The USD Index reversed lower yesterday as the Brexit negotiation breakthrough speculation hit the tape. Importantly though, the decline was stopped by the closest support at hand. And the dollar is holding up quite well despite today's weak retail sales figures. Does it make the current situation similar to the September's broad bottoming?

Meanwhile, crude oil is seemingly trading on a seesaw in the last few days. Moving higher earlier, it gave up all of its gains this week. What can we make of such moves that cancel each other out? Is there any sign that would favor either the upswing or the downswing continuation? Yes, and it tilts the scales even more in a certain direction...

As you've read in the previous Oil Trading Alerts and Forex Trading Alerts, Nadia Simmons, who is the author of these reports has not been feeling well. This remains to be the case, and as it's been several days since you received crude oil or forex analysis from us, I (PR here) would like to help.

Consequently, I will be writing analyses of both: crude oil and the forex market and I will publish them combined, so that those, who normally enjoy access to only one of these reports, will get something extra. That's not much of a positive surprise for those, who already have access to both Alerts (for instance through the All-Inclusive Package), so if you have access through this package or you subscribed to both products individually, I will provide you with something extra. I will analyze any company of your choice with regard to its individual technical situation, and I will send you this on-demand analysis over e-mail. If this applies to you, please contact us with the name of the company that you're interested in.

On an administrative note, Nadia will be back and Oil Trading Alerts as well as Forex Trading Alerts will take their regular form on Tuesday, Oct 22. Thank you for your patience.

Having said that, let's take a look at the crude oil market.

Crude Oil Analysis

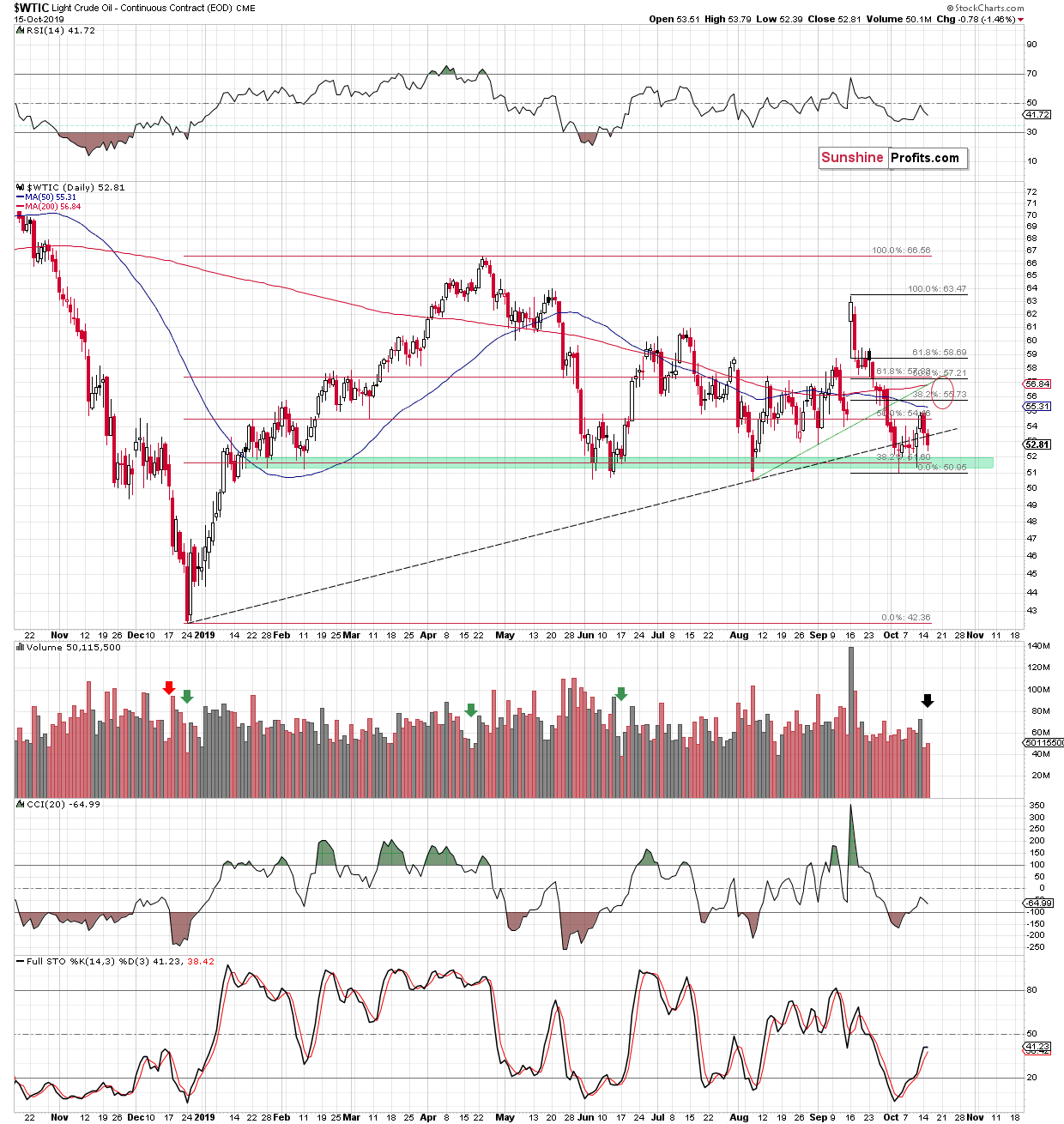

When we were writing yesterday's Oil & Forex Trading Alert, crude oil was trading a bit above the $53 level. At the moment of writing these words, its trading a bit below $53, which means that very little changed price-wise and practically everything that we wrote yesterday on crude oil's outlook remains up-to-date. Namely, the black gold is still likely to move higher as it didn't correct yet to even the first of the classic Fibonacci retracement levels.

There's one thing that we would like to add to yesterday's comments and that's the analysis of volume. You see, this week's decline in crude oil took place on very low volume, which is not something we see very often. In fact, we saw it only 4 times in the past year (not counting the current situation). And what happened then?

In three out of four cases, crude oil rallied shortly after this move. In one case, it declined. With only four similar cases with regard to volume, it's hard to say that the reliability of this indication is very high, however, it's bullish nonetheless.

Meanwhile, our comments on the USD Index with regard to the USD Index remain up-to-date:

One concerning matter is the situation in the USD Index. In the very recent past - the last several days - the USD Index and crude oil moved in the opposite ways. Thursday's and Friday's upswing in crude oil corresponded to declining USD. And the USD Index seems to be bottoming.

Then again, the relationship may be very short-lived and crude oil might be able to rally despite USD's rally for a few days, anyway. After all, the USD Index is up at the moment of writing these words, and crude oil is almost done correcting its initial downswing.

Consequently, in our view, the current long position is justified from the risk-reward point of view.

Trading position: Long position in crude oil with a stop-loss order at $49.88 and the binding profit-take target at $55.78 is justified from the risk/reward perspective.

Forex Analysis

As far as the currency market is concerned, Nadia usually covers the individual currency pairs. However, that's not what I specialize in, so instead of the usual format of these analyses, I will maximize their usefulness and likely profitability. This means that instead of focusing on individual currency pairs, I will cover the USD Index, as that's what I've been following on a regular basis for years.

It's also tradable, as there are futures on it (DX symbol) as well as ETFs, for instance the UUP and the UDN.

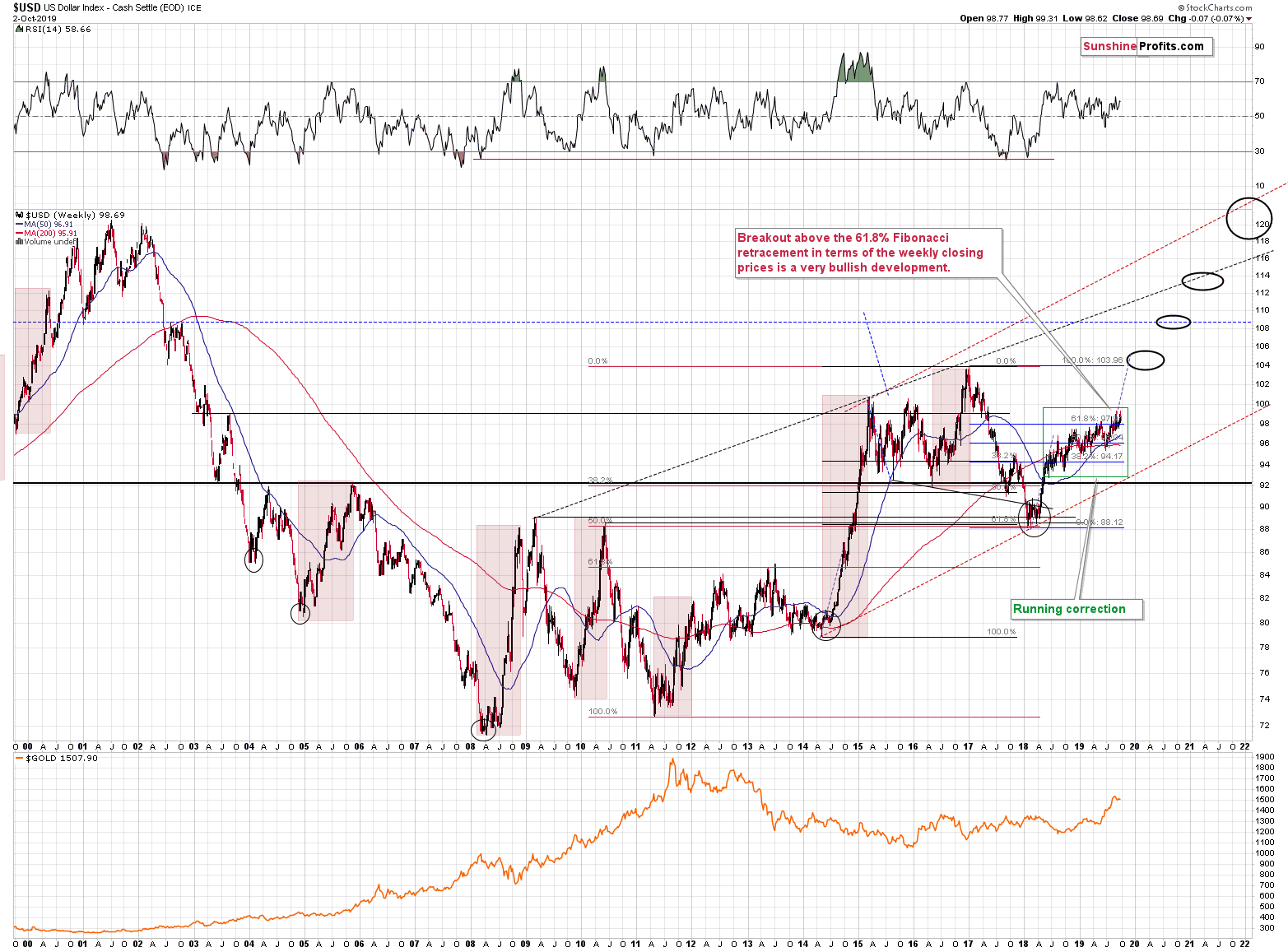

The USD Index declined on Friday, moving a bit below the 50-day moving average, but you were prepared for this situation.

In Friday's Alert, we wrote the following:

The double support that was reached: the early October low and the rising red support line based on the August lows is likely to trigger a reversal, just as it did in September. Please note that, just as it was the case in September, the USD Index might move below the red line temporarily (perhaps to the 50-day moving average at about 98.15 or so) before rallying. Such a move would not invalidate the bullish setup at all.

The decline didn't change the bullish outlook at all. Conversely, the USD Index appears to be forming a broad bottom, just like it did in mid-September and in the first half of August. That's normal, not bearish. The fact that the USD Index didn't break below the rising red support line adds to the bullish picture for the short term.

Other than the above, there is very little that we can tell about the situation that we haven't already written in the last few days - the price didn't change or it changed in tune with what we wrote, so we will quote the up-to-date parts from the previous analyses:

(...) as you can see on the above chart, the decline in the USDX stopped at the rising dashed line, which stopped most of this year's short-term declines. Only the mid-year decline was the exception from this rule.

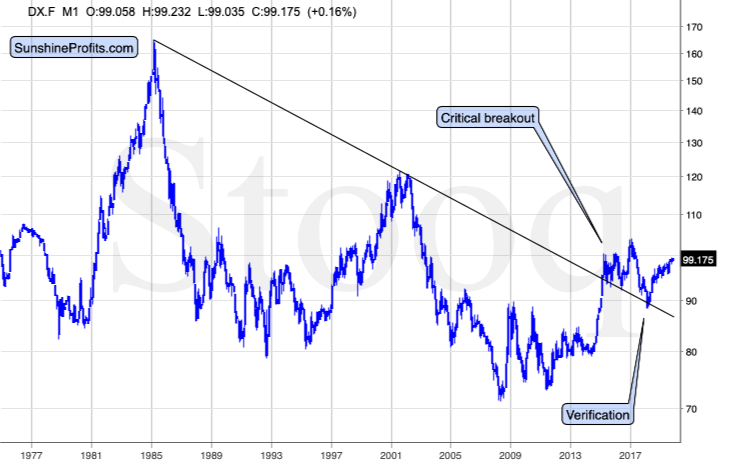

Why are we focusing on the long positions in the USD Index? Because of the long-term trend, which remains up.

The USD Index is after a major long-term breakout and this breakout was already verified a few times. The most recent rally is just the very early part of the post-breakout rally. Much higher USD Index values are likely to follow in the upcoming months.

The long-term trend is up as even the dovish U-turn by the Fed, rate cuts, and myriads of calls from President Trump for lower U.S. dollar and much lower (even negative) interest rates, were not able to trigger any serious decline.

What we saw instead was a running correction that's the most bullish kind of corrections. It's the one in which the price continues to rally, only at significantly smaller pace.

Trading position (short-term; our opinion): Long position in the USD Index with a stop-loss order at 97.27 and the binding profit-take target at 99.17 is justified from the risk/reward perspective.

As always, we will keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager