In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.2990)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0035; the initial downside target at 0.9849)

- AUD/USD: none

EUR/USD

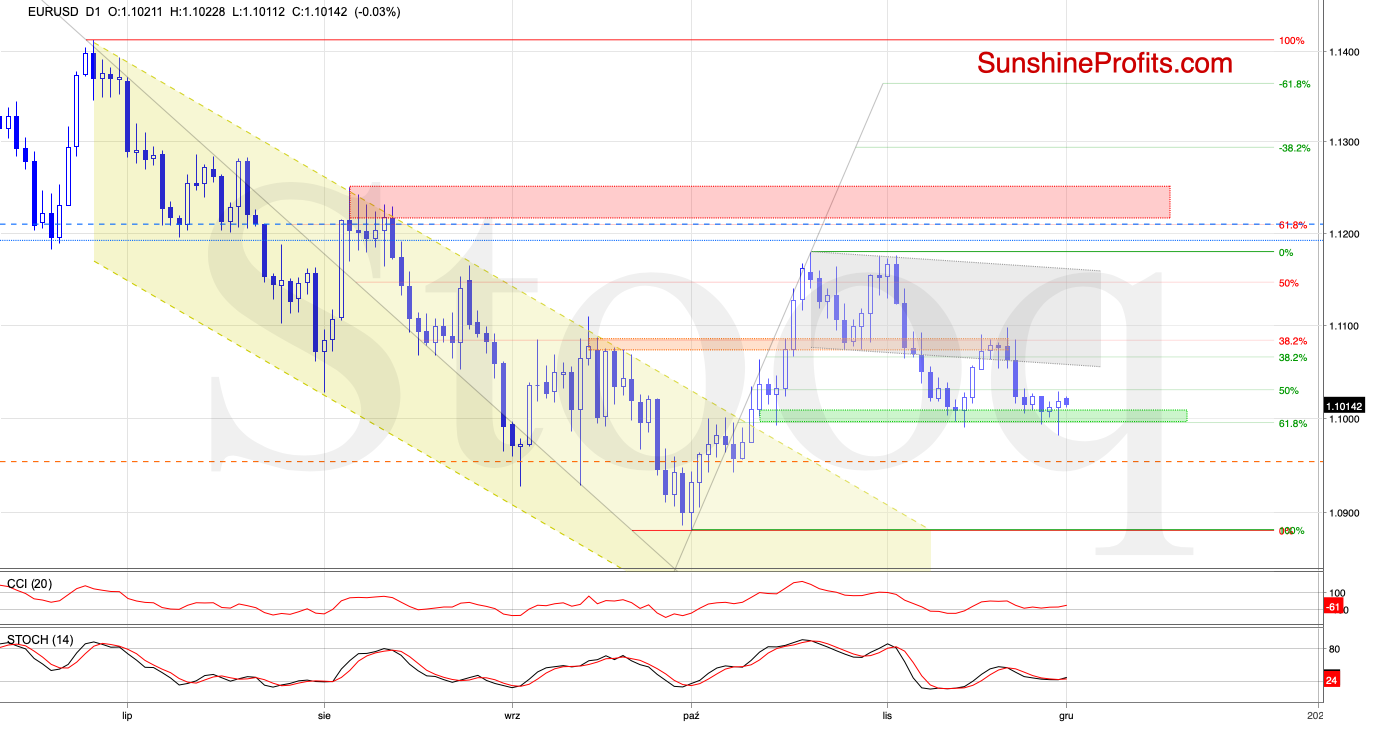

While EUR/USD slightly decline on Friday, the green support zone coupled with the 61.8% Fibonacci retracement stopped the sellers. A rebound followed, and the pair finished the day above the said support. This way, the tiny intraday breakdown below it has been invalidated.

In mid-November, we have seen similar price action, which suggests that reversal followed by higher values of the exchange rate may be just around the corner. This is especially so when we factor in the position of the daily indicators. Both the CCI and the Stochastic Oscillator have generated their buy signals just as they did in mid-November, which increases the likelihood of further improvement this week.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

GBP/USD

The short-term situation remain unchanged as GBP/USD is still trading inside both the pink multi-week consolidation and the very short-term blue consolidation. It means that as long as there is no breakdown below the lower border of the pink formation, a bigger move to the downside is not likely to be seen and one more upswing in the coming days can't be ruled out.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the exit target at 1.2990 are justified from the risk/reward perspective.

USD/CAD

After the preceding upswing, USD/CAD has been trading in a tight range recently. With the declining trend channel's upper border at hand, and the orange resistance zone nearby, what are the chances of upswing continuation?

Similarly to GBP/USD, neither for USD/CAD has the short-term picture changed much. The pair is still trading inside the blue consolidation around the upper border of the declining red trend channel.

Unless there is no breakout above the upper border of the formation or breakdown below its lower border, another bigger move is not likely to be seen. Short-lived moves in both directions wouldn't surprise us in the least.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist