The currencies haven’t moved much since yesterday really. One could say that it’s as exciting as watching paint dry. Quite the opposite - we think that it’s as insightful as watching a Greco-Roman wrestling match. While much may not appear to happen at first sight, there’s actually a lot happening if one takes a good look at the balance of forces. In our case, the balance of buying and selling forces. And how they fit the situation each pair is in right now.

In our opinion, the following forex trading positions are justified - summary:

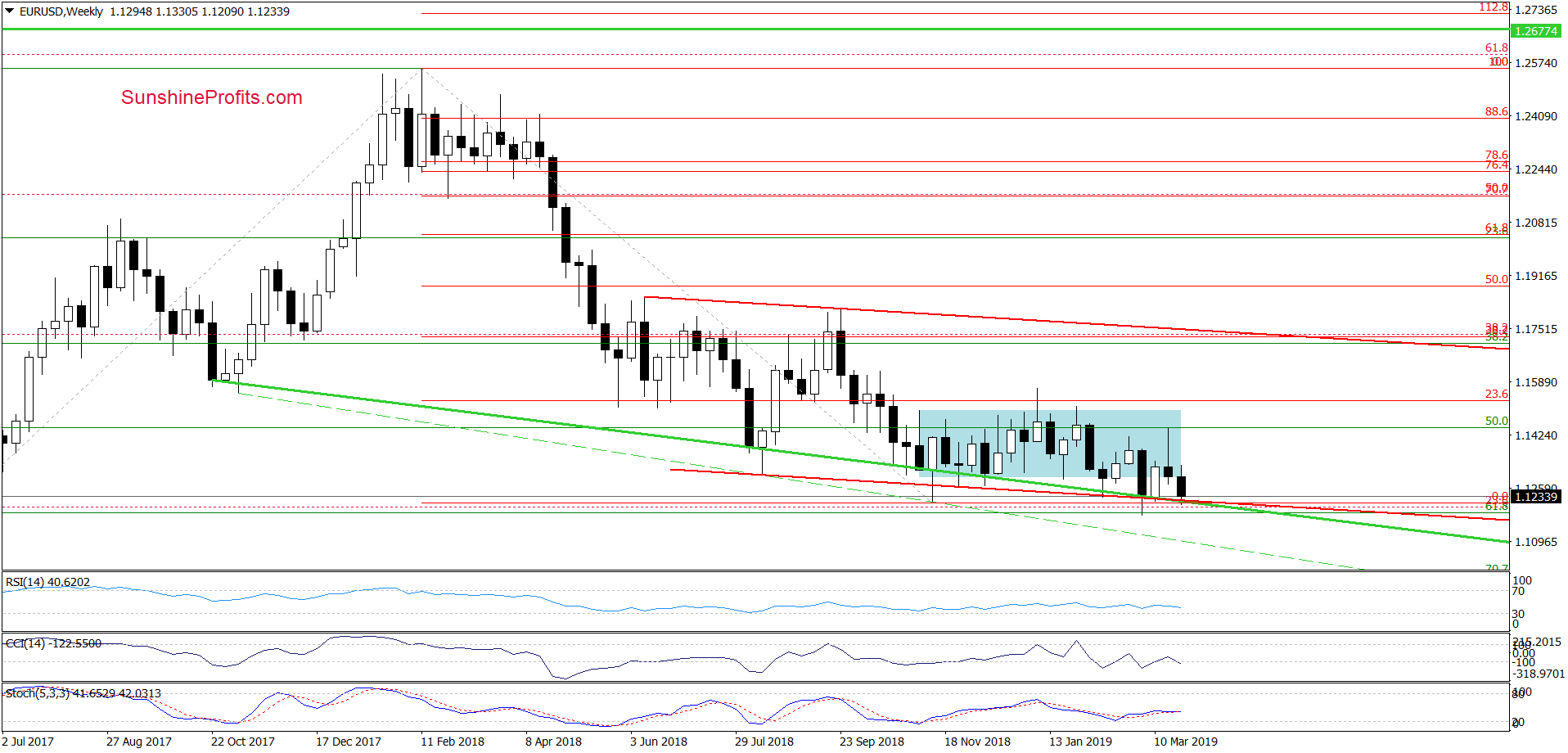

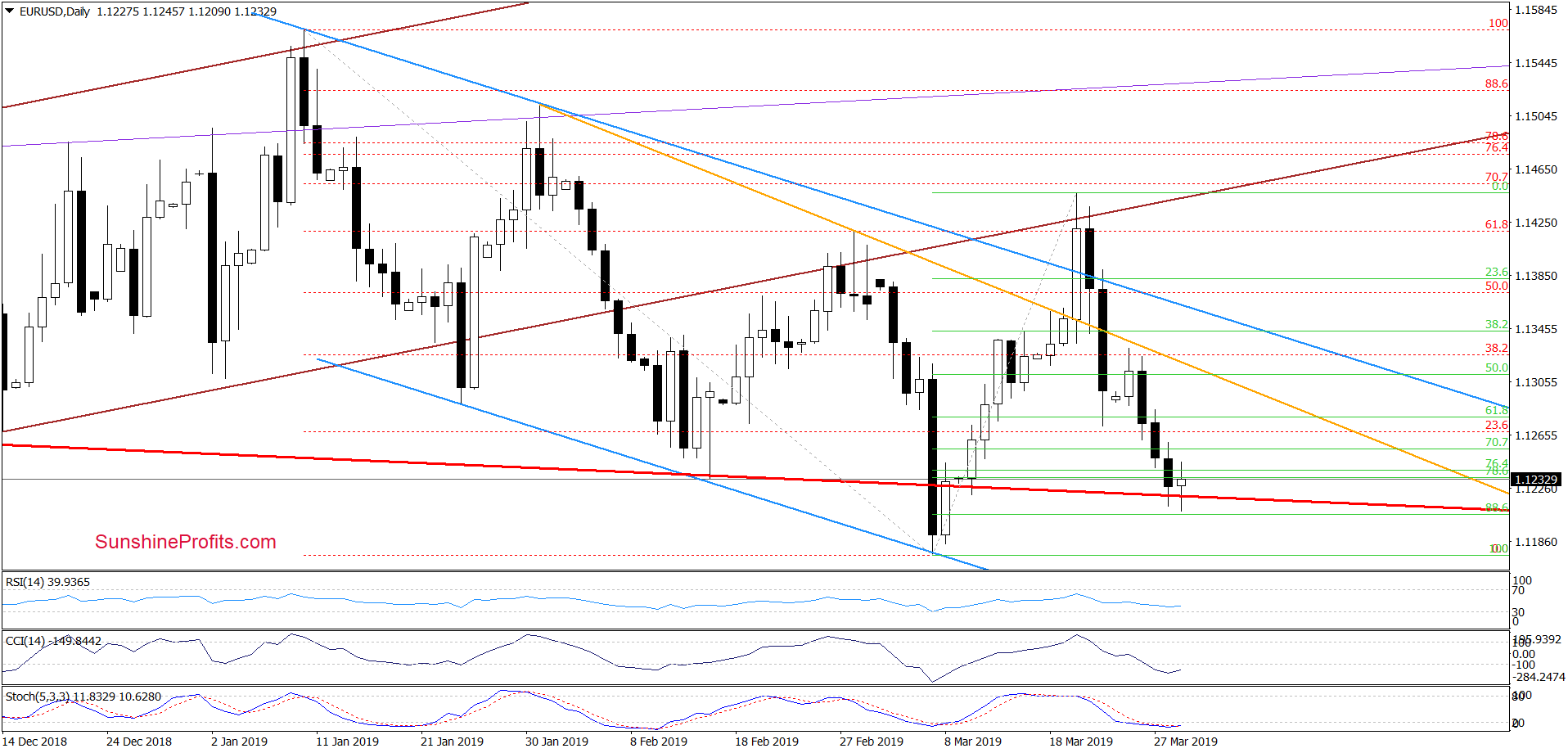

EUR/USD

Taking another look at the weekly chart, we see that the lower border of the long-term red declining trend channel and the long-term green support line have held so far. They have been strong enough to stop the sellers quite a few times in the past, which keeps alive the likelihood of another upswing in the coming day(s).

On the daily chart, we see that the sellers didn’t manage to hold the exchange rate below these weekly supports for long. The resulting rebound means invalidation of the tiny breakdown below the red declining support line on the daily chart. At the moment of writing these words, EUR/USD is as well trading above both weekly supports, which in combination with the current position of the daily indicators increases the probability of further improvement in the coming week.

Nevertheless, any bullish price action will be more likely and reliable only if EUR/USD closes today’s session above both the above-mentioned supports.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

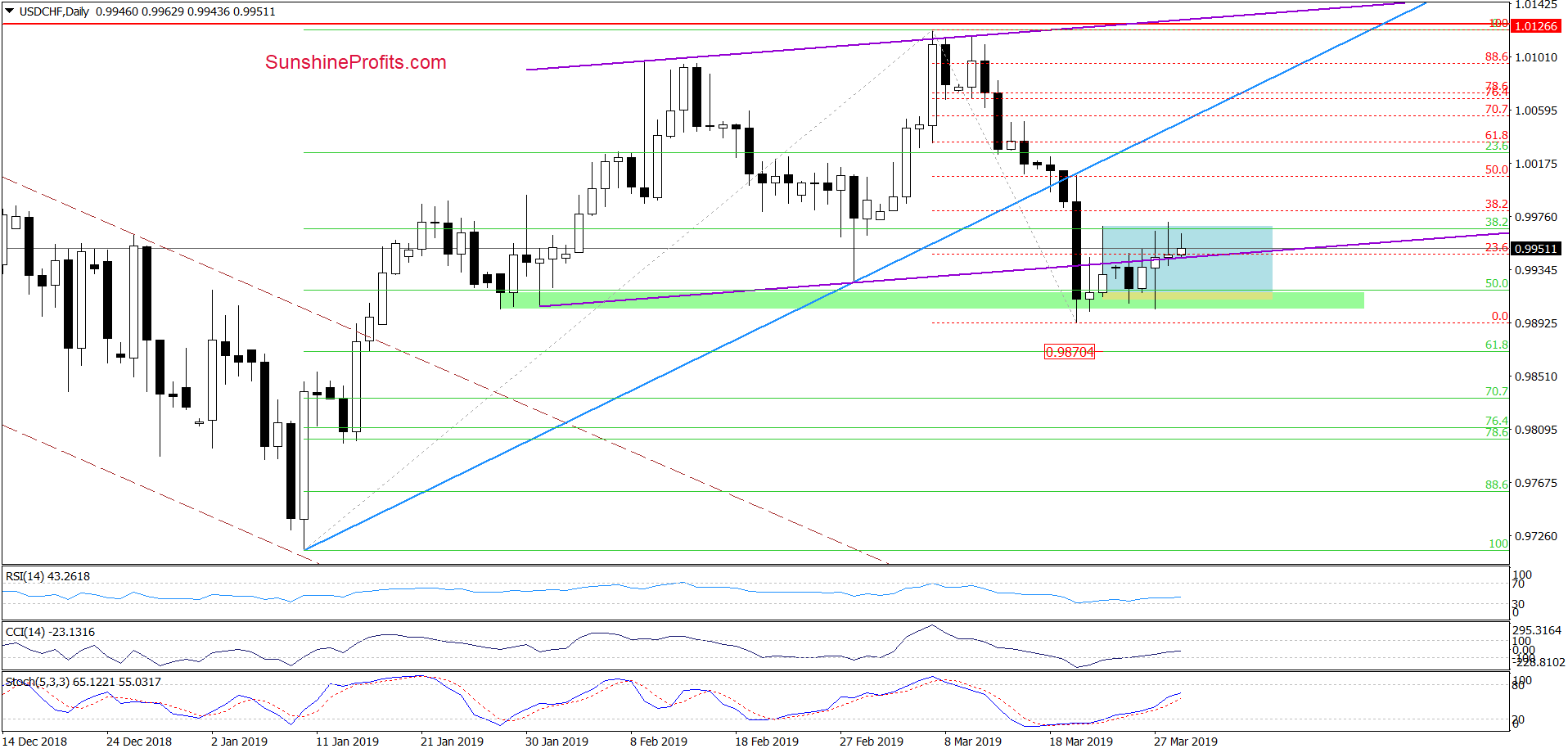

USD/CHF

On Wednesday, USD/CHF invalidated the earlier breakdown below the purple support line that forms the lower border of the rising trend channel. Yesterday, the bulls tried to go north, but the upper border of the blue consolidation stopped them.

As a result, the pair retested how strong the purple support line actually is. It looks like a verification of the earlier move above it.

Additionally, the buy signals generated by all daily indicators remain on the cards and this suggests further price improvement. Earlier today, we have seen another attempt to move higher, but it is our opinion that as long as there is no successful breakout above the consolidation, any bigger move to the upside is questionable. Short-lived moves in both directions should not surprise us as a result.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

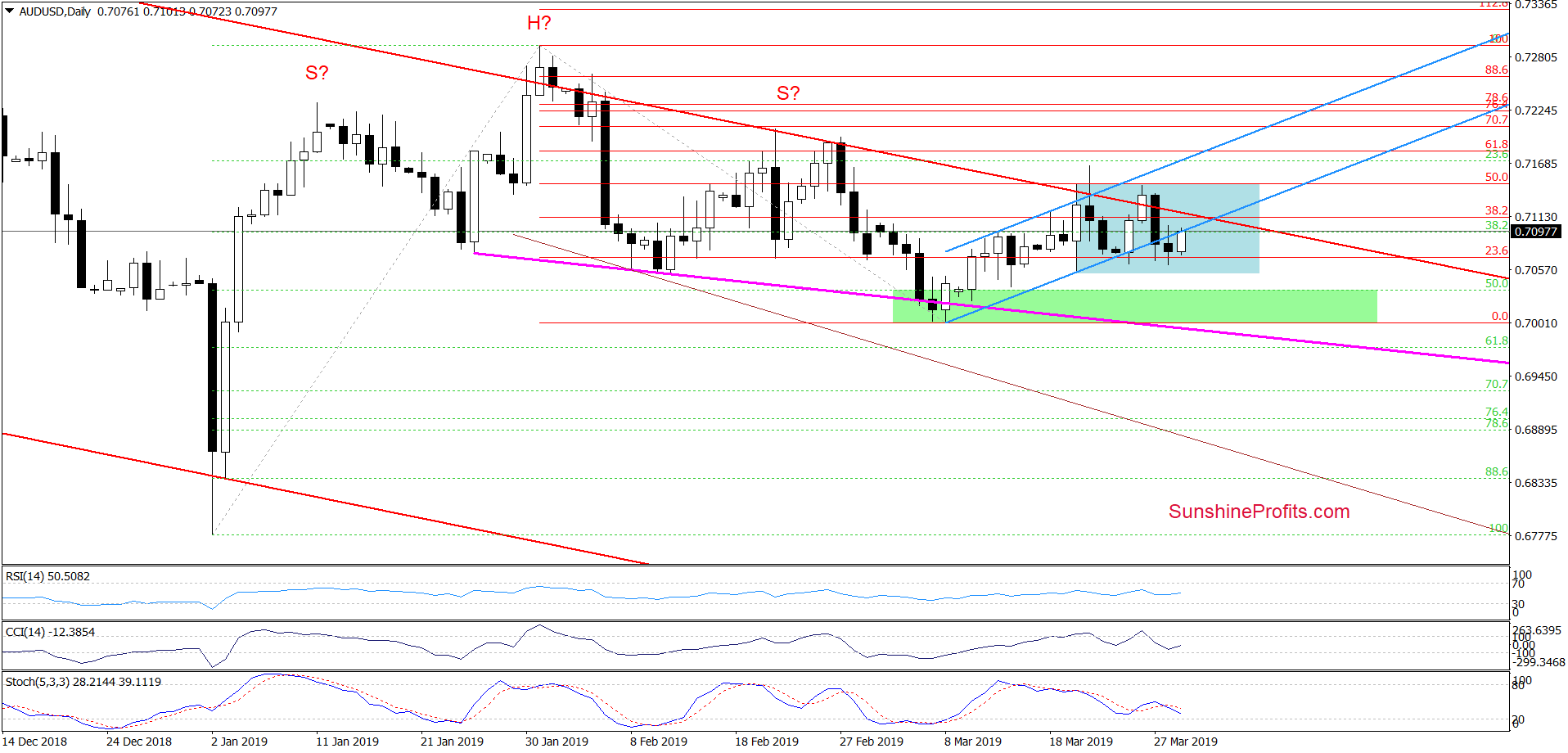

AUD/USD

On Wednesday, AUD/USD invalidated Tuesday’s breakout above the upper border of the red declining trend channel. This triggered quite a sharp decline. The pair slipped below the lower line of the very short-term blue rising trend channel and closed the day below it.

The sellers attempted to follow through with more selling action but were stopped dead in their tracks on Thursday. They didn’t manage to take the pair below the lower border of the blue consolidation.

The bulls countered this show of weakness earlier today. Today’s rebound looks like another verification of Wednesday’s breakdown so far. If this is the case (and it certainly looks so as the pair trades at around 0.7090 currently), AUD/USD will likely reverse and retest recent lows.

Nonetheless, another bigger move will be more likely and reliable only if AUD/USD breaks above the upper border of the consolidation, or below its lower border.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist