The euro has just made a nice comeback. Are better days ahead for the euro bulls? But not all commodity currencies are recovering. The USD Index went down today, so what can we make of this mixed bag? Far better than running for the shelter is to examine the opportunities that are shaping up. We've just identified one. Fanfare or not, let's dive in.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none (our profitable short positions were closed at a profit by the stop-loss order)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions) (a new stop-loss order at 0.7074; the next downside target at 0.6960).

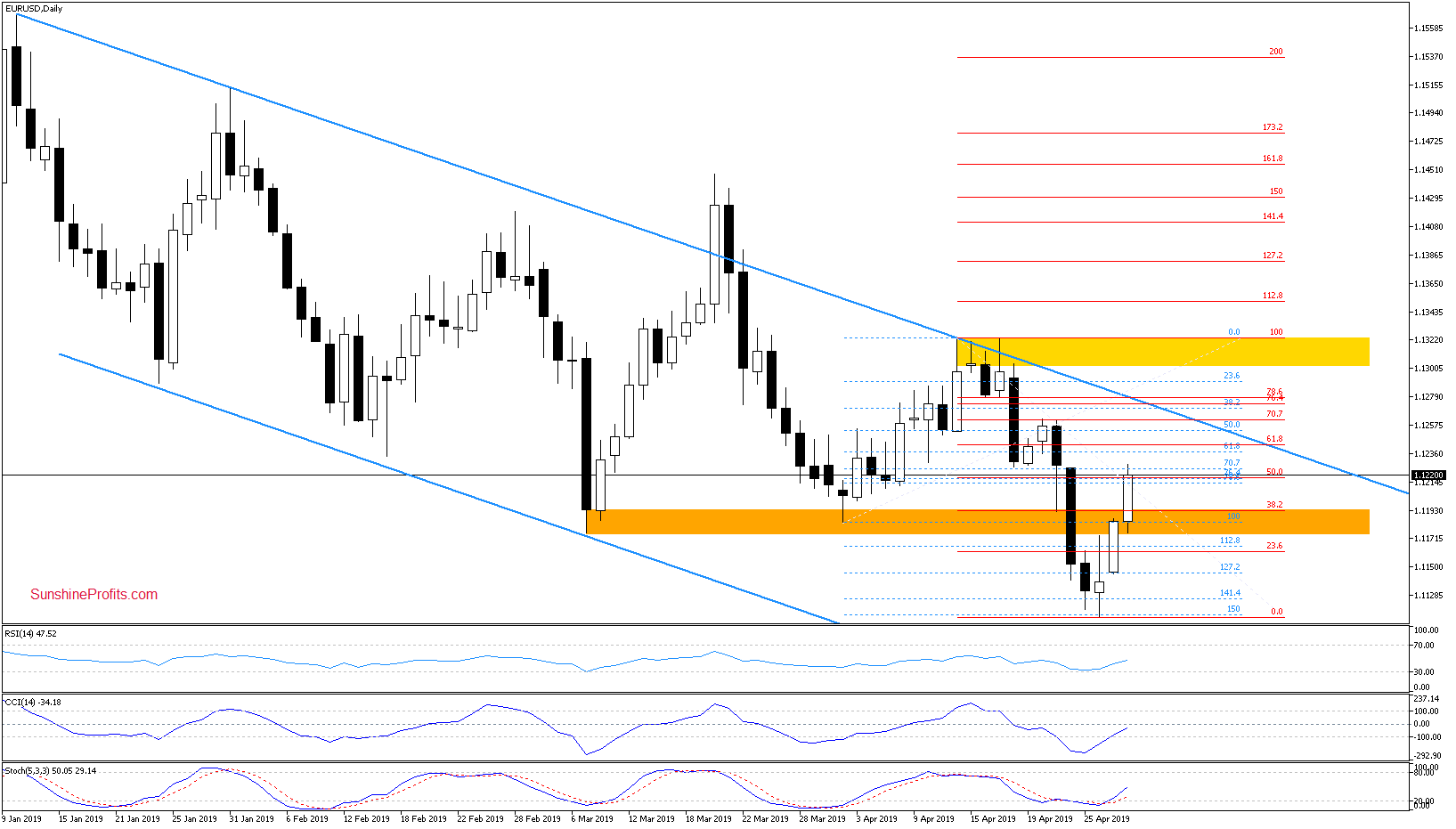

EUR/USD

Yesterday's EUR/USD session closed above the early-March low. This means invalidation of the earlier breakdown below it. This event encouraged the bulls to take the pair higher earlier today.

As a result, the pair climbed above the 50% Fibonacci retracement. Combined with the buy signals by the daily indicators, it suggests that we can see a test of the 61.8% Fibonacci retracement in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

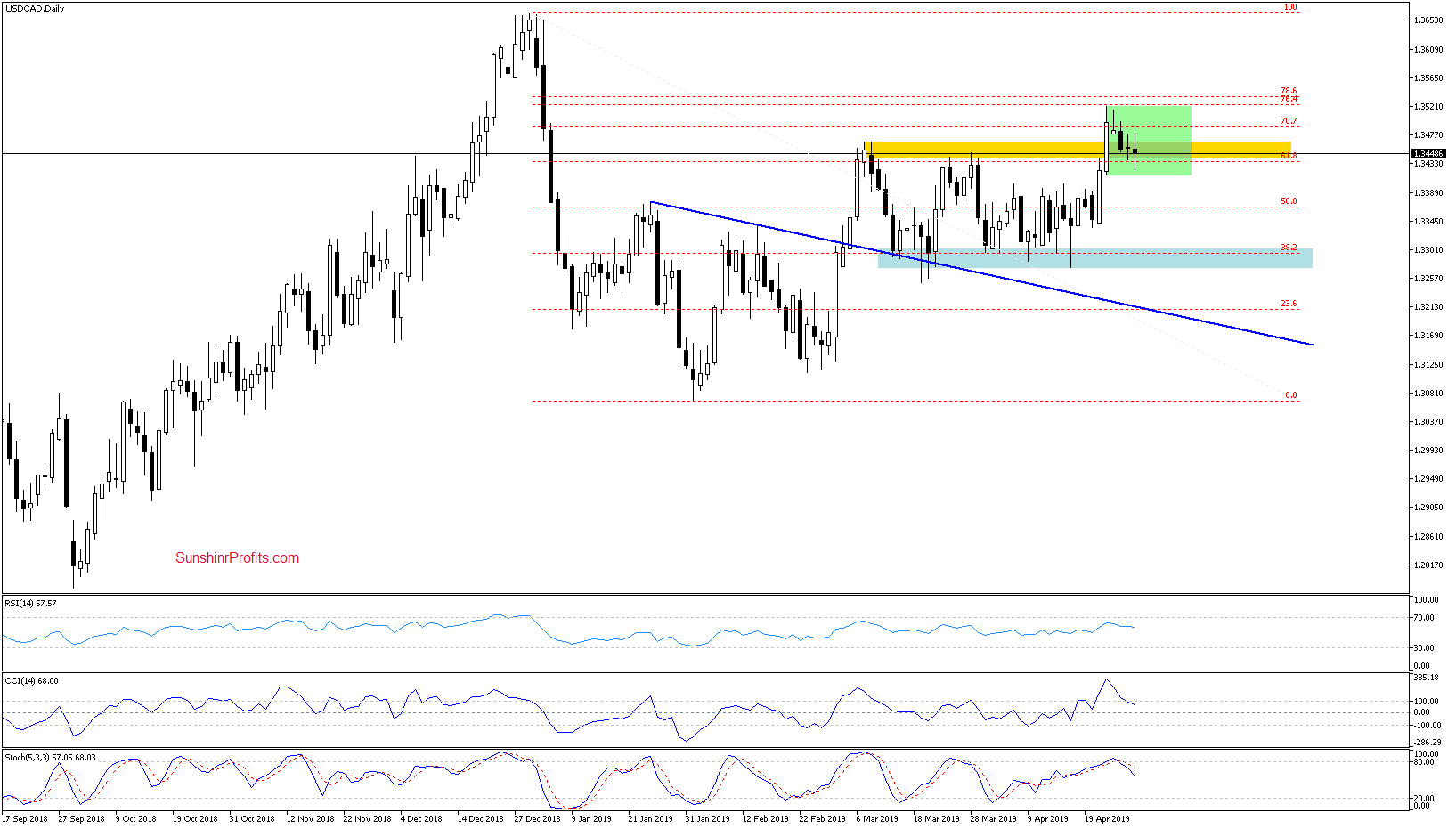

USD/CAD

The medium-term picture has deteriorated slightly as currency bulls gave up a meaningful portion of last week' s gains and let the pair slide back into the yellow consolidation. The earlier tiny breakout above it was thus invalidated.

This is a negative sign for the bulls. Lower values of the exchange rate may be just around the corner.

This scenario is also reinforced by the daily chart. Let's take a look below.

Here, we see that the bulls have reached the resistance zone created by the 76.4% and 78.6% Fibonacci retracement. The price got stuck inside the green consolidation.

On Friday, the pair closed the day below the upper border of the yellow resistance zone (that is based on the March peaks). This doesn't bode well for higher values of the exchange rate going forward.

Additionally, the CCI and the Stochastic Oscillator generated their sell signals. That increases the probability of further deterioration in the coming days. Such price action will be more likely and reliable only if USD/CAD drops below the lower border of the green consolidation (that's the April 24 low at 1.3415). Until then, an attempt to move higher can' t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but if we see a daily close below the green consolidation marked on the daily chart, we'll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

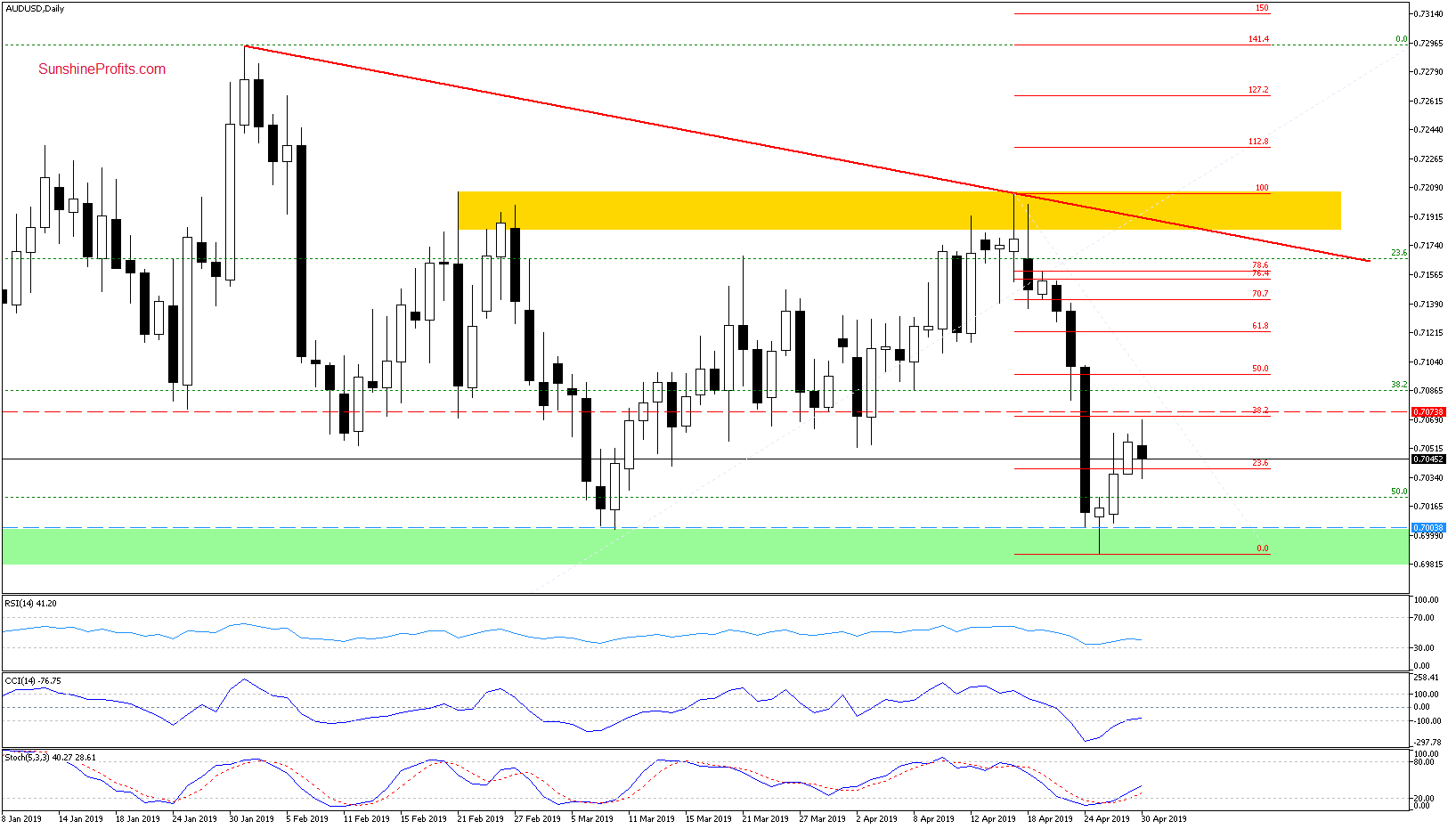

AUD/USD

Although AUD/USD moved higher since Friday, the proximity to the 38.2% Fibonacci retracement stopped the buyers. Earlier today, the pair has almost touched it only to reverse lower.

As a result, the pair moved below yesterday's high. Combined with the weekly picture, it suggests that one more attempt to move lower may be on the horizon.

The weekly chart shows the pair having climbed to the previously-broken upper border of the red declining trend channel. It looks like a verification of last week' s breakdown that left the price trading back inside the trend channel. If this is the case and AUD/USD extends losses from here, we're likely to see a retest of the green support zone (that is marked on the daily chart) in the following days.

Trading position (short-term; our opinion): short (50% of already existing positions) with a stop-loss order at 0.7074 and the next downside target at 0.6960. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the remainder of our profitable short position in EUR/USD has been profitably closed by the stop-loss order and the pair could move slightly higher from here. In the case of AUD/USD, any attempts to move higher look off the table as the pair experiences a strong downward move today and the short position (the remainder thereof) remains justified from the risk-reward point of view. As for USD/CAD, the technical posture looks deteriorating and should the price break down from the green consolidation on the daily chart, we'll consider opening short positions. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist