Today is another volatile day, and not only in the currencies, that is. The euro upswing has run into headwinds and the upcoming developments can mark a new trading decision. Speaking of which, we're adjusting the parameters of one of our open profitable positions. While the other one keeps profitably humming along, join us in exploring the other setups on our watch.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 107.45; the next downside target at 105.60)

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 0.9845; the next downside target at 0.9706)

- AUD/USD: none

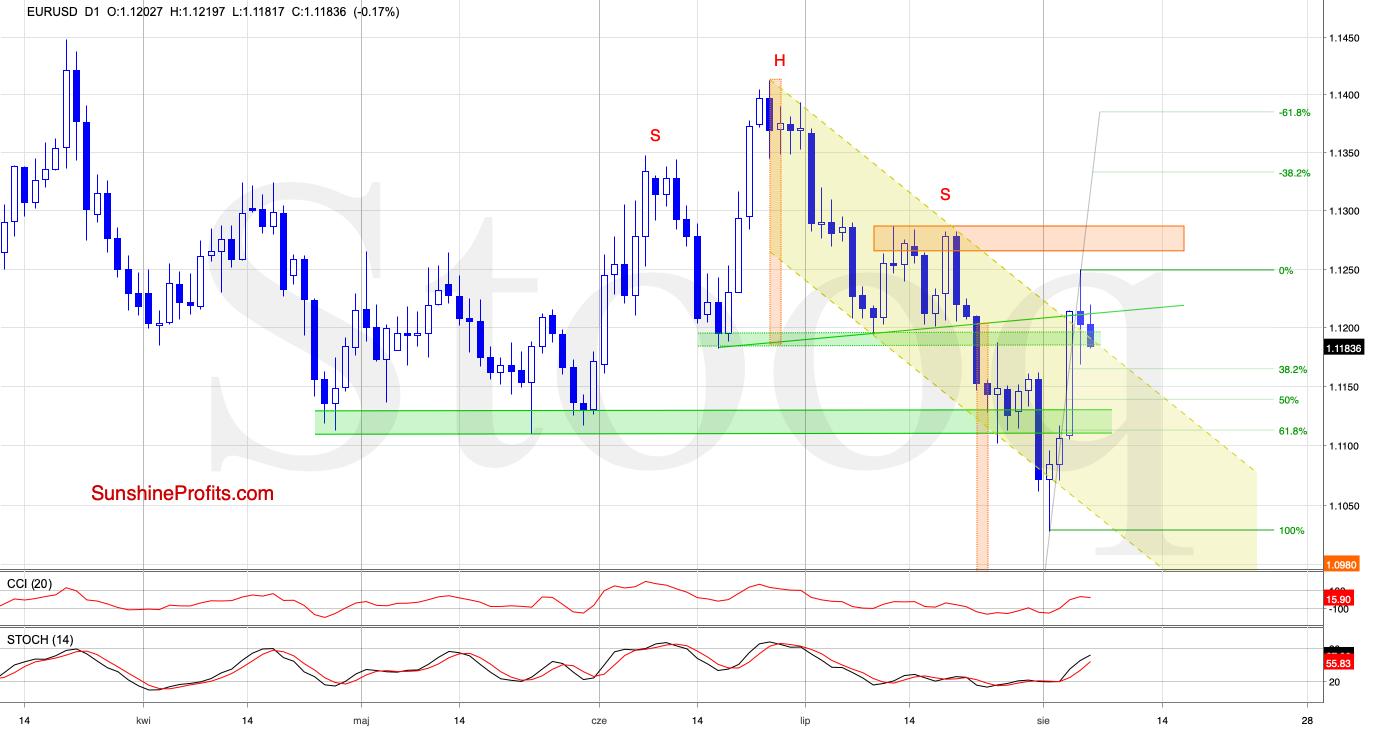

EUR/USD

EUR/USD closed yesterday's session below the previously-broken neckline of the head and shoulders formation, which triggered further deterioration earlier today. Additionally, the exchange rate moved below the upper border of the declining yellow trend channel, suggesting that we'll see a test of the 38.2% Fibonacci retracement in the very near future.

Nevertheless, the buy signal generated by the Stochastic Oscillator suggests that the bulls will defend this support. If they rebound higher from there, we could see a test of yesterday's peak or even a test of the orange resistance zone in the coming days.

Should the bulls fail, the way to the green support zone and the 61.8% Fibonacci retracement will be likely open and we'll consider reopening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

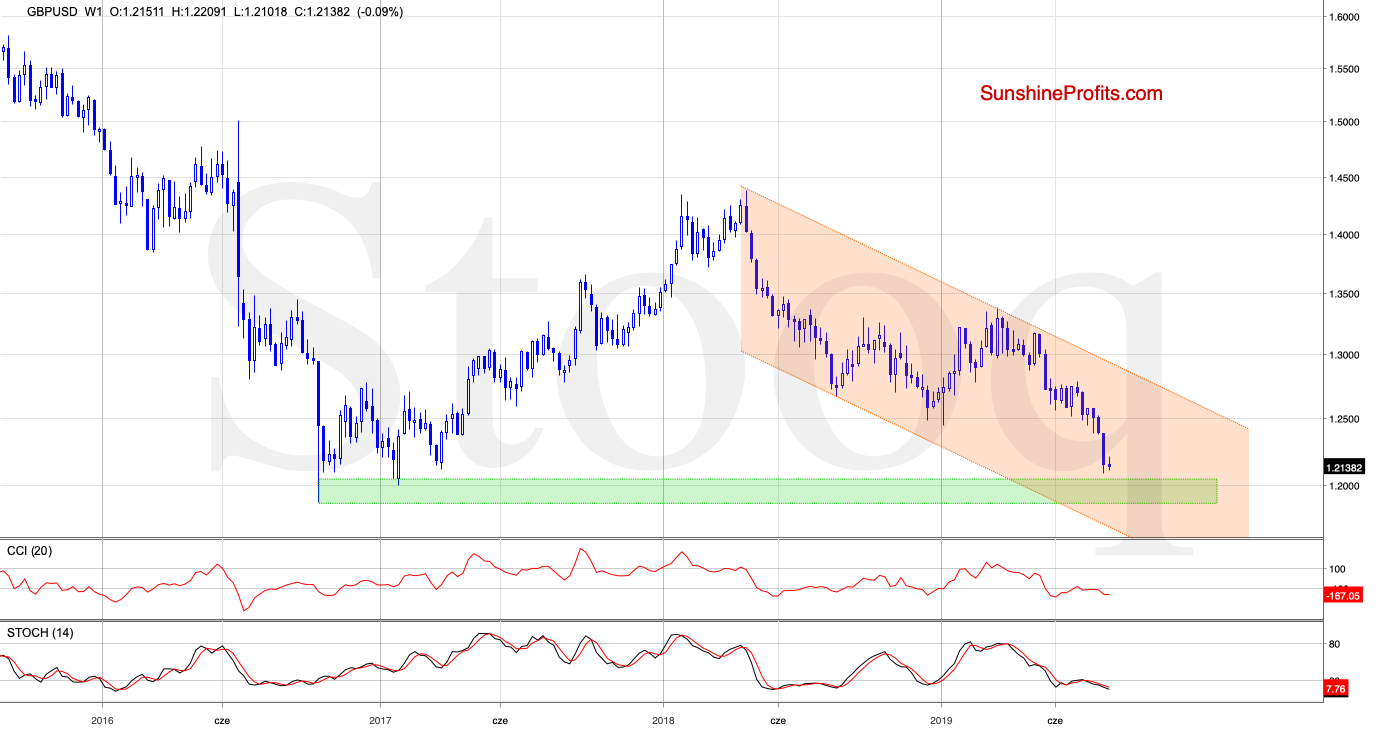

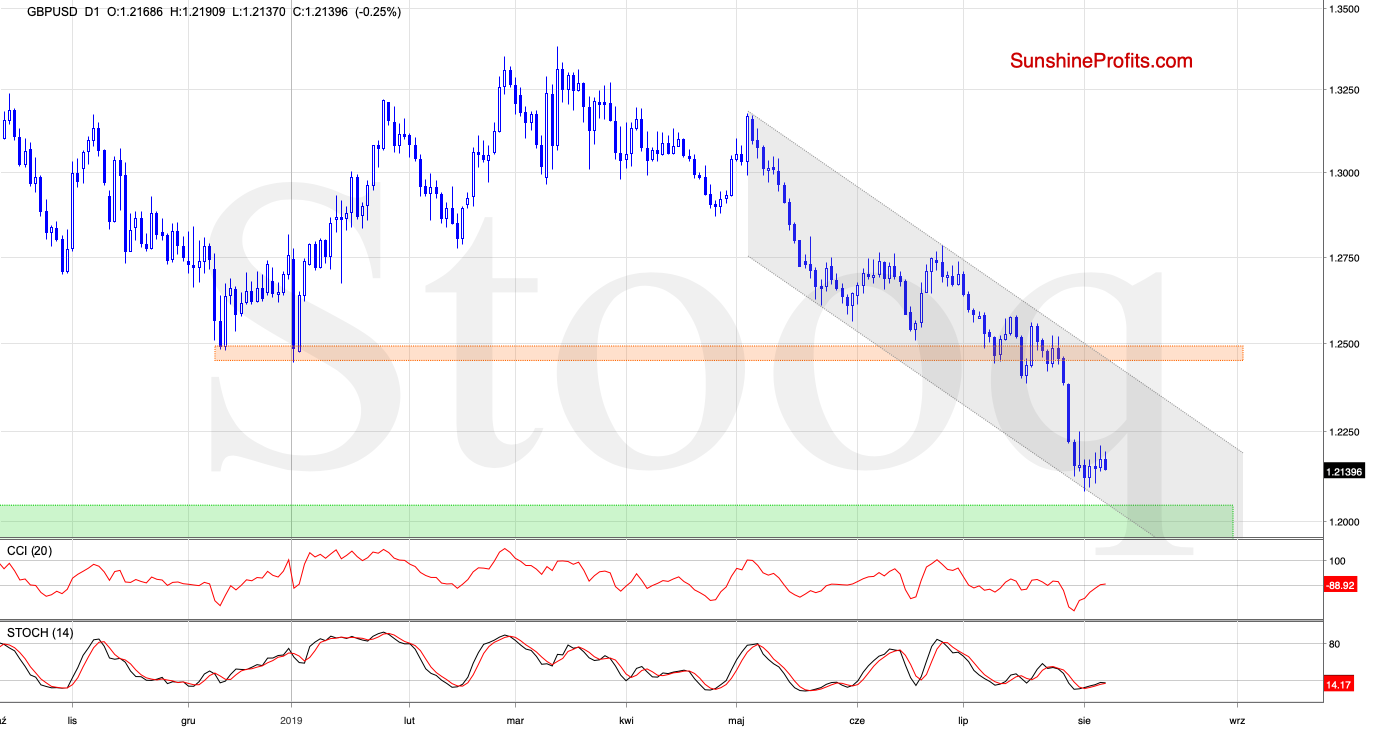

GBP/USD

GBP/USD has extended losses in the previous week, as the first (weekly) chart shows. The downswing took the pair to the lower border of the declining grey trend channel. This support withstood the selling pressure, triggering a rebound.

While the buyers attempts to move higher, the exchange rate is trading well below several previously-broken support areas. Namely, below the support created by the December and January lows and also below the late-July peak, suggesting that the bears may not have said their last word.

If this is the case and the pair moves lower once again, we'll likely see a retest of the lower border of the declining grey trend channel. Even a test of the nearby green support zone (seen more clearly on the weekly chart) isn't out of the question.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

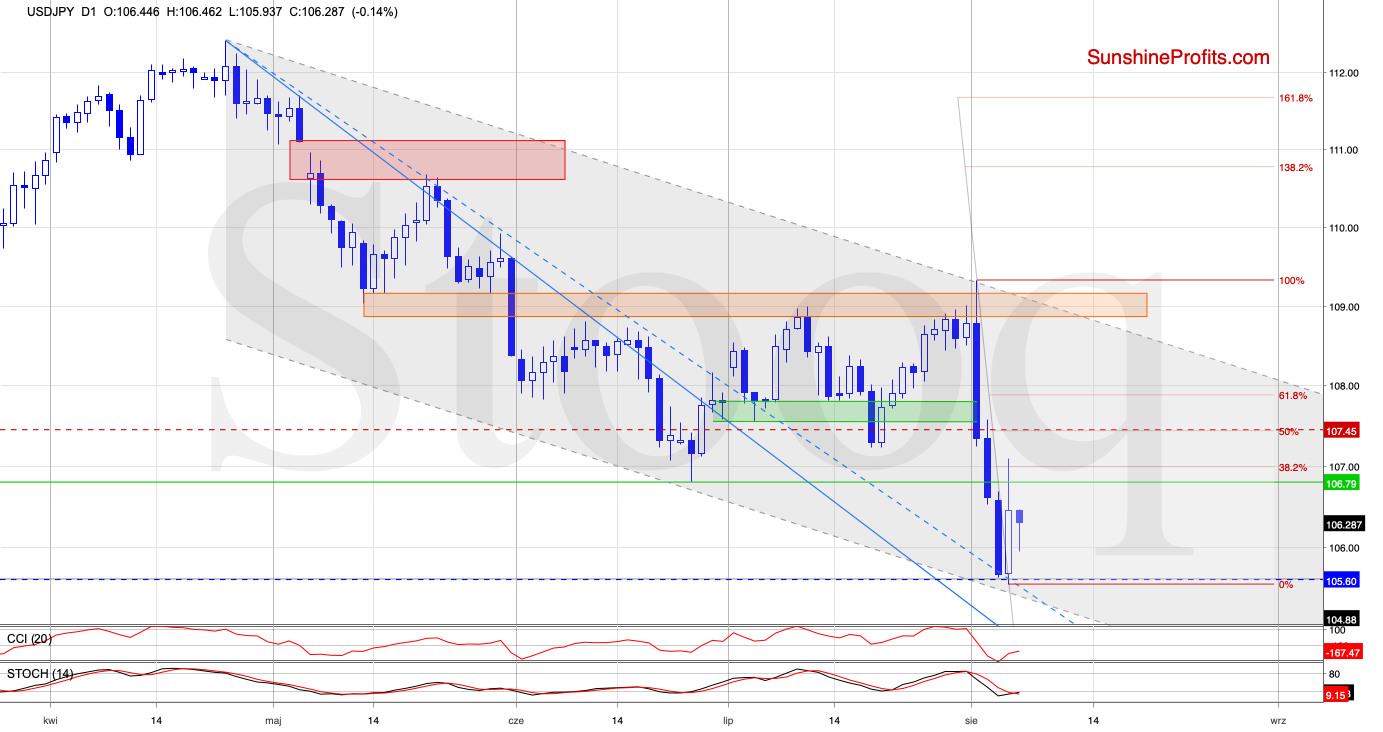

USD/JPY

USD/JPY approached the lower border of the declining grey trend channel, encouraging the buyers to act. The pair moved sharply higher during yesterday's session, testing the previously-broken late-June low and the 38.2% Fibonacci retracement.

The sellers stopped further advances and the pair pulled back, closing the day below these resistances. This show of weakness triggered further deterioration earlier today, increasing the probability that we'll see a retest of the recent lows or even of the lower border of the declining grey trend channel (currently at around 105.40) in the following days.

Trading position (short-term; our opinion): 50% of profitable short positions with a stop-loss order at 107.45 and the next downside target at 105.60 are justified from the risk/reward perspective. However, if the pair moves below the lower border of the declining grey trend channel, the next downside target for remaining 50% of our short positions will be at 104.90 (slightly above the February 2019 low).

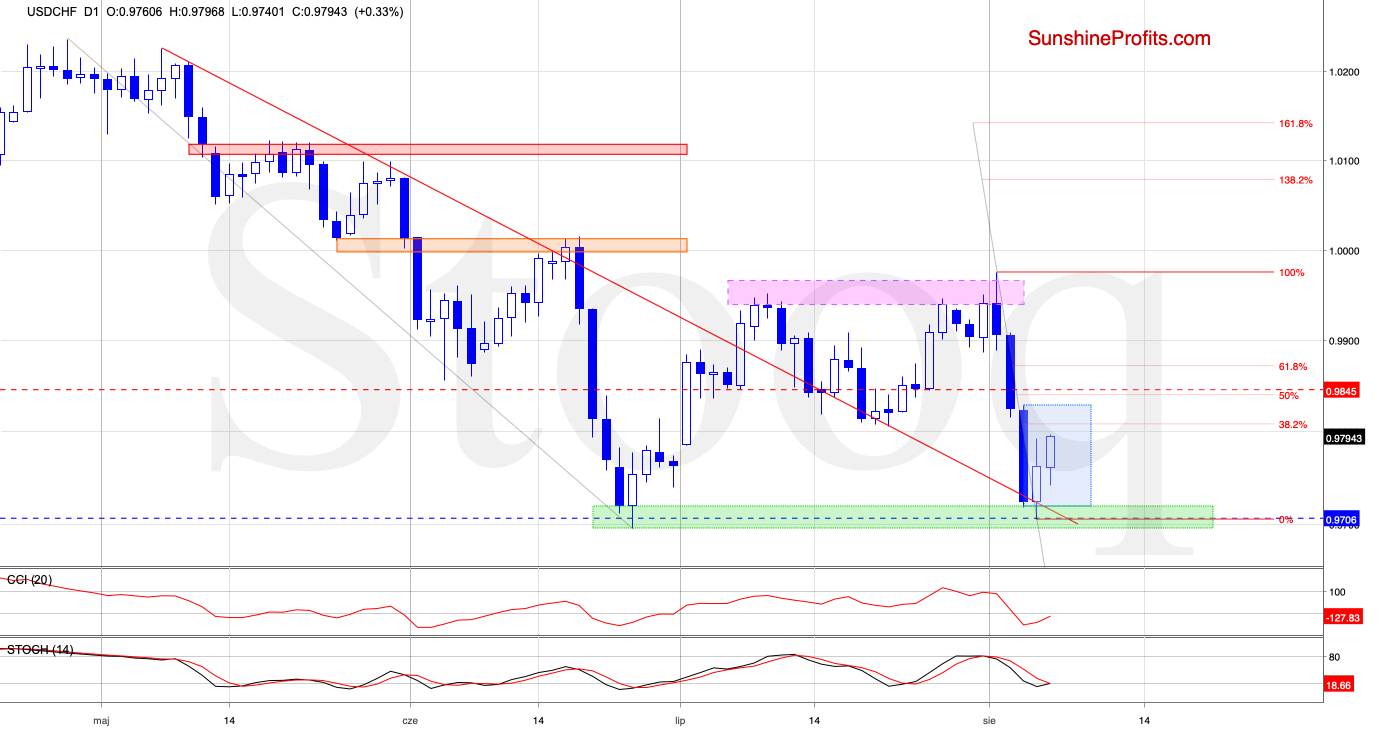

USD/CHF

USD/CHF tested the green support zone during yesterday's session, but the sellers didn't manage to take the pair any lower. The bulls stepped in and moved the rate to the upside, extending their gains earlier today.

Such price action suggests that we'll see a test of the 38.2% Fibonacci retracement or even of the upper border of the blue consolidation in the very near future. However, as long as there is no daily close above these resistances, another retest attempt of the recent lows is very likely.

Trading position (short-term; our opinion): 50% of profitable short positions with a fresh stop-loss order at 0.9845 and the next downside target at 0.9706 are justified from the risk/reward perspective.

Summing up the Alert, the euro upswing has been partially retraced yesterday, and we're waiting for signs of the bulls' weakness before making any decision on reopening the short positions. The USD/JPY bears are making a retrace of yesterday's upswing, increasing the likelihood of downside targets retest in the coming days. The remaining 50% of our profitable short position remains justified. The remaining half of our profitable USD/CHF position also remains justified. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist