The euro has recovered a bit yesterday but checking its chart today reveals a different story entirely. Similar back-and-forth movement is a sign of tension, and of a closely contested battle beneath the surface. And what follows indecisive moments of low volatility? You nailed it, higher volatility and a juicy move. So, let's get positioned accordingly.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1324; the initial downside target at 1.1197)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a fresh stop-loss order at 0.7078; the downside target at 0.6925) ; the downside target at 0.6925)

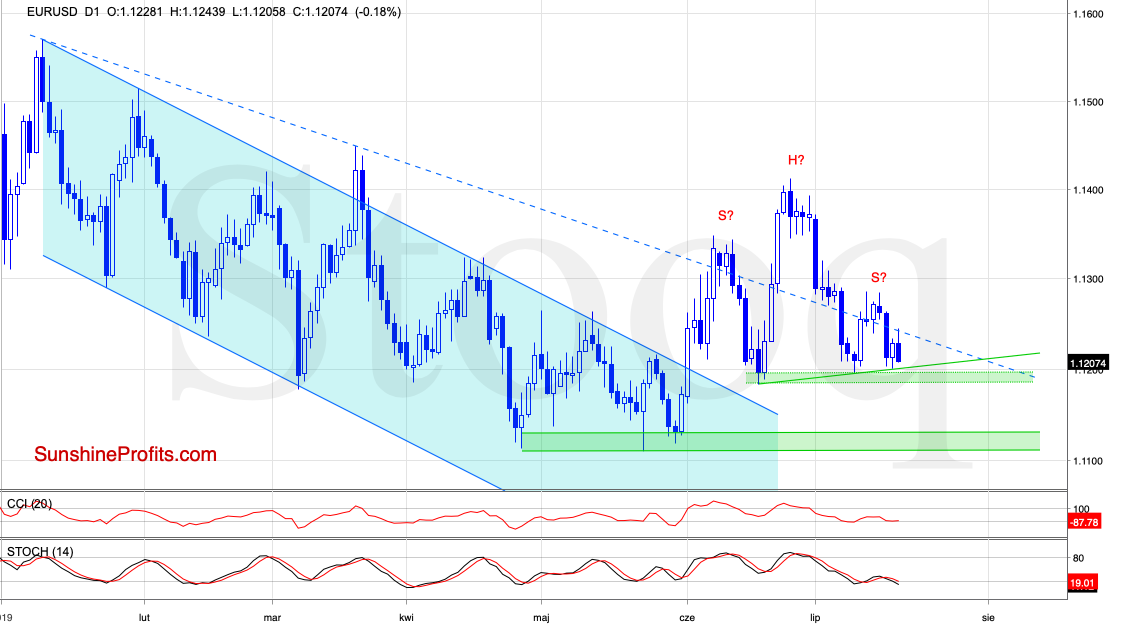

EUR/USD

Yesterday, EUR/USD bounced off the green support line based on the previous lows, and climbed to the previously-broken declining blue dashed line. Such a weak close looks like a verification of Tuesday's breakdown below this declining blue line. The bears have called the bluff and took the pair lower earlier today.

The exchange rate is currently trading again close to the green line that also serves as a neckline of a potential head and shoulders formation marked with appropriate letters on the chart.

Coupled with the sell signal of the Stochastic Oscillator, the bears appear ready for a retest of the above-mentioned green line, or even of the green support zone in the very near future.

As long as there is no daily close below the green line, the sketched head and shoulders formation remains incomplete and as such, doesn't carry any implications just yet. Therefore, a bigger downside move would be more likely only if EUR/USD finishes soon below both the green line and the green support zone.

Trading position (short-term; our opinion): Already profitable short positions with a stop-loss order at 1.1324 and the initial downside target at 1.1197 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

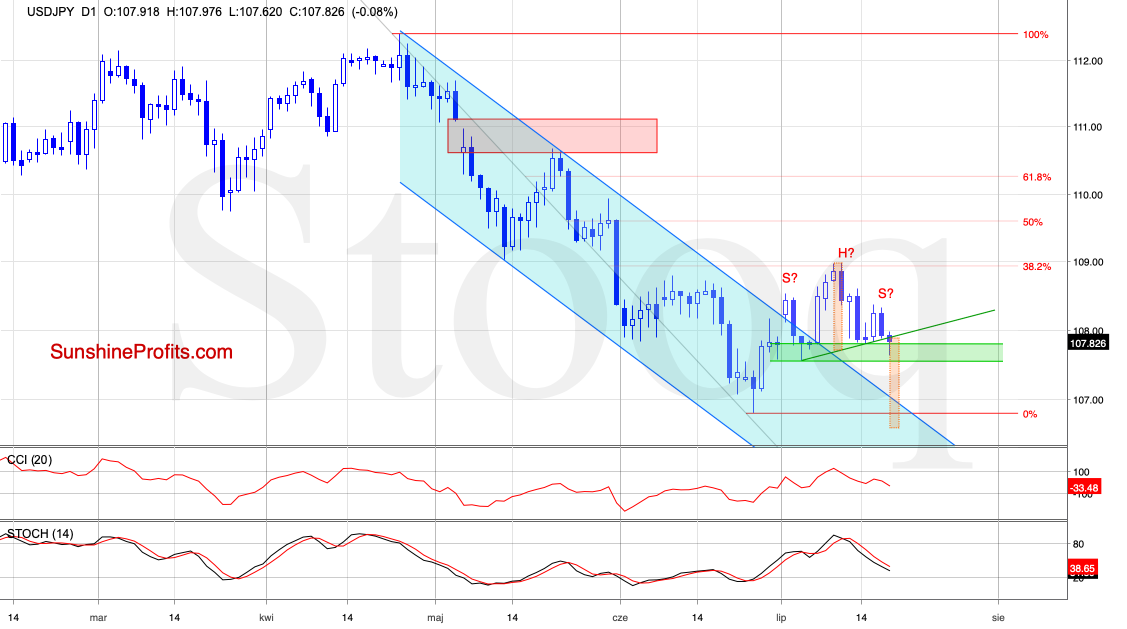

USD/JPY

One of the first things that strikes you on the above chart, is yet another incomplete, potential head and shoulders pattern (again, appropriately marked for your convenience).

Although USD/JPY bounced off the green support zone and the green support line that forms the neckline of the potential head and shoulders formation on Tuesday, the bulls couldn't keep the momentum. The pair reversed lower yesterday, slipping below both the above-mentioned supports.

Follow-through selling continued earlier today, and the sell signals of the daily indicators suggest that further deterioration is probably just around the corner.

Should it be the case and the pair closes soon below the green line, the probability of a test of the June lows would increase. It is worth noting that below this line, the size of the downward move would correspond to the height of the above-mentioned potential head and shoulders formation.

Should we see the bears gaining the upper hand, we'll likely open short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

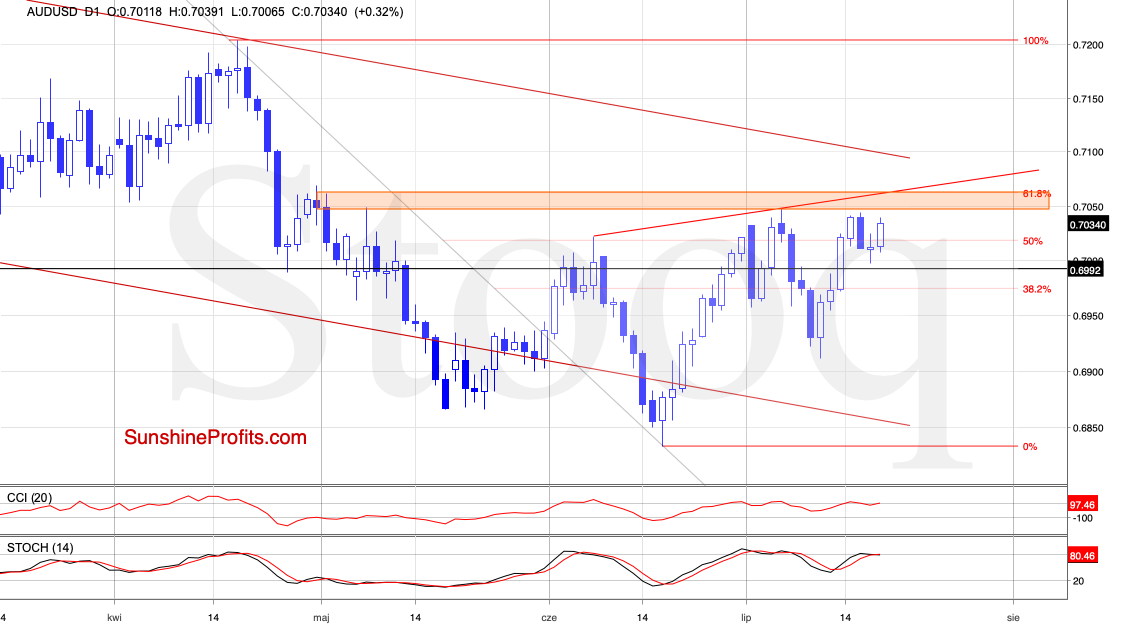

AUD/USD

While AUD/USD moved higher earlier today, it is still trading not only below the Tuesday's peak but also below its major resistances. Similarly to the observation of our Tuesday's commentary:

(...) the resistance area created by the early-May and early-July peaks, and the pink gap

continue to be a serious obstacle for the bulls. Therefore, our Tuesday's comments remain up-to-date also today:

(...) Such a strong combination of resistances has been strong enough to stop the bulls at the beginning of this month already. It suggests that as long as the gap is open, another downward reversal from here with further declines to boot, remain very likely indeed.

Even if the bulls manage to push the pair higher from here, they've got one more resistance to reckon with. It's the rising red line that is based on the previous peaks. It serves as an additional reinforcement of the strong mix of previously described obstacles.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.7078 and the next downside target at 0.6925 are justified from the risk/reward perspective.

Summing up the Alert, while the EUR/USD slightly retraced its Tuesday's decline yesterday, it is sliding lower today, making our short position more profitable. The daily indicators continue to support the bears. AUD/USD upswing attempts continue being stopped at the strong combination of nearby resistances, and lower values still remain probable and the short position justified. Should we see decidedly bearish action in USD/JPY, we'll consider opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist