In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

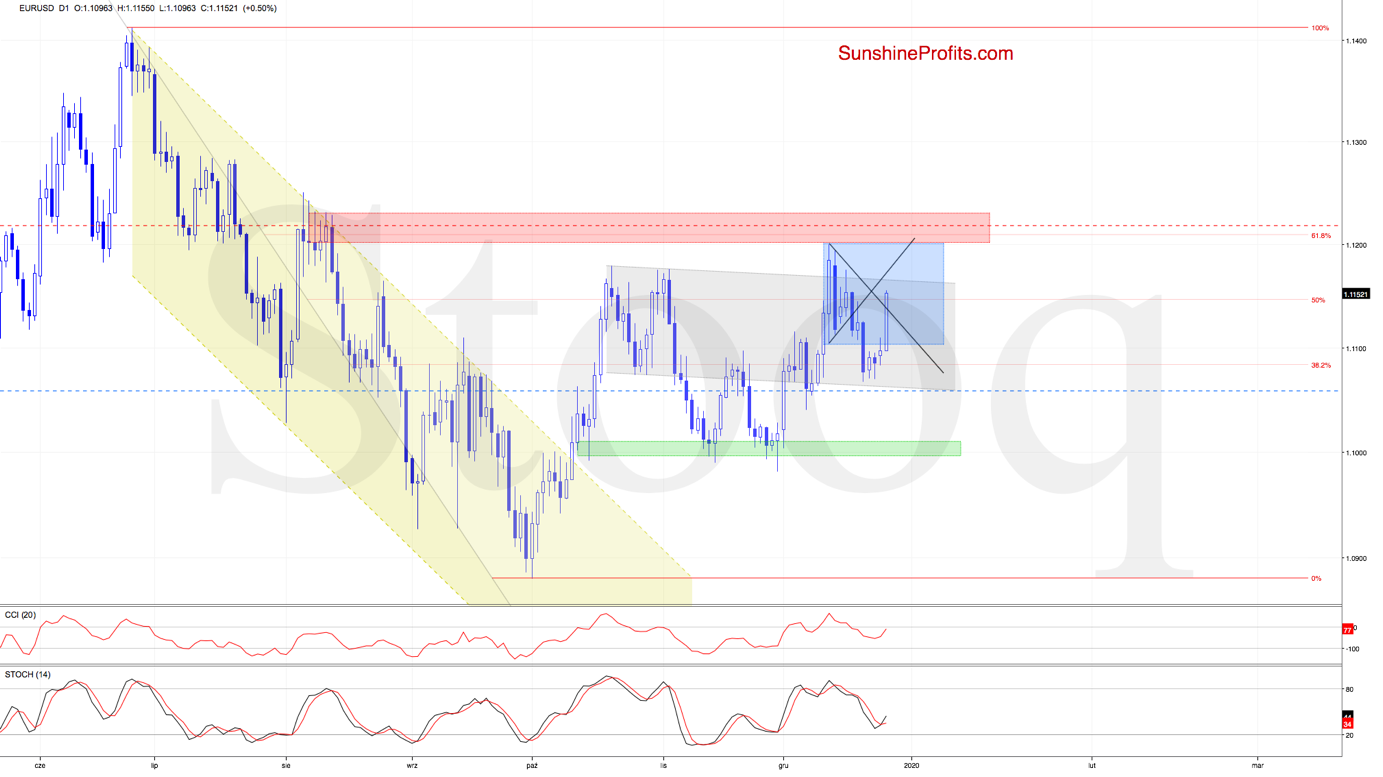

EUR/USD

EUR/USD moved sharply higher earlier today, breaking out above the declining black resistance line that is based on its previous peaks. This move also brought us invalidation of the earlier breakdown below the lower border of the blue consolidation, while the Stochastic Oscillator generated its buy signal.

Taking the above developments into account, it seems probable that we'll see further improvement and a test of the lower arm of the black triangle, of the upper border of the declining grey trend channel or even of the recent peaks at the upper border of the blue consolidation.

Therefore, closing short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/JPY

The overall situation in the short term hasn't changed much as USD/JPY is still trading inside the blue consolidation slightly below both the recent peaks and the rising green wedge.

Let's bring up our latest commentary as it is still up-to-date:

(...) the exchange rate is still trading below the rising green wedge, which suggests that another reversal may be just around the corner. This is especially the case when we factor in a potential head-and-shoulders formation.

Should it be the case and the pair moves lower from here, thus creating the right arm of the formation, the first downside target will be the support area created by last week's lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.40 and the initial downside target at 108.04 are justified from the risk/reward perspective.

USD/CHF

The Swiss franc has been trading around the green support zone recently, until it broke down earlier today. Is it a one-day event where the dollar bulls can be expected to step in shortly? Or is there some dollar-selling still ahead?

Earlier today, USD/CHF broke below the green support zone and the 61.8% Fibonacci retracement, triggering further deterioration and a breakdown below the recent lows.

This move opens the way to the next support area based on the 76.4% and 78.6% Fibonacci retracements, as the bears have the initiative.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist