Looking at today's trading, perhaps the euro bulls will be able to erase some of their previous losses. The $64,000 question is whether today's upswing changes anything - or even more precisely, how would it have to look like in order to change anything. We have quite a few points to tell you regarding this. Meanwhile, the cable continues plunging like there's no tomorrow - any ideas where the British pound stops its descent? Let's sharpen our trading plans examining all the above and more.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1228; the initial downside target at 1.1120)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

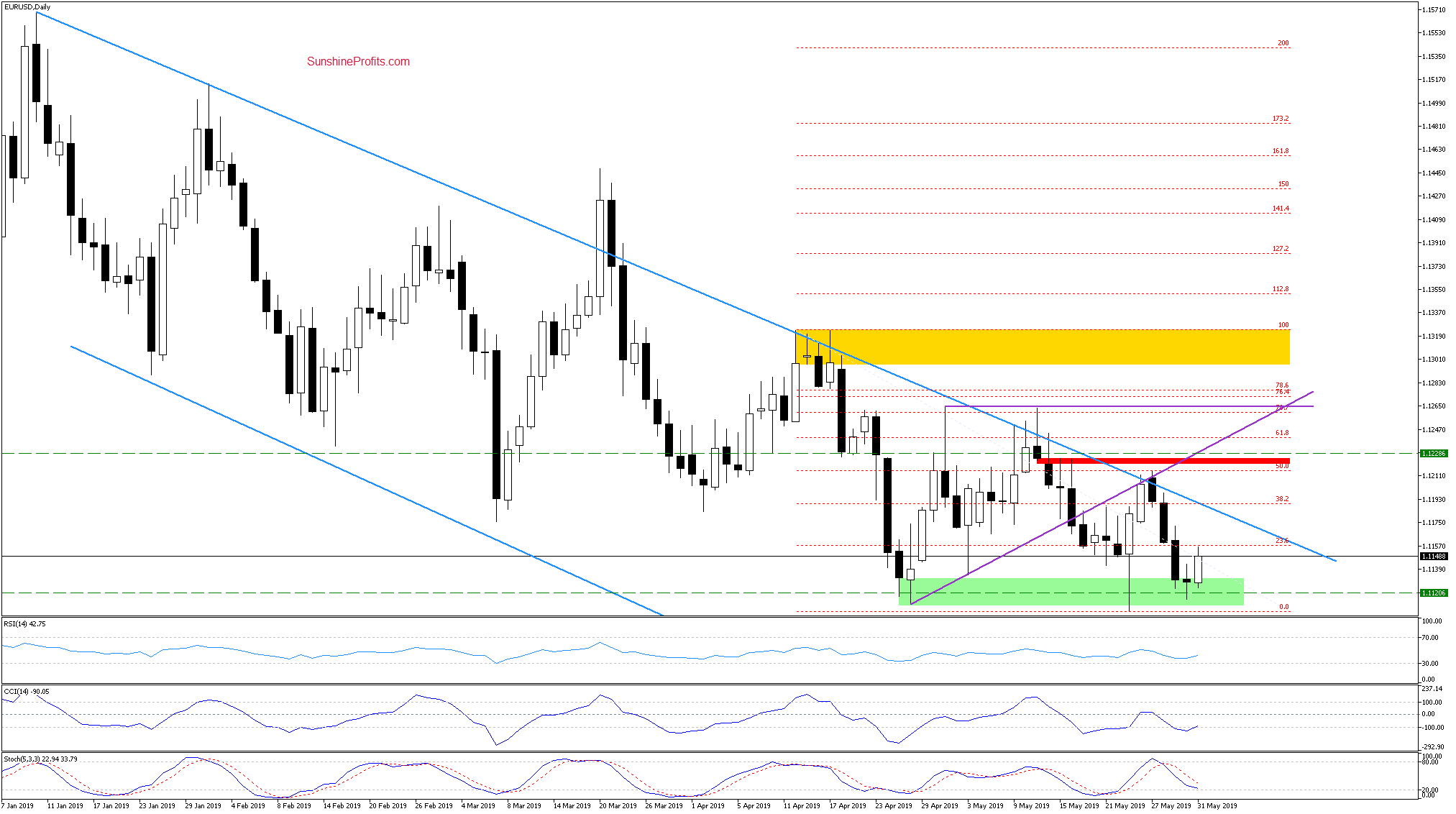

EUR/USD

EUR/USD has yesterday retested the green support zone, in line with our expectations. This downswing has however encouraged the bulls to act - they have reversed yesterday's losses and took the pair higher earlier today.

While the rate currently trades at around 1.1150, it's not only below the upper border of the declining blue trend channel but also below the nearest Fibonacci retracement, the 23.6% one.

Combined, these suggest that one more downswing is likely around the corner. Should it be so, a test of the recent lows as a minimum will happen shortly.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1228 and the initial downside target at 1.1120 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

GBP/USD went on to extend losses in recent days. Let's remember our Wednesday's words regarding the breakdown below the lower border of the declining red trend channel:

(...) At the start of both the previous and the current week, the rate has attempted a comeback to the declining red trend channel. Unsuccessfully, as the following price action went on to take the pair lower.

As a result, both recent upswing attempts look like a verification of the breakdown below the lower border of the declining red trend channel.

Now, the pair went on to break below the support area created by the 76.4% and 78.6% Fibonacci retracements (marked in green). The Stochastic Oscillator is still on a sell signal. How low can the bears think of taking the rate? Let's turn to our recent comments again:

(...) Take a look at the yellow vertical rectangles. One marks the width of the red trend channel the rate has broken down from. The corresponding target would be at the lower end of the right yellow rectangle, where the late December 2018 lows are (at around 1.2443). But first, the bears have to push the rate below last week's lows.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

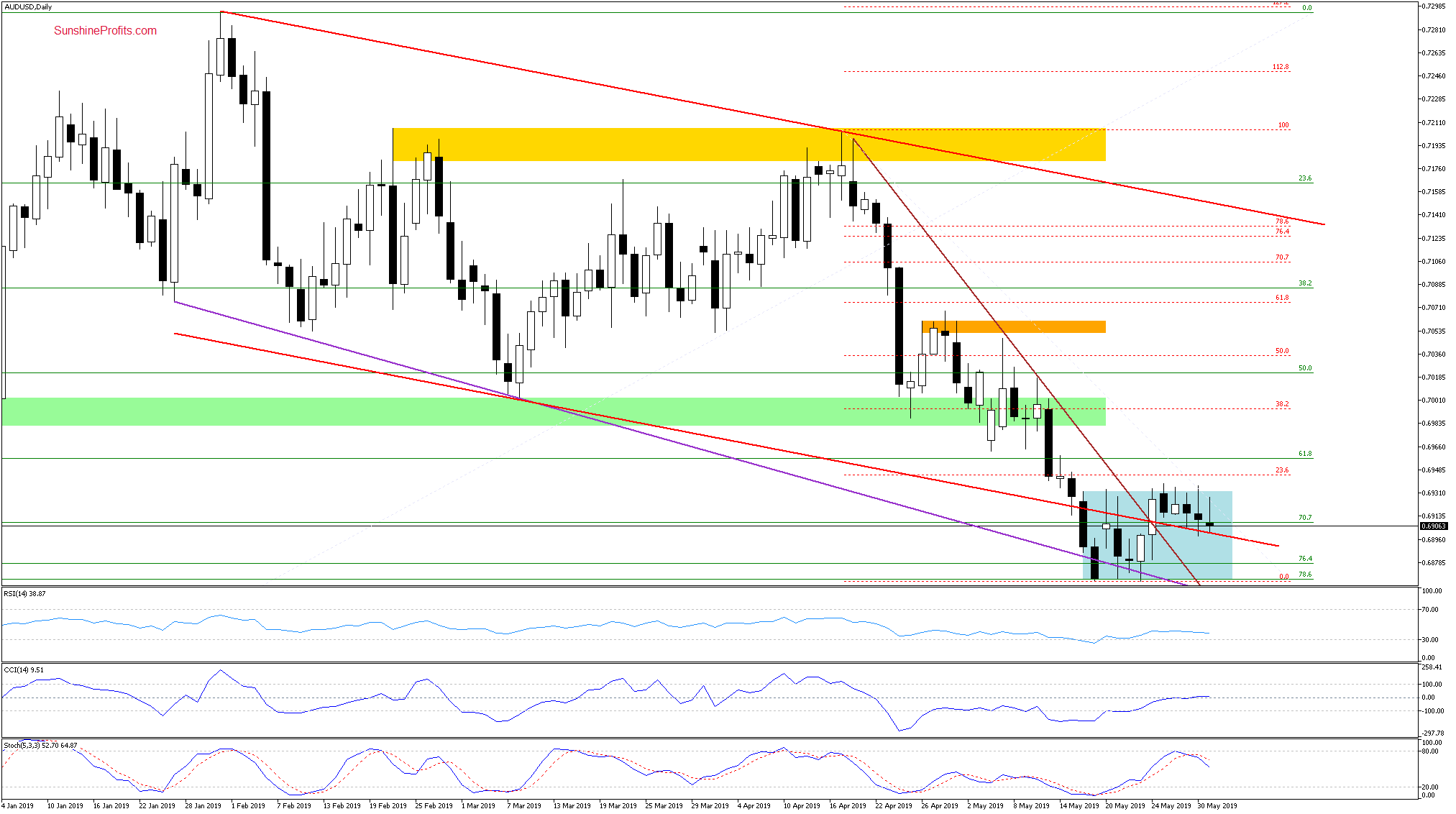

AUD/USD

Since the late last week's upswing has ended, AUD/USD has been trading near the upper border of the blue consolidation. All attempts to break higher have been rebuffed and the pair has been slowly but surely giving up its previous gains.

The Stochastic Oscillator is on a sell signal. This constellation doesn't bode well for a further rally. What is likely coming next? Let's remember our Wednesday's observations:

(...) If the bulls don't succeed in breaking out from the blue consolidation to the upside, we're likely to see a test of the lower border of the declining red trend channel as a minimum. Even a decline to the steeply-descending brown resistance-turned-support line or the lower border of the blue consolidation isn't out of the question in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, while EUR/USD has erased some of its previous losses earlier today, the chart posture and daily indicators continue to suggest one more downswing, targeting the green support zone initially. USD/CAD is yet again testing its strong combination of resistances that have sent it lower many times earlier already. Our short position remains justified. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist