The common currency is hanging in a precarious position. Will it make a recovery, or fall to new lows? The British pound has also been unable to stage a meaningful upswing. With all eyes on tomorrow's Powell speech, many currency pairs are bidding their time. Yet, there's one candidate leading the pack in presenting us with a tradable opportunity. Read on to find out which one it is.

In our opinion, the following forex trading positions are justified - summary:

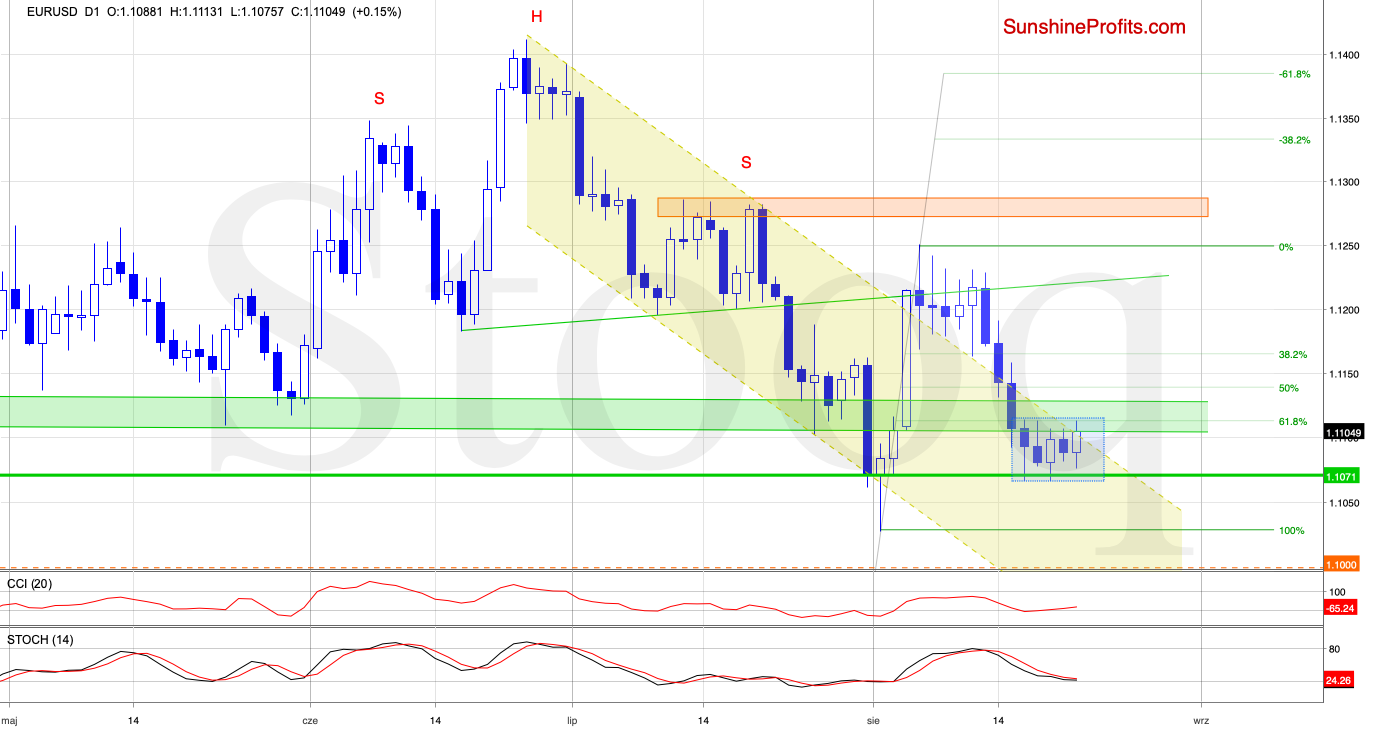

EUR/USD

Earlier today, EUR/USD moved a bit higher once again. Despite this upswing, the exchange rate is however still trading inside the blue consolidation between the green horizontal support line and the green zone based on April and May lows. At the moment of writing these words, the rate is testing the green support line as it trades at around 1.1070 currently.

Let's recall our yesterday's observation:

(...) Meanwhile, the CCI generated its buy signal, while the Stochastic Oscillator is very close to doing the same. These suggest that an upside move may be just around the corner. Nevertheless, as long as there is no breakout above the upper border of the consolidation, or a breakdown below its lower border, higher, or respectively lower values of EUR/USD are not likely to be seen. Short-lived moves in either direction should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

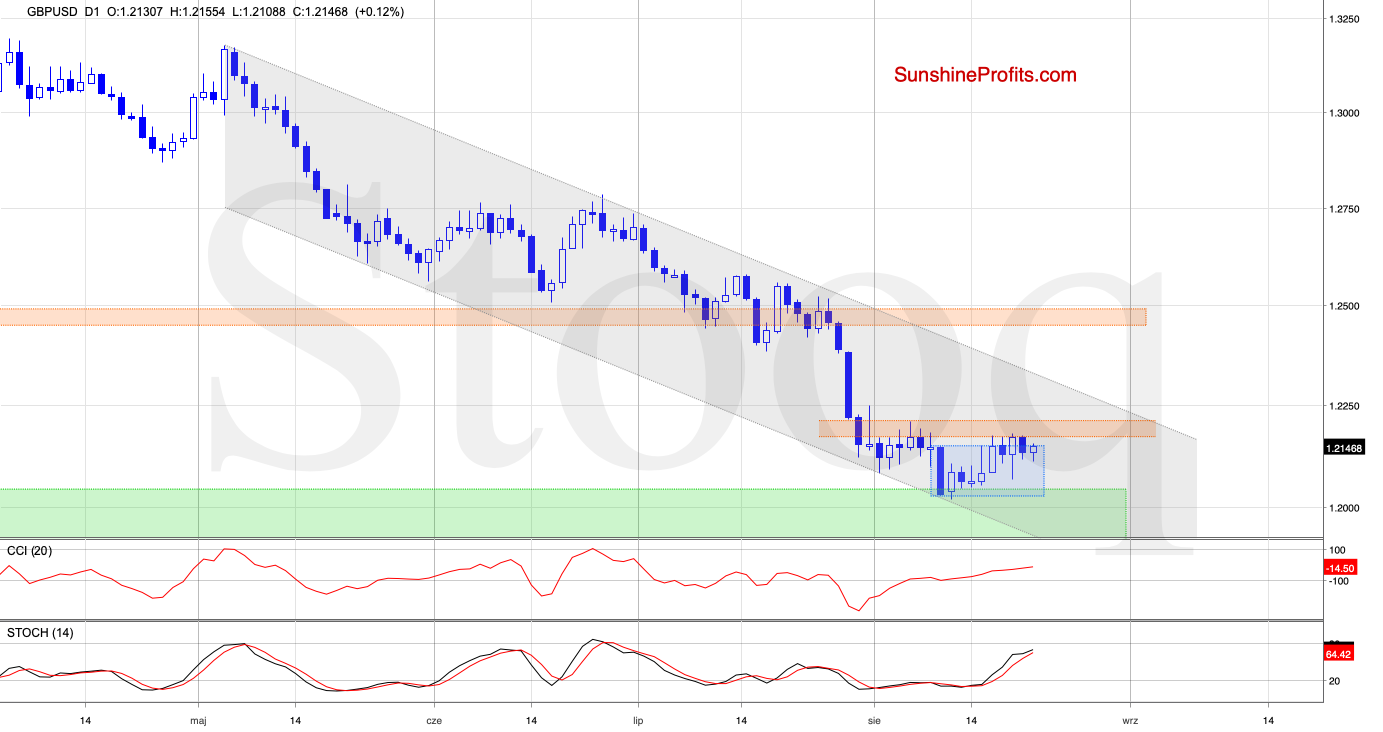

GBP/USD

The daily chart reveals that the bulls still have some trouble breaking above the orange resistance zone. Let's turn to our Tuesday's commentary:

(...) As long as there is no breakout above the upper border of the formation and the orange resistance zone, or a breakdown below the above-mentioned supports, a bigger move in either direction is not likely to be seen. Short-lived moves in both directions should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

The first thing that catches the eye on the daily chart is yesterday's unsuccessful breakdown below the lower border of the rising green trend channel. The bears have tried several times already, and were rebuffed each and every one. It suggests that as long as the sellers do not close today's or one of the following sessions below this support, a bigger move to the downside is not likely to be seen.

Nevertheless, the current position of the daily indicators suggests that another attempt to move lower may be just around the corner. Connecting the dots, if we see a daily close below the green channel, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

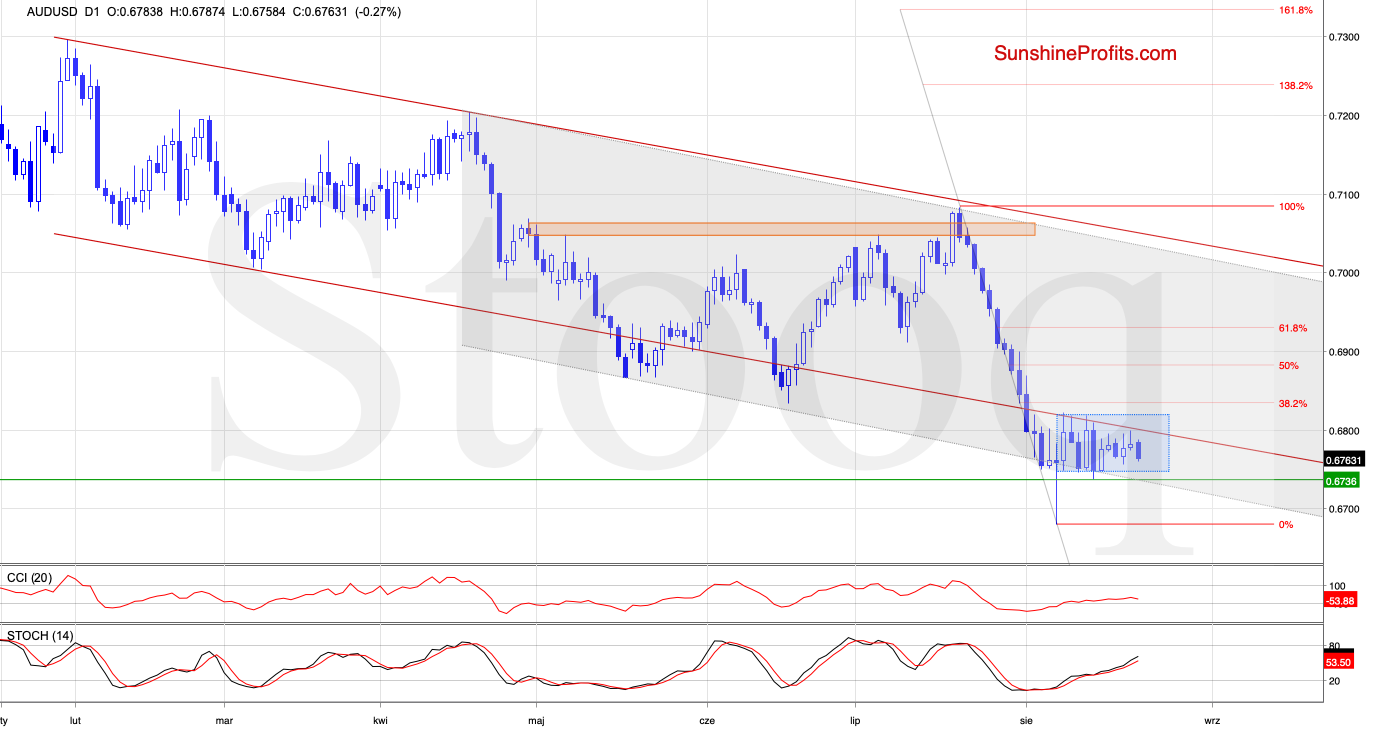

AUD/USD

Since our Tuesday's commentary, the AUD/USD situation overall hasn't changed much. The pair is still trading inside the blue consolidation between the lower border of the declining grey trend channel and the previously-broken lower border of the declining red trend channel, which serves as the nearest resistance.

Let's recall our Friday's commentary - it is up-to-date also today:

(...) the pair is still trading inside the declining grey trend channel and above the early-2019 low. The daily indicators have also just flashed their buy signals, hinting at a possible reversal around the corner.

But as long as there's no breakout above the lower border of the declining red trend channel, a bigger move to the upside is questionable. Therefore, opening long positions isn't justified from the risk/reward perspective.

What could happen if the bulls fail in the above-mentioned support area? Then, further deterioration and even a test of the green support zone seen (created by the late 2008 and early 2009 lows) would lie ahead.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the EUR/USD upswing has given way to a test of the green support line, with the pair still trading inside its recent consolidation. There have been no signs of the USD/JPY and USD/CHF bulls' strength and a break above their respective resistances that would justify possible long positions. GBP/USD also continues to keep us on the sidelines. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist