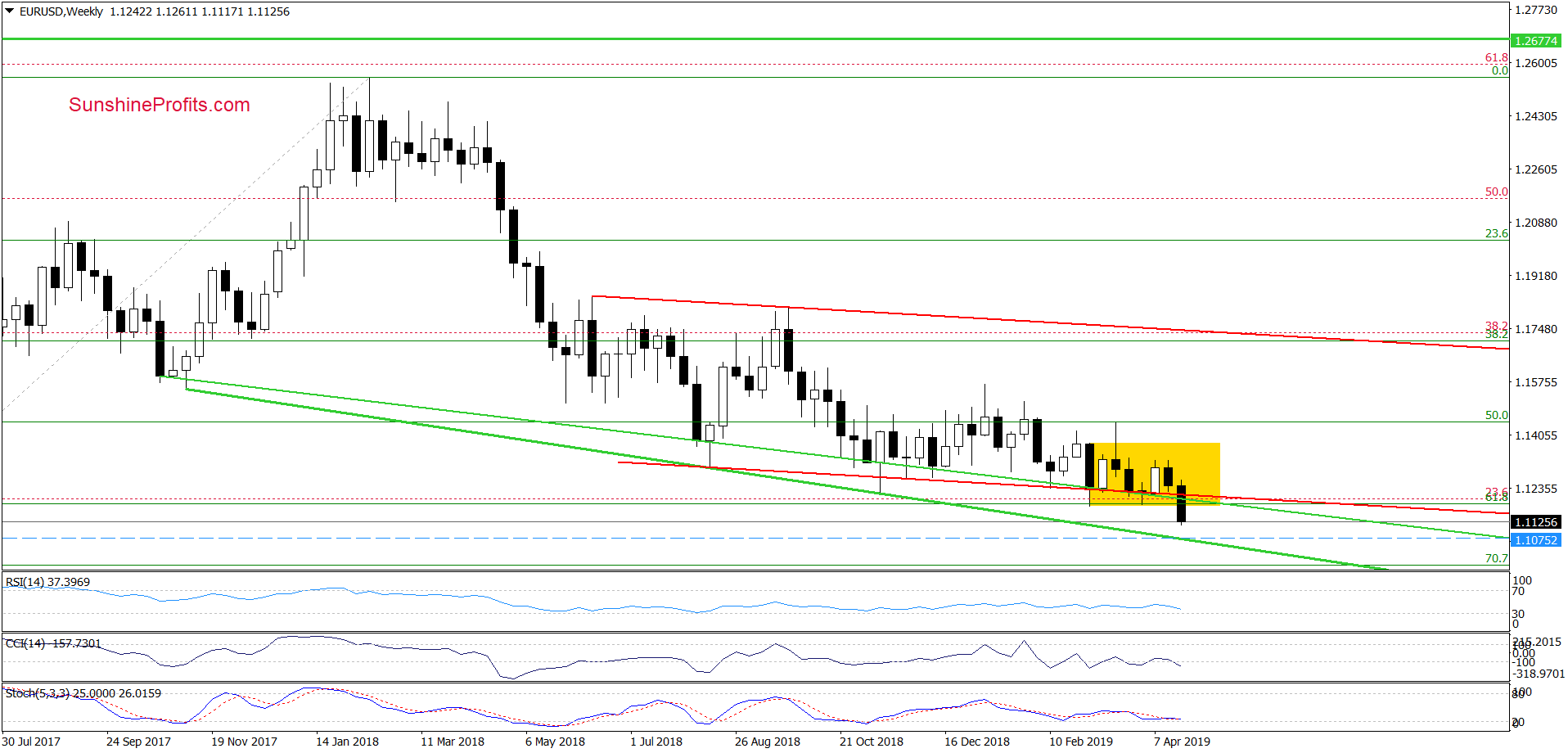

The daily chart shows that EUR/USD has moved sharply lower during yesterday's session. It broke below important supports such as the lower border of the red declining trend channel or the previous lows on the daily chart. Scrolling down to the weekly chart below reveals that the long-term green support line has also been broken.

Earlier today, the pair further extended losses. It suggests a likely drop below the 127.2% Fibonacci extension. That would open the way to the next Fibonacci extension at around 1.1075. In that area, there's one more support (shown below on the weekly chart) - the long-term green support line that is based on three previous lows.

Taking the above fact into account, we decided to move our target and stop-loss order lower. This step will protect more of our open profit. All details can be found below.

Trading position (short-term; our opinion): 20% of profitable short positions with a new stop-loss order at 1.1219 and the next downside target at 1.1075 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

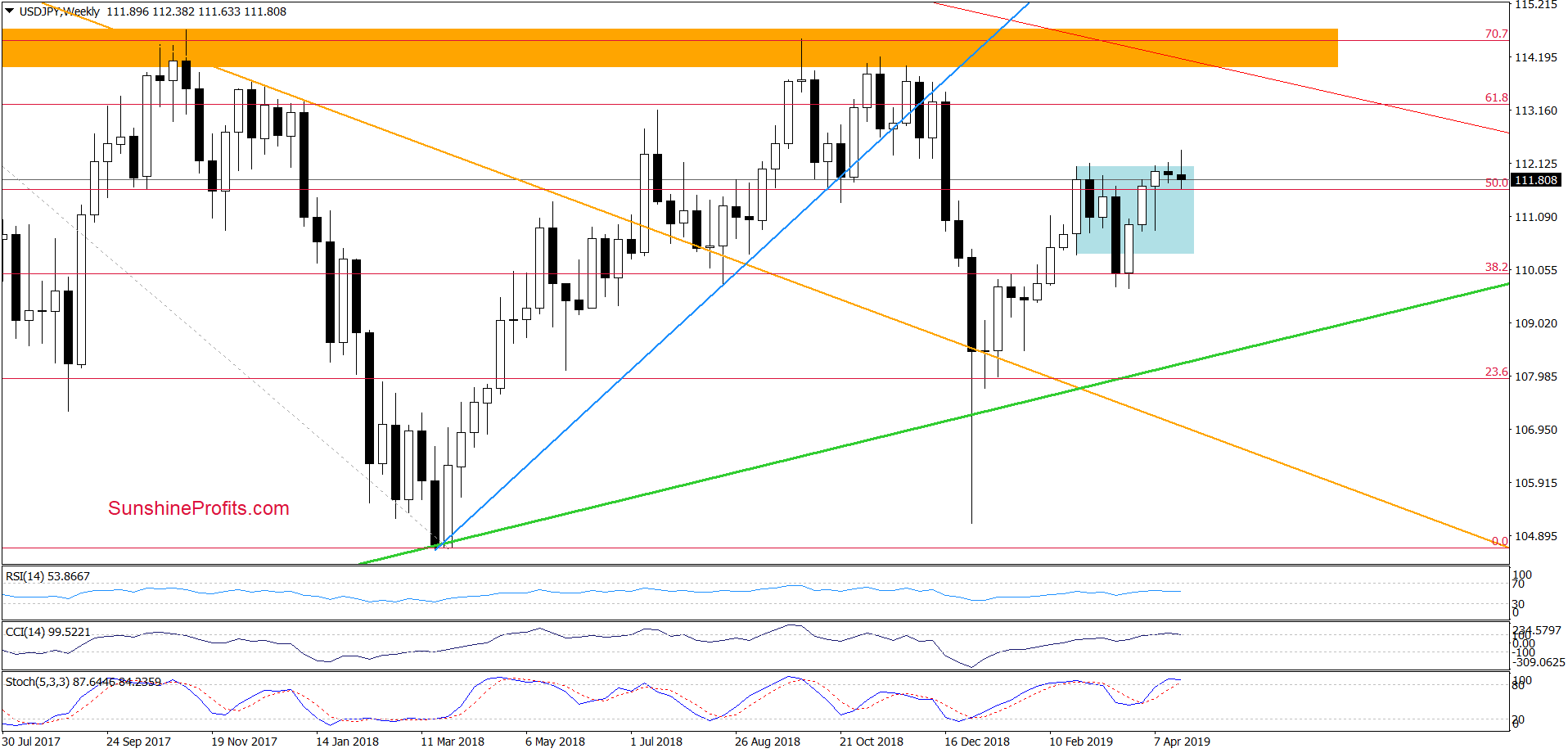

USD/JPY

Let's start with the weekly perspective. USD/JPY had moved above the upper border of the blue consolidation yesterday. This improvement was temporary and the pair gave back much of its gains before the session was over. In the process, it invalidated the earlier breakout above the blue consolidation.

This is a bearish development. It triggered further deterioration and we've just been witnessing that in earlier trading today.

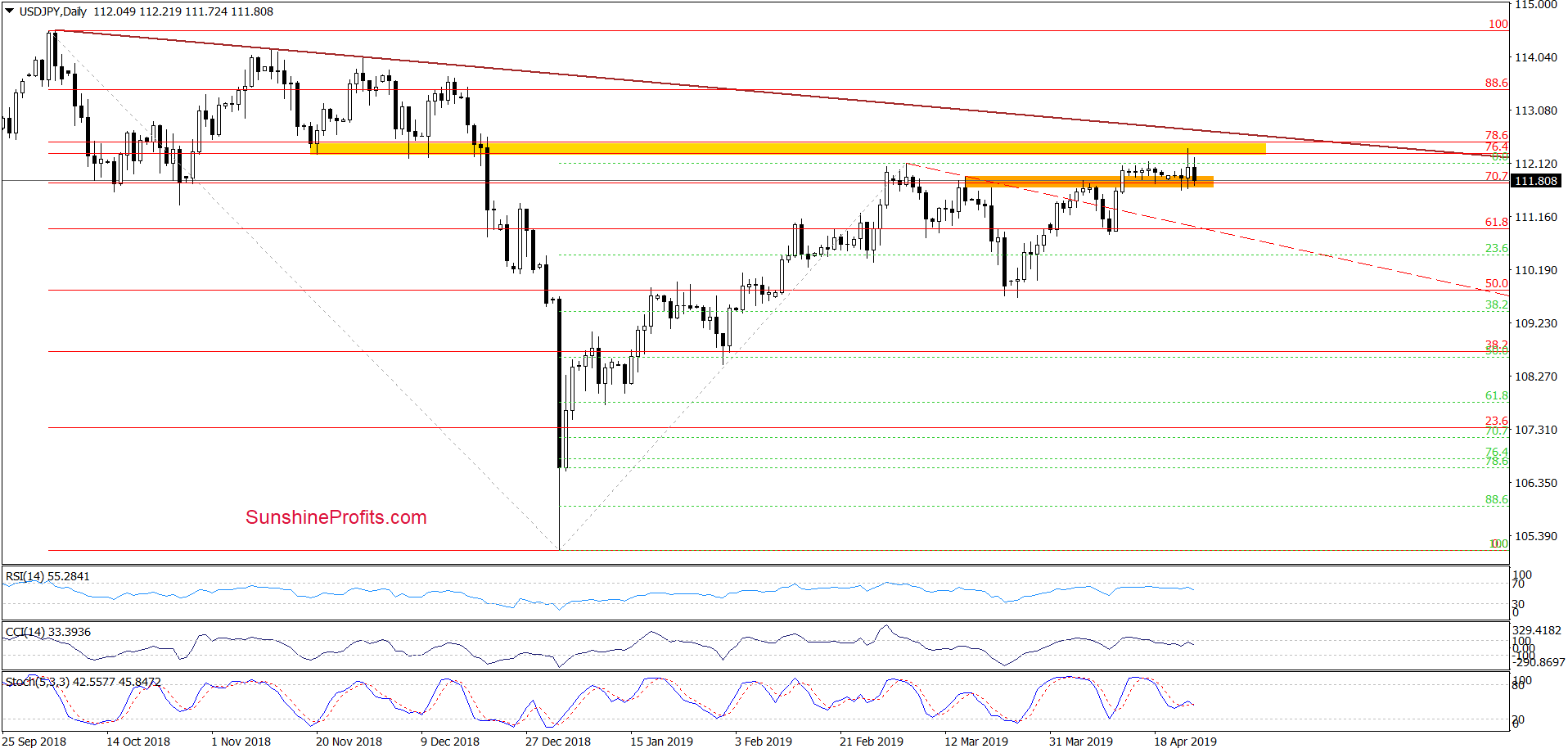

Let's examine the daily chart now and the effects these events have had there.

Although USD/JPY hit a fresh 2019 peak, the yellow resistance area stopped the buyers and a pullback followed. Thanks to this move, the exchange rate slipped to the previously-broken orange zone, which serves as the nearest support.

Now, the question is whether we will see further deterioration. The current position of the daily indicators suggests that lower values of the exchange rate could be just around the corner. However, as long as there is no daily close below the orange resistance-turned-support zone, one more rebound from here can't be ruled out. That would rhyme with what we have seen in recent days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

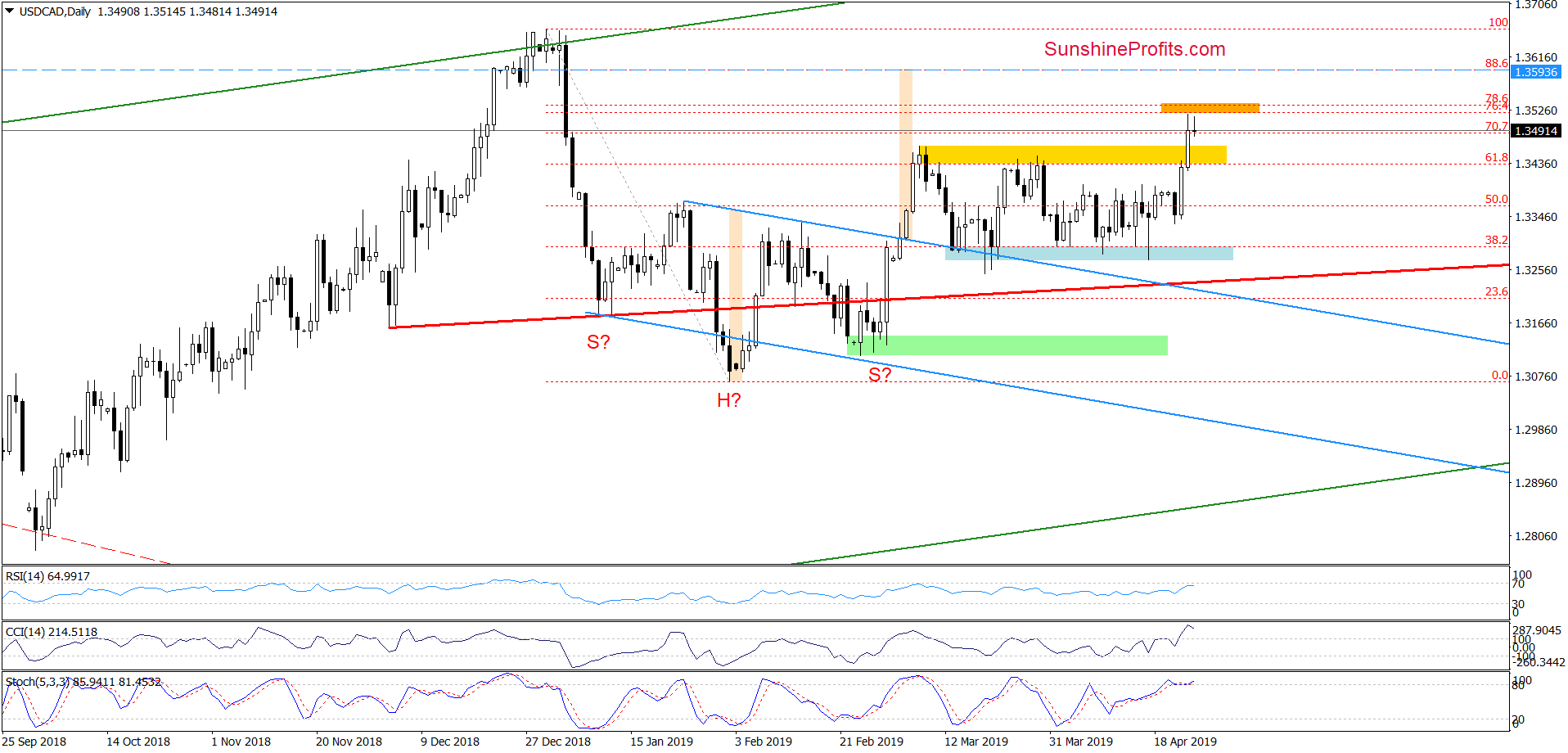

USD/CAD

The daily chart reveals a breakout above the yellow resistance zone. The upswing has reached the orange area created by the 76.4% and 78.6% Fibonacci retracements.

Both the CCI and the Stochastic Oscillator have climbed to their overbought areas. However, as long as there are no sell signals by the daily indicators, one more upswing remains likely.

Therefore, if USD/CAD moves above the orange resistance zone, the next upside target will likely be around 1.3593. This is where the size of the upward move would correspond to the height of the reverse head and shoulders formation that we've conveniently marked for you with appropriate letters on the chart.

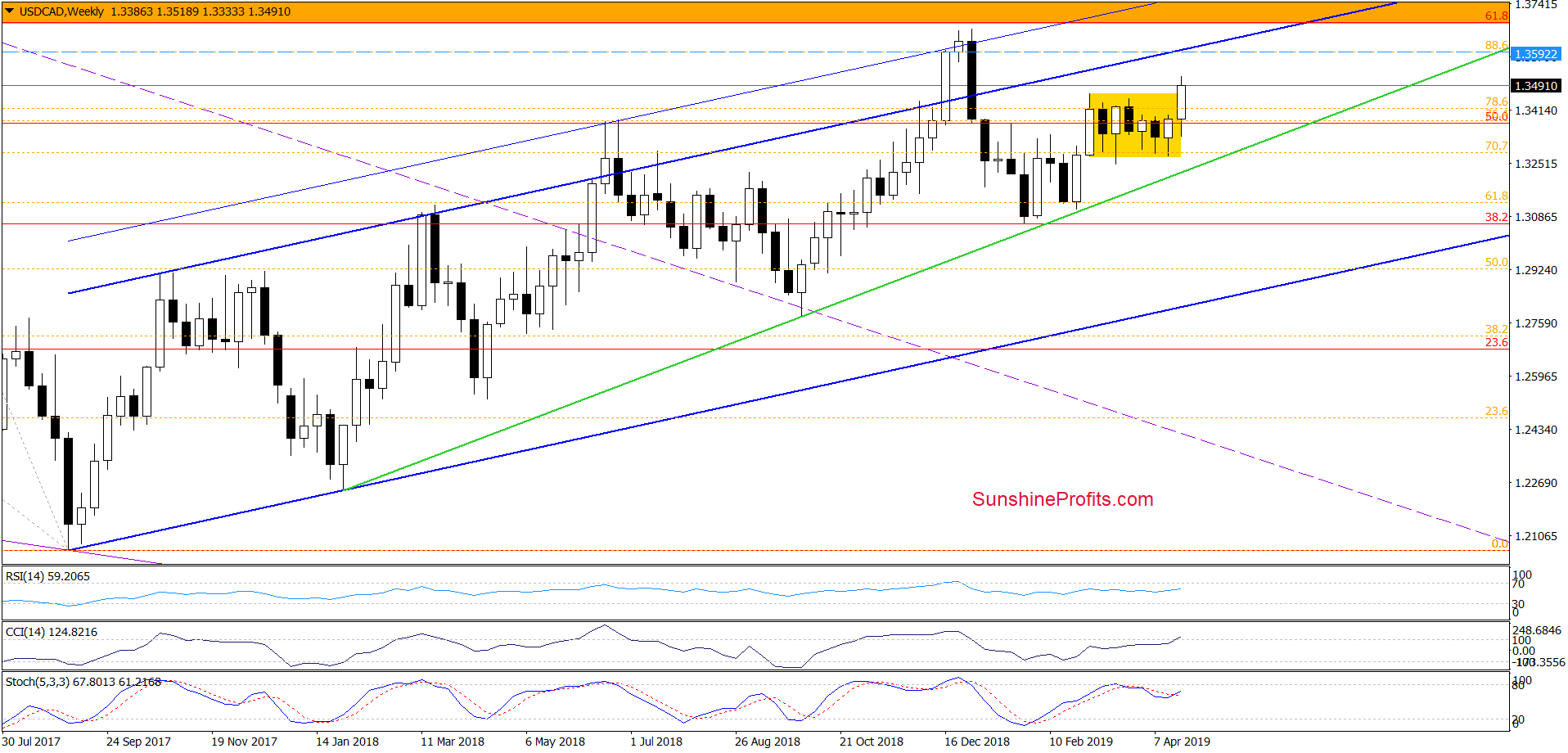

There's one more interesting thing to comment on. This is the area where the bulls will find one more resistance - the upper border of the blue rising trend channel that you can see marked on the weekly chart below.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, instead of a rebound, both EUR/USD and AUD/USD just fell through their strong support levels. This has made us reevaluate the profit potential for the remaining part of both short positions and also to tighten their stop-loss orders in order to protect more of their open profits. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist