Low volatility periods precede high volatility ones, and vice versa. Don’t be mistaken - the EUR/USD situation is tense. It looks to be on the verge of committing to the next tradable move. GBP/USD looks very interesting here, too. In short, the forex realm is rife with opportunities now. Please join us in exploring the action we take and the outlook we see.

- EUR/USD: short (a stop-loss order at 1.1410; the initial downside target at 1.1258)

- GBP/USD: short (a stop-loss order at 1.3236; the initial downside target at 1.2820)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (a stop-loss at 0.7228; the exit target at 0.7042)

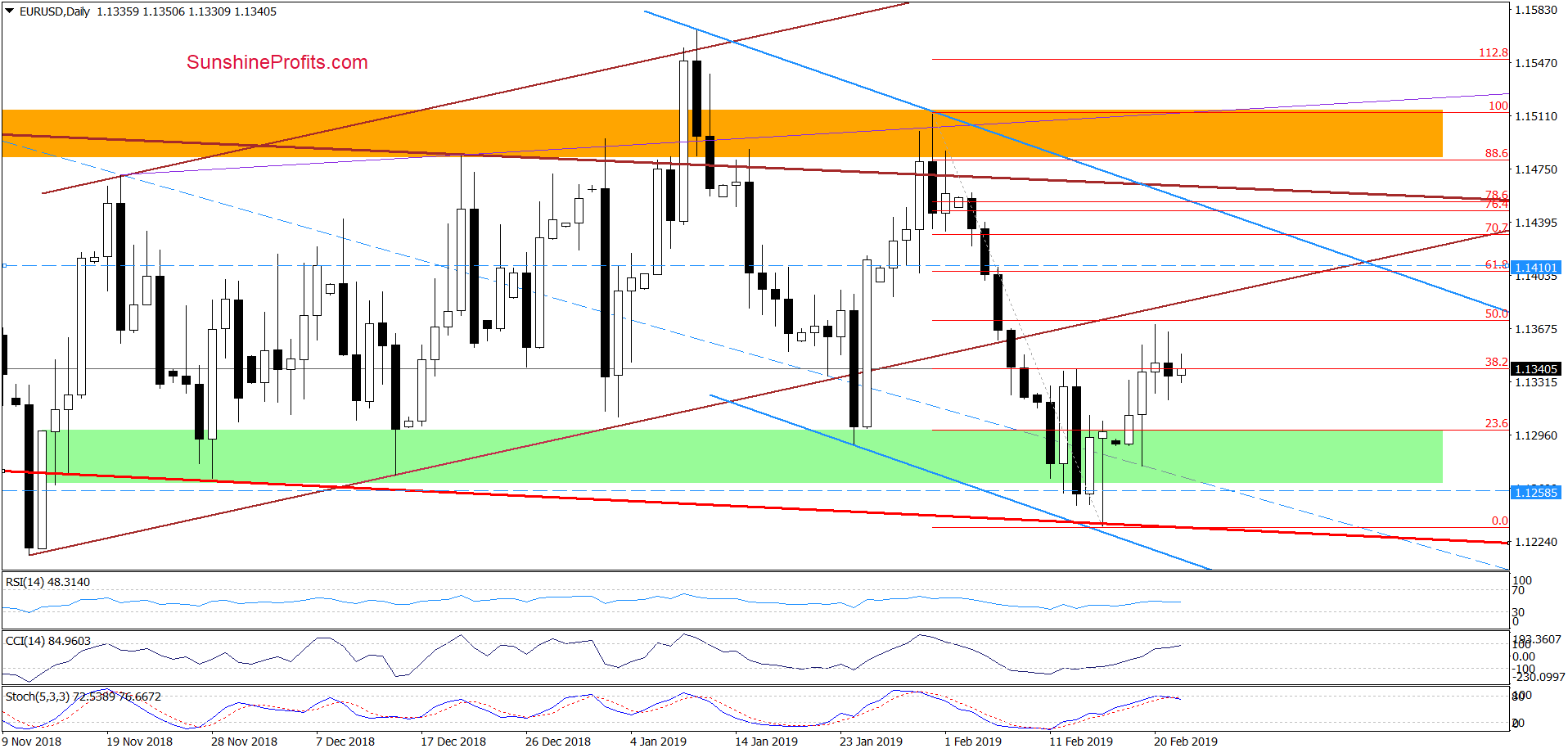

EUR/USD

On the daily chart, we see that EUR/USD closed yesterday’s session below the 38.2% Fibonacci retracement. It means invalidation of the earlier breakout above it, which is a negative development for the bulls.

The Stochastic Oscillator generated a sell signal. Let’s now look at this in conjunction with the position of the CCI, the bulls’ weakness face-to-face with the 50% Fibonacci retracement and the relative proximity to the lower border of the brown rising trend channel. These factors suggest that another attempt to move lower is just around the corner – indeed, the rate trades slightly below 1.1330 at the moment of writing these words.

If that’s indeed the case, we’re likely to first see another retest of the green support zone, and then of the long-term red support line based on the October 2017 and August 2018 lows. The latter happen to be not too far away from the recent lows at around 1.1250.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1410 and the initial downside target at 1.1258 are justified from the risk/reward perspective.

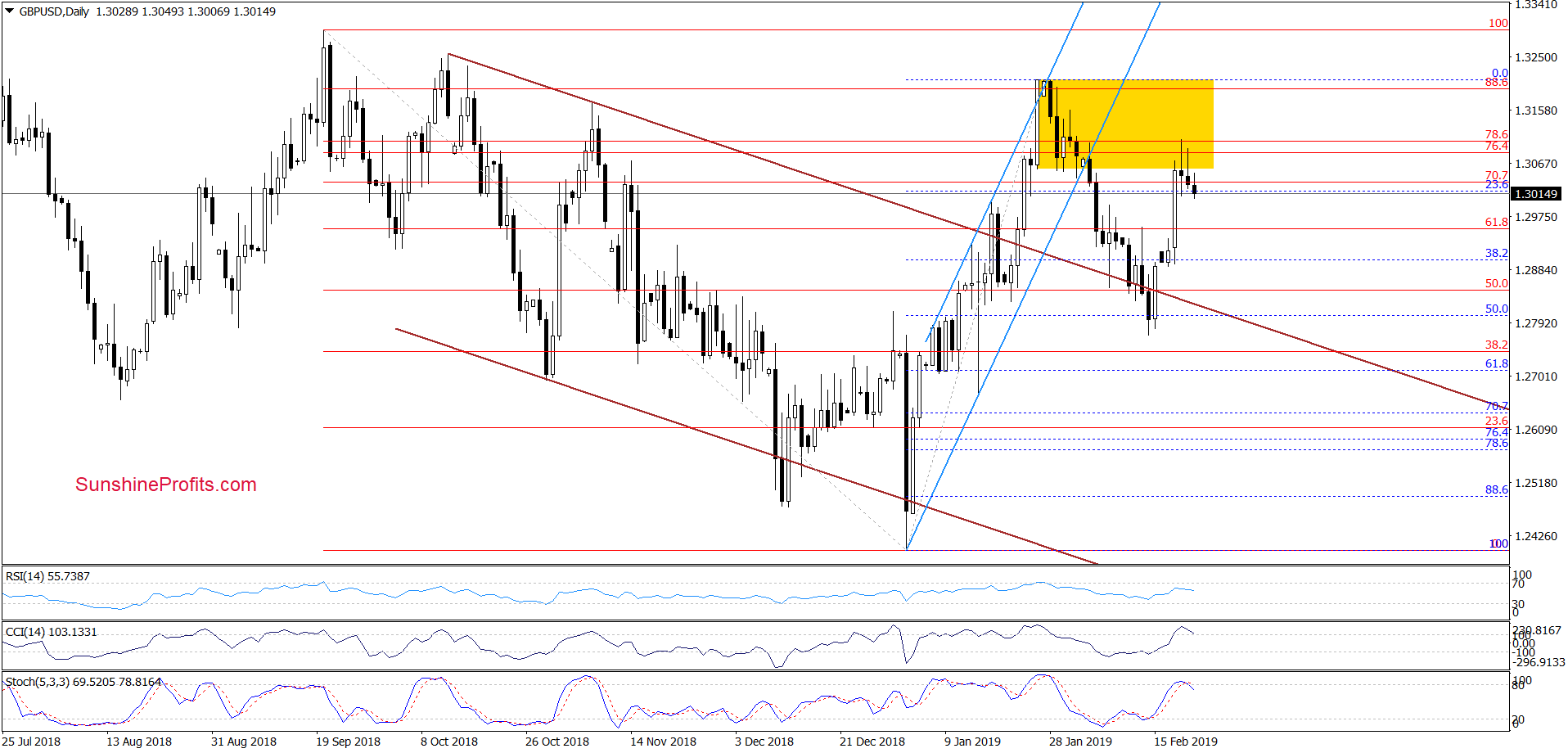

GBP/USD

Looking at the daily chart, we see that GBP/USD bounced off the previously broken upper border of the brown declining trend channel and invalidated its earlier breakdown beneath it. This positive event triggered further improvement and a comeback to the previously broken lower border of the yellow consolidation.

Nevertheless, there was no daily close above this line yet, which suggests that the rebound could nothing more than a verification of the earlier breakdown – especially when we factor in the bulls’ inability to move any higher in recent days).

Additionally, the Stochastic Oscillator generated a sell signal, while the CCI is very close to doing the same, which in combination with the above suggests that lower values of GBP/USD are just around the corner.

If the exchange rate declines from here, we’re likely to see a drop to around 1.2820 as a starting point at least. This is where the upper border of the brown declining trend channel and the 50% Fibonacci retracement are.

Taking all the above into account, we think that opening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3236 and the initial downside target at 1.2820 are justified from the risk/reward perspective.

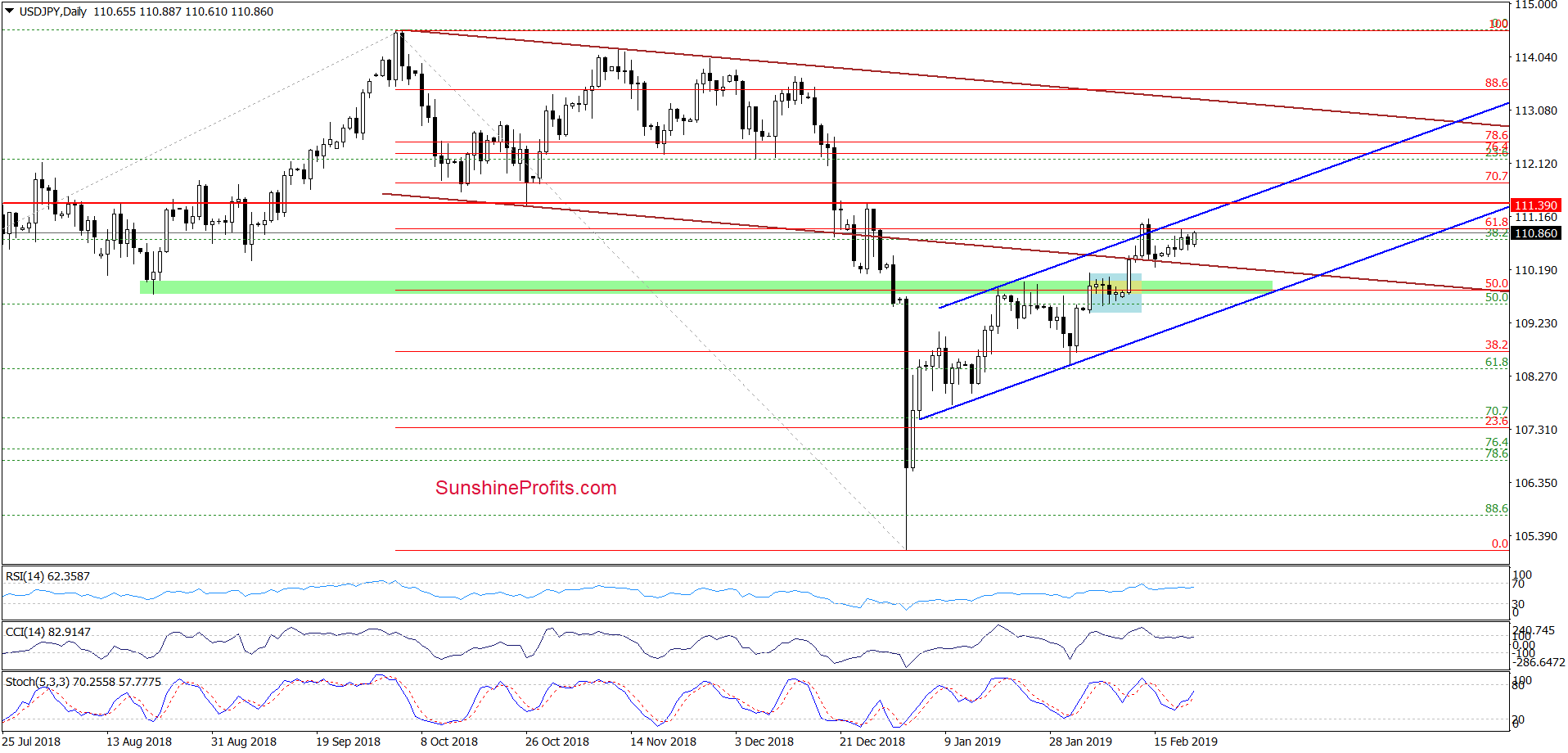

USD/JPY

From today’s point of view, we see that the overall situation in USD/JPY remains almost unchanged. The exchange rate is trading at around the same levels as at the time of our Wednesday’s commentary:

(…) Although currency bears tried to take USD/JPY below the lower border of the brown declining trend channel, they failed. This translated into an invalidation of the tiny breakdown below that brown line.

This positive price action triggered further improvement in the following days. It increases the likelihood that we’ll see a retest of the strength of the upper line of the blue rising trend channel in the very near future.

If the bulls show strength there and manage to break above that blue line and last week’s peaks, we’re likely to see a test of the red horizontal resistance line based on the late December high. However, if they show weakness again, the probability of a bigger move to the south (targeting at least a test of the lower line of the blue trend channel) will increase and we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but the decision to open short positions is potentially just around the corner. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist