Today is another interesting day in the forex arena. Powell's yesterday statements at the Council on Foreign Relations have dialed back the surefire market expectations of the July rate cut. And the mighty U.S. dollar strengthened as a result. But what about now, how does the situation look at this very moment? Let's find out and dive into the opportunities identified...

In our opinion, the following forex trading positions are justified - summary:

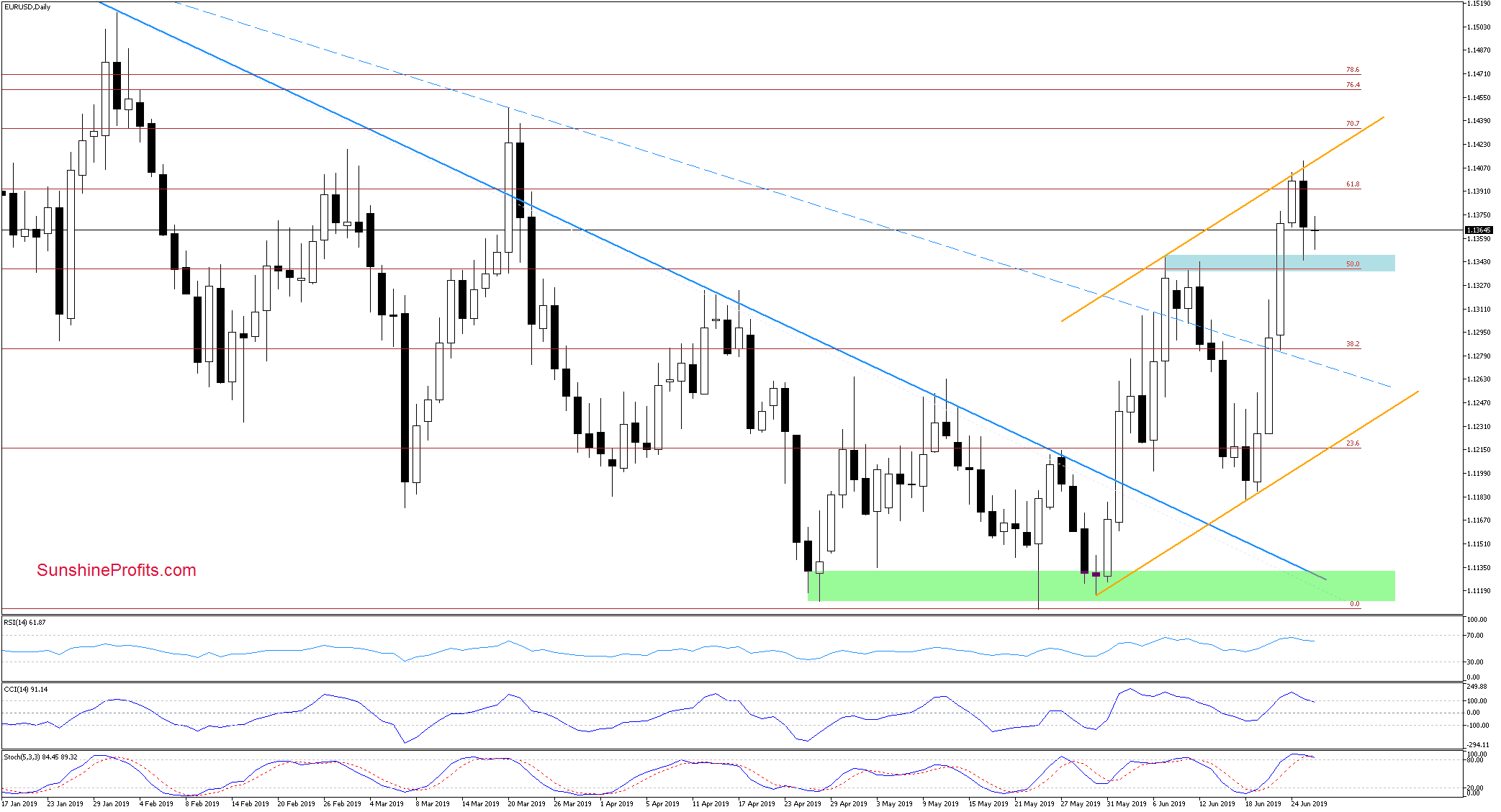

EUR/USD

Yesterday's session marked a reversal in the EUR/USD. The pair declined after making another unsuccessful attempt to break above the upper border of the rising orange trend channel.

The exchange rate went on to test the blue support zone based on the early-June highs, rebounded, and closed the day below the 61.8% Fibonacci retracement. This way, its earlier breakout above it has been invalidated, hinting at a likely deterioration in the very near future.

Let's examine the daily indicators for more clues. While their position is supportive to the bears, one more upswing targeting a retest of recent resistances can't be ruled out as long as the pair still trades above the blue support zone.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

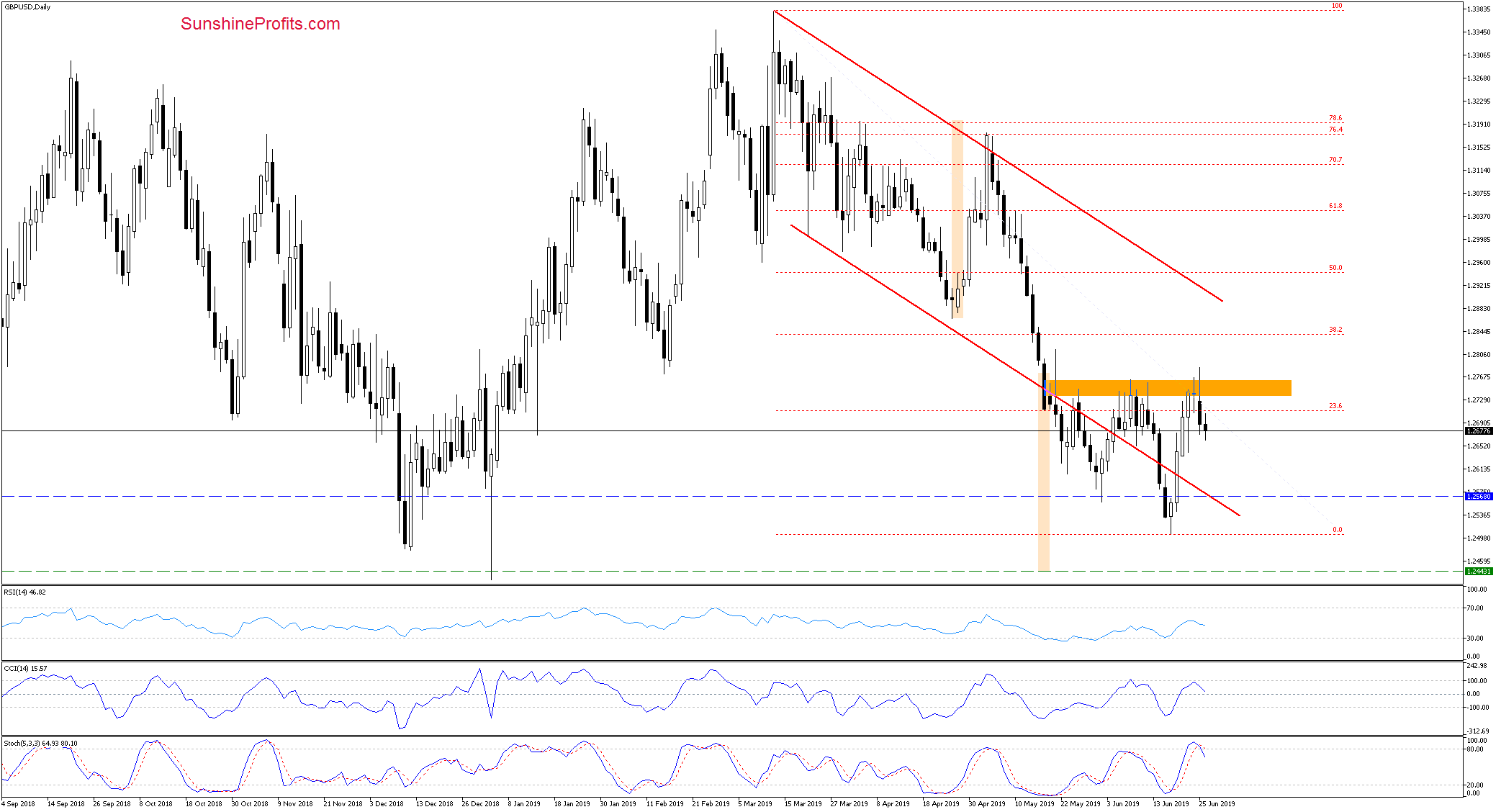

GBP/USD

GBP/USD has invalidated yesterday's tiny intraday breakout above the orange resistance area created by the previous peaks. This is an ominous sign for the bulls - especially when we remember the fact that all such previous instances have translated into sizable downswings.

This is reinforced by the sell signals of the daily indicators. Universally, they're pointing to a similar outcome down the road this time, too.

Should it be the case and GBP/USD extends losses from here, we're likely to see a drop to approximately 1.2568. This is where the lower border of the red declining trend channel currently is. Prior to that however, one more upswing verifying the strength of the orange resistance zone can't be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

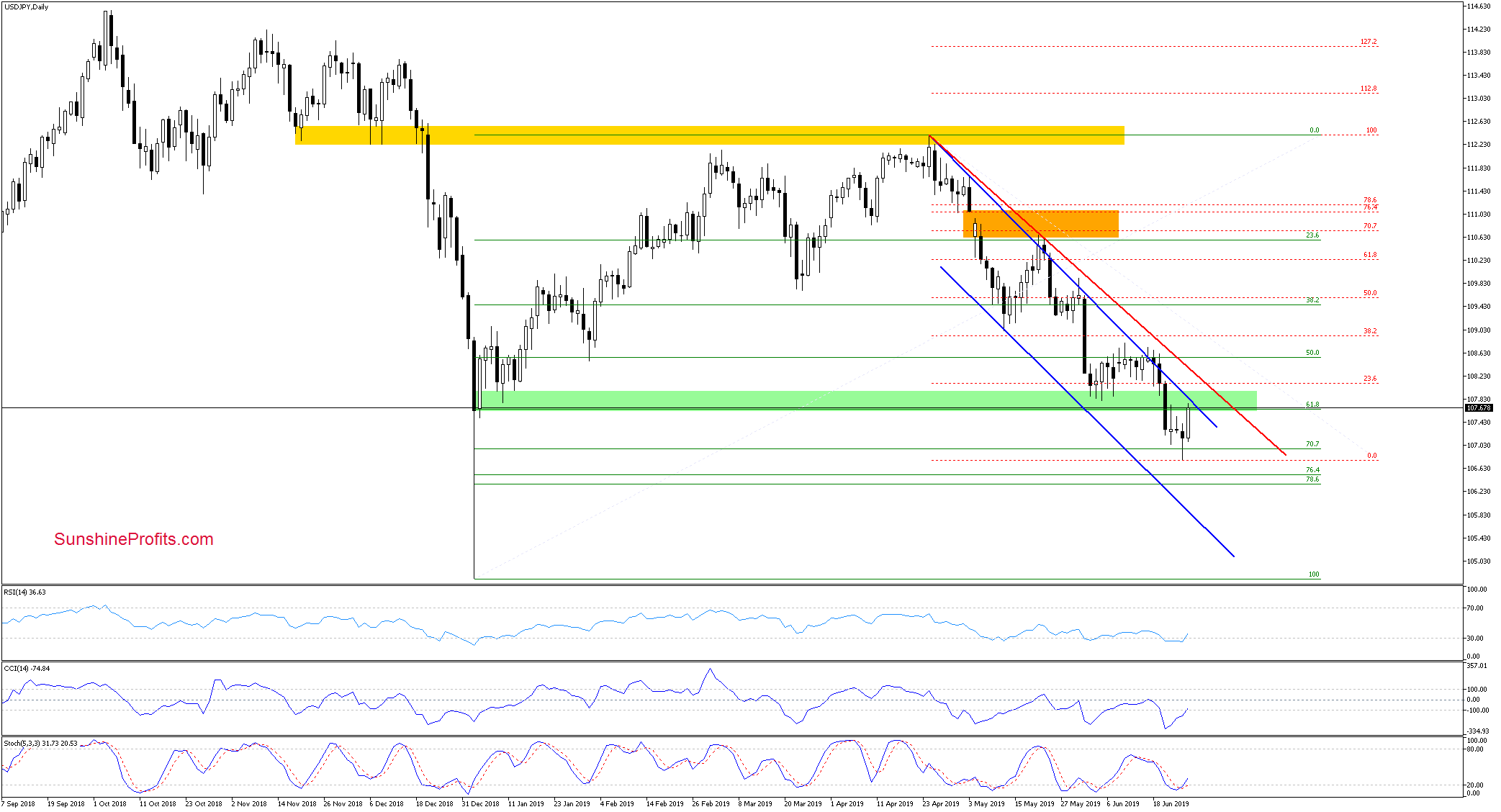

USD/JPY

USD/JPY extended losses yesterday, hitting a fresh June low. Most of the downside move has however been retraced before the closing bell, and earlier today, we've witnessed some follow-through buying.

The pair is hitting at the green support-turned-resistance zone. Additionally, the upper border of the declining blue trend channel adds more strength to the resistance ahead. A bigger move to the upside will be more likely and reliable only if we see a breakout above both of these resistances.

How likely is that? Looking at the daily indicators, we see them positioned in a conducive way. It's probable that the bulls will attempt to erase of the sizable recent losses in the near future.

Should we see bulls' strong performance and a daily close above both resistances, we'll consider opening long positions. As long as both resistances remain unbroken, one more downswing targeting the 70.7% Fibonacci retracement (or even the lower ones) can't be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, while the EUR/USD technical posture is deteriorating, we haven't yet seen sufficient signs of the bulls' weakness so as to open short positions. Similarly, there're not yet enough signs of an ongoing USD/CHF reversal higher. Neither the AUD/USD bulls have given up, so opening short positions isn't warranted. We'll patiently observe USD/JPY for clues as to the bulls' strength that would allow us to open long positions with confidence. As for now however, there're no opportunities worth acting upon in the currencies and capital preservation rules the day. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist