Starting yesterday’s Alert, we’ve led in with the seesaw price action in the euro. Today is no exception as the pair is bidding its time. This doesn’t make us complacent but rather reexamine the outlook in light of the most recent developments. There’re many relevant points to express: not only about the euro, but also about the Japanese yen and Canadian dollar. Let’s dive in.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1099; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

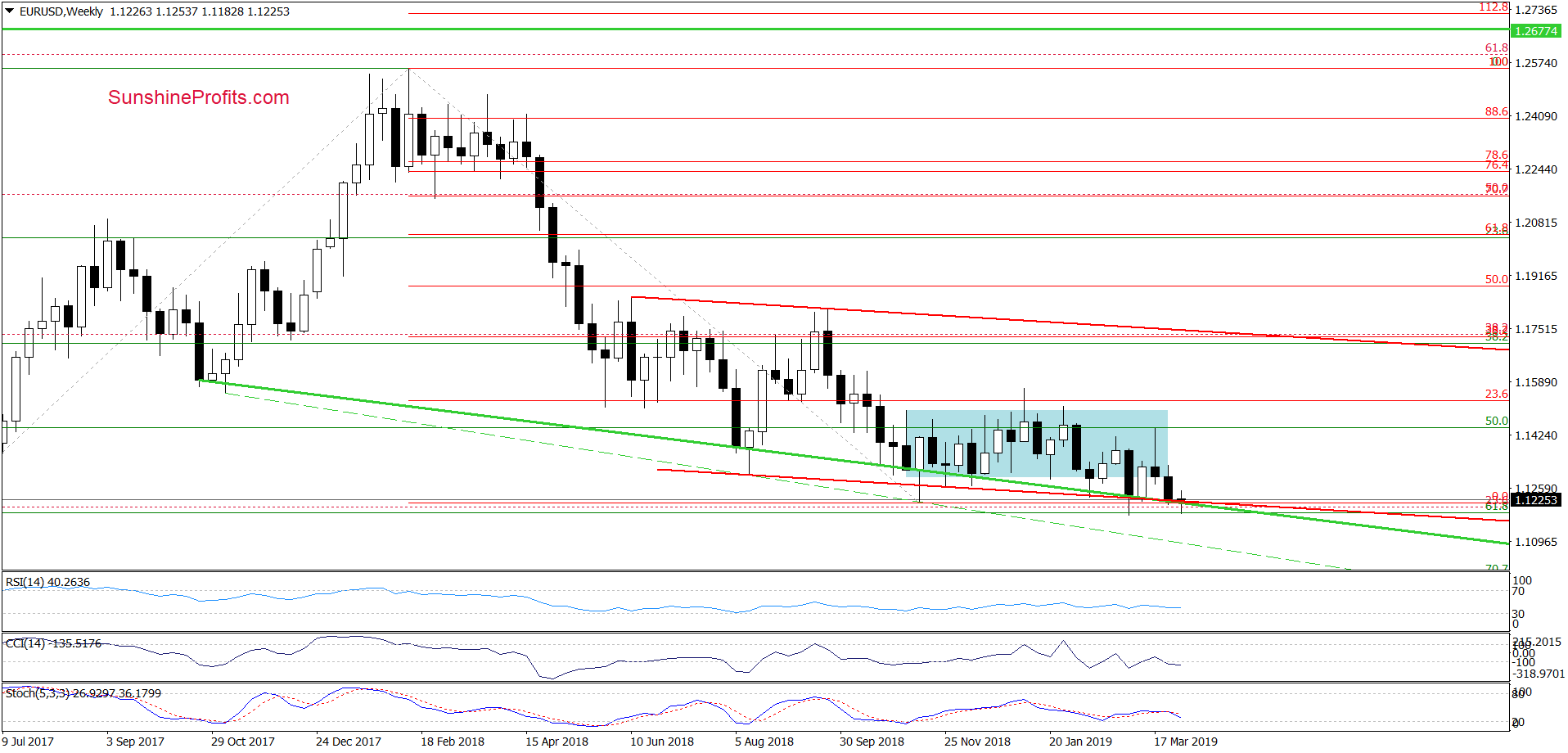

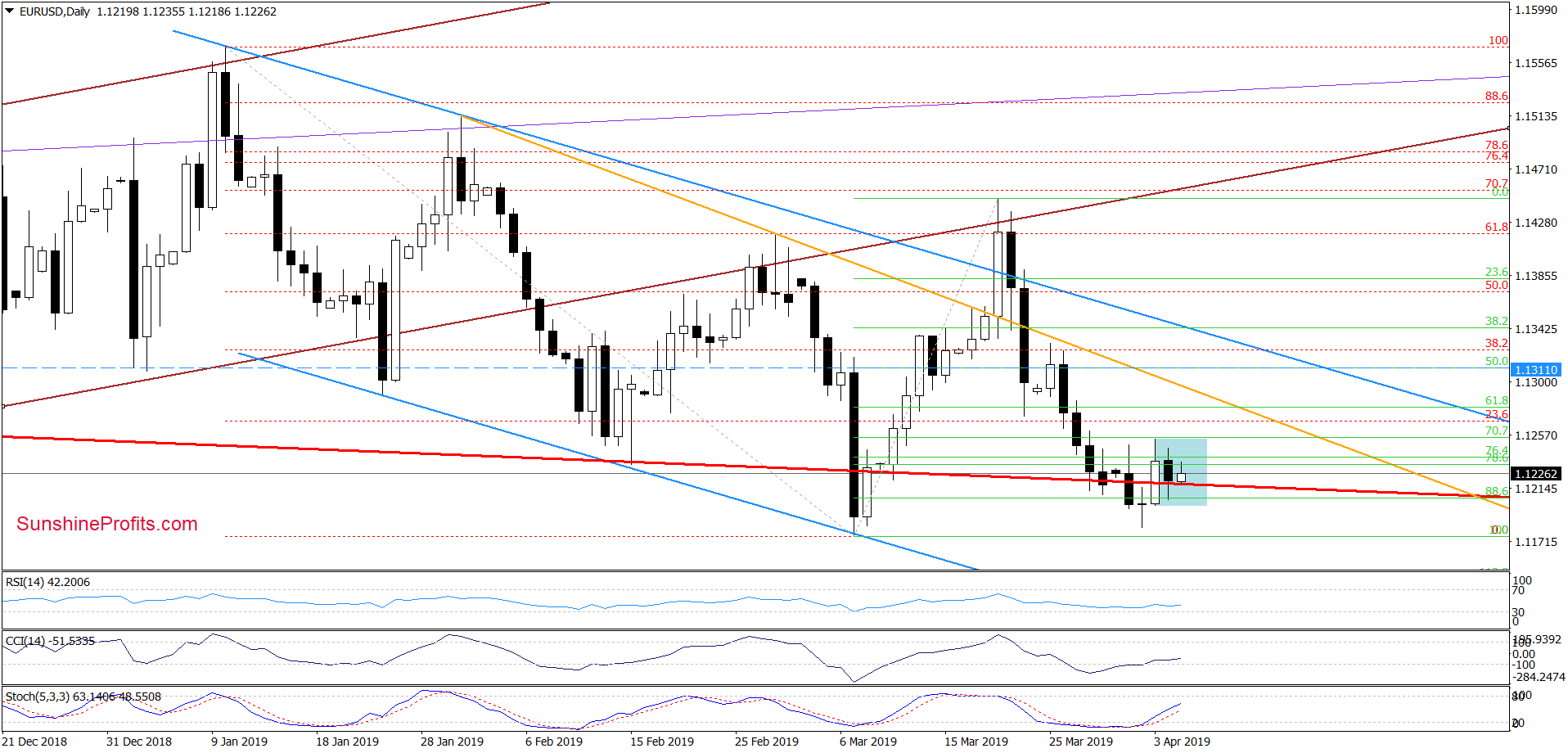

EUR/USD

We wrote these words yesterday:

(…) EUR/USD reversed and declined. The pair came back below the lower border of the red declining trend channel. This breakdown is not confirmed however, as the day is far from being over yet.

Despite this deterioration, the long-term green support line and the buy signals generated by the daily indicators continue to support the buyers. Especially when we take into account the proximity to March lows.

Therefore, in our opinion, another reversal and rebound from this area still remains likely.

The situation developed in line with our assumptions. EUR/USD came back above the lower border of the red trend channel, invalidating yesterday’s small intraday breakdown.

This is a positive event for the bulls, which in combination with the above-mentioned bullish points suggests higher values of the exchange rate in the coming week. This

scenario will be more likely if we see a breakout above Wednesday’s peak, which also marks the upper border of the blue consolidation.

How high can the bulls set their sights? The first upside target would be the declining orange resistance line.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1099 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

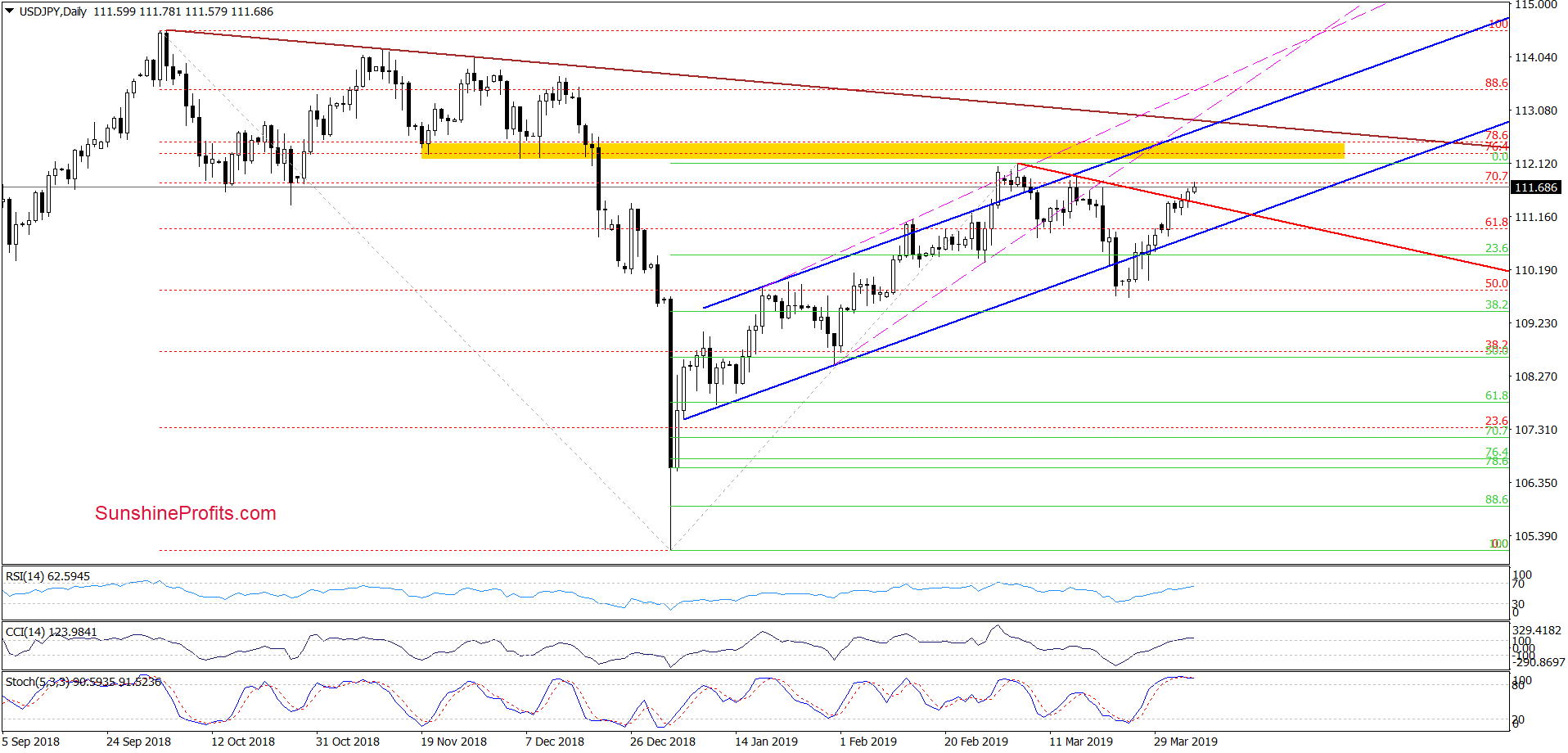

USD/JPY

USD/JPY broke above the red declining resistance line yesterday. This turn of events suggests further improvement - and indeed, the pair is trading higher also today so far.

How high can the bullish tide reach? Let’s quote from our Wednesday’s Alert:

(…) if the bulls manage to close (…) session above (…) (the red declining resistance line), the way to the mid-March highs would be open.

Please keep in mind however, that the CCI and the Stochastic Oscillator moved to their overbought levels, which can translate into a reversal in the coming days. Should we see such price action accompanied by signs of bulls’ weakness, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

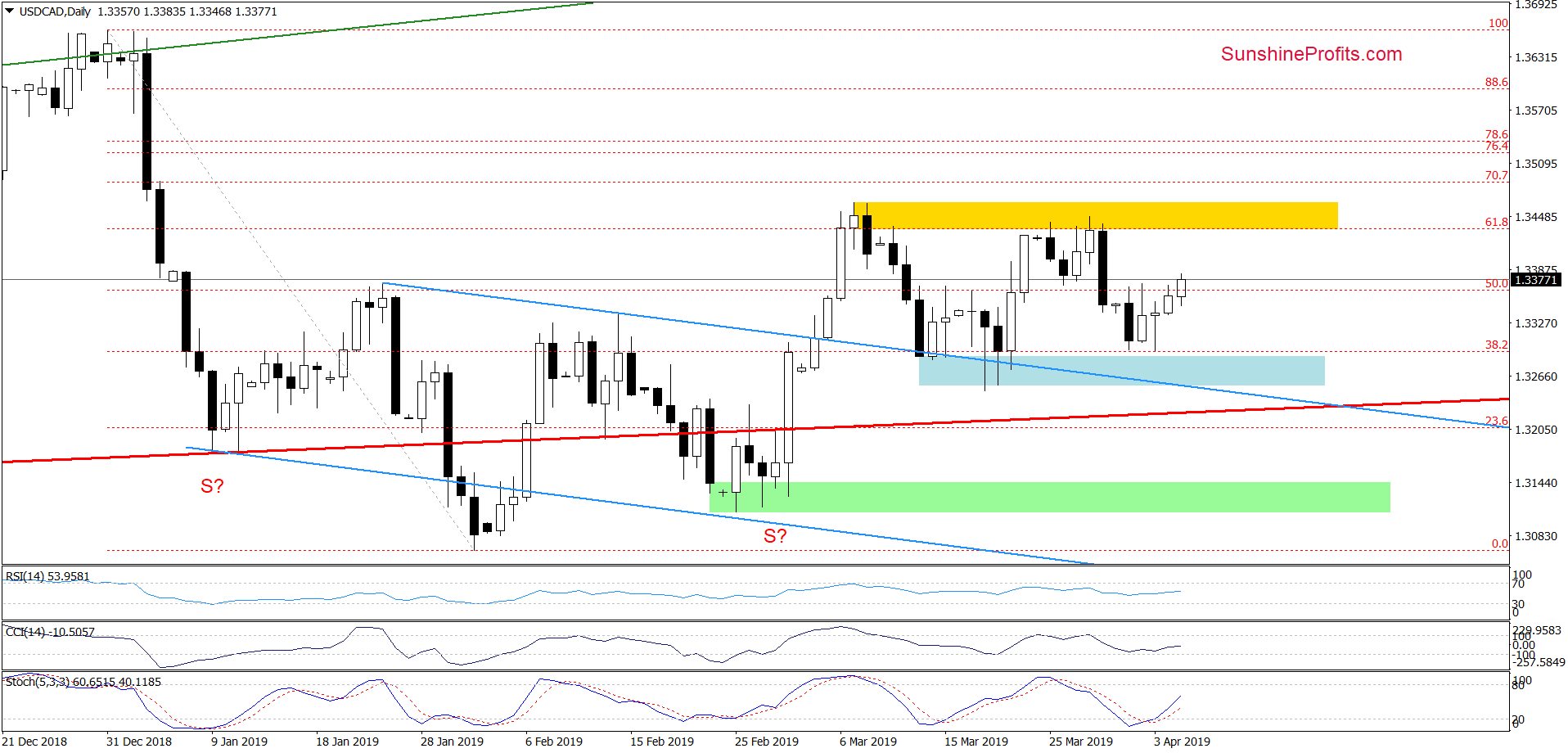

USD/CAD

The pair eventually bounced off the blue support area created by the previous lows. In addition, the CCI and the Stochastic Oscillator generated their buy signals. This suggests further improvement and a test of the yellow resistance zone, which had stopped the buyers several times in March already.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist