The euro bulls have been unable to sustain most of Friday's gains, let alone build on them yesterday. Does it mean the return of range-bound euro, or is there more downside on the immediate horizon? After Monday's strong showing of USD/JPY bulls, the same question goes to this pair too. Yet it's a different pair that has just made us jump into the action with both feet.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3353; the initial downside target at 1.3144)

- USD/CHF: none

- AUD/USD: none

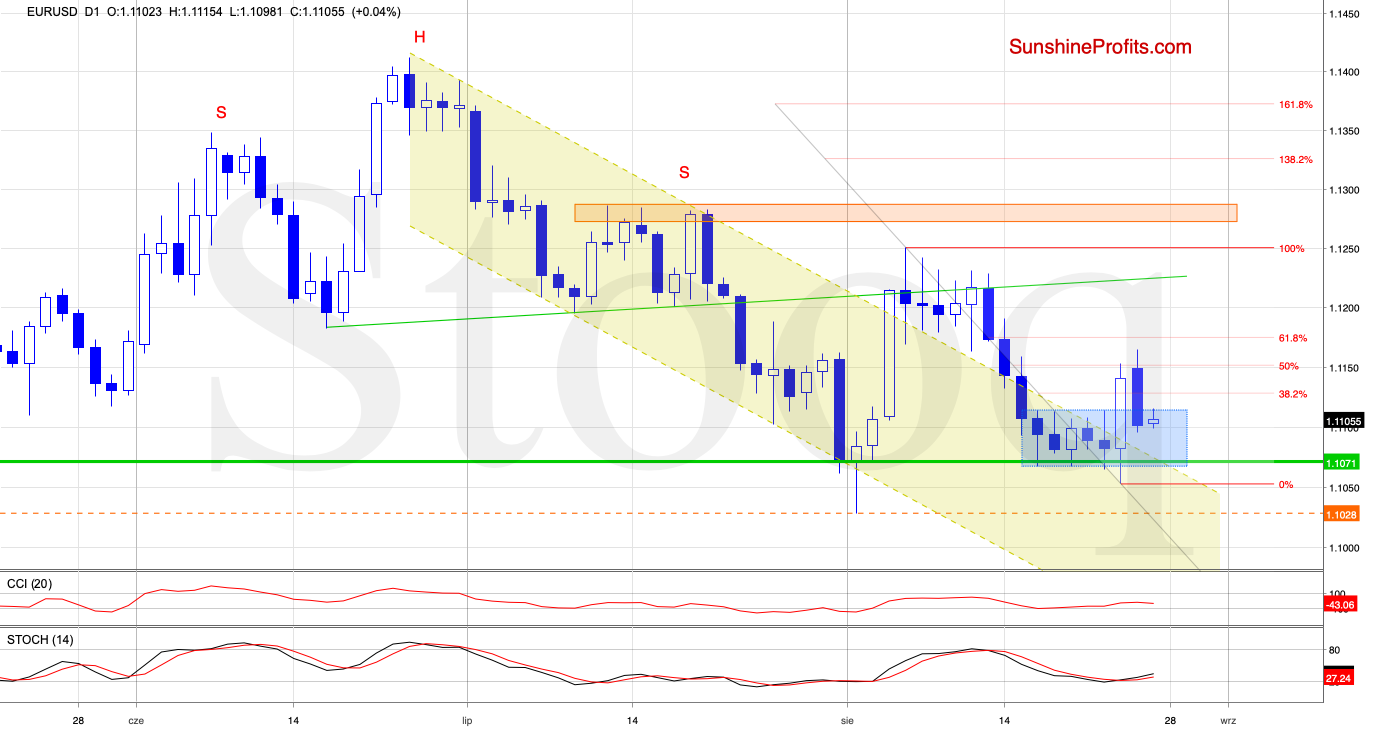

EUR/USD

EUR/USD moved sharply lower yesterday, invalidating the earlier breakout above the upper border of the blue consolidation. This is a bearish development.

Earlier today, the bulls tried to take the pair higher, but the exchange rate still trades inside the blue consolidation. This suggests that we could see a test of the lower border of the formation and the green horizontal support line in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

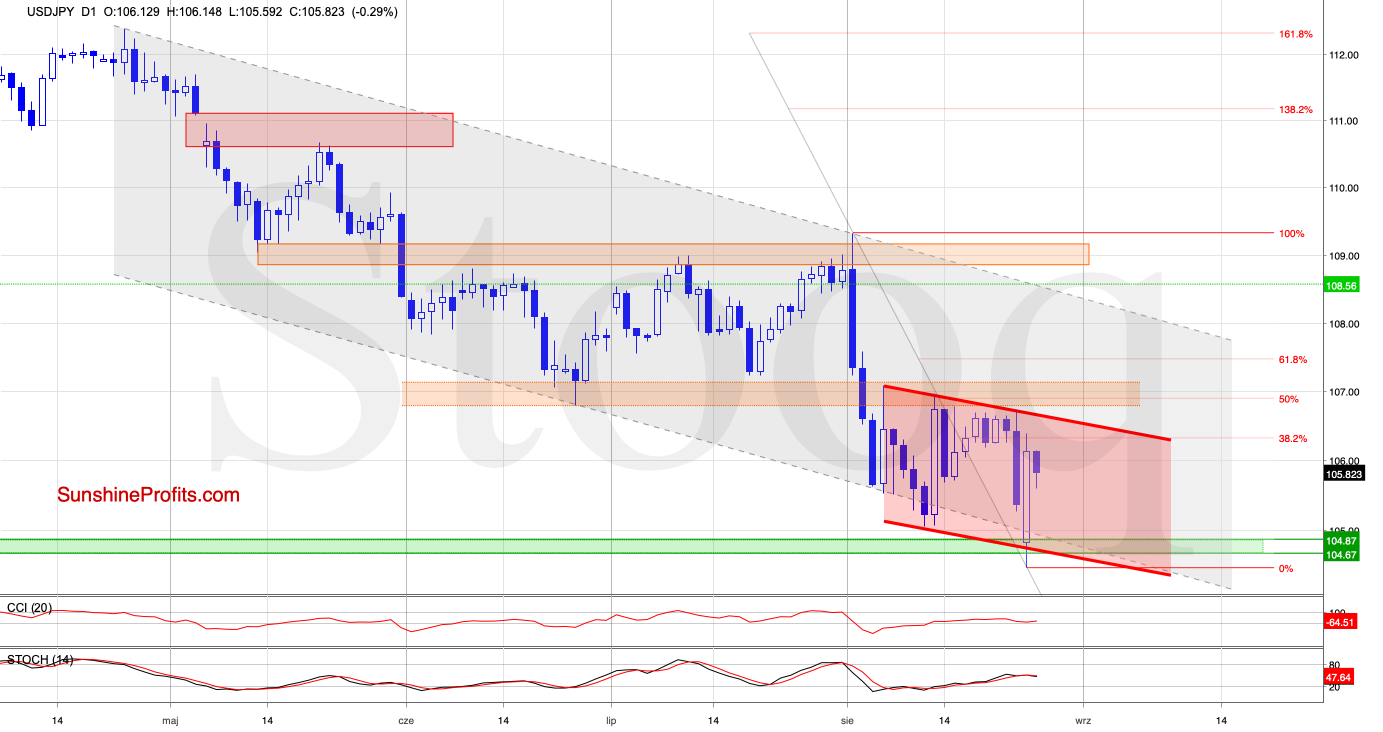

USD/JPY

The first thing that catches the eye on the daily chart is yesterday's fresh August low. The downswing took the exchange rate below the green support zone, the lower line of the declining grey trend channel and the lower border of the red declining trend channel.

The buyers however quickly invalidated all three breakdowns, and the pair swiftly moved to the upside. This upswing closed the Monday's opening gap, which looks encouraging for the buyers.

Nevertheless, the current position of the daily indicators suggests that one more slide aiming to test the above-mentioned supports can't be ruled out. This is especially the case when we factor in the bulls being unable to build on yesterday's huge white candle.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

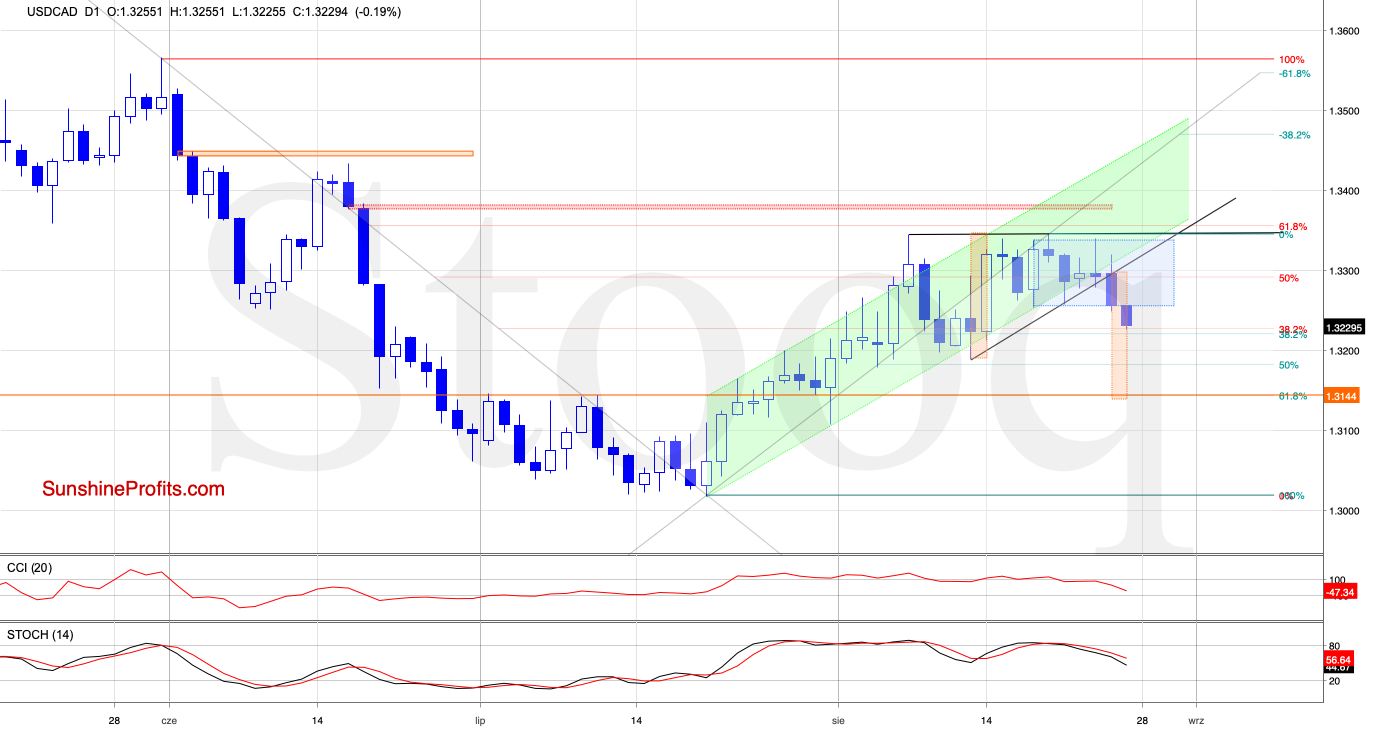

USD/CAD

Yesterday, USD/CAD broke below the lower border of the rising green trend channel and the lower line of the black triangle. Additionally, the pair closed the day below both supports, which encouraged the sellers to act earlier today.

The CCI and the Stochastic Oscillator generated their sell signals, increasing the probability of further deterioration in the coming days.

If that's the case and the exchange rate moves lower from here, the initial downside target will be around 1.3144, where the size of the downward move will correspond to the height of the triangle. This is also where the 61.8% Fibonacci retracement is.

Taking all the above into account, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3353 and the initial downside target at 1.3144 are justified from the risk/reward perspective.

Summing up the Alert, EUR/USD has again reversed lower, and could very well retest its recent lows. USD/JPY bulls' show of strength has been a one day phenomenon only, and neither the USD/CHF bulls' action justifies opening long positions. It's however USD/CAD's breakdown below important supports and daily indicators' position that justifies opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist