The Fed Chair spoke and the markets have moved, including the currencies. While it's easy to get carried away by the daily moves so far, cool heads prevail as they ask themselves what has changed and what has not. So, let's take a look together at what changes to our open positions are warranted.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (fresh stop-loss order at 1.1283; the next downside target at 1.1174)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.6991; the next downside target at 0.6898)

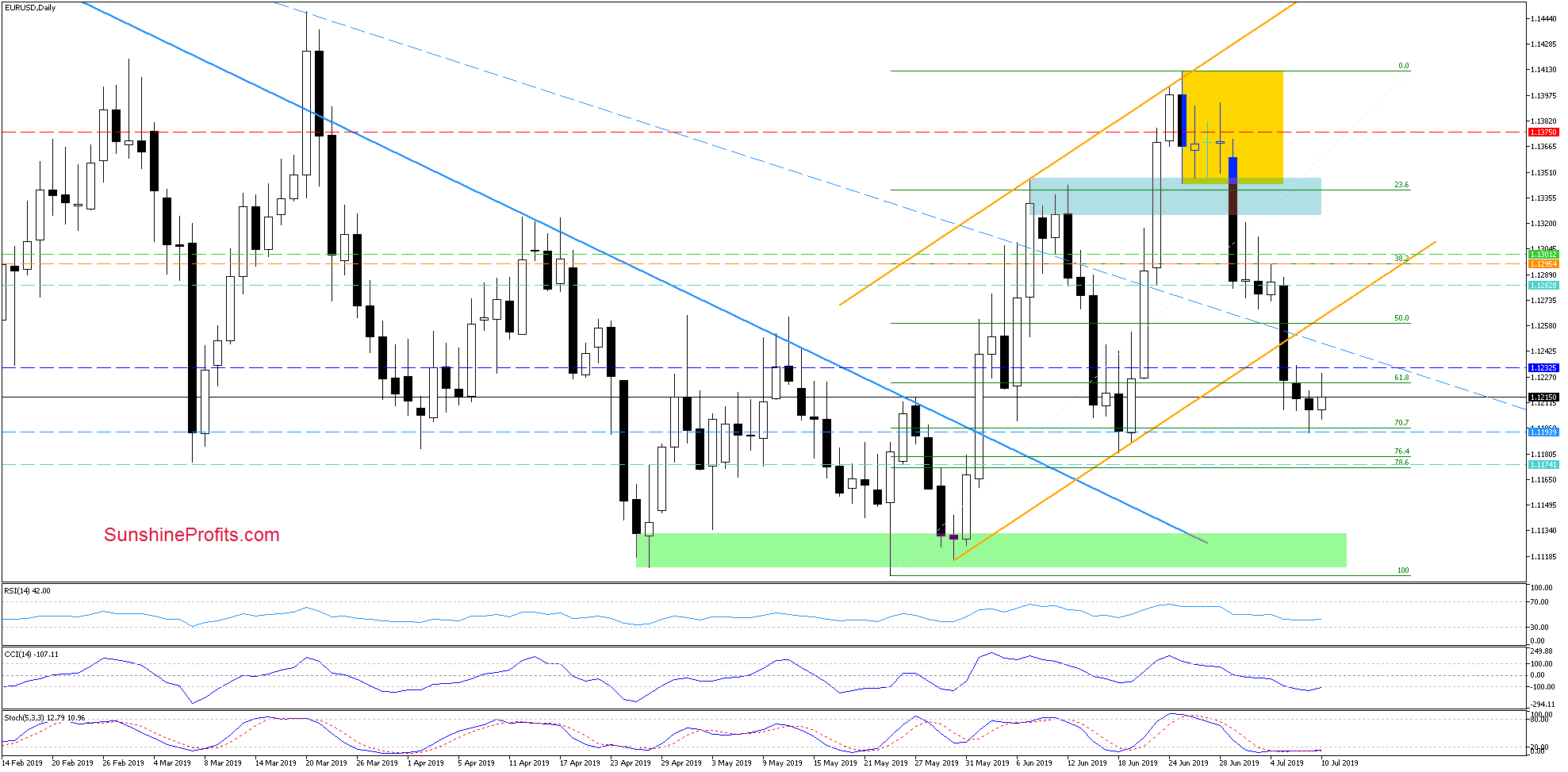

EUR/USD

Yesterday, EUR/USD dropped to the 70.7% Fibonacci retracement, which triggered a rebound and a daily close above the retracement. Earlier today, the bulls have extended their gains. Notwithstanding this upswing, the pair is still trading below the previously-broken lower border of the rising orange trend channel as the Powell testimony propelled it to around 1.1250.

As long as there is no comeback above it, all the moves higher are nothing more than a verification of the earlier breakdown. If it is indeed the case, we'll likely see one more attempt to move lower and a test of yesterday's low or even a decline to the 76.4% Fibonacci retracement in the following days.

Trading position (short-term; our opinion): short positions with a stop-loss order at 1.1283 and the next downside target at 1.1174 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

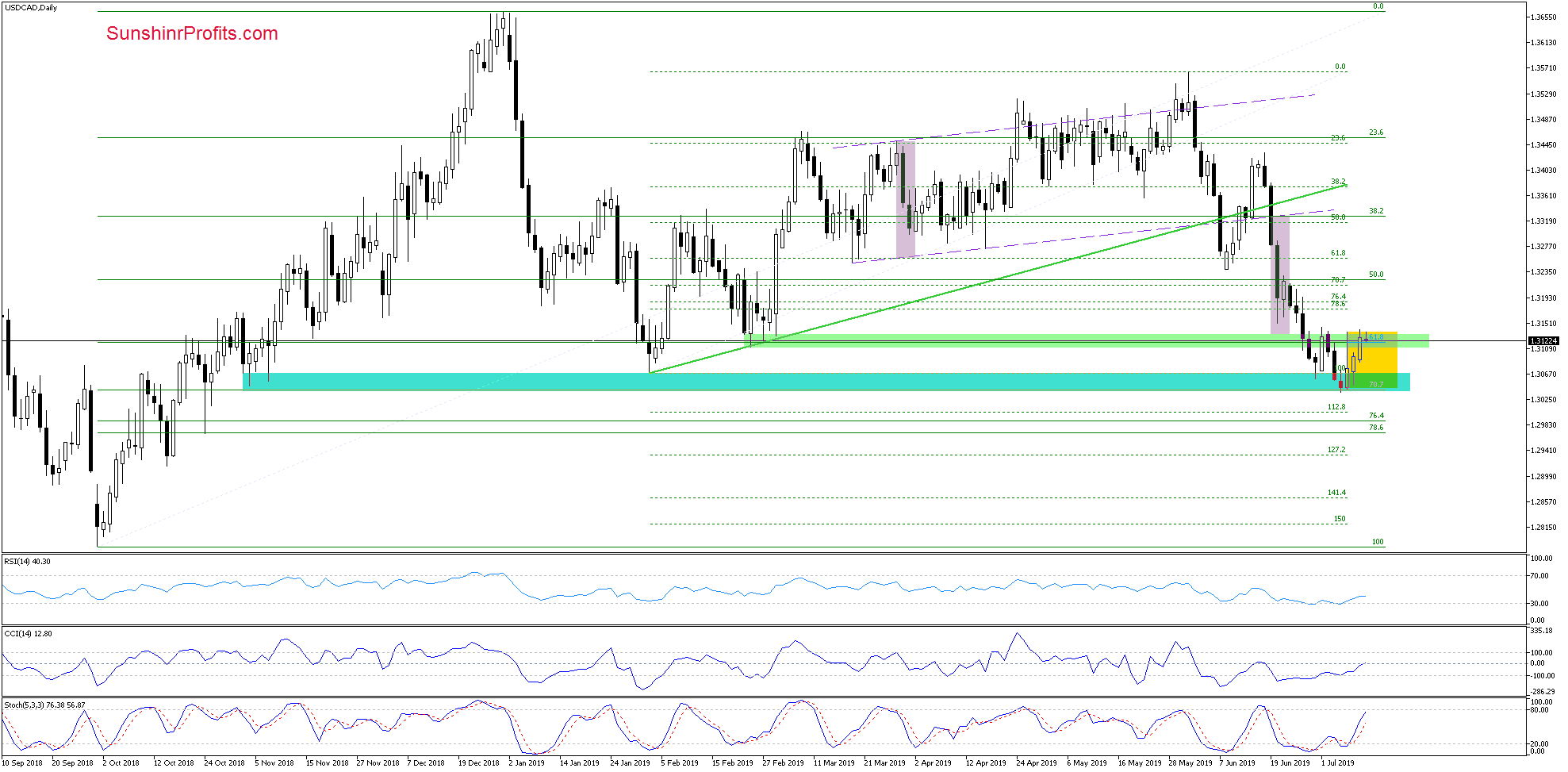

USD/CAD

We wrote these words in our Wednesday's commentary:

(...) the bulls didn't manage to break above the upper border of the green zone. The upward move has fizzled out and further deterioration remains very much likely. It would target a test of the lower border of the turquoise support zone (created by the early-November 2018 lows and the 70.7% Fibonacci retracement).

The situation has developed in tune with the above, and USD/CAD dropped to the turquoise support zone in the previous week. This important support stopped the sellers, and the pair rebounded. Earlier today, it has collapsed to the turquoise support zone again to trade at around 1.3070 as we speak.

As long as there is no breakdown below the turquoise support (or breakout above the green resistance), a bigger move is not likely to be seen. Short-lived moves in both directions should not surprise us then.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

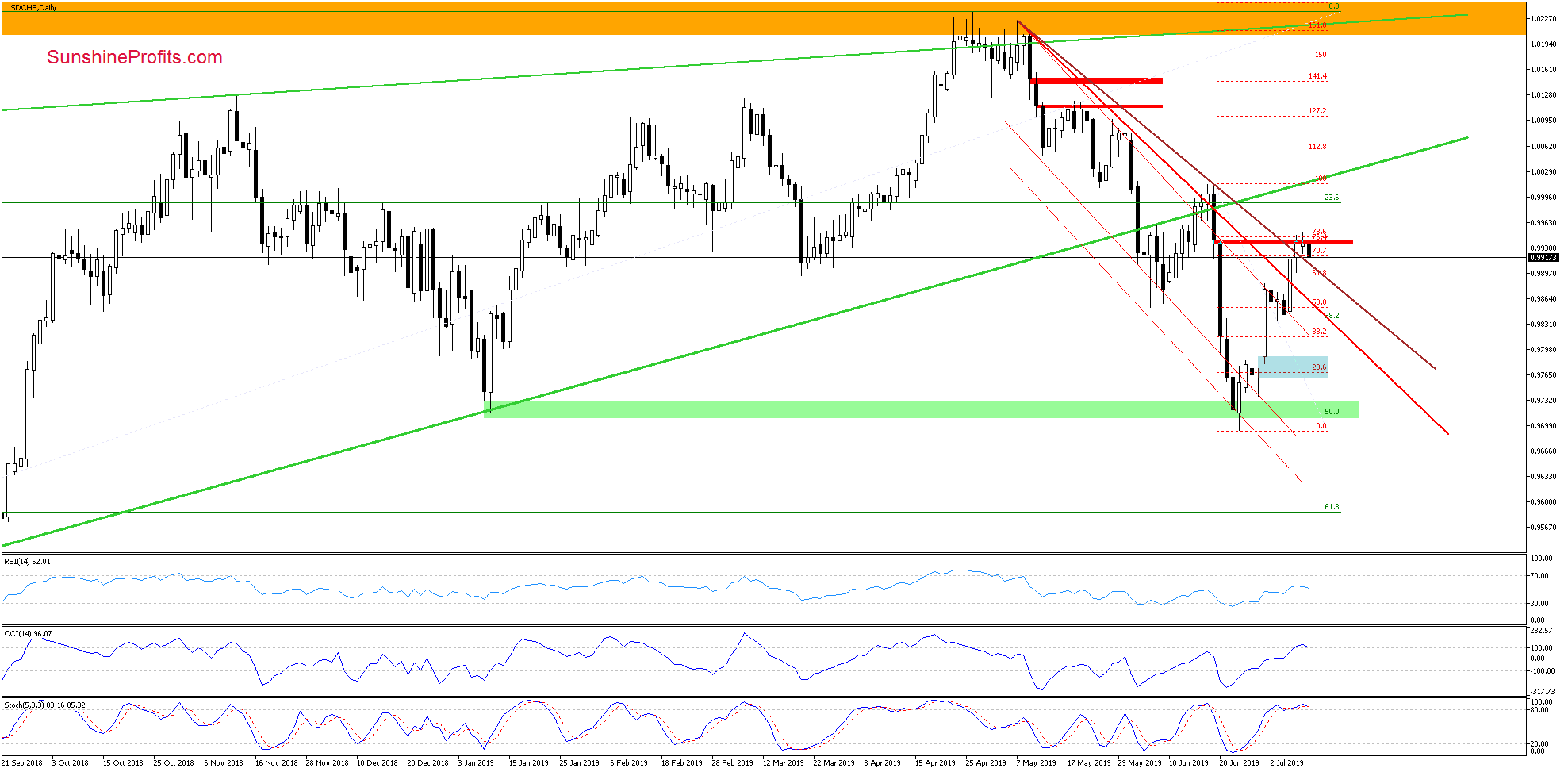

USD/CHF

The daily chart shows the bulls having reached the strong resistance area created by two Fibonacci retracements (the 76.4% and the 78.6% ones) and the red gap. They haven't seen much success overcoming them, however.

Combined with the current position of the daily indicators, it suggests that a reversal is just around the corner. Should we see a daily close below the above-mentioned resistances later today, we'll consider going short. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Summing up the Alert, while EUR/USD has rebounded higher, it still trades below the previously-broken lower border of the rising orange trend channel.AUD/USD has also recovered today but the upswing is smaller than the preceding decline, and the previously mentioned bearish factors still apply. Should USD/CHF opportunely close the day below nearby resistances, we'll consider opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist