These are very interesting days across the currencies, with one opportunity worth acting upon closely followed by yet another one. And that's the case also today. Which pair deserves immediate action on our part, what do you think?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0963; the initial upside target at 1.1112)

- GBP/USD: long (a stop-loss order at 1.2139; the initial downside target at 1.2467)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 0.9951; the initial downside target at 0.9768)

- AUD/USD: long (a stop-loss order at 0.6751; the initial upside target at 0.6916)

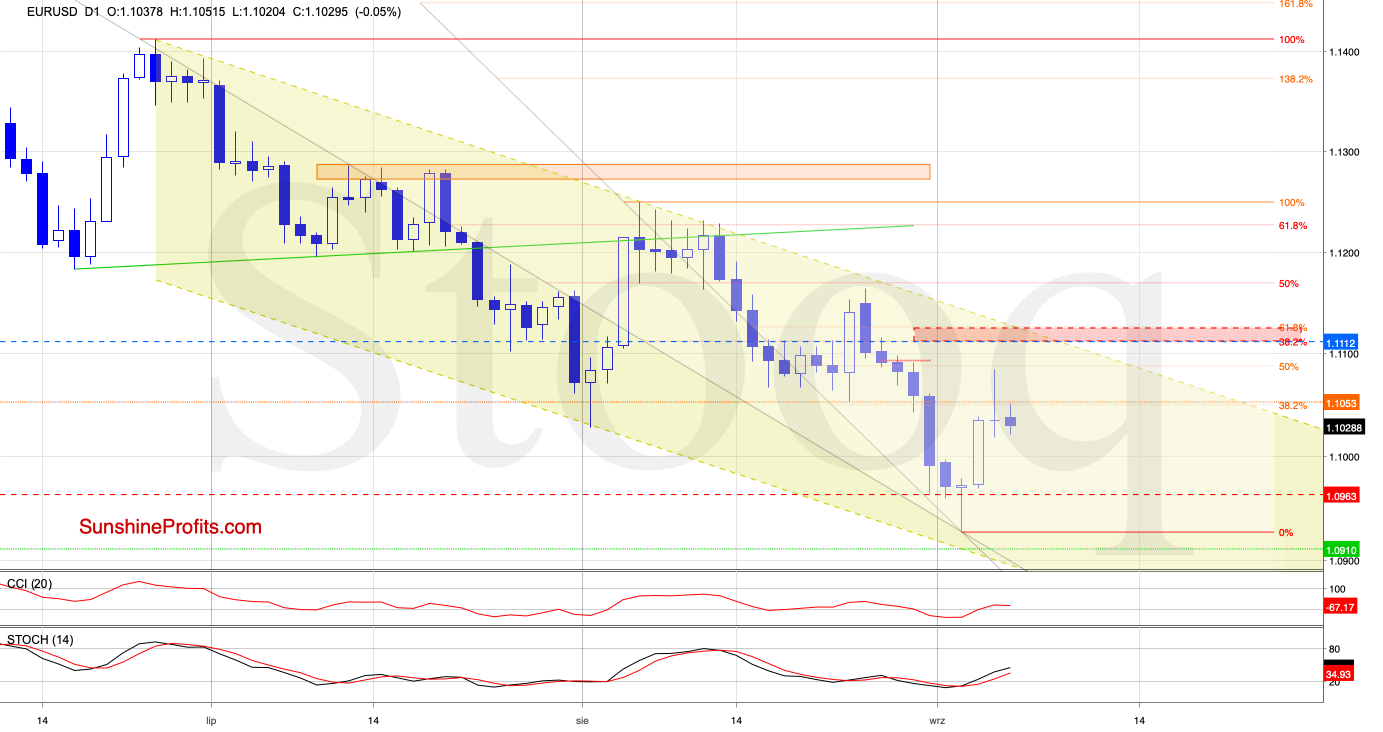

Yesterday, EUR/USD has invalidated the breakout above the 38.2% Fibonacci retracement, and went on to pull back a little earlier today.

But the morning star formation remains in play - just as the buy signals of the daily indicators do. Let's quote our yesterday's take on the upside target:

(...) All the above suggests further improvement and at least a test of the red resistance zone created by two important retracements: the 61.8% Fibonacci retracement and the 38.2% Fibonacci retracement based on the entire June-September downward move.

All the above suggests further improvement and at least a test of the red resistance zone created by two important Fibonacci retracements: the 61.8% one and the 38.2% one based on the entire June-September downward move.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0963 and the initial upside target at 1.1112are justified from the risk/reward perspective.

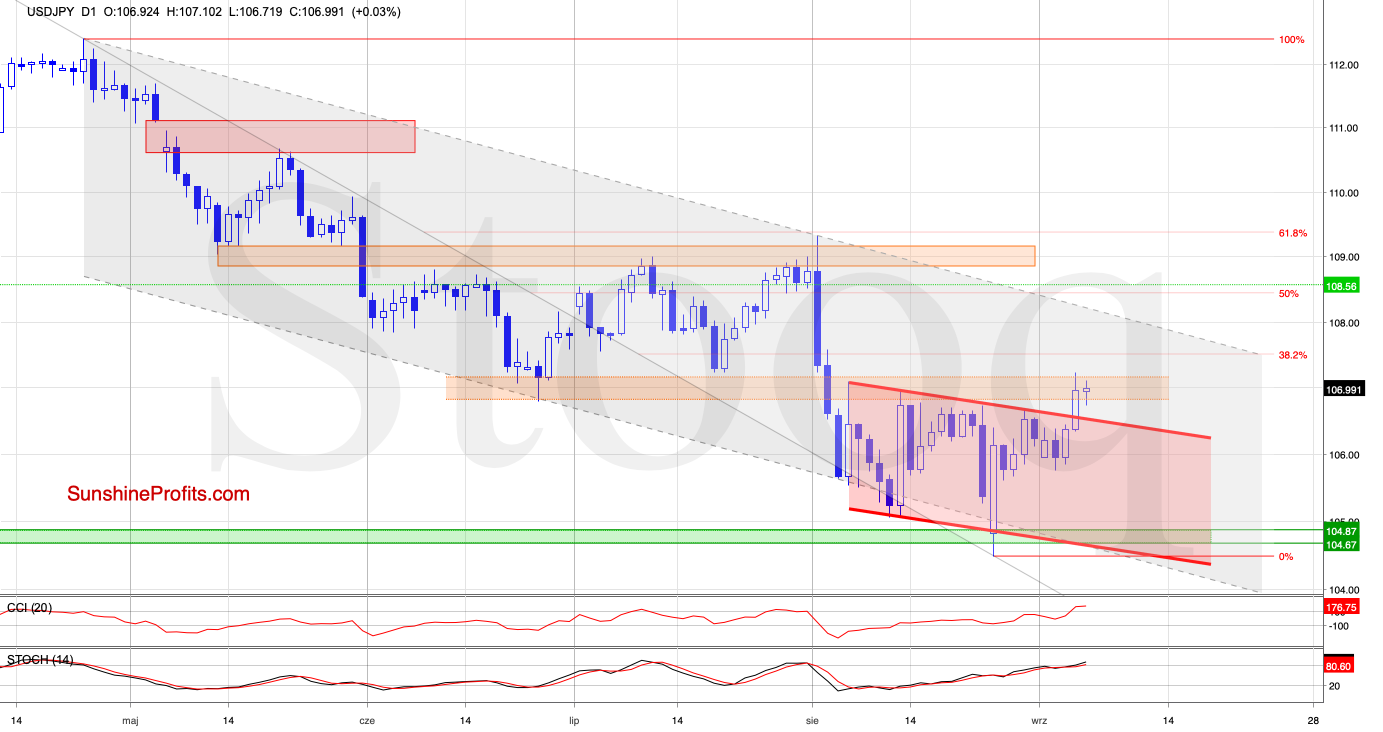

USD/JPY

USD/JPY has broken above the upper border of the declining red trend channel. It has also tested the orange resistance zone. This is certainly a bullish development.

The daily indicators' buy signals remain on the cards, suggesting a test of the 38.2% Fibonacci retracement in the very near future. On the other hand though, the indicators' high reading also suggests that a reversal (or at least a pullback) may be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

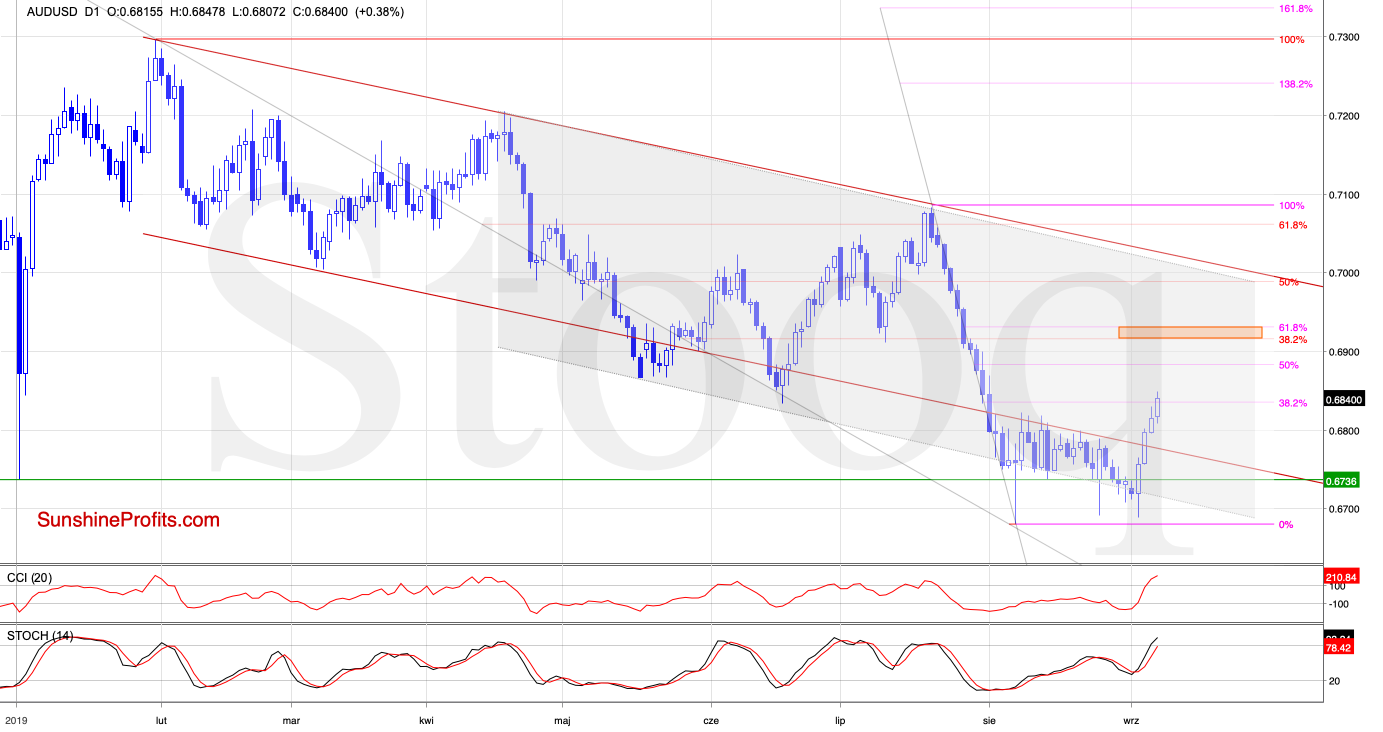

AUD/USD

We wrote these words in our Tuesday's commentary on this currency pair:

(...) Current price action can be seen as a double bottom formation in the making. Should it be the case, then the rate would go on to invalidate the breakdown below the lower border of the grey trend channel, having to move above the lower border of the previously-broken declining red trend channel and also the August peaks.

AUD/USD has indeed invalidated the earlier breakdown, and has climbed above the previous peaks. The daily indicators' buy signals continue supporting the bulls.

Earlier today, the pair has broken above the 38.2% Fibonacci retracement, which indicates further improvement.

Should we see such price action, the initial buyers' target will be the orange resistance zone that is created by two important Fibonacci retracements: the 61.8% one and the 38.2% one based on the entire 2019 decline.

Connecting the dots, opening long positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 0.6751 and the initial upside target at 0.6916 are justified from the risk/reward perspective.

Summing up the Alert, the euro and British pound upswing has earlier run into headwinds, but these don't appear to be particularly stiff - both long positions remain justified. USD/CHF upswing appears to have run into formidable resistance earlier today, and the short position also remains justified. AUD/USD has invalidated its recent breakdown, and reverted back into the declining red trend channel. Taking into account the supportive position of the daily indicators, opening the long position is justified from the risk-reward point of view. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist