In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the exit target at 1.3300)

- USD/CHF: short (a stop-loss order at 1.0001; the initial downside target at 0.9849)

- AUD/USD: none

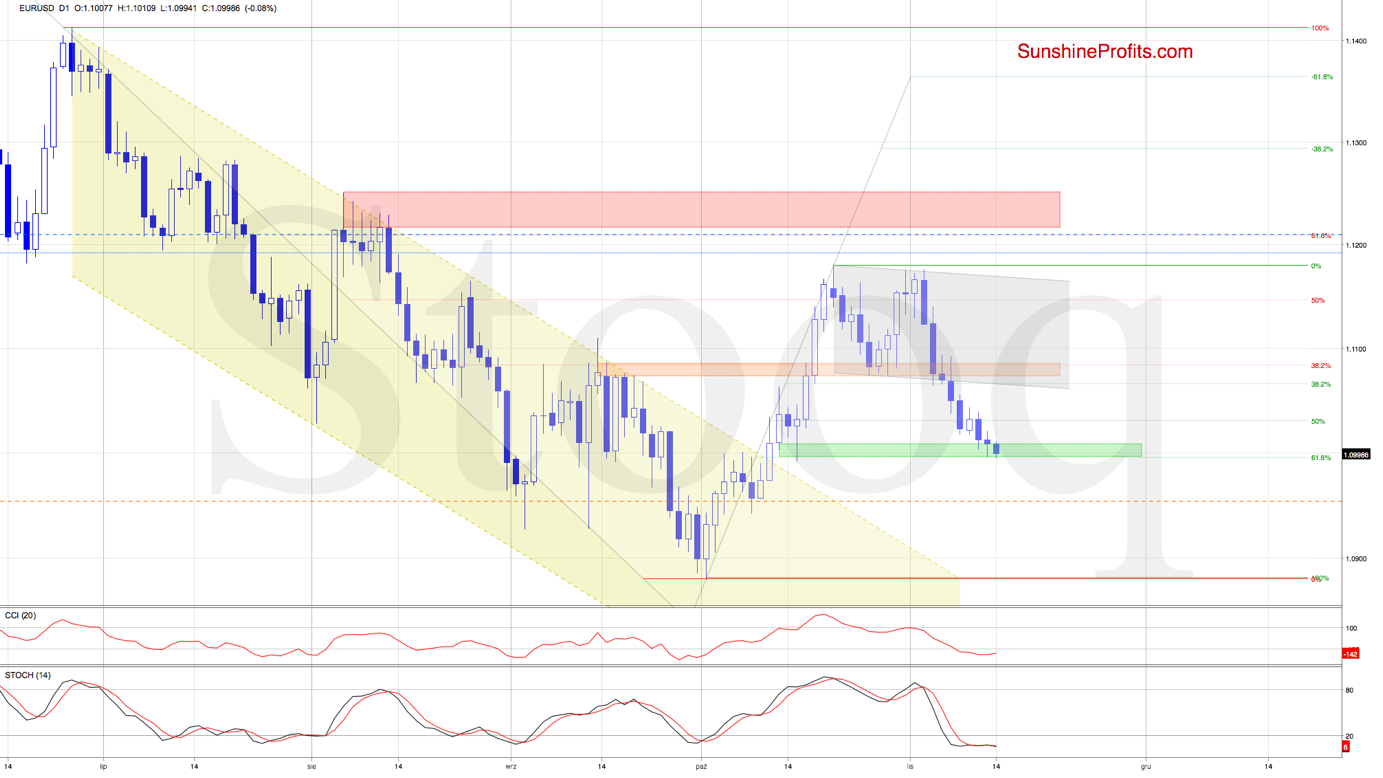

EUR/USD

The euro has been having a hard time catching a bid recently. Yet the pace of its decline has slowed day-by-day. The say that when everyone piles up in one direction, the market tends to surprise in the other. Does it mean that the bears are to face stiff headwinds soon?

While EUR/USD moved lower once again earlier today, the combination of the green support zone based on mid-Oct lows and the 61.8% Fibonacci retracement continues to keep declines in check. That's still true at the moment of writing these words, as the pair keeps above 1.0990.

It means that our yesterday's observations are up to date also today:

(...) Let's examine the daily indicators. While they're in their oversold areas, the Stochastic Oscillator is on the verge of flashing its buy signal.

Connecting the dots, there is a high probability of a reversal being just around the corner.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in GBP/USD and USD/CHF. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

GBP/USD

Sideways trading in the narrow range continues, and the short-term situation is little changed from our Friday's commentary:

(...) While GBP/USD moved lower, the overall short-term situation remains again almost unchanged: the pair is still trading inside the purple consolidation and well above the Oct 24 low.

Therefore, as long as there is no daily close below these supports, a bigger move to the downside is not likely to be seen. An upside reversal in the very near future should not surprise us.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the initial upside target at 1.2976are justified from the risk/reward perspective.

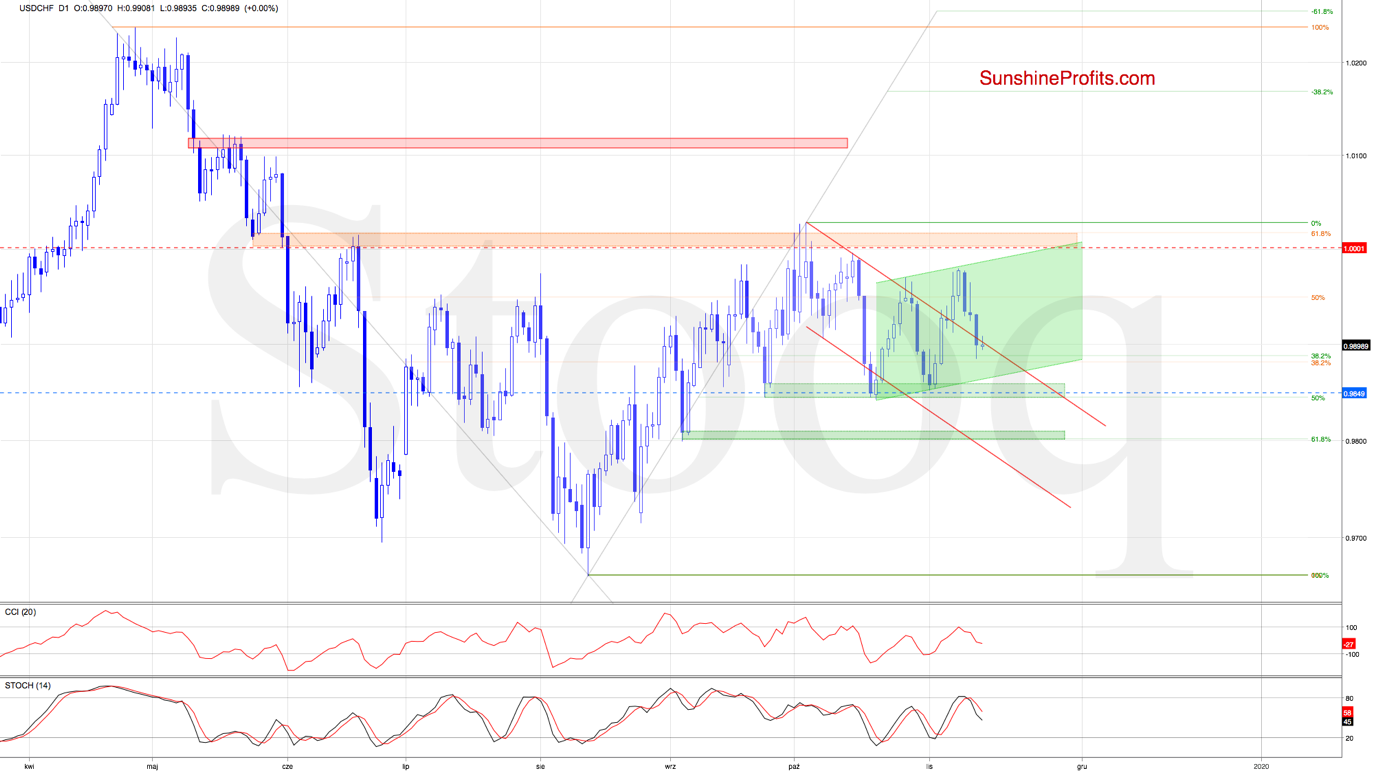

USD/CHF

Yesterday's shapr move lower in USD/CHF marks invalidation the earlier breakout above the upper border of the declining red trend channel. This is certainly a bearish sign.

Earlier today, we've seen a tiny rebound attempt, which could nothing more than verification of the earlier breakdown. Should it be so, the way to at least the green support zone based on the previous lows would be open.

Additionally, both the CCI and the Stochastic Oscillator generated their sell signals, increasing the probability of further deterioration. Connecting the dots, opening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.0001 and the initial downside target at 0.9849 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist