The start of the trading week brought us modestly higher U.S. dollar on the heels of strong New York manufacturing data. This move has played quite well into one of our open positions. As for the other, AUD/USD is keeping its gain after strong Chinese retail data. Where next have we seen strong moves, and what do they mean for our trading positions?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1324; the initial downside target at 1.1197)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7052; the next downside target at 0.6925)

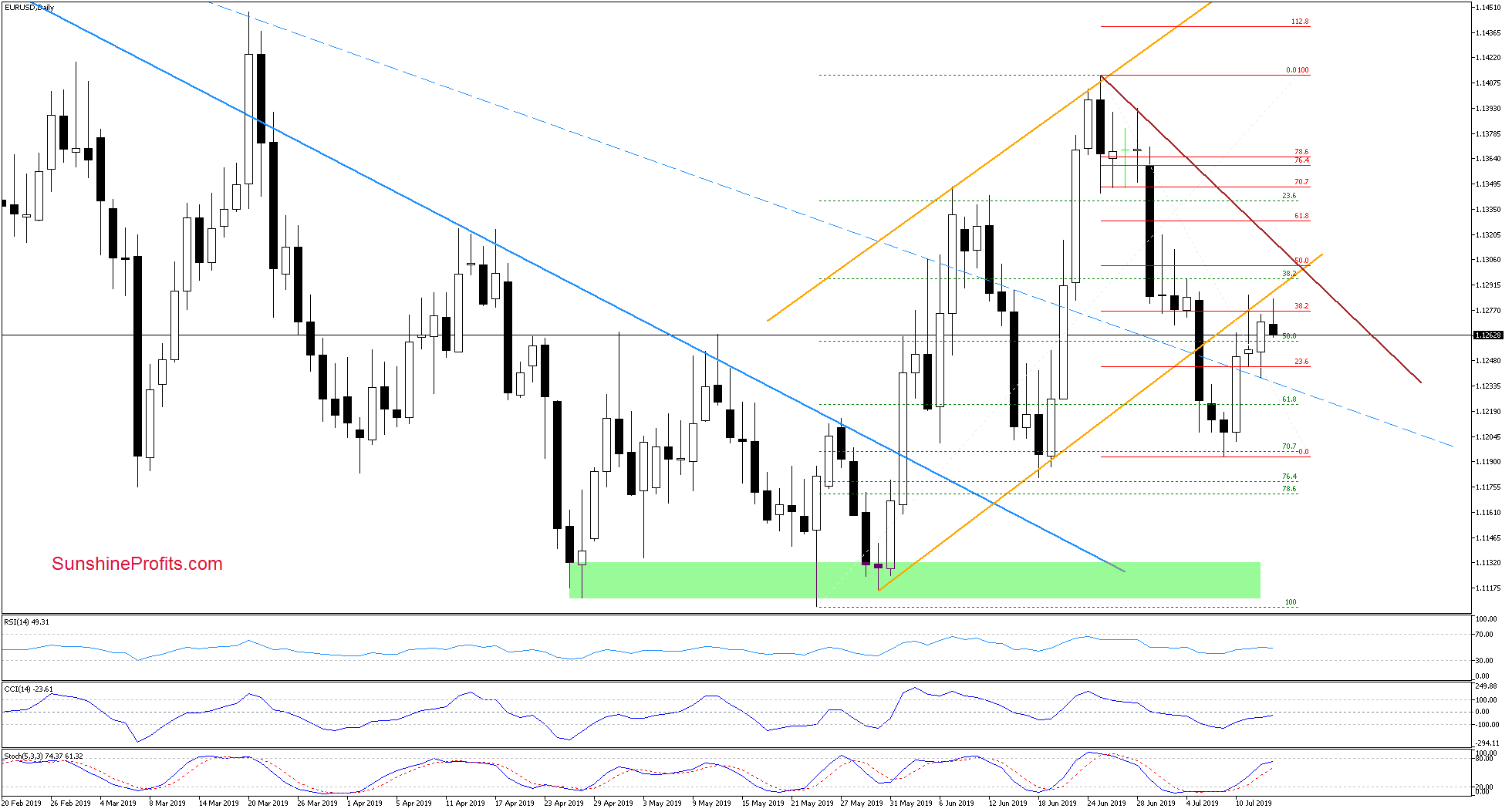

EUR/USD

After rising on Friday again, EUR/USD has earlier today verified its breakdown below the lower border of the rising orange trend channel. It has also tested the 38.2% Fibonacci retracement, and reversed lower to trade at around 1.1260 at the moment of writing these words.

Both verifications increase the probability of further deterioration this week. Should it be the case and the pair extends losses from here, we'll see a test of the recent lows as a minimum.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1324 and the initial downside target at 1.1197 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

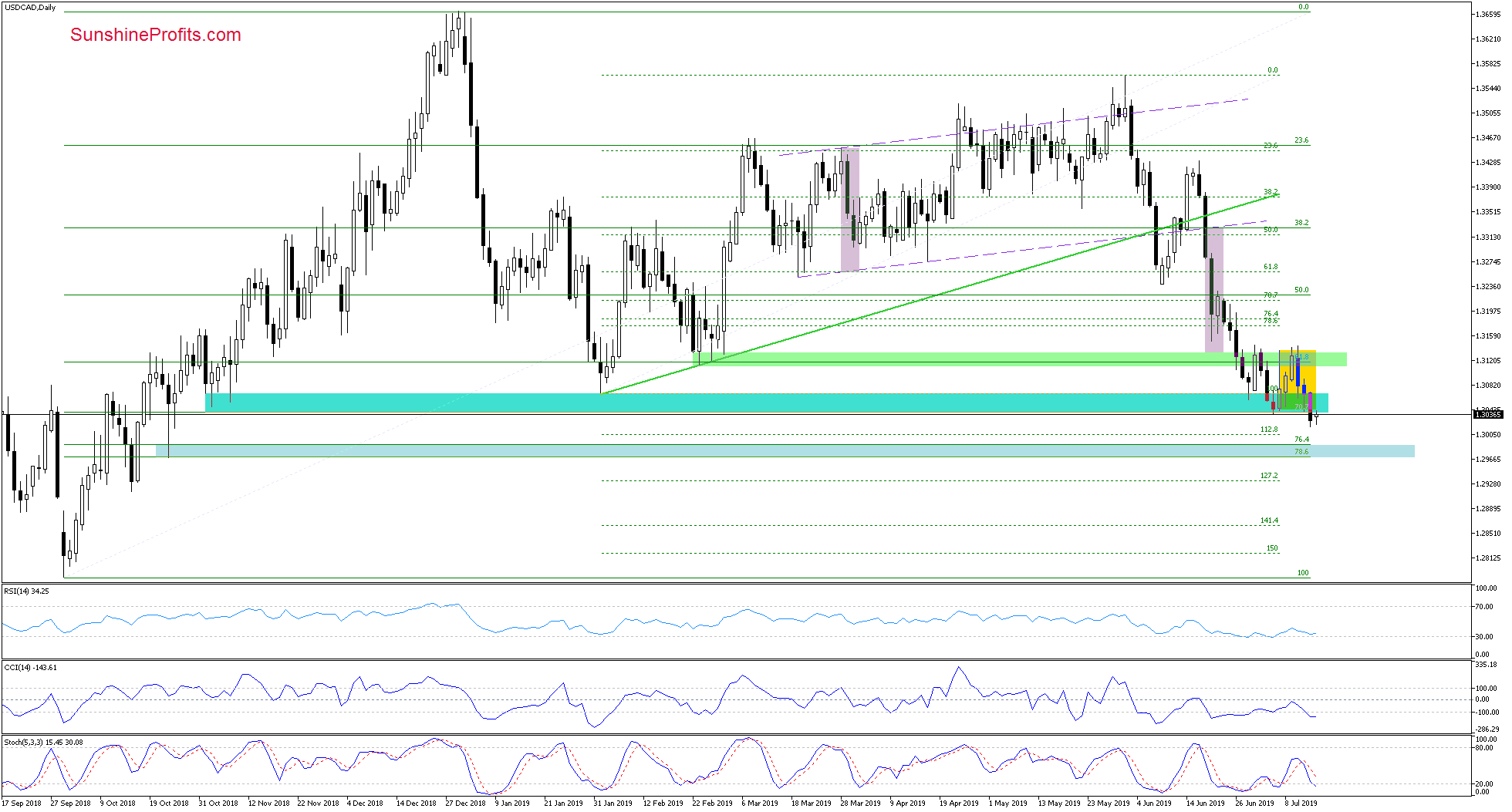

USD/CAD

On Friday, USD/CAD has closed below the turquoise support zone. This fact alone suggests further deterioration down the road. This is especially the case if we factor in the sell signals of the daily indicators. The price action earlier today also looks like a potential verification of Friday's breakdown below that support zone (the pair changes hands at around 1.3045 currently).

Should it be the case, and the pair goes south from here, what would be the bears' target? A test of the blue support zone based on the 76.4% and 78.6% Fibonacci retracements seems probable in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

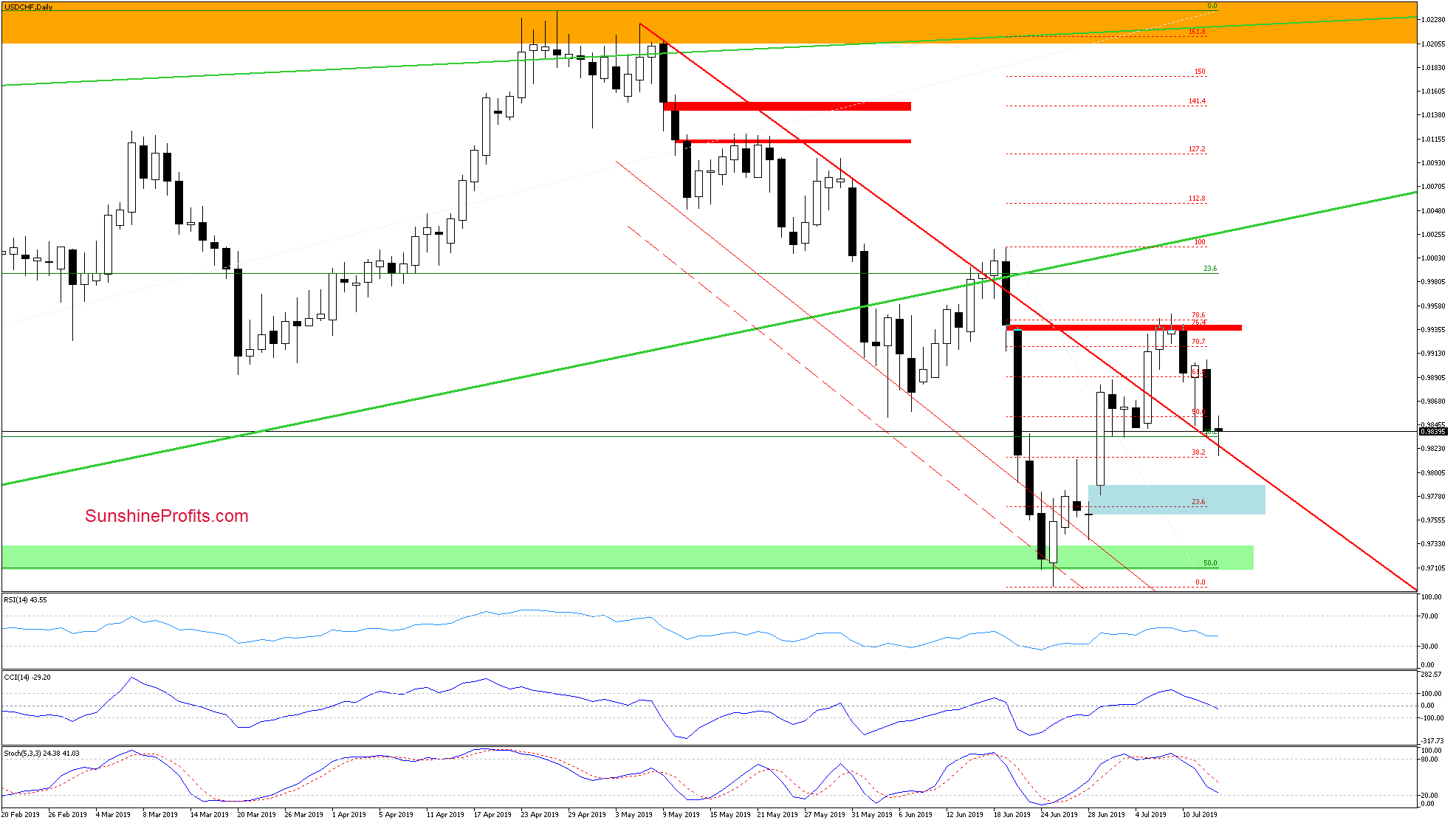

USD/CHF

In our Wednesday's commentary, we wrote that the bulls have:

(...) reached the strong resistance area created by two Fibonacci retracements (the 76.4% and the 78.6% ones) and the red gap. They haven't seen much success overcoming them, however.

Combined with the current position of the daily indicators, it suggests that a reversal is just around the corner.

USD/CHF has indeed declined in the last couple of days. On Thursday, the pair tested the previously-broken declining red line, but it withstood the selling pressure and a rebound followed. On Friday though, the exchange rate has closed right at the red line.

Earlier today, the pair keeps trading in the vicinity of this line. This can be viewed as a situation ripe for a rebound as the path south has been rejected earlier today, or it could be seen as a repeat of last week's action: one more rebound, and then a drop back to this red line.

Therefore, a bigger move to the downside is not likely to be seen unless we get a daily close below this red line.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Summing up the Alert, the EUR/USD rebound looks to be out of steams as the lower border of the orange rising trend channel and the 38.2% Fibonacci retracement have stopped the bulls. The bearish outlook remains, and the short position is justified. The AUD/USD is currently experiencing an upswing, yet its weekly bearish outlook hasn't changed. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist