It might look to some as a seesaw action. One day, the euro is up, only to see it retracing most of its gains just like earlier today. Instead of concentrating on the daily fluctuations, the key question to ask is: does it change the outlook? Are we getting new information from the charts, or not really? Let’s get you updated on the developments throughout the currencies realm right now.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1099; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

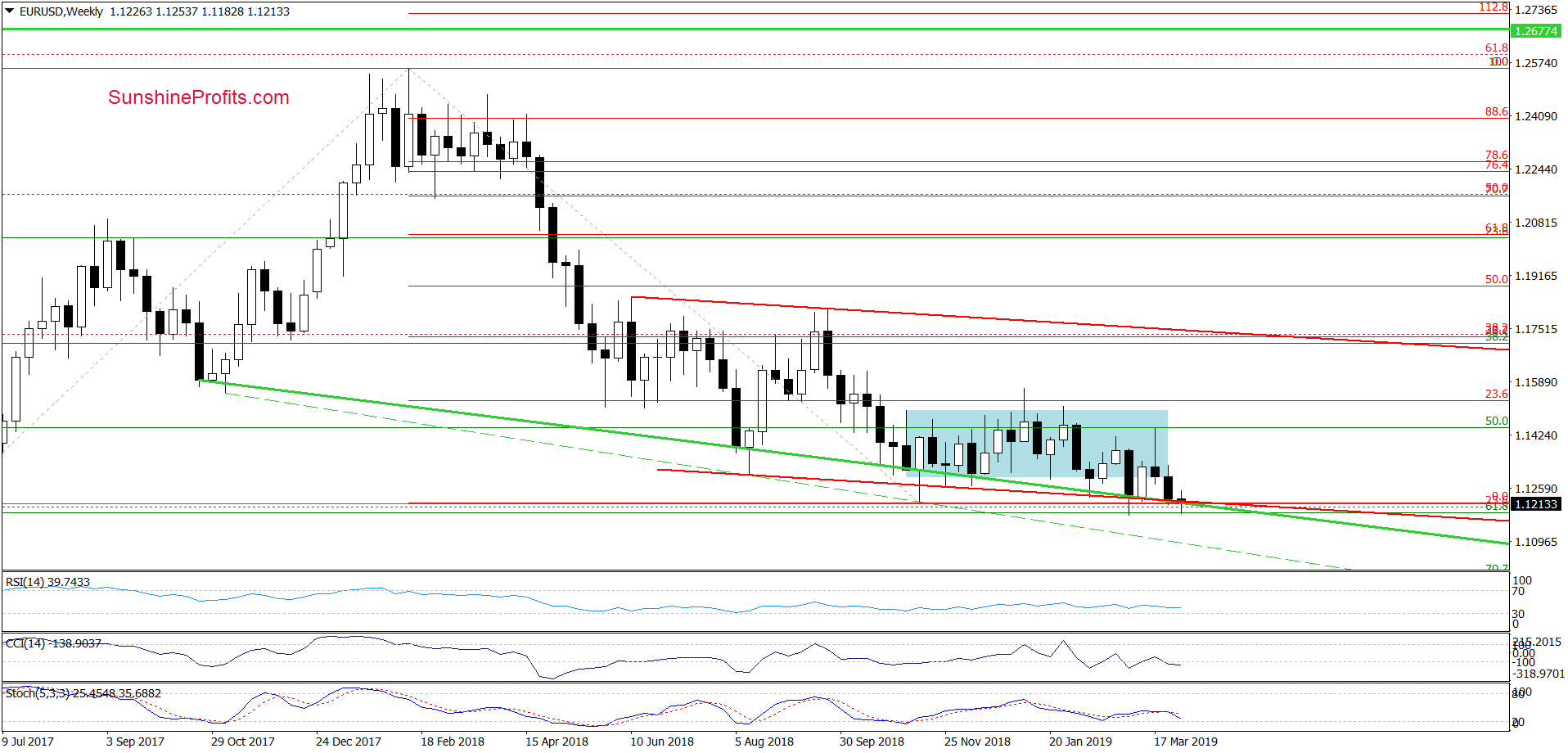

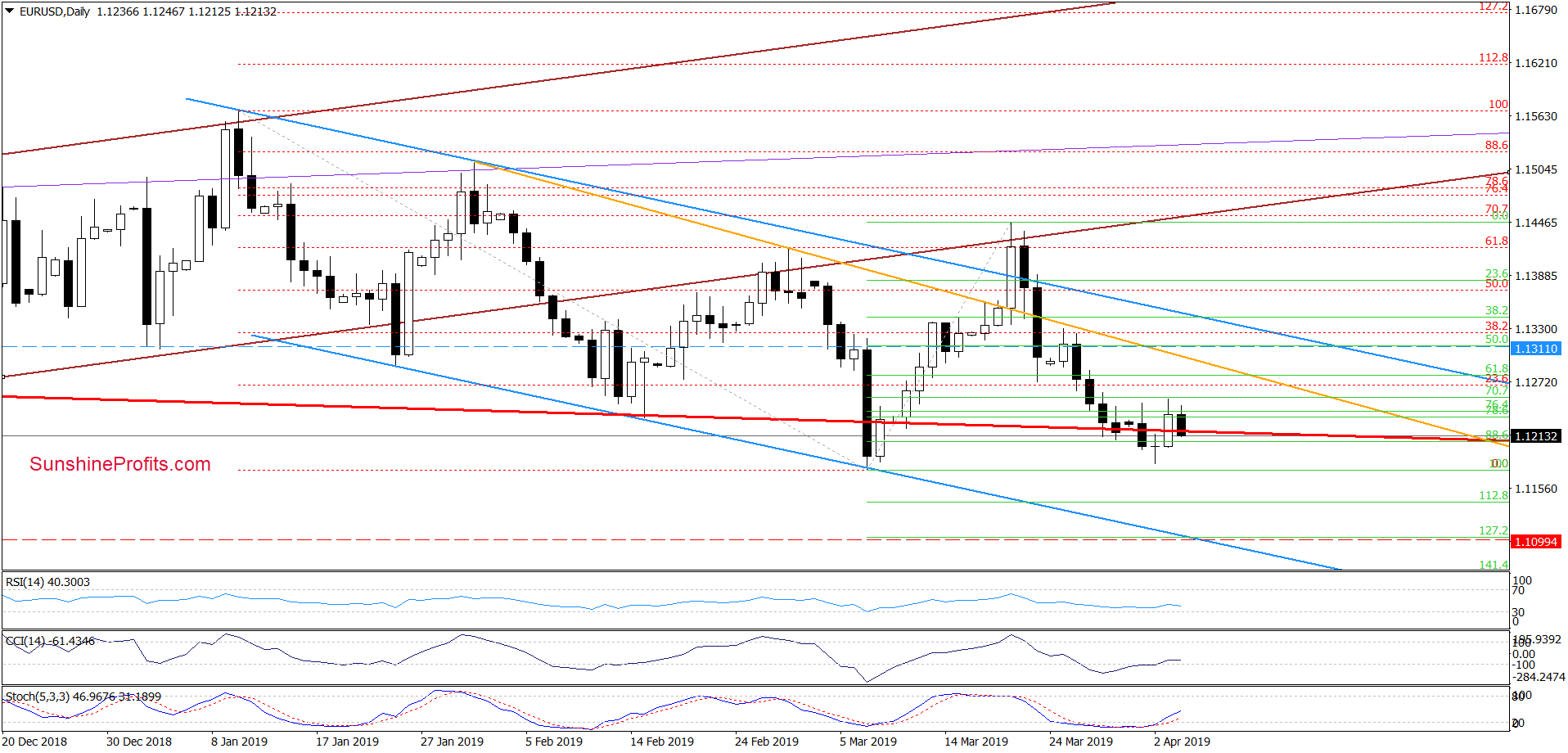

EUR/USD

Earlier today, EUR/USD reversed and declined. The pair came back below the lower border of the red declining trend channel. This breakdown is not confirmed however, as the day is far from being over yet.

Despite this deterioration, the long-term green support line and the buy signals generated by the daily indicators continue to support the buyers. Especially when we take into account the proximity to March lows.

Therefore, in our opinion, another reversal and rebound from this area still remains likely.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1099 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

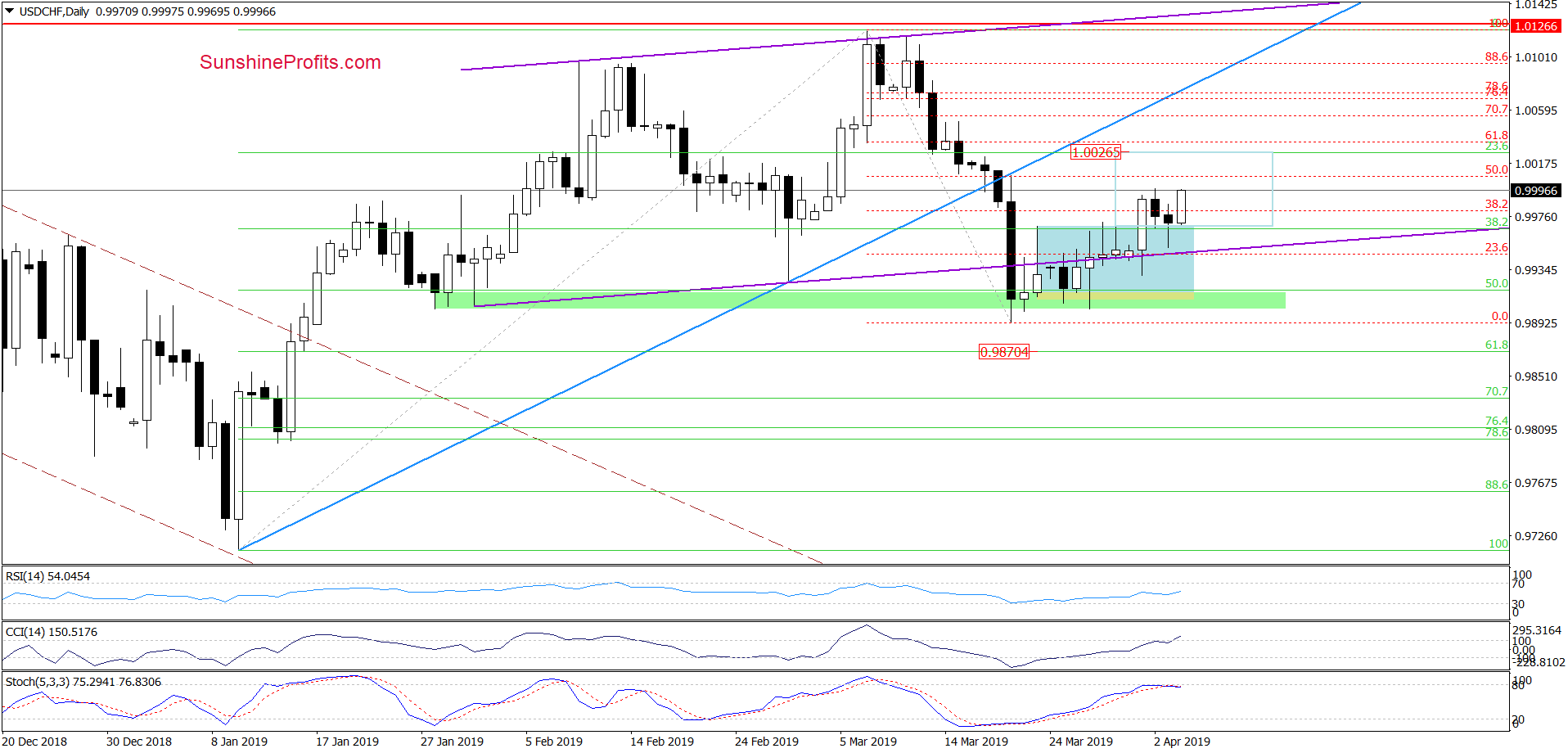

USD/CHF

Examining the daily chart, we see that USD/CHF moved lower during previous two sessions. The previously-broken upper border of the blue consolidation stopped the sellers however. The ensuing rebound and Wednesday’s close above the formation received follow-through buying earlier today.

This brings up what we have written on Tuesday:

(…) If the pair extends gains from here, the first upside target would be around 1.0026, where the size of the upward move would correspond to the height of the blue consolidation.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

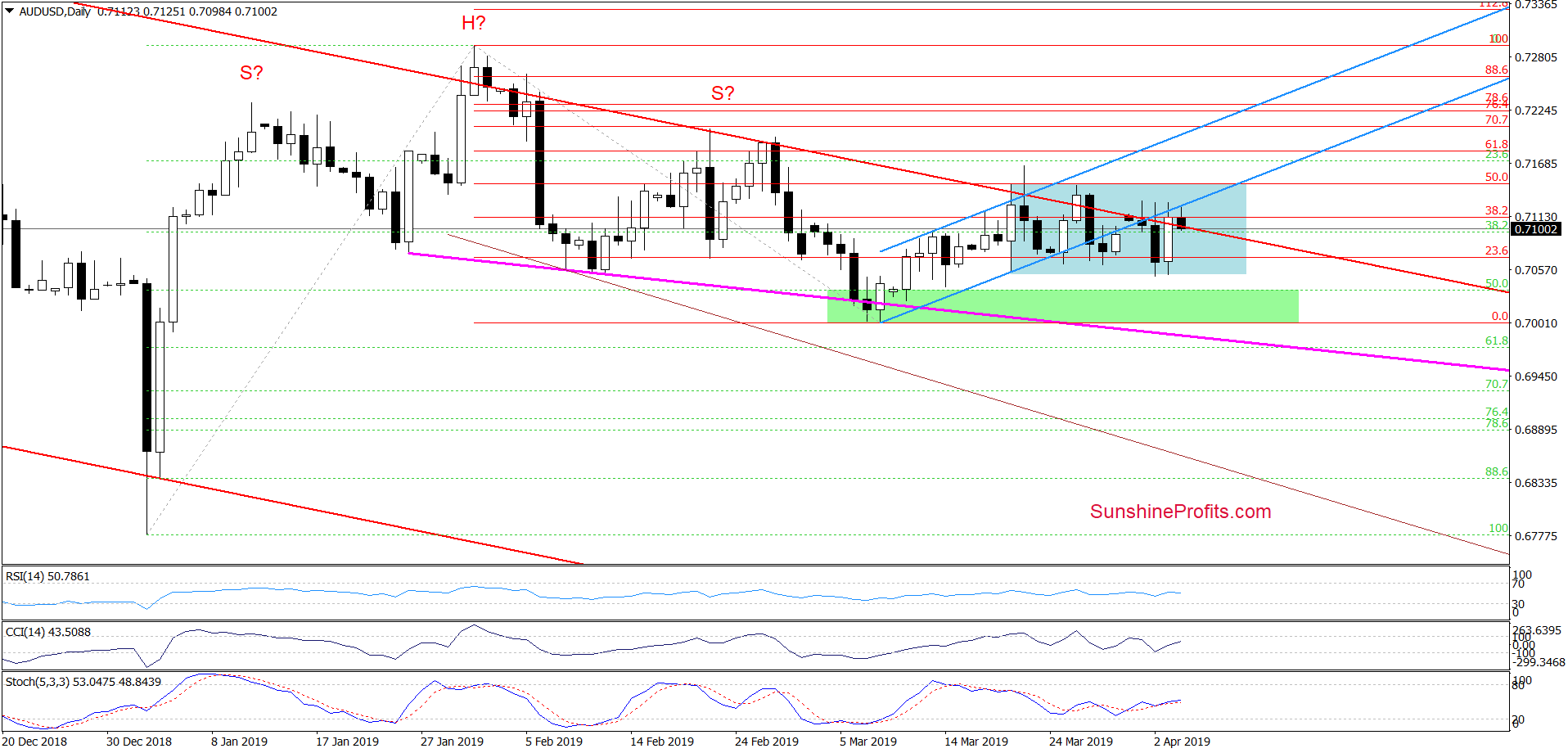

AUD/USD

Looking at the daily chart, we can summarize it with just four words: more of the same. Although AUD/USD moved above the upper border of the red declining trend channel during yesterday’s session, the sellers took the pair lower earlier today. This is similar to what we have seen quite a few times in recent weeks.

Therefore, we believe that our Tuesday’s analysis remains up-to-date also today:

(…) It’s clearly visible that the bulls have serious problems overcoming this resistance, which means that the road to the north looks closed now absent a bullish turn of events.

What does it mean for the exchange rate going forward? In our opinion, short-lived moves in both directions while still remaining inside the blue consolidation. However, if the Stochastic Oscillator generates its sell signal, it will strengthen the case for seeing a retest of the green support zone in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist