Both the euro and the cable are posting decent gains today, and the Australian dollar didn't disappoint either. Is it just a temporary retreat of the mighty greenback? What kind of upside potential do the other currencies enjoy actually? Let's take a look at them, one by one.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0963; the initial upside target at 1.1112)

- GBP/USD: long (a stop-loss order at 1.2139; the initial downside target at 1.2467)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 0.9951; the initial downside target at 0.9768)

- AUD/USD: long (a stop-loss order at 0.6751; the initial upside target at 0.6916)

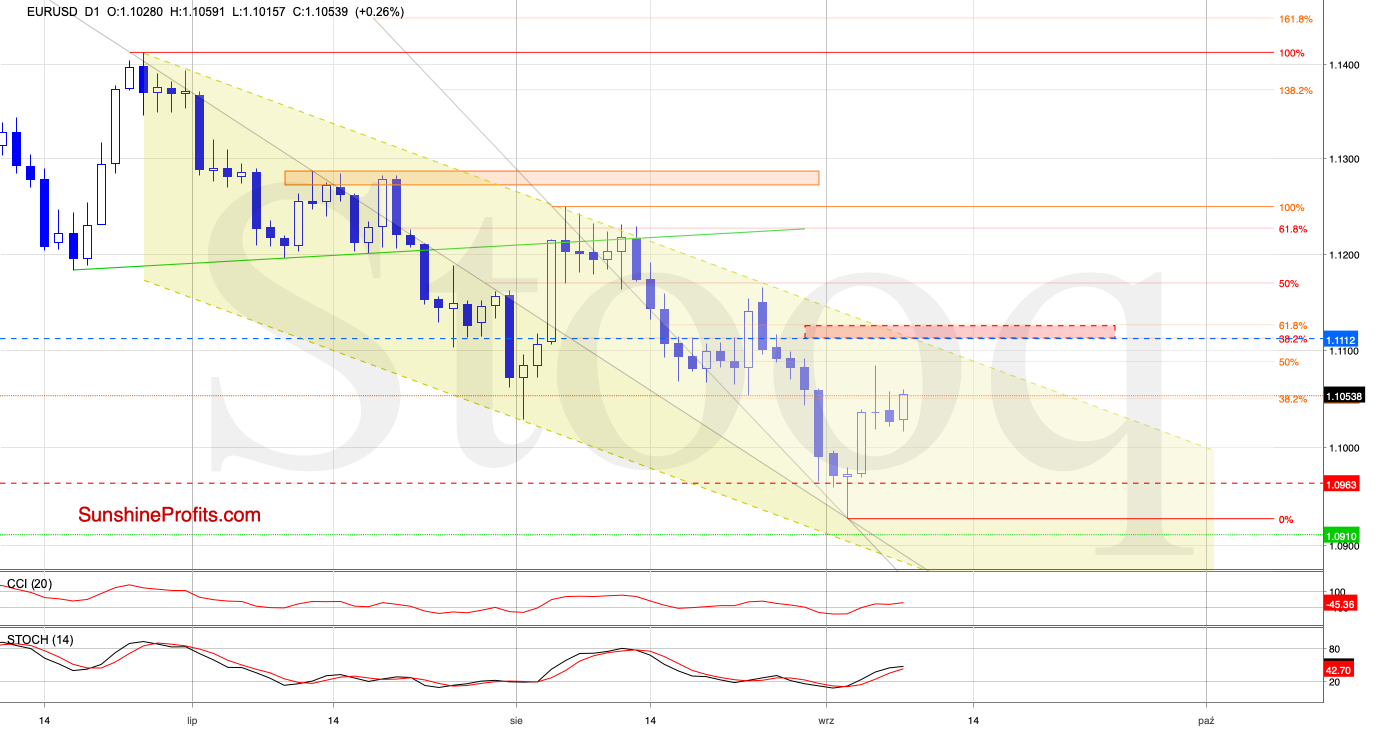

Earlier today, EUR/USD has been breaking above the 38.2% Fibonacci retracement. The morning star formation remains at play, supporting the move higher - just as the daily indicators do.

Let's quote our Thursday's words regarding the upside target:

(...) All the above suggests further improvement and at least a test of the red resistance zone created by two important retracements: the 61.8% Fibonacci retracement and the 38.2% Fibonacci retracement based on the entire June-September downward move.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0963 and the initial upside target at 1.1112are justified from the risk/reward perspective.

GBP/USD

GBP/USD has broken above its last week's peaks, making our positions more profitable. The buy signals of the daily indicators continue supporting the buyers, and the pair also trades comfortably above the orange zone.

All the above suggests further improvement and an upward move reaching at least the pink resistance zone created by the 61.8% Fibonacci retracement and the 38.2% retracement based on the entire May-September downward move.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2139 and the initial downside target at 1.2467 are justified from the risk/reward perspective.

USD/CHF

USD/CHF has invalidated the breakdown below the declining red line. Further, the Stochastic Oscillator has generated its buy signal. But has it changed the short-term outlook?

The pair is still trading not only below the pink resistance zone, but also below the orange resistance zone created by the previous peaks and the upper border of the rising green trend channel. This means that the short-term picture remains unchanged.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.9951 and the initial downside target at 0.9768 are justified from the risk/reward perspective.

Summing up the Alert, the euro and British pound upswings are continuing today and both long positions remain justified. While USD/CHF has invalidated the breakdown below the declining red line, the upswing appears to be running into resistance at its early-September peaks today. As a result, the short position also remains justified. AUD/USD keeps trading inside the declining red trend channel, and its daily indicators continue supporting the upside move. The profitable long position remains justified from the risk-reward point of view. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist