By comparison to quite a few previous sessions, yesterday's one might seem uneventful. That was not the case however. The markets never sleep - they offer plenty of insights, hinting at their next moves. Evaluating these, and the directions they point to, brings strong rewards. We're ready for the powerful opportunities identified. Let's go!

In our opinion, the following forex trading positions are justified - summary:

EUR/USD

While EUR/USD closed yesterday above the 61.8% Fibonacci retracement, the upper border of the rising orange trend channel has again stopped the bulls. The resulting pullback took the pair below the retracement and at the moment of writing these words, the exchange rate trades right at it (at around 1.1390).

A more sizable correction will be more likely and reliable only once we see the pair close today, or in the coming days, below the retracement. Should we see such price action, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

USD/CAD reversed sharply lower last week, and broke down now only below the medium-term green support line, but also below the lower border of the rising purple trend channel.

Bears then took the pair to the support area created by the 76.4% and the 78.6% Fibonacci retracements. The exchange rate currently trades inside the yellow consolidation.

As there are no buy signals on the daily indicators, one more downswing targeting the green support zone remains probable. There, the size of the downward move would correspond to the height of the purple trend channel, which should work to decrease the selling pressure once the green support zone is reached.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

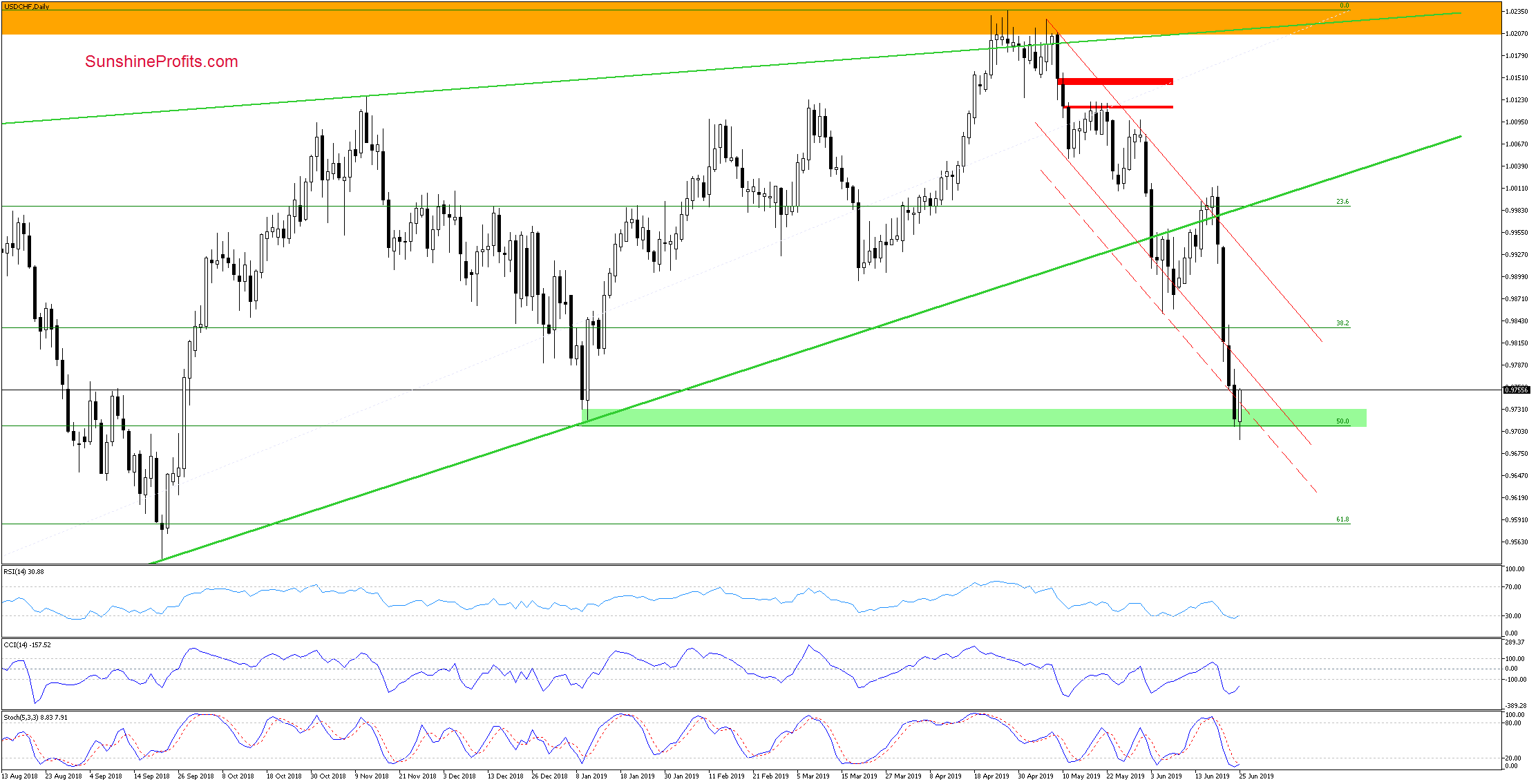

USD/CHF

Both the above daily charts differ only in their starting point. Zooming out, we see that the breakdown below the rising green support line was followed by a unsuccessful comeback above it. Then, the pair has moved sharply lower, reaching the green support zone and also testing the 50% Fibonacci retracement in the process.

Coupled with the positioning of the daily indicators, the odds of a reversal and a bigger move to the upside in the very near future have risen. Should we see more bullish factors and signs emerge, we'll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

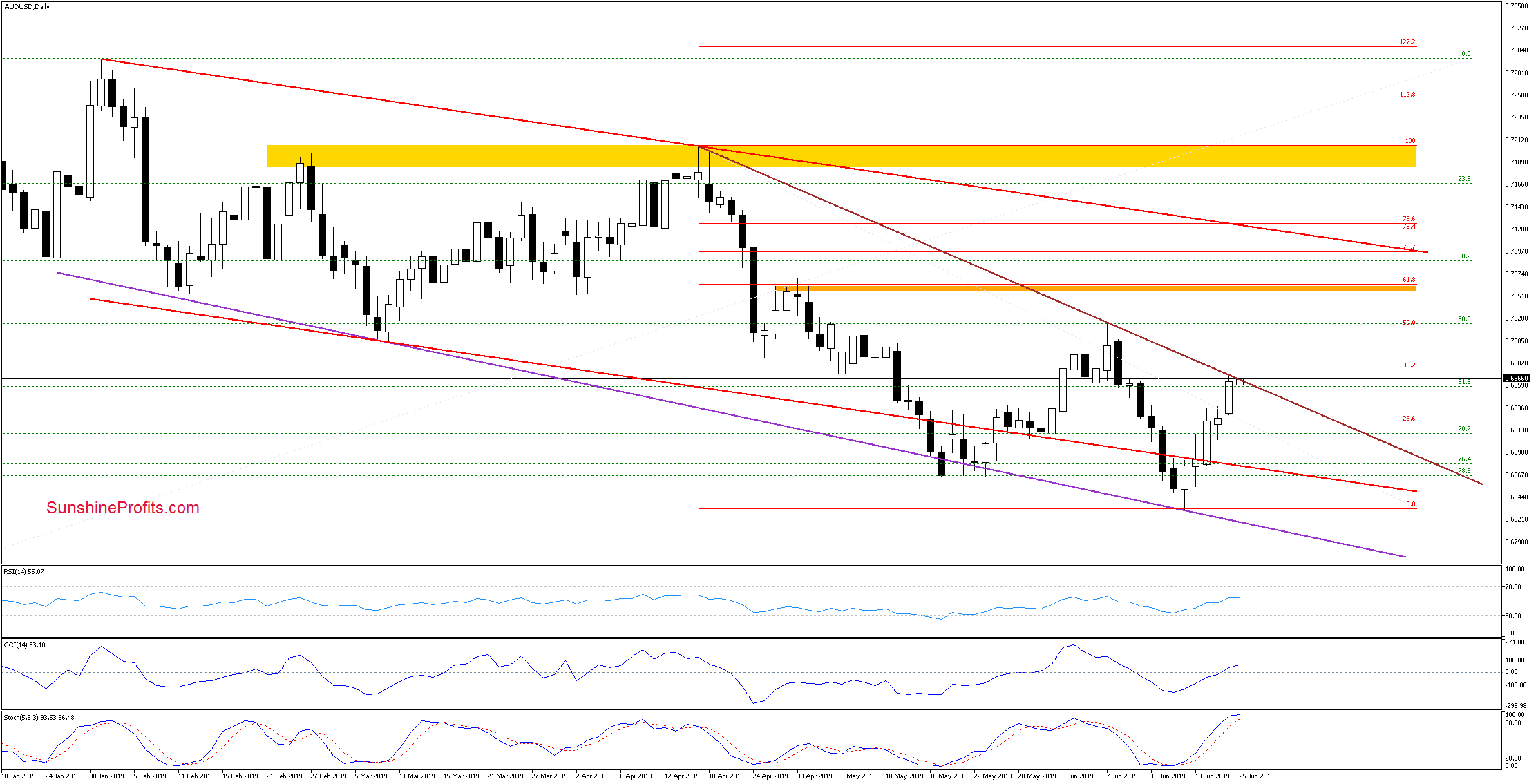

AUD/USD

In the last couple of sessions, we have seen AUD/USD eventually bounce off the previously-broken lower border of the declining red trend channel. The upswing took the pair to the declining brown resistance line (that is based on previous peaks) and the 38.2% Fibonacci retracement.

Additionally, the Stochastic Oscillator has moved to its overbought area, suggesting that we could see a reversal in the near future. Should we see currency bulls failing to overcome this resistance convincingly and lastingly, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD currently trades at around an important resistance and should we see signs of the bulls' weakness, we'll consider opening short positions. USD/CHF appears to have reached a support, and a reversal is in the air - should we see more signs pointing in this direction, we'll consider opening long positions. AUD/USD has come to a resistance level and should we see the bulls' strength sputtering, we'll consider opening short positions. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist