In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1218; the initial downside target at 1.1058)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

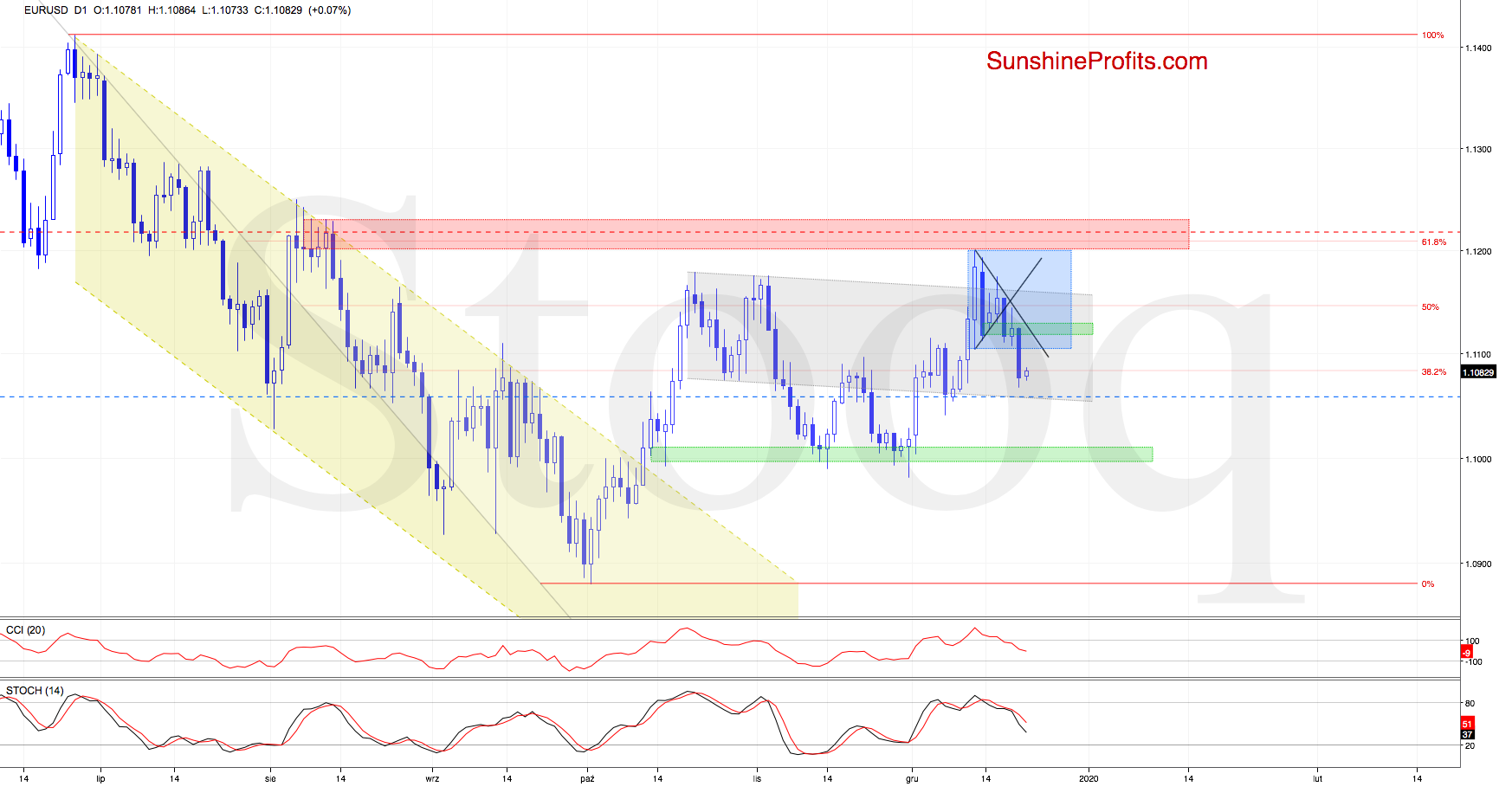

EUR/USD

In our Friday's commentary on the EUR/USD breakdown, we stated that the pair broke:

(...) below the lower border of the black triangle. This bearish development resulted also in the green gap getting closed.

The euro bulls pushed the pair higher yesterday, but upon reaching the previously-broken lower line of the triangle, the exchange rate pulled back.

Thanks to this price action, the exchange rate verified the earlier breakdown from the triangle, which increases the probability of further deterioration in the coming days.

This is especially so when we factor in the sell signals generated by the daily indicators and also the breakdown below the lower border of the blue consolidation.

The situation has developed in line with the above expectations, and EUR/USD closed the week sharply lower. On top of that, the pair closed the day below the blue consolidation, which gives one more bearish indication.

Coupled with the sell signals of the daily indicators, the above suggests that we'll see the below bearish scenario realized:

(...) Should it be the case and the pair extends losses from here, the initial downside target for the sellers will be the lower border of the declining grey trend channel.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1218 and the initial downside target at 1.1058 are justified from the risk/reward perspective.

USD/CAD

The Canadian dollar has been growing in strength recently, yet the greenback bulls staged a rebound recently. Just a pause in the previous trend, or a change in gears looms?

Although USD/CAD moved below the black support line based on the previous lows that also forms the neck line of the potential head-and-shoulders formation, the deterioration proved only temporary. The exchange rate rebounded on Friday, invalidating not only the earlier breakdown below the black line, but also below the previously broken green support zone that is based on the early-November lows.

Additionally, the CCI joined the Stochastic Oscillator in generating its buy signal, suggesting that higher values of USD/CAD may be just around the corner.

Such price action will be more likely and reliable though only if the pair succeeds in breaking above the upper border of the blue consolidation.

Should the bulls be strong enough to close today or one of the following days above this resistance, we'll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

Although AUD/USD moved lower at the beginning of the previous week, the 50% Fibonacci retracement stopped the sellers. A rebound followed, and the pair moved sharply higher, almost erasing its earlier losses.

While this may seem bullish on the surface, let's keep in mind that the exchange rate just came back to the orange resistance area created by two strong Fibonacci retracements (the 38.2% and 61.8% ones) and also to the early-November peaks.

This zone has been strong enough to stop the buyers in mid-December, which suggests that a reversal this time may be also just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

We would like to wish you Merry Christmas and Happy Holidays - may you spend this festive period in peace and harmony with the closest ones. Let the upcoming days be filled with joy and happiness all around.

In the meantime, we'll be watching the markets for you.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist