Jackson Hole announcements are here! And the currencies are responding with their moves. Yet the euro is still trading close to unchanged as we speak. Its downswing has been erased, though the bulls haven't made any real progress higher. For how long can such a situation continue? And have other pairs' moves been more clear? They have, and let's dive in.

In our opinion, the following forex trading positions are justified - summary:

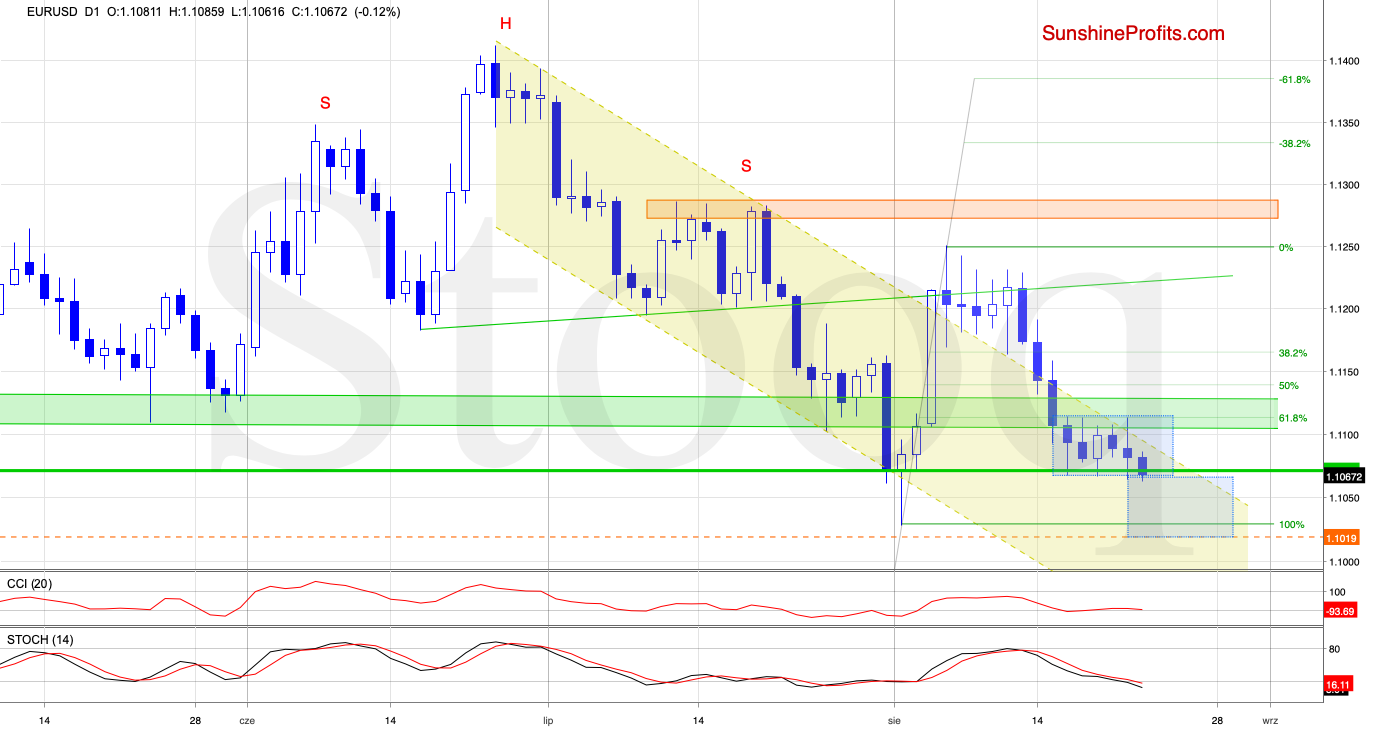

EUR/USD

While EUR/USD moved a bit higher yesterday, the bulls didn't manage to take the pair above the upper border of the blue consolidation and the green zone based on April and May lows. This zone now serves as the nearest resistance.

Such show of weakness resulted in a test of the horizontal green support line and the lower border of the blue consolidation. Earlier today, we noticed a breakdown below both supports, which suggests that we could see further deterioration and a test of the early-August low or even a drop to around 1.1019, where the size of the downward move would correspond to the height of the preceding consolidation.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

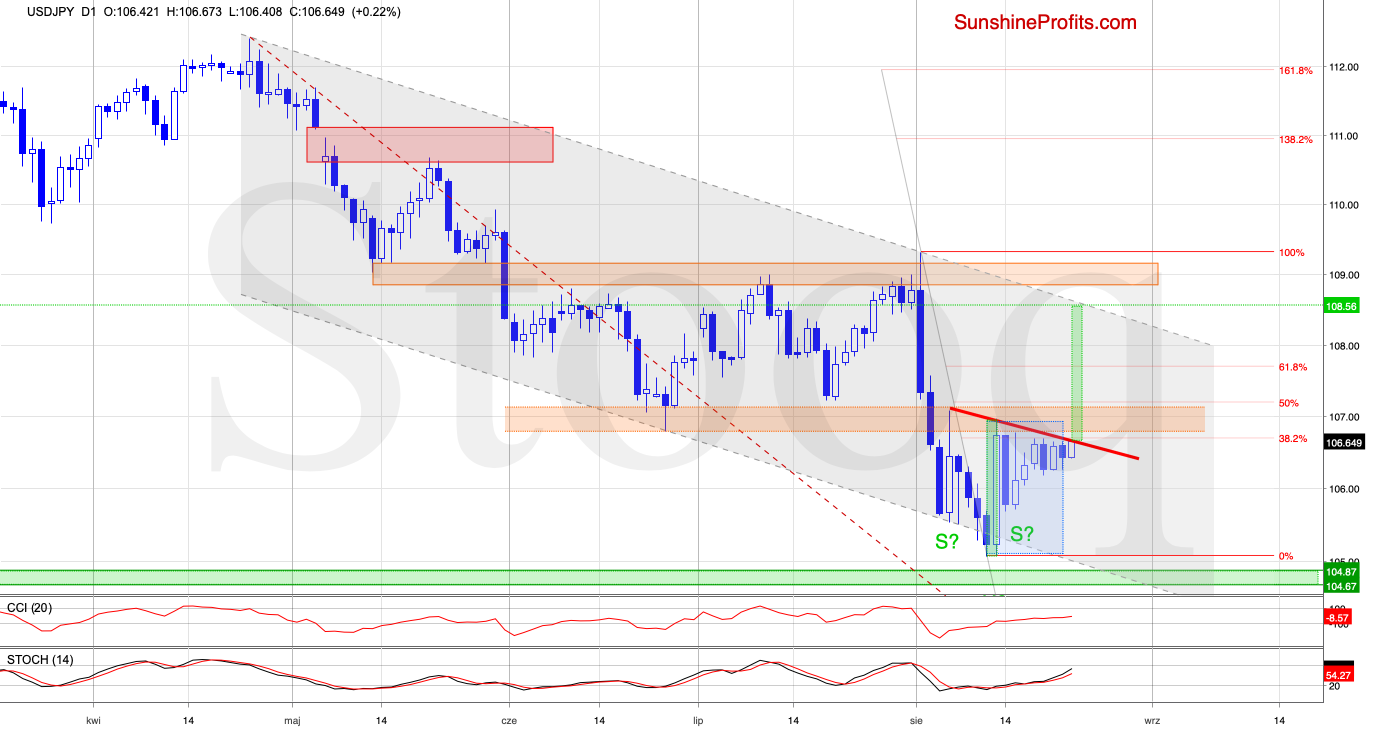

USD/JPY

Earlier today, USD/JPY moved a bit higher, yet the exchange rate still remains inside the blue consolidation, slightly below the red resistance line and the orange resistance zone. We have written these words about upswing attempts on Wednesday:

(...) It suggests that we'll see a test of the red declining resistance line based on the previous peaks soon. This resistance could be a neckline of a potential reverse head and shoulder formation - successful breakout both above the neckline and the above-mentioned orange resistance zone could open the way to the north.

Additionally, the current position of the daily indicators suggests that the bulls are likely to see them flash buy signals in the very near future. This increases the probability of an upward move in the coming days. Should we see USD/JPY breaking above these mentioned resistances, we'll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

USD/CHF broke above the upper border of the blue consolidation and the orange resistance area during yesterday's session. This has brought on further improvements earlier today.

Let's combine it with the current position of the daily indicators. They are in the bullish territory, and connecting the dots, a test of the 38.2% Fibonacci retracement or even the red declining resistance line based on the previous peaks is probable in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD is peeking lower, and further deterioration beyond the early-August lows remains possible despite its relative stabilization currently. There have been no signs of the USD/JPY and USD/CHF bulls' strength and a break above their respective resistances that would justify possible long positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist