In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1165)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0035; the initial downside target at 0.9849)

- AUD/USD: none

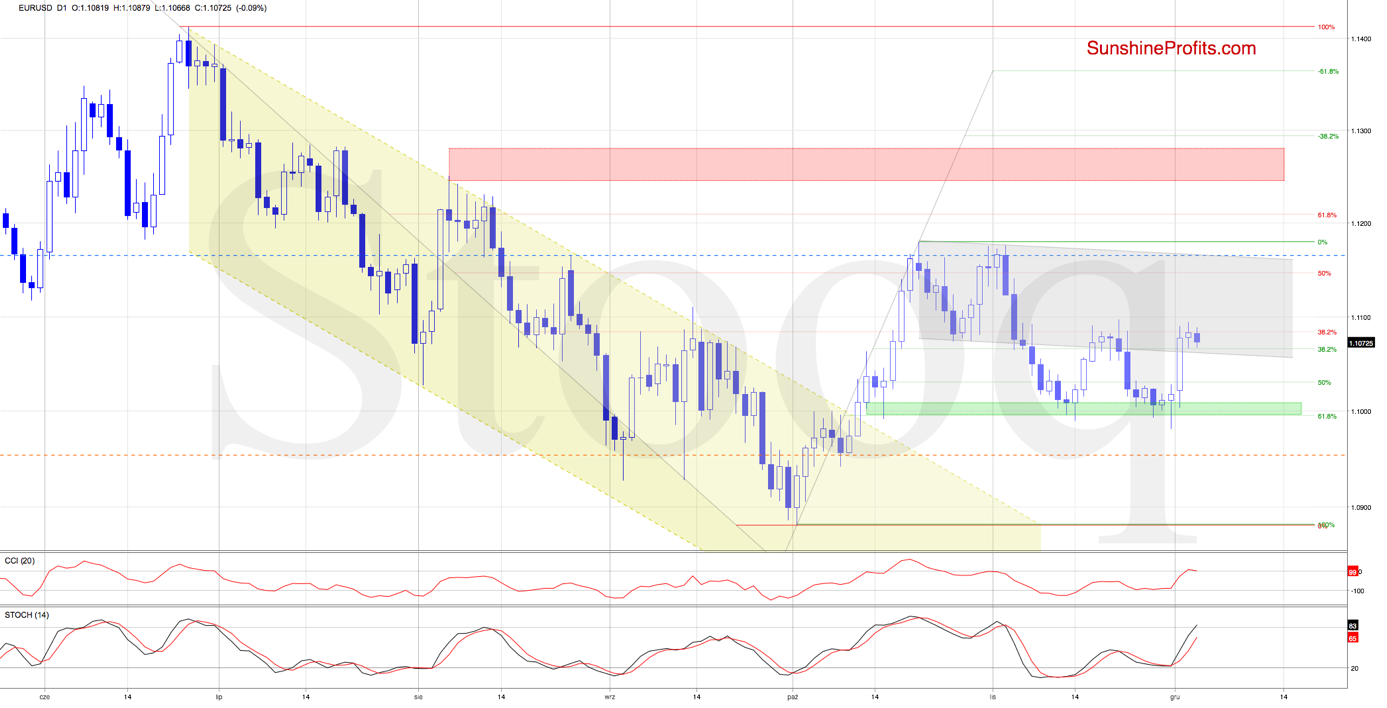

EUR/USD

While EUR/USD has moved slightly lower earlier today, the overall short-term situation hasn't changed much. The exchange rate is still trading above the previously broken lower border of the declining grey trend channel.

The daily indicators' buy signals remain on the cards though, lending support to the buyers. Let's quote our yesterday's observations as they're still valid today:

(...) It's our opinion that further rally will be more likely and reliable only if the exchange rate breaks above the late-November peaks.

Should the bulls prove strong enough and overcome that 1.1100 mark, the way to the upper border of the grey trend channel would be open.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1165 are justified from the risk/reward perspective.

USD/CAD

The USD/CAD situation in the short-term remains almost unchanged as the pair keeps trading inside the blue consolidation around the upper border of the declining red trend channel.

As long as there is no breakout above the upper border of the formation or breakdown below its lower border, another bigger move is not likely to be seen. Short-lived moves in both directions wouldn't surprise us in the least.

Let's examine the daily indicators for more clues. They look quite extended. As the bulls are having readily apparent problems taking the rate higher, it's probable that lower values of the pair are just around the corner.

Should we see more bearish signs, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

After a prolonged decline, the Australian dollar shot up recently. While swift and sizable, has the upswing been profound enough to turn the tide? Let's examine the technical outlook as it stands right now.

On one hand, AUD/USD broke above the upper border of the blue consolidation yesterday. On the other hand though, the 61.8% Fibonacci retracement stopped the buyers, and a pullback followed.

Earlier today, the pair extended losses and came back into the consolidation, which is a bearish development. Nevertheless, as long as there is no daily close inside the formation and the buy signals generated by the daily indicators remain on the cards, another attempt to move higher remains likely.

Should we see such price action, the bulls will likely test not only the 61.8% Fibonacci retracement, but also the medium-term declining grey resistance line in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist