Whoa, the euro did really move, closing the day almost at the very level we saw as our probable target. But what about today, does its upswing change anything? While the AUD/USD downswing is also playing into our cards nicely, can it still go on? Let's dive into these and other opportunities across the forex arena.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1324; the initial downside target at 1.1197)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a fresh stop-loss order at 0.7078; the downside target at 0.6925) ; the downside target at 0.6925)

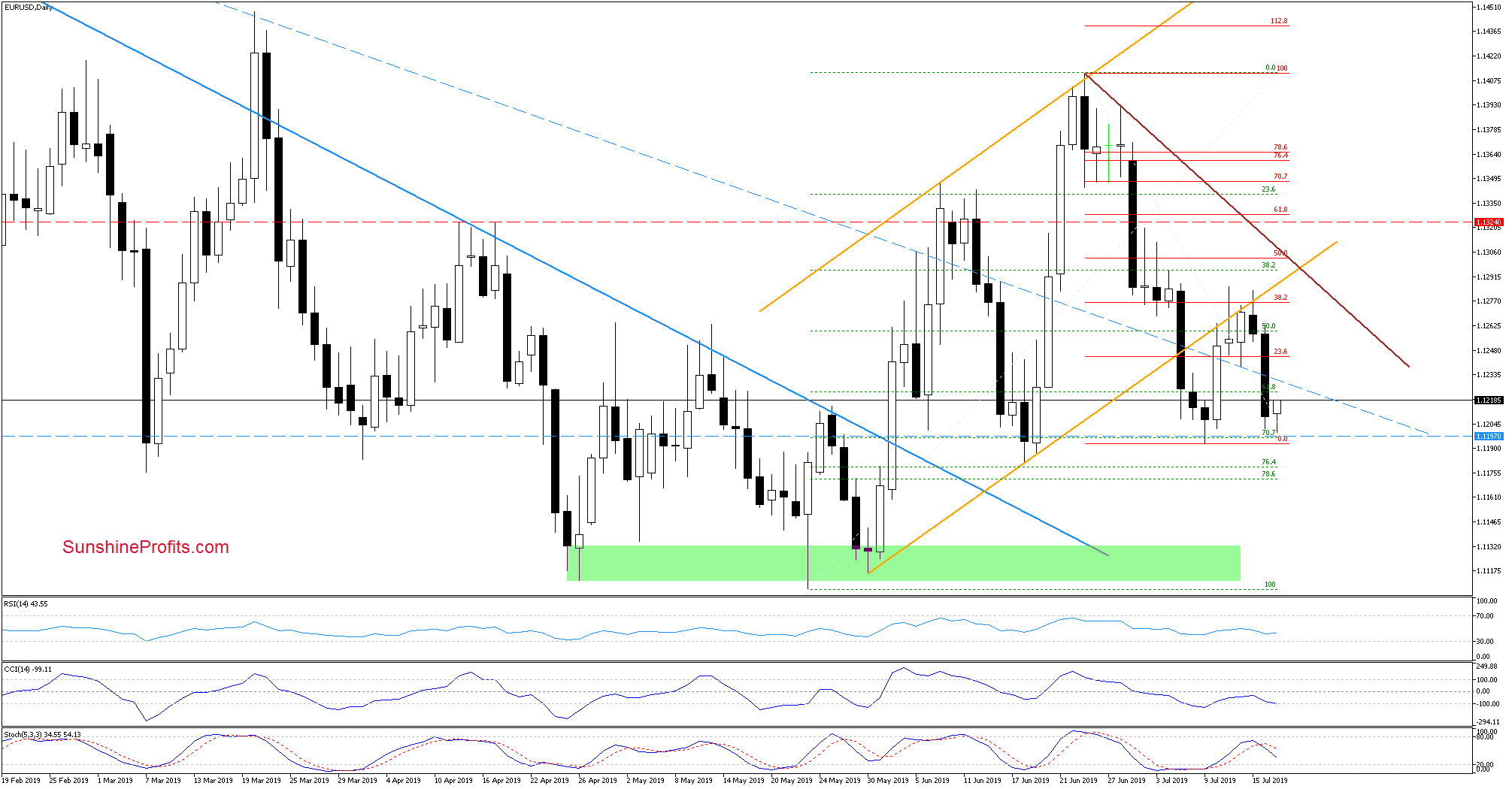

EUR/USD

As EUR/USD has moved sharply lower yesterday, our short positions became even more profitable. EUR/USD approached recent lows and our initial downside target, slightly rebounding earlier today.

Today's upswing doesn't really compare to the size of yesterday's candlestick. Additionally, the sell signals of the daily indicators continue to support the sellers, suggesting that another move lower may be just around the corner.

Should it be the case and the pair extends losses, we'll likely see a test of the mid-June lows or even the support area created by the 76.4% and 78.6% Fibonacci retracements.

Trading position (short-term; our opinion): Already profitable short positions with a stop-loss order at 1.1324 and the initial downside target at 1.1197 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

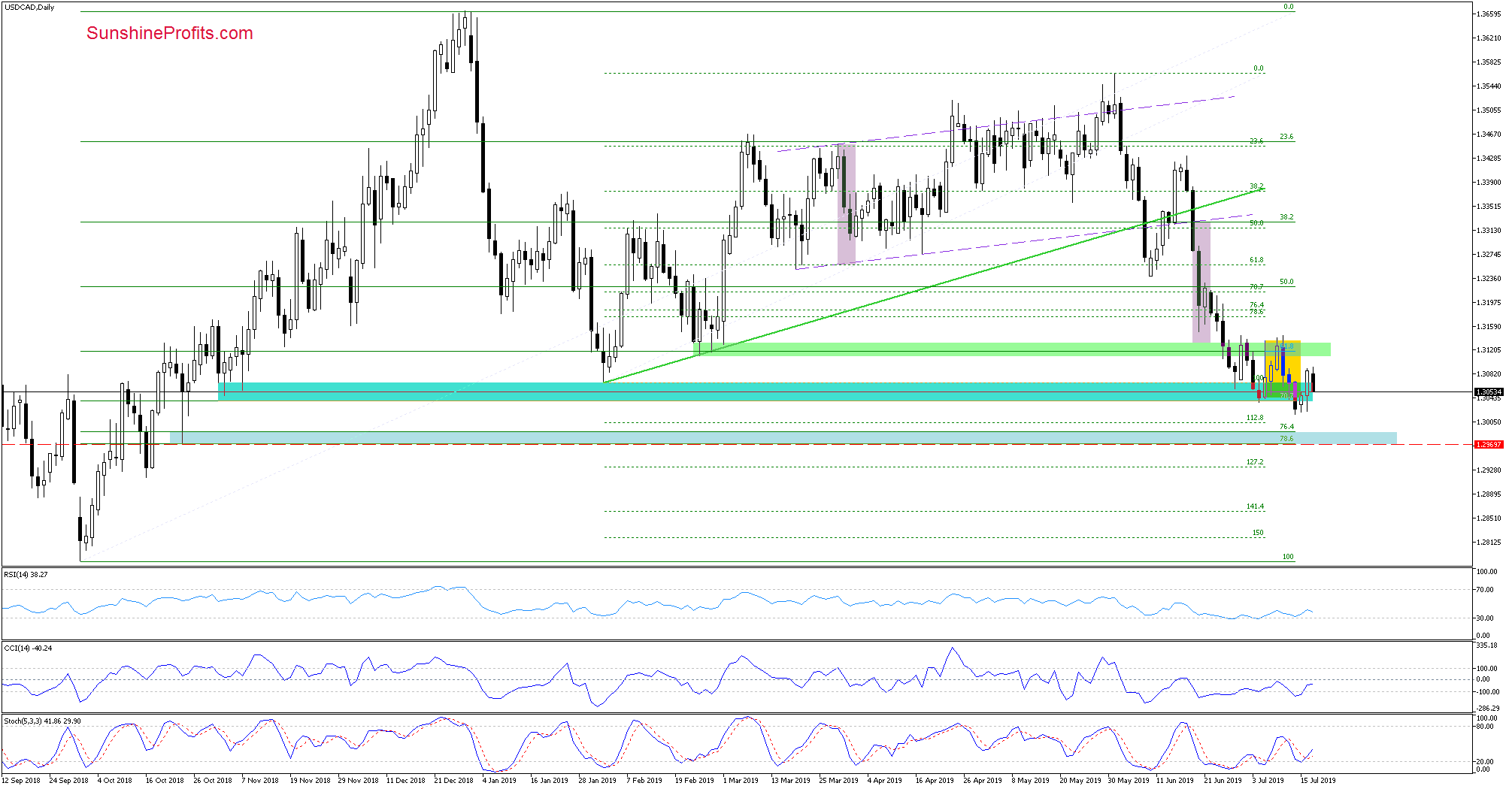

USD/CAD

Although USD/CAD reversed higher from the turquoise support zone yesterday, the bulls couldn't make it even to the previously-broken green support-turned-resistance zone. This encouraged the sellers to act, and the pair is heading lower to trade at around 1.3065 as we speak.

Another downswing remains likely as long as there is no breakout above the green resistance zone. Let's recall our Monday's commentary:

(...) Should it be the case, and the pair goes south from here, what would be the bears' target? A test of the blue support zone based on the 76.4% and 78.6% Fibonacci retracements seems probable in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

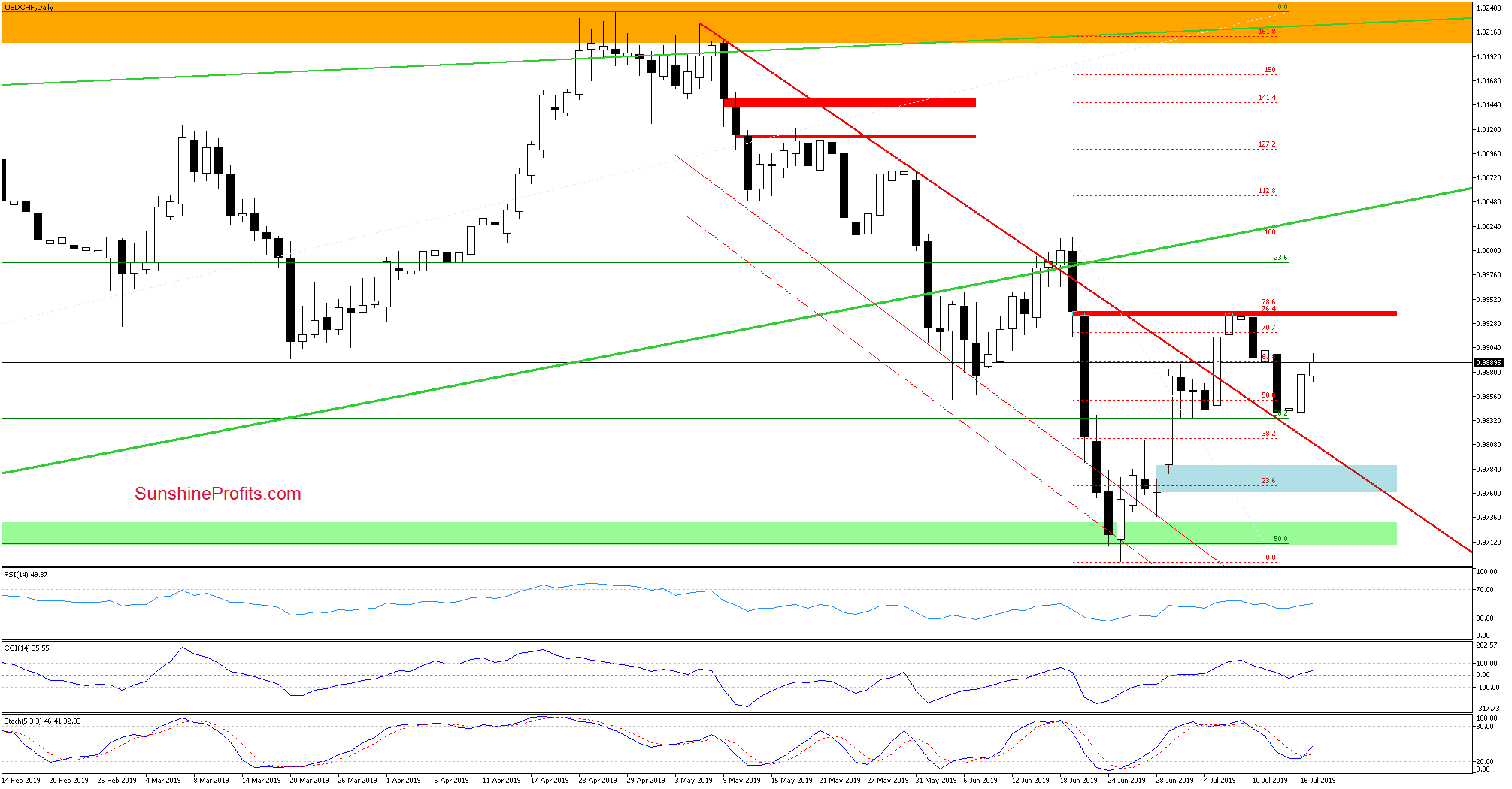

USD/CHF

Monday's downswing attempt has been rejected, and USD/CHF went on to rebound from the declining red support line. Additionally, the CCI and the Stochastic Oscillator generated their buy signals, suggesting more upside potential. The bulls' target would then be the July peaks and the red gap.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the EUR/USD fell sharply yesterday, making our short position more profitable. The daily indicators continue to support the bears. AUD/USD upswing has stopped at the strong combination of nearby resistances, and lower values ruled the day both yesterday and also earlier today. Our short position remains justified as the bearish outlook is very much on. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist