In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the exit target at 1.3278)

- USD/CHF: short (a stop-loss order at 1.0001; the initial downside target at 0.9849)

- AUD/USD: none

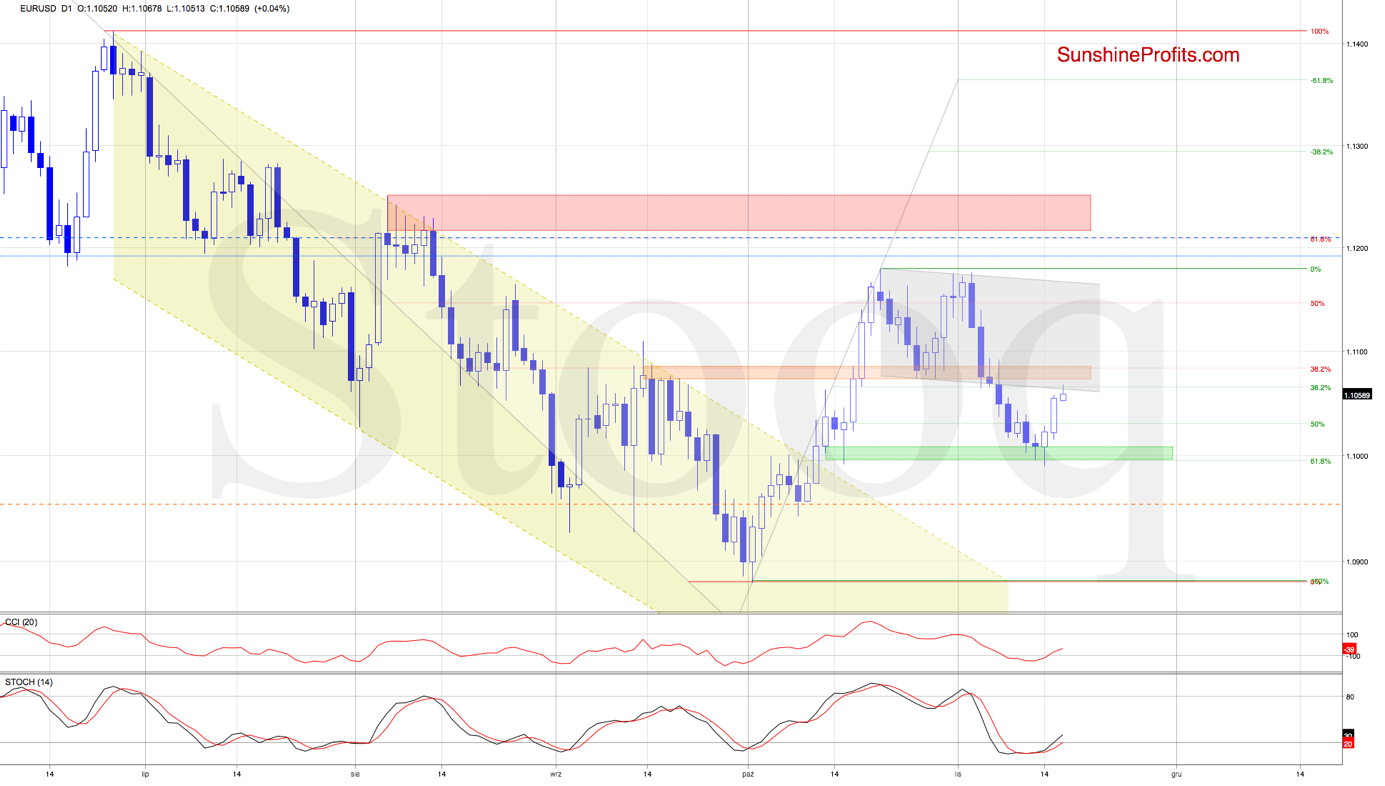

EUR/USD

The euro has recently rebounded, and the pair is approaching resistance after swift Friday's action. Will the bulls be strong enough to overcome it - and if so, where exactly can their efforts take them?

These were our Friday's observations:

(...) The EUR/USD bears were stopped at the combination of the green support zone based on mid-Oct lows and the 61.8% Fibonacci retracement yesterday. A rebound followed, resulting in the exchange rate invalidating the earlier tiny breakdown below these supports.

This suggests further improvement, especially when we factor in the buy signals generated by the daily indicators.

Should it be the case and the pair extends gains from here, we'll see at least an increase to the previously broken lower border of the declining grey trend channel in the coming week.

The situation indeed developed in line with the above, and EUR/USD has reached the first above-mentioned upside target.

Then, both the CCI and the Stochastic Oscillator generated their buy signals, increasing the likelihood of further improvement in the very near future - even if we see a small pullback from current levels first.

Nevertheless, if the bulls prove strong enough to break higher, the way to the upper border of the grey channel (or even recent peaks) may be open.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

GBP/USD

GBP/USD closed Friday's session above the upper border of the very short-term blue consolidation that's located inside the larger purple consolidation. This has encouraged the bulls to act.

As a result, the pair opened strongly with a bullish gap, which together with the buy signals generated by the indicators increases the probability of hitting a fresh peak in the very near future.

Nevertheless, such price action will be more likely and reliable only if GBP/USD breaks above the upper line of the purple consolidation and the upper border of the green rising trend channel.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the initial upside target at 1.2976are justified from the risk/reward perspective.

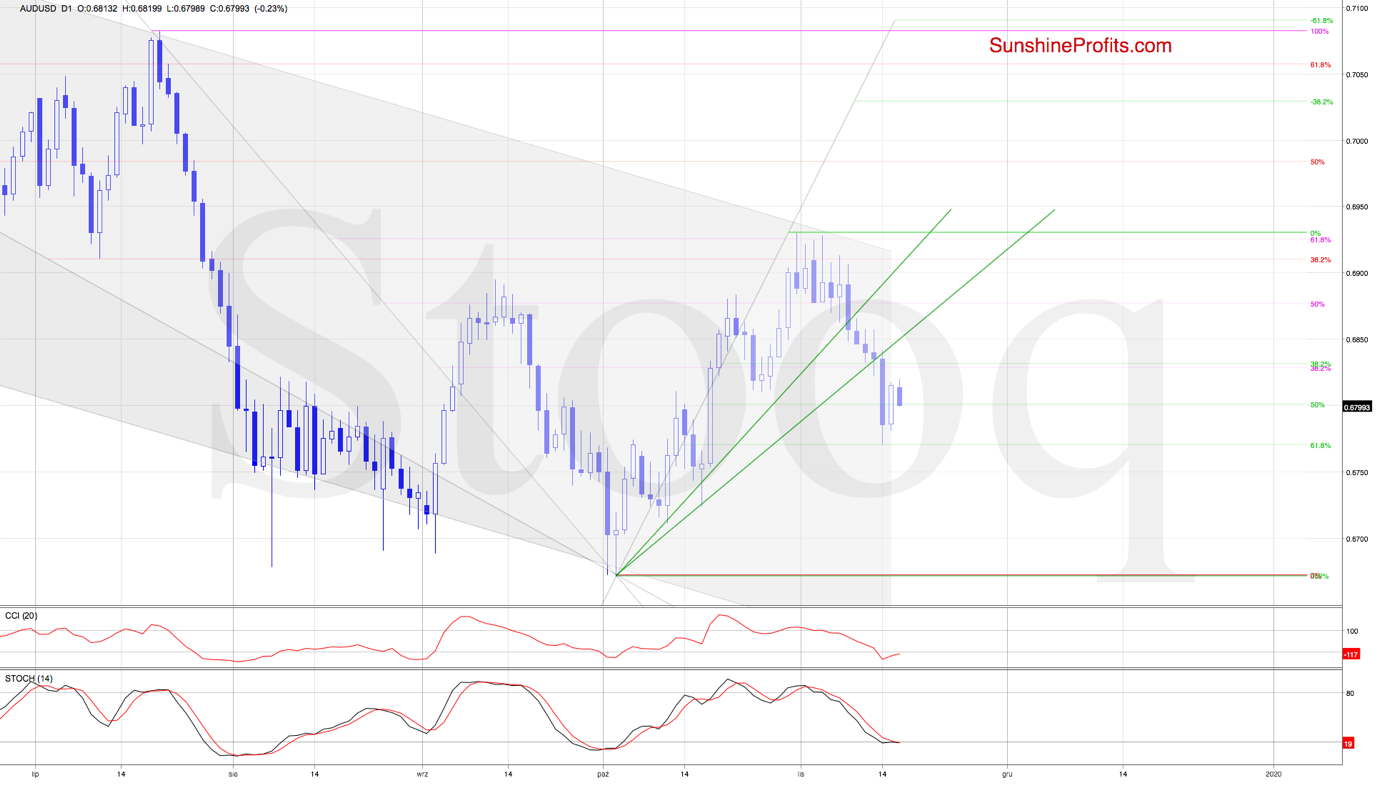

AUD/USD

AUD/USD broke down below both the 38.2$% Fibonacci retracement and the rising green support line that is based on the previous lows. This has triggered a sharp move to the downside, which took the pair all the way to the 61.8% Fibonacci retracement.

This support has triggered Friday's rebound, which suggests that further improvement could be just around the corner.

Would the daily indicators confirm that? As they are very close to generating their buy signals, the answer is yes.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist