Some pretty powerful currency moves have marked the finish of last week's trading, and today's session is no exception in the richness of information it provides. It's not only about the direction of last week's moves but about the pace in each respective pair. Unsurprisingly, we see quite a few opportunities on the horizon, being ready to jump at them like a tiger, at a moment's notice. Let's get ready!

In our opinion, the following forex trading positions are justified - summary:

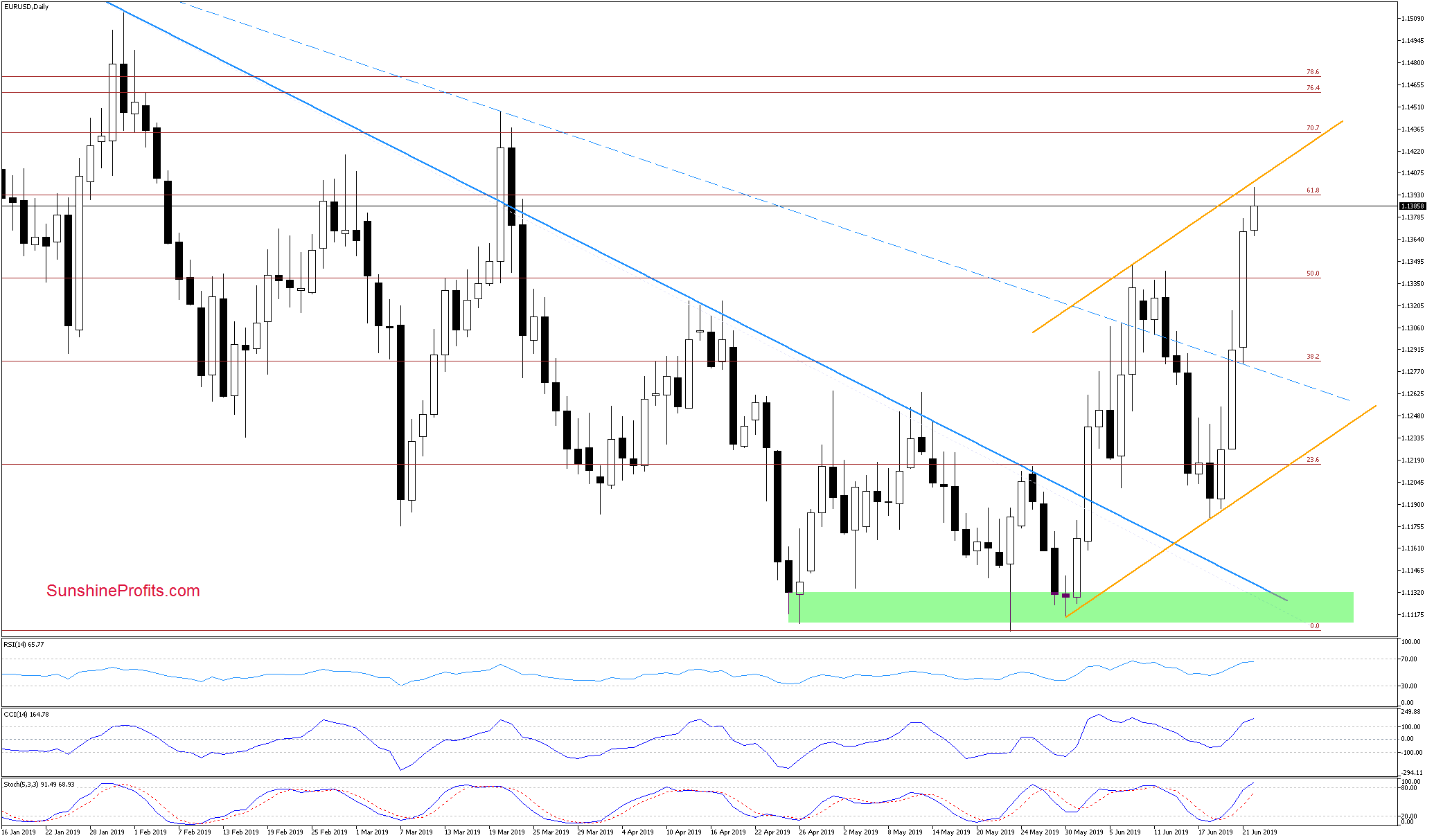

EUR/USD

EUR/USD has further extended gains on Friday. So sharp was the upswing continuation that the pair has broken above its early-June peaks. Earlier today, further gains have been scored, and the rate has reached the 61.8% Fibonacci retracement. The bulls are facing resistance there, and the pair trades at around 1.1390 currently.

Should we see a daily close below this retracement and signs of euro bulls' weakness (such as an unsuccessful attempt to break above the orange channel), we'll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

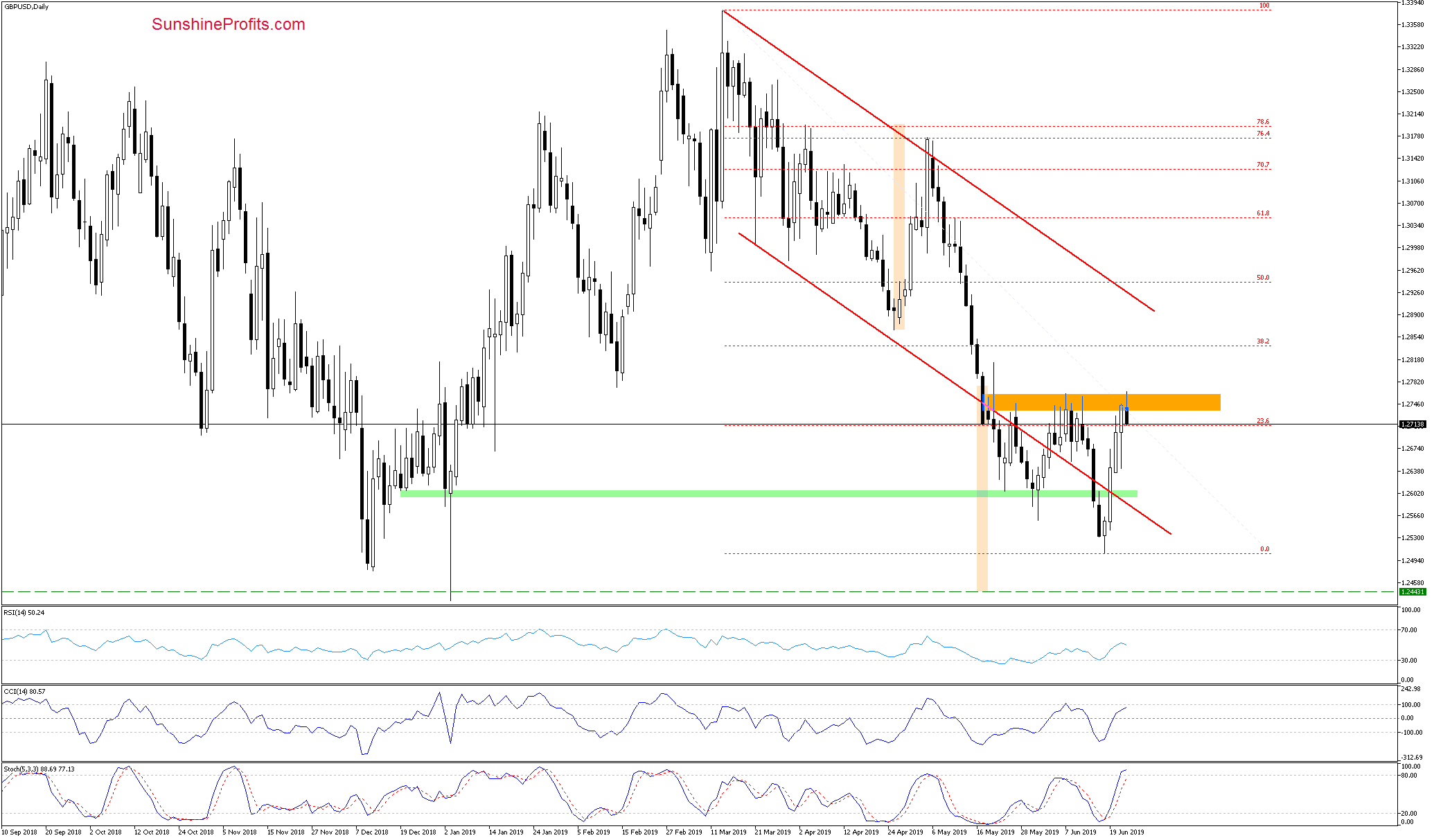

GBP/USD

GBP/USD has invalidated its earlier breakdown below the green support zone and came back inside the declining red trend channel in the previous week. These are positive developments for the bulls and have resulted in the move to the orange resistance zone created by the late-May and early-June peaks.

Earlier today, the bulls tried to break above the orange resistance zone, but the pair has reversed and came back below the orange zone to trade at around 1.2730 currently. Drawing on previous experience with reversals of this kind shows that a bigger move to the downside remains probable this week.

Should we see a daily close below the orange resistance zone, we'll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/JPY

Since April, USD/JPY has been trading inside the declining blue trend channel. The upper border of the declining blue trend channel has stopped the buyers in the previous week and the pair rolled over to the downside. The decline led to breaking below the green support zone and the pair has approached the 70.7% Fibonacci retracement.

Earlier today, the bulls tried to push the rate higher, but failed. They didn't make it even to the vicinity of the green support-turned-resistance. As long as the breakdown below it isn't invalidated, another downswing targeting the 76.4% and the 78.6% Fibonacci retracement can't be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the aftermath of Fed's dovish turn led to progressively higher EUR/USD and GBP/USD values. While the USD has broadly weakened, we remain on the lookout for the bulls' weakness in both pairs as they're facing important resistances currently, and the pace of decline in the USD Index is decelerating. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist