The Fed spoke and the resulting gyrations could be felt widely across the board. Especially the euro reacted in a volatile way. Has it brought any change to the pair’s outlook? What is the real effect on that rate’s technical standing? While the rest of our positions are humming along nicely, we invite you to find out precisely what we are going to do about the euro situation right now. And not only about it, that is.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1501; the initial downside target at 1.1305)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 112.32; the initial downside target at 109.82)

- USD/CAD:long (a stop-loss order at 1.3228; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

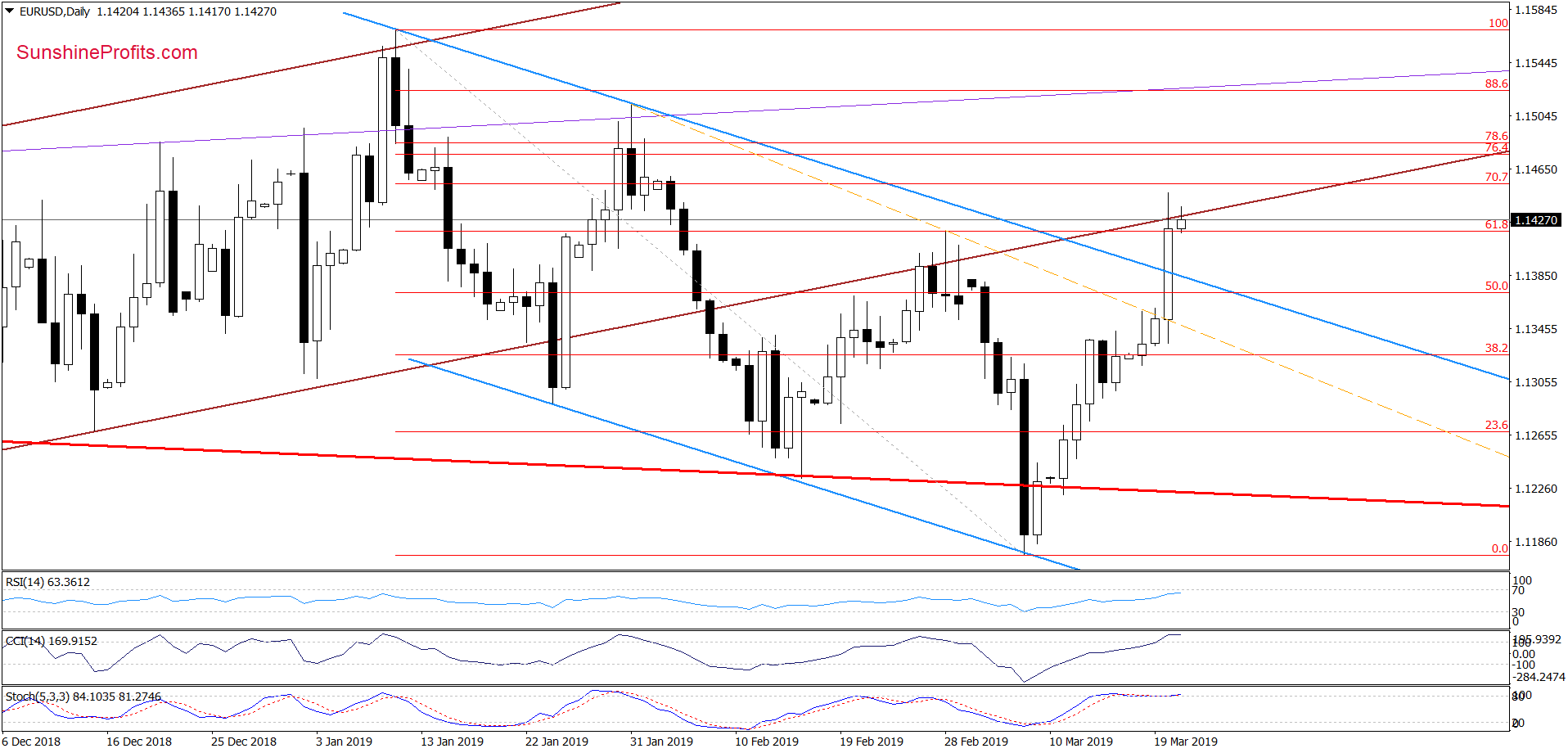

EUR/USD

Yesterday, the U.S. dollar moved sharply lower after the Fed monetary policy U-turn: the deep change to the interest rate hike projections in the Fed’s dot plot and the announced balance sheet reduction tapering in May followed by stopping them entirely before September is over. Technically, this has pushed EUR/USD above the upper border of the blue declining trend channel.

The exchange rate also tested the previously-broken lower border of the brown rising trend channel, however the bulls have run out of steam before the closing bell. This way, the pair invalided the earlier tiny breakout above that lower border. It’s similar to what we have seen at the end of February. Back then, the buyers struggled for several days before giving up on further breakout attempts.

Earlier today, we witnessed another unsuccessful attempt to move higher. Combined with the vulnerable position of the daily indicators, it suggests that reversal is just around the corner. Therefore, we believe that opening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1501 and the initial downside target at 1.1305 are justified from the risk/reward perspective.

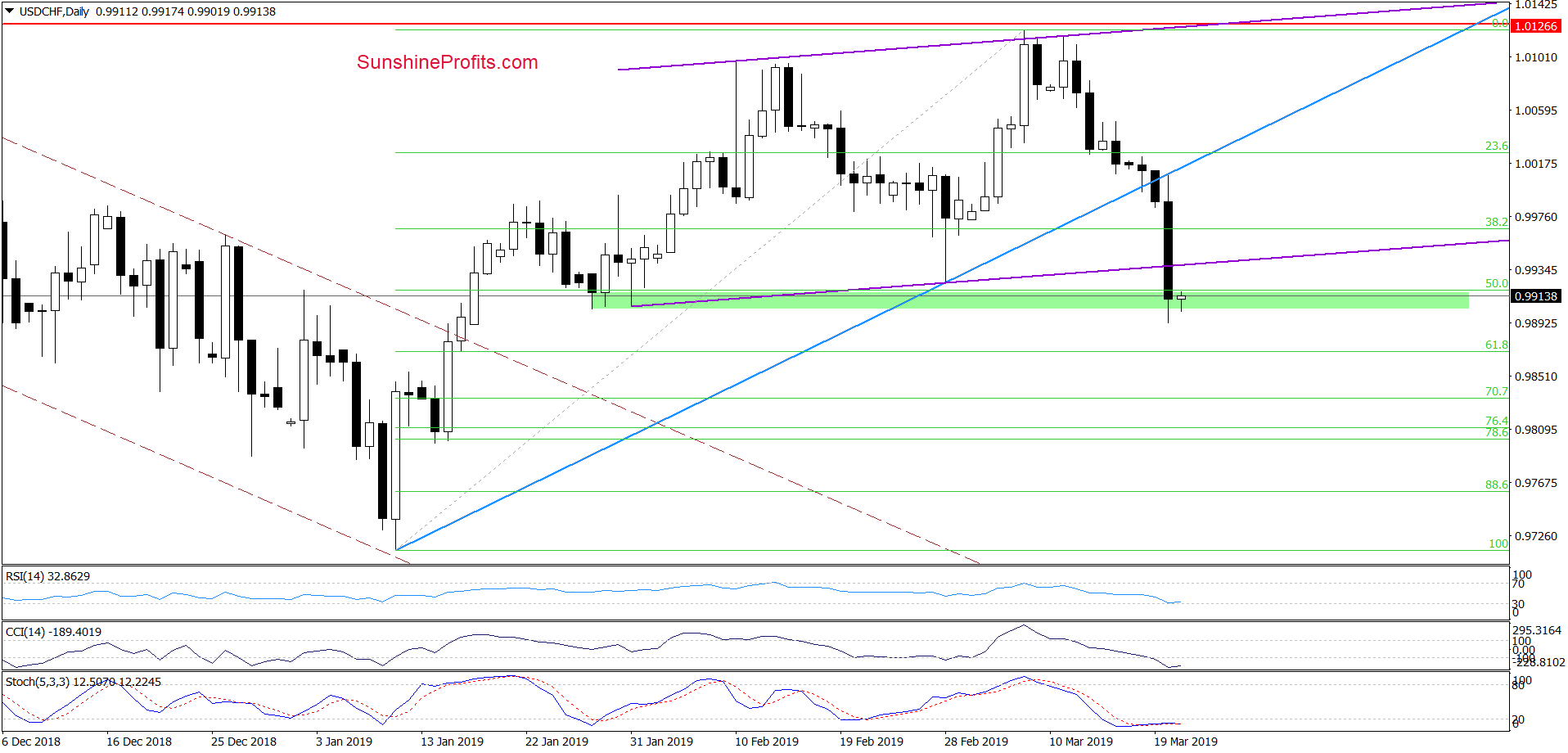

USD/CHF

Tuesday’s close below the rising medium-term blue support line in combination with yesterday’s monetary policy news triggered a sharp move down. As a result, USD/CHF dropped not only below the late-February lows, but also below the lower border of the rising purple trend channel. The pair went on to test the strength of the green support zone marking the late-January lows and also the 50% Fibonacci retracement.

Additionally, all daily indicators dropped to their lowest levels since the beginning of the year, which together with the above-mentioned support area proximity increases the probability of reversal in the very near future.

If USD/CHF moves higher from here and invalidates the breakdown below the purple support line, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

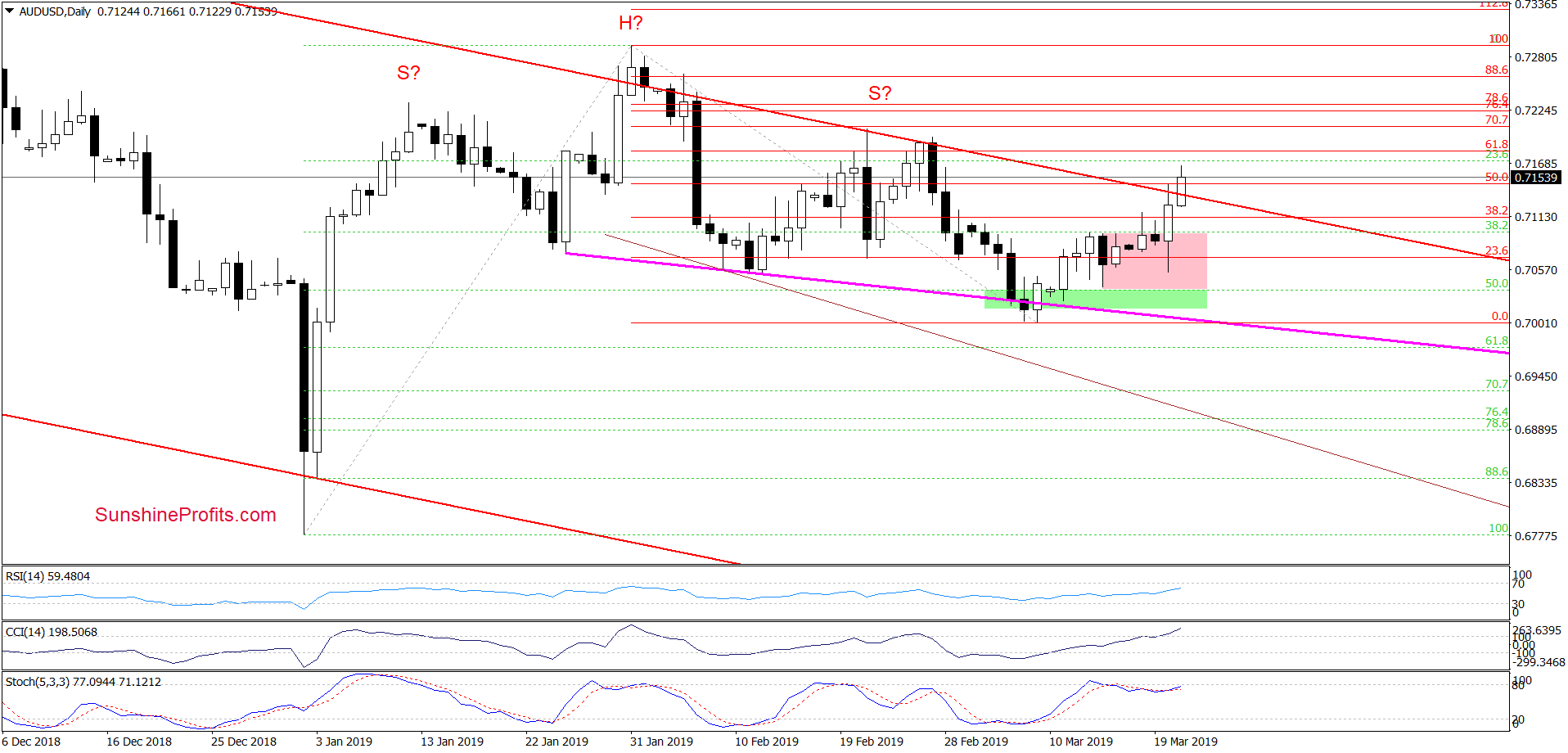

AUD/USD

Yesterday, AUD/USD broke not only above the upper border of the pink consolidation, but also above the red declining resistance line (the upper line of the long-term red declining trend channel). On the surface, this looks to be a bullish sign. Nevertheless, the current position of the daily indicators suggests that the space for gains may be limited. Especially, when we factor in the proximity to the 61.8% Fibonacci retracement and the late-February peaks.

Therefore, should we see reliable signs of the bulls’ weakness (for example an invalidation of the breakout above the red line), we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist