Has the carnage in the currencies stopped? That's surely a question on many a trader's mind. Have we seen any kind of a top for the U.S. dollar? After all, the euro is recovering nicely today and the same can be said about the Australian dollar. Take a look also at the Canadian dollar. Not too shabby. Just how to untangle the forex moves? Our helpful analysis with concrete next steps and scenarios to the rescue.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (20% of already existing positions) (a new stop-loss order at 1.1219 and the next downside target at 1.1075))

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions) (a new stop-loss order at 0.7070; the next downside target at 0.6960)).

EUR/USD

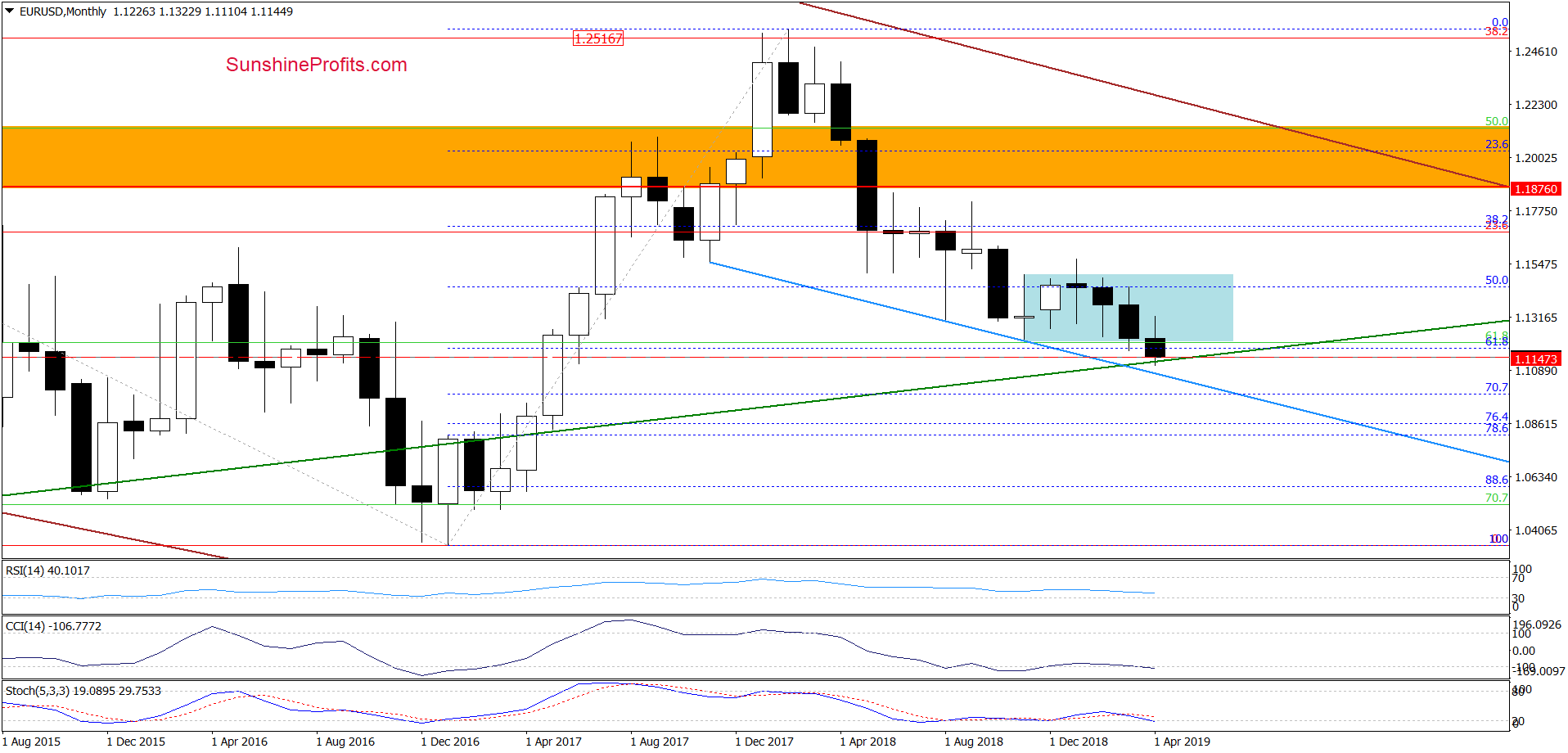

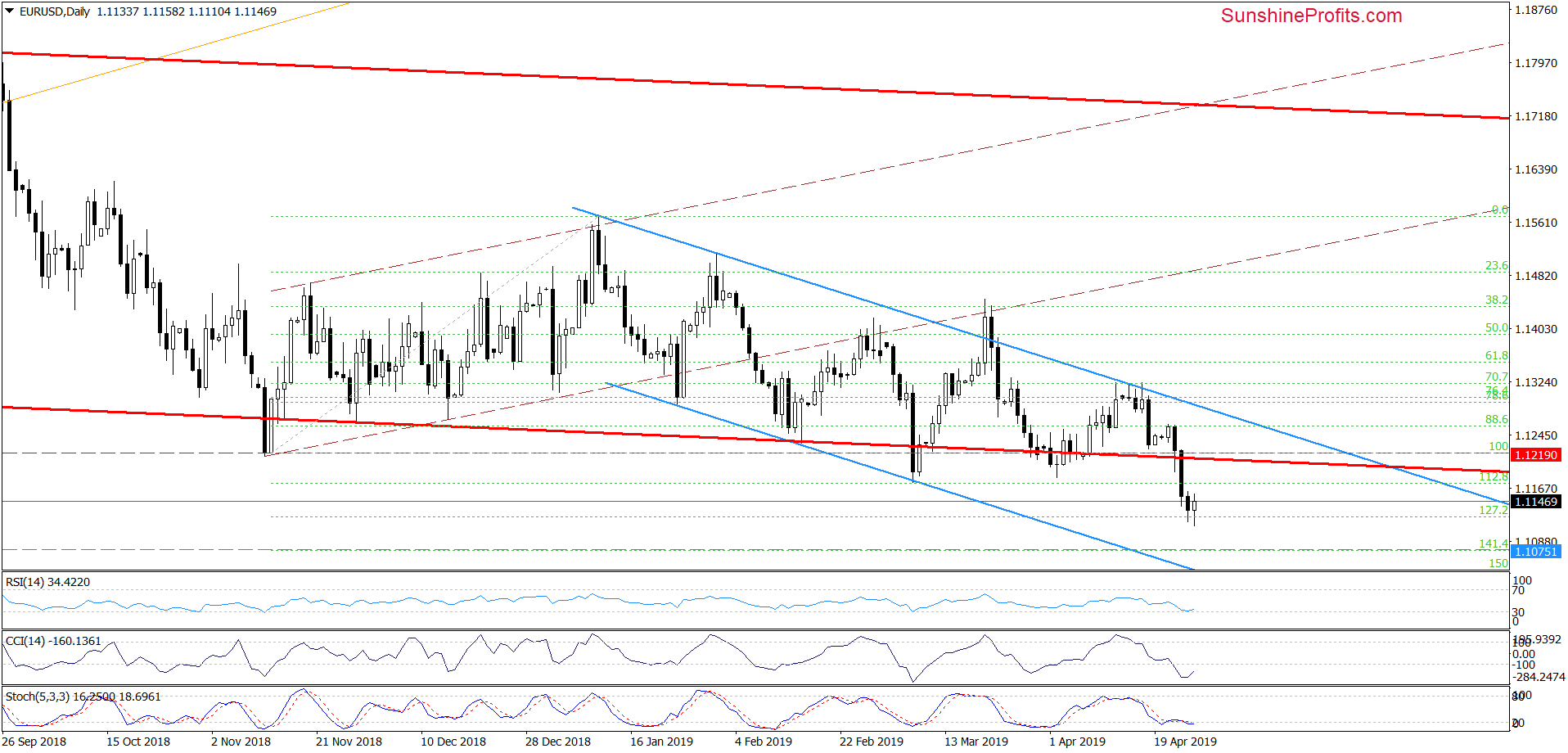

Let's start with the monthly charts (they differ only in their starting point). We can see that the green rising support line has stemmed the slide so far. Let's examine the daily chart to see whether there is anything that could lend support to the bulls.

Indeed, the daily chart shows the rate trading at the 127.2% Fibonacci retracement. This has encouraged the bulls to act earlier today and the pair currently trades at around 1.1150, approaching its yesterday's peak.

Despite this improvement however, EUR/USD is still trading below the mid-November 2018, early-March and early-April 2019 lows. This suggests that as long as there is no invalidation of the breakdown, one more attempt to move lower is likely.

Trading position (short-term; our opinion): 20% of the remaining profitable short position with a stop-loss order at 1.1219 and the next downside target at 1.1075 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

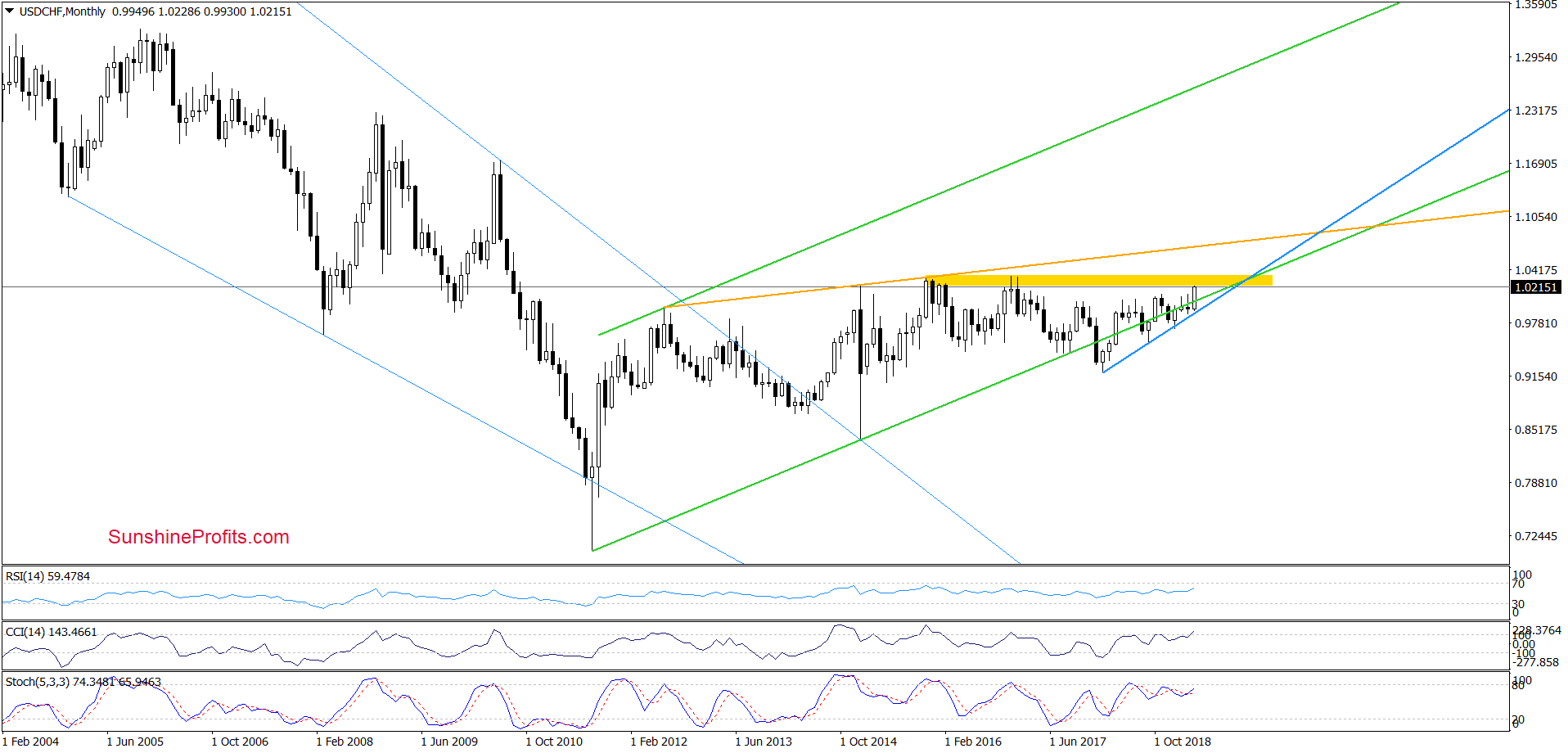

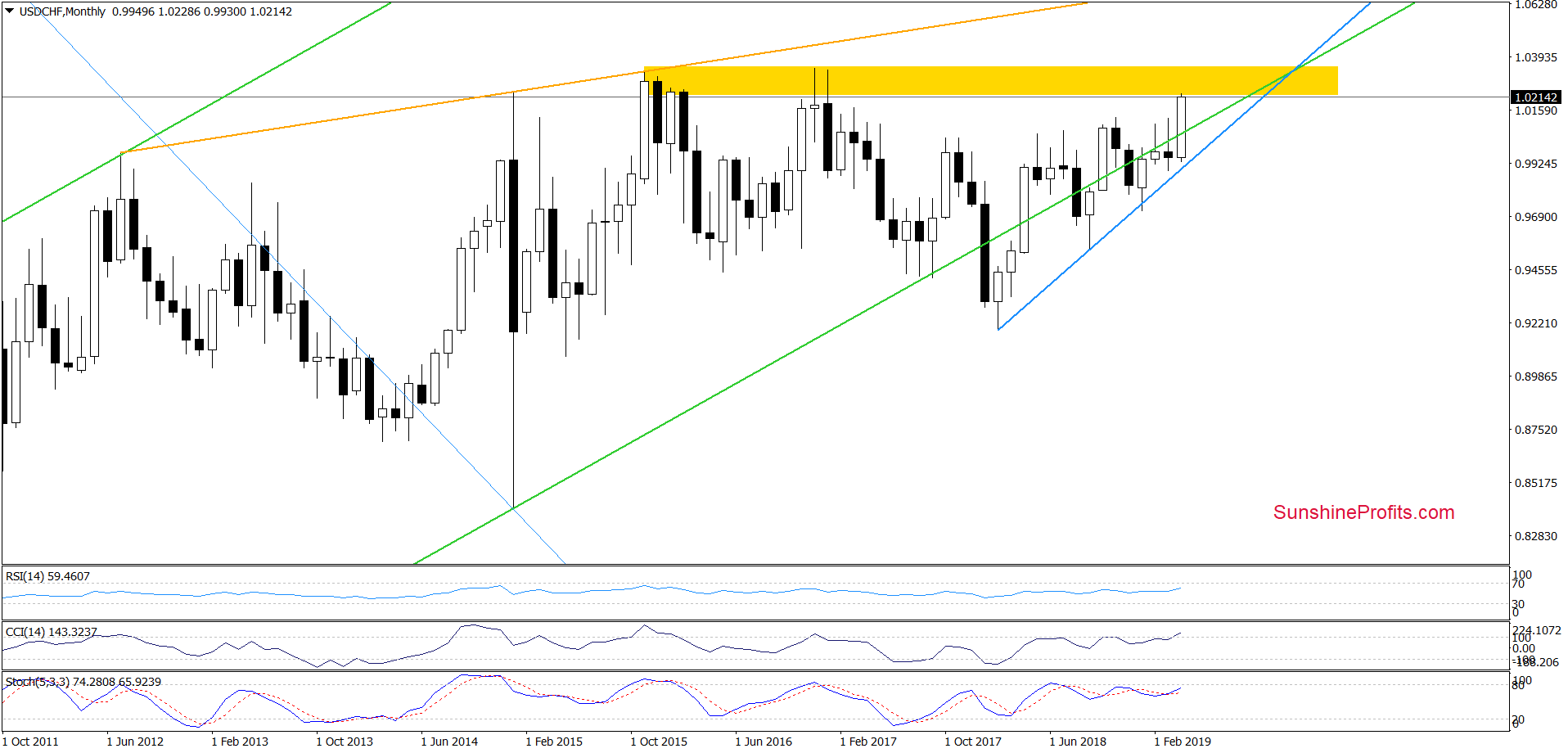

Again, let's see two monthly charts differing only in their starting point. It's apparent that USD/CHF has extended gains and reached the yellow resistance zone. This is a major resistance that has stopped the buyers several times in the past already.

As long as there is no breakout above it, the sustainability of any further improvement is questionable and another downward reversal from here should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

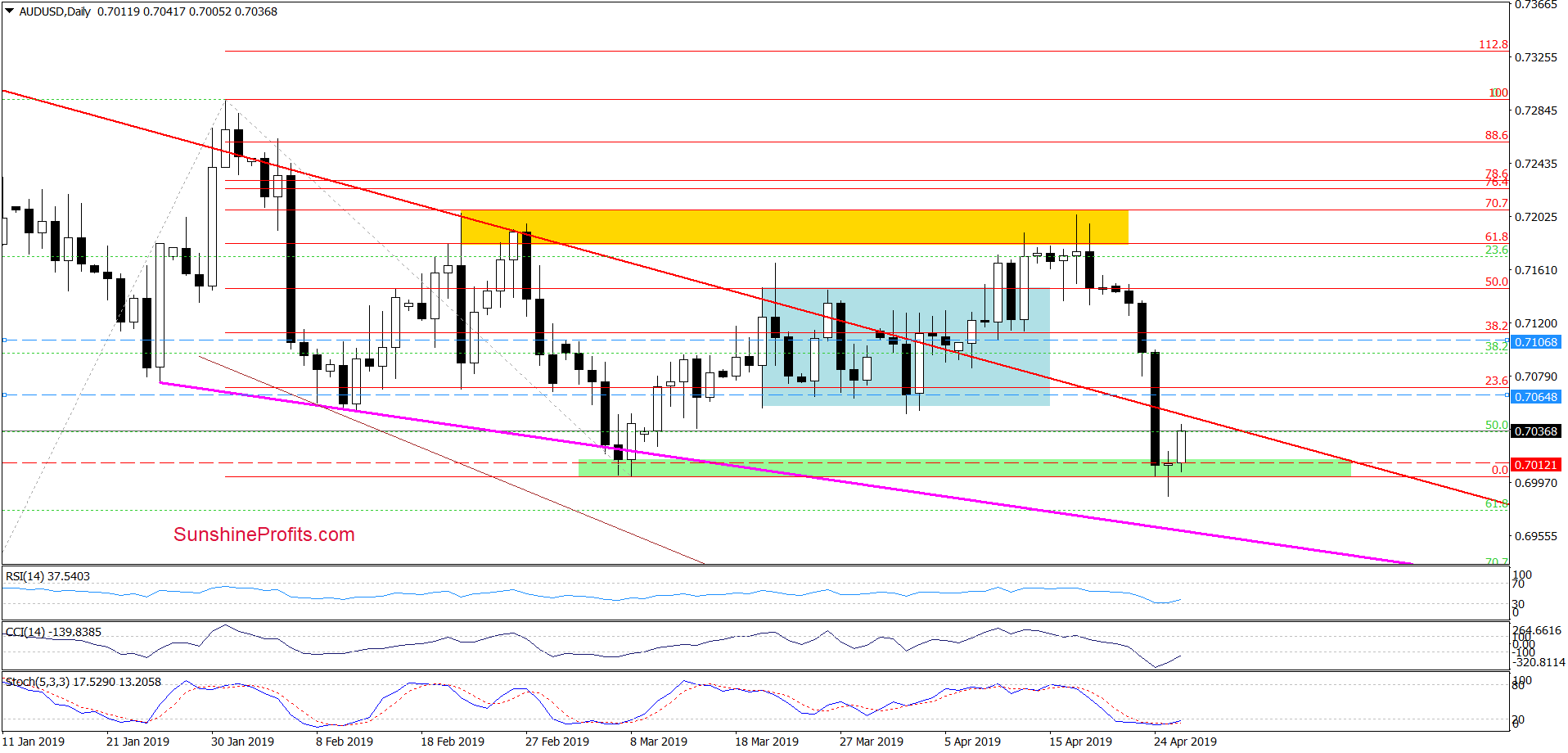

AUD/USD

Yesterday, AUD/USD slipped slightly below the green support zone. The bulls have responded with an upside reversal and continue to show strength earlier today. The result is an invalidation of yesterday's breakdown below the green support zone.

Taking this into account, today's upswing is likely to make the pair verify yesterday's breakdown below the upper border of the declining red trend channel. However, as long as there is no daily close above it, one more downswing still remains likely.

Trading position (short-term; our opinion): 50% of the remaining profitable short position with a stop-loss order at 0.7070 and the next downside target at 0.6960. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, earlier today, we're seeing a corrective upswing in both EUR/USD and AUD/USD. They both have fallen through important support levels recently and today's price action looks like attempts at verification of both preceding breakdowns. Therefore, both short positions (the remainders thereof) remain justified from the risk-reward point of view. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist