A new week has breathed new life into the action in many currency pairs. Just look at the euro. Is it such a surprise that it’s moving higher today so far? Is this the new piece of chart information we have been waiting for? Let’s jump in to the developing story and examine other key pairs along the way.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1099; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

We have written these words on Friday:

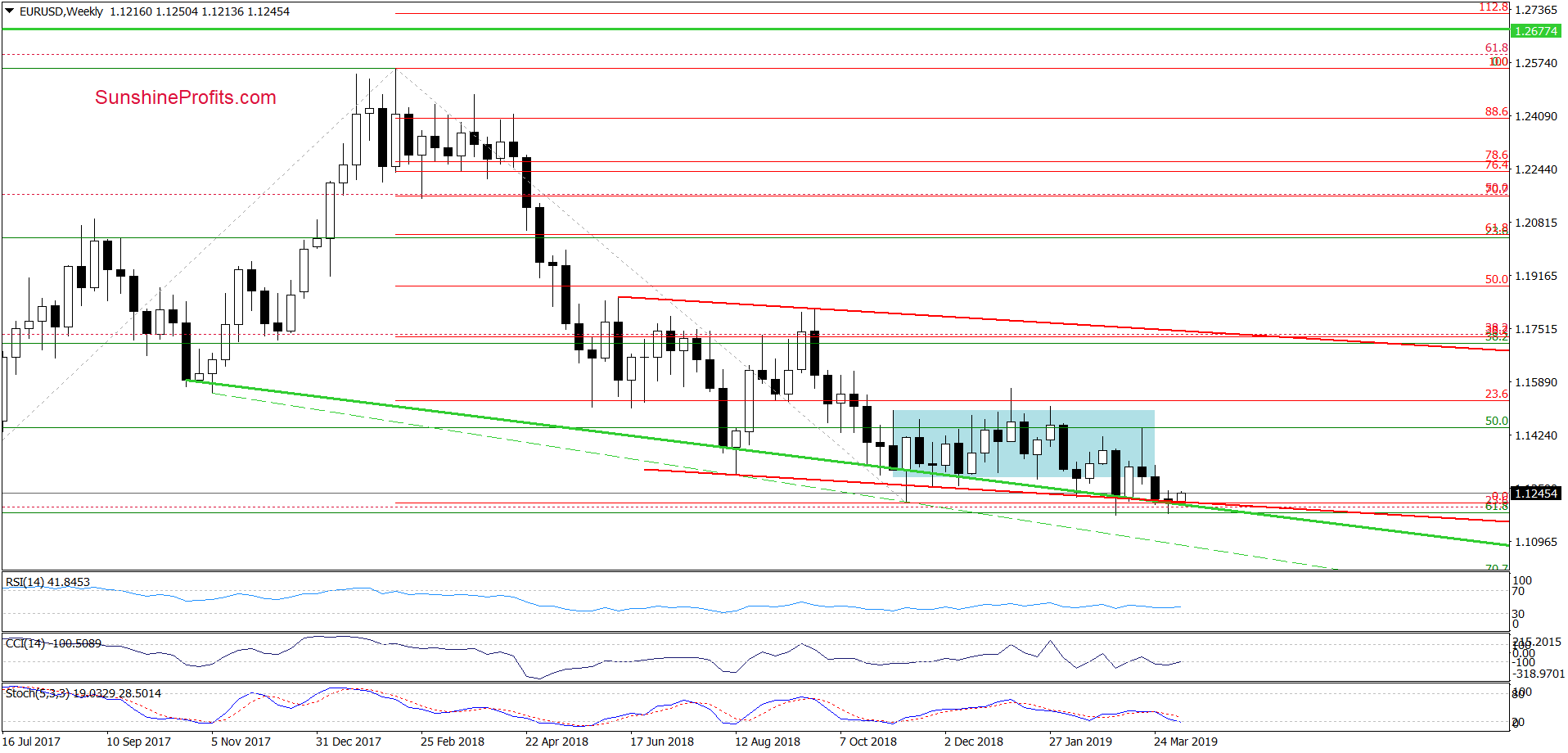

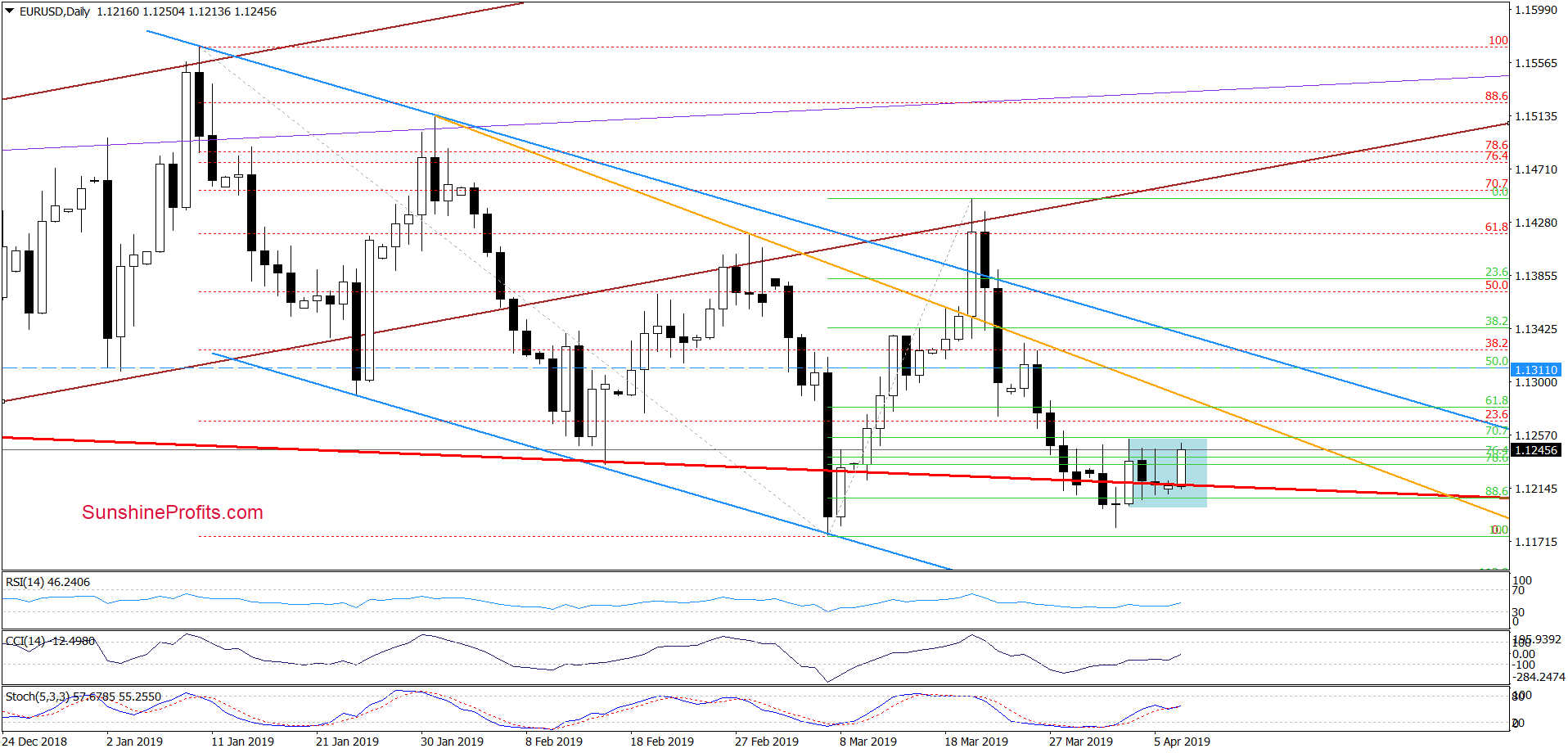

(…) EUR/USD came back above the lower border of the red trend channel, invalidating yesterday’s small intraday breakdown.

This is a positive event for the bulls, which in combination with the above-mentioned bullish points suggests higher values of the exchange rate in the coming week.

The pair has closed the week above the long-term green support line. Earlier today, the lower line of the red declining trend channel triggered a rebound and the exchange rate trades currently at around 1.1270. This means it’s attempting an intraday breakout above the blue consolidation (as shown on the daily chart).

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1099 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

USD/CHF

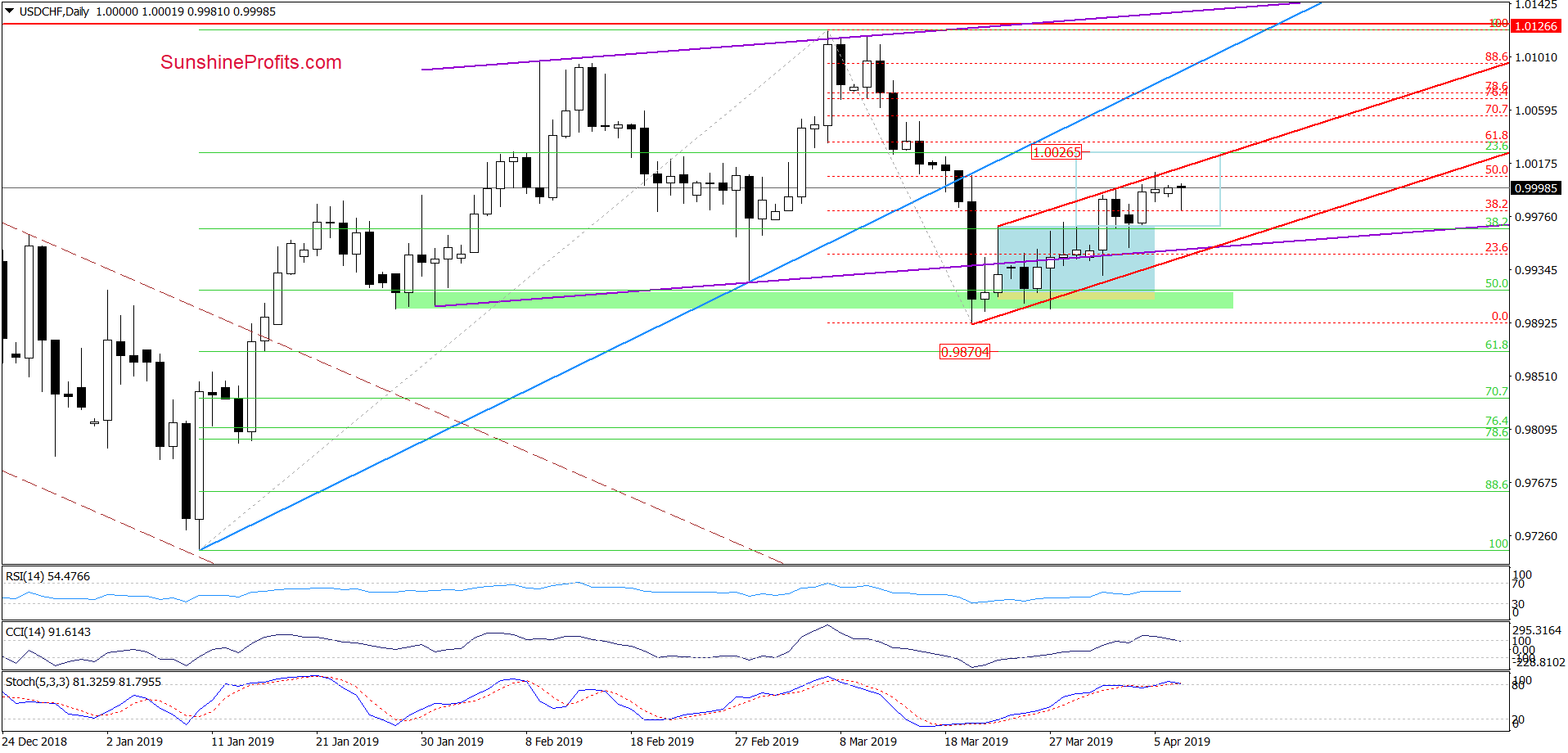

The overall situation in the short term remains almost unchanged. The pair is still trading in a narrow range between the April 1 peak and the 50% Fibonacci retracement of the entire March downswing.

The pair also remains below the red rising resistance line based on the previous highs. As long as there is no breakout above it, higher values of USD/CHF are questionable. It’s also worth mentioning that the CCI and the Stochastic Oscillator generated their respective sell signals, increasing the probability of decline in the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

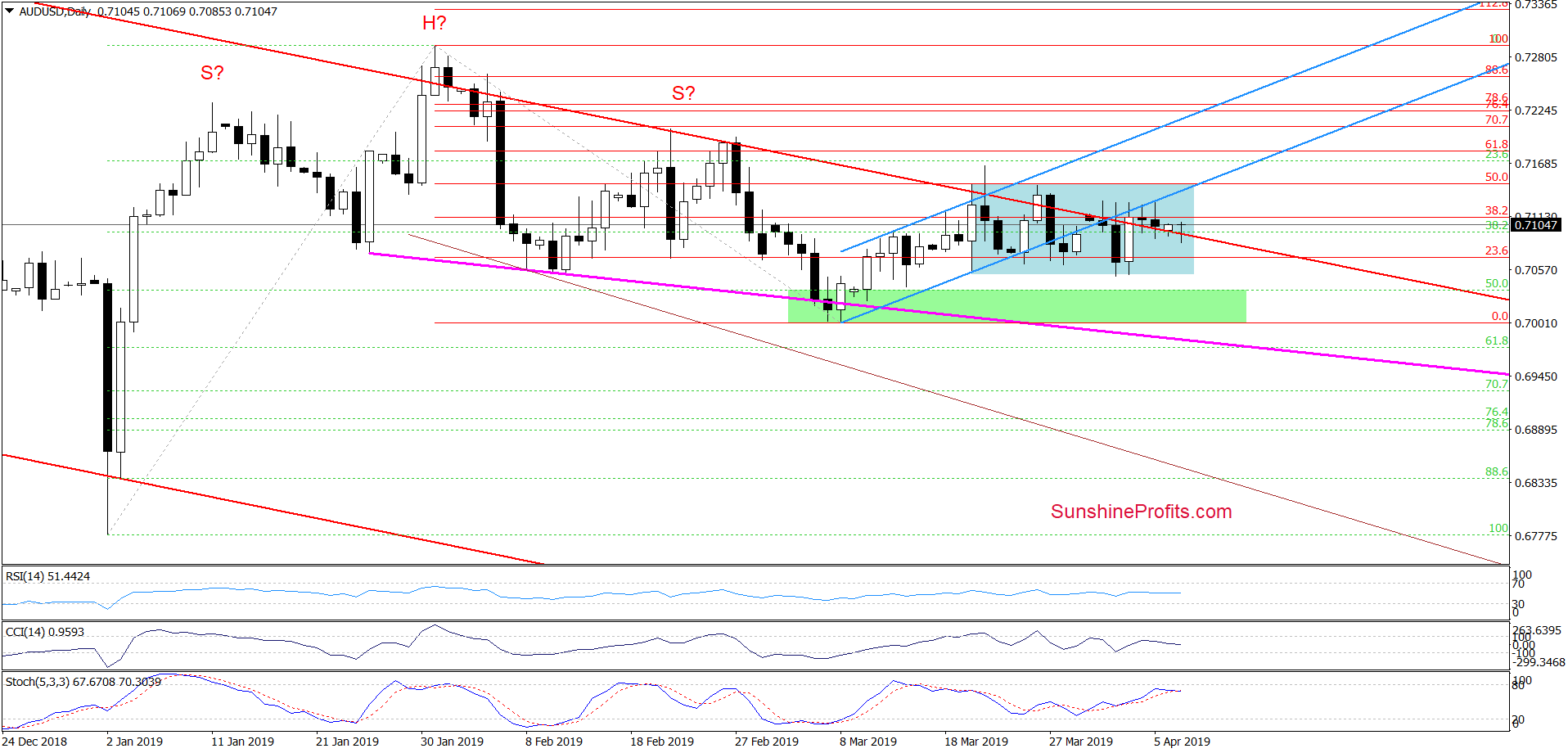

The overall situation in the short term remains almost unchanged. The pair is still trading in a narrow range between the April 1 peak and the 50% Fibonacci retracement of the entire March downswing.

The pair also remains below the red rising resistance line based on the previous highs. As long as there is no breakout above it, higher values of USD/CHF are questionable. It’s also worth mentioning that the CCI and the Stochastic Oscillator generated their respective sell signals, increasing the probability of decline in the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist