The aftermath of the rich Wednesday session got the forex world going, and we saw some strong moves that didn't last till the closing bell yesterday. Such action leaves us with pretty important signs that are hard to ignore. And even harder not to act on. So, where exactly are the new trading positions we just jumped at?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1324; the initial downside target at 1.1197)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7052; the next downside target at 0.6925)

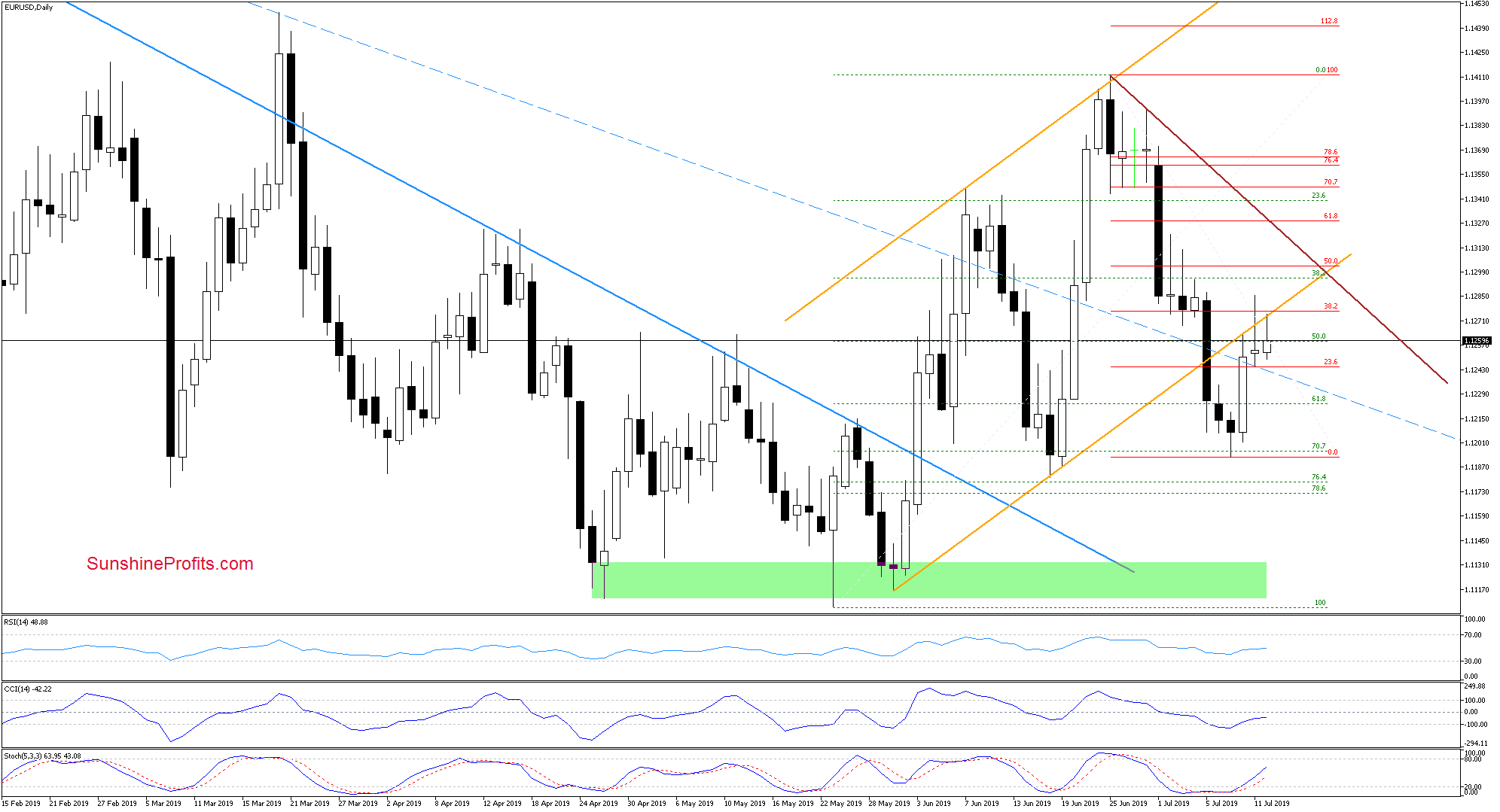

EUR/USD

EUR/USD moved higher yesterday, breaking slightly above the 38.2% Fibonacci retracement and the lower border of the orange rising trend channel. This activated our stop-loss order and profitably closed the remaining half of our earlier short position.

Despite this improvement, the bulls didn't manage to hold gained ground, and the pair closed the day below both resistances. This way, the earlier tiny breakouts have been invalidated, suggesting that the buyers may not be as strong as it may seem at first sight.

Earlier today, they have made another attempt to move higher, but failed to break above the above-mentioned obstacles for the second time in a row.

Taking all the above into account, we think that reopening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1324 and the initial downside target at 1.1197 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Before moving onto another currency pair...

...AUD/USD note first: similar to the EUR/USD price action (an activation of the stop-loss order, leading to closing the short positions and taking profits off the table) also happened in this pair. Nevertheless, the very short-term outlook remains bearish, which justifies reopening short positions with a stop-loss order at 0.7052 and the next downside target at 0.6925.

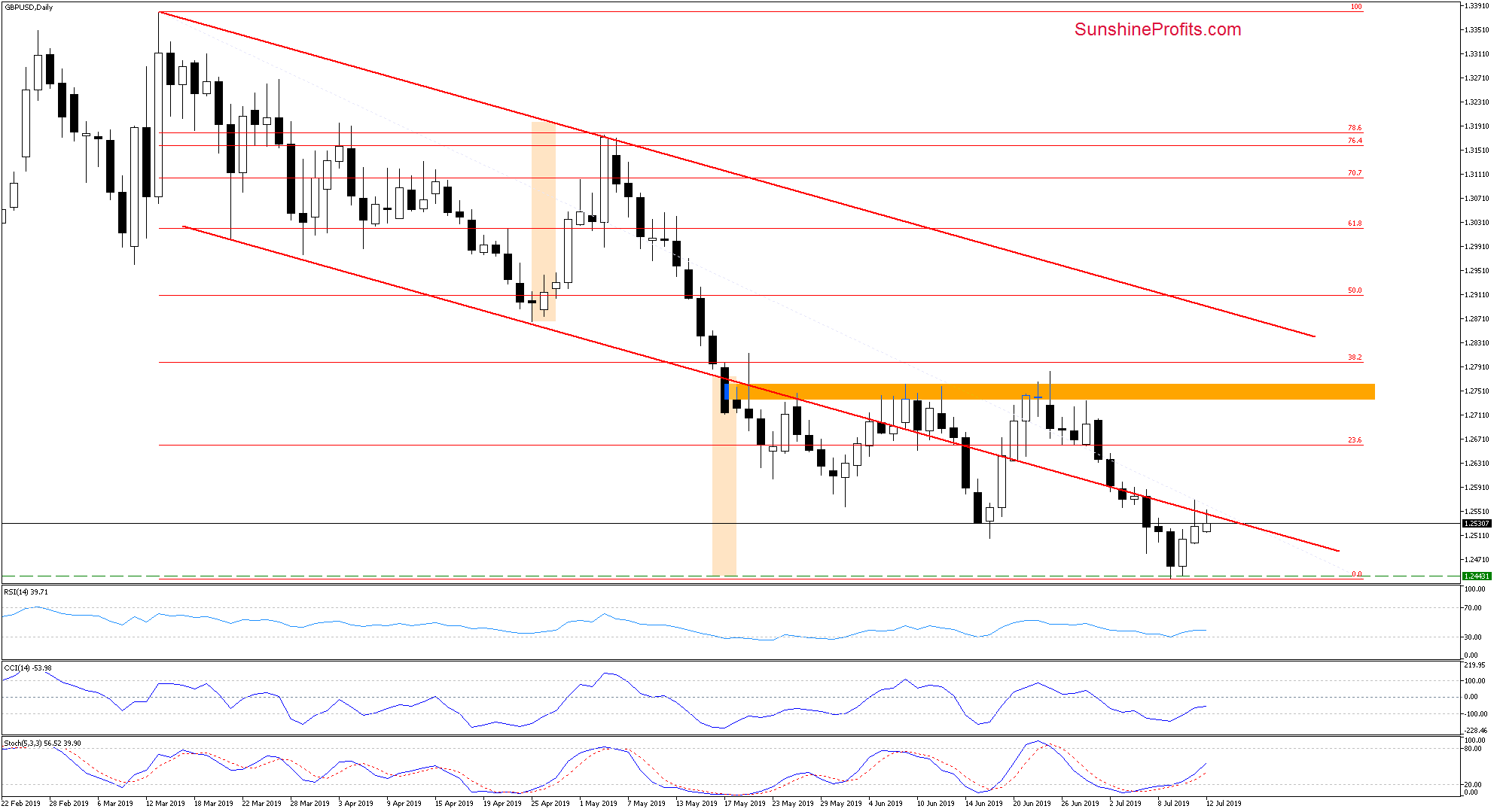

GBP/USD

Earlier this week, the pair reached the green dashed support line. There, the size of the downward move corresponds to the height of the declining red trend channel that the rate broke down earlier from.

This encouraged the bulls to act, and higher values followed. While that may seem bullish, both attempts to move higher failed as evidenced by the significant upper knots. The previously-broken lower border of the declining red trend channel stopped the buyers, and the rate pulled back.

As long as there is no successful comeback above this trend channel's lower border, a bigger move to the upside is questionable and another retest of the green horizontal line can't be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

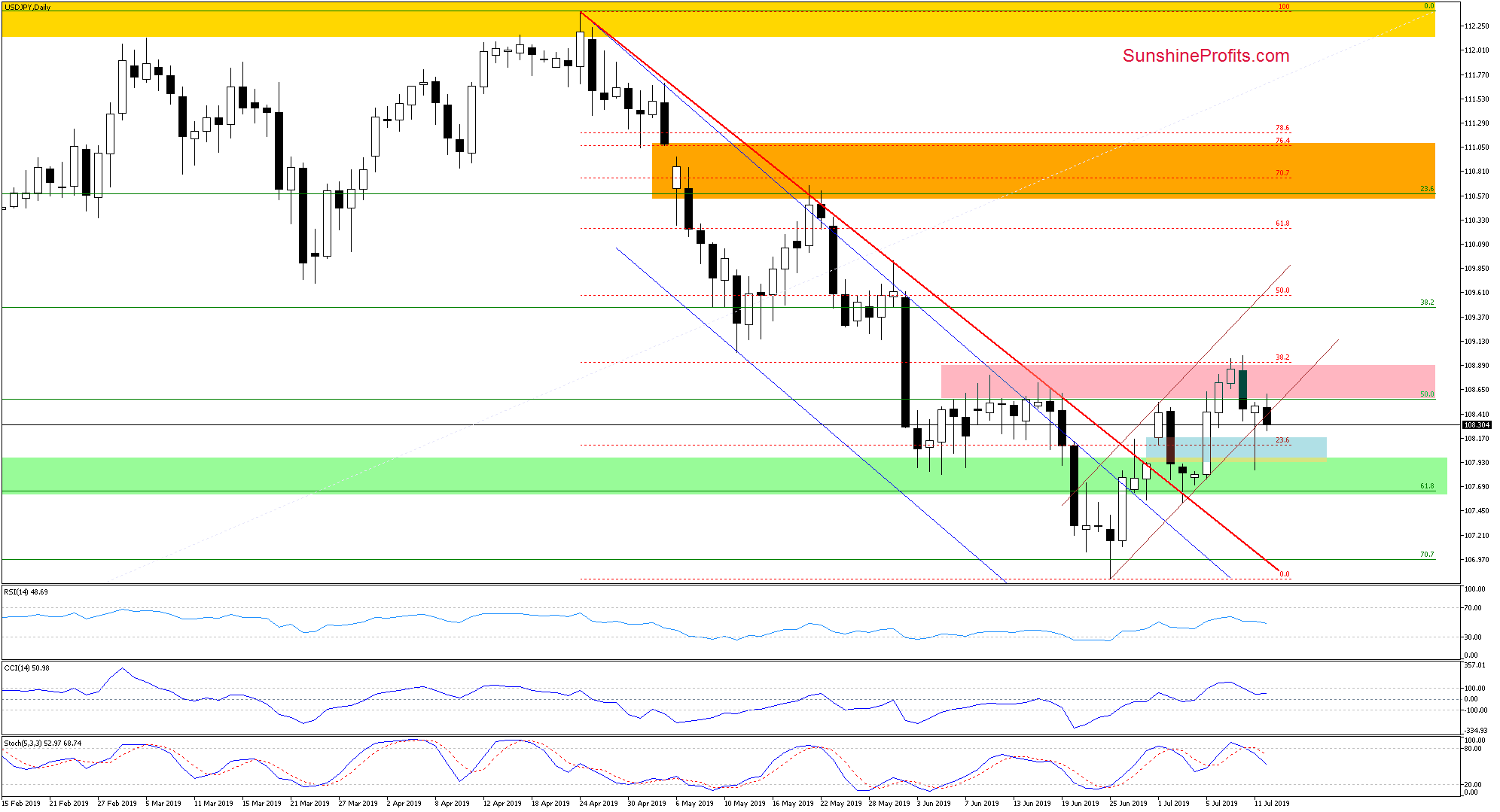

USD/JPY

The combination of the pink resistance zone and the 38.2% Fibonacci retracement encouraged the sellers to act. Although they took the exchange rate below the lower border of the rising brown trend channel, the blue gap stopped them.

The pair rebounded and closed the day back inside the rising trend channel, invalidating the earlier intraday breakdown. While this is a positive sign for the bulls, yesterday's move took the pair to the above-mentioned pink resistance zone. Such price action looks like nothing more than a verification of the earlier breakdown below this zone.

The bears returned to the trading floor earlier today once again, and the pair trades at around 108.05 currently. Coupled with the sell signals generated by the daily indicators, it increases the probability of another attempt to close the blue gap in the very near future. Should we see such price action, we'll consider going short.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, while EUR/USD has rebounded higher lately, the bulls' attempts were stopped by powerful resistances (the lower border of the orange rising trend channel and the 38.2% Fibonacci retracement), leading to a pullback. As the upside momentum appears waning today and the bearish outlook remains on, opening short positions is justified. The AUD/USD weekly and daily bearish outlook remains in force. Today's upswing notwithstanding, opening short positions is also justified. Should we see the USD/JPY bears' strength in closing the blue gap, we'll consider opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist