The euro is making a comeback, and so does the British pound. Can it last in the face of all the recent USD strength? And does it justify any call to taking new trading action? And what about the Canadian dollar's run, does it mean we better take sizable profits off the table? Let's dive in to all the relevant details.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0963; the initial upside target at 1.1112)

- GBP/USD: long (a stop-loss order at 1.2139; the initial downside target at 1.2467)

- USD/JPY: none

- USD/CAD: none (in other words, closing short positions and taking profits off the table is justified at the moment)

- USD/CHF: short (a stop-loss order at 0.9951; the initial downside target at 0.9768)

- AUD/USD: none

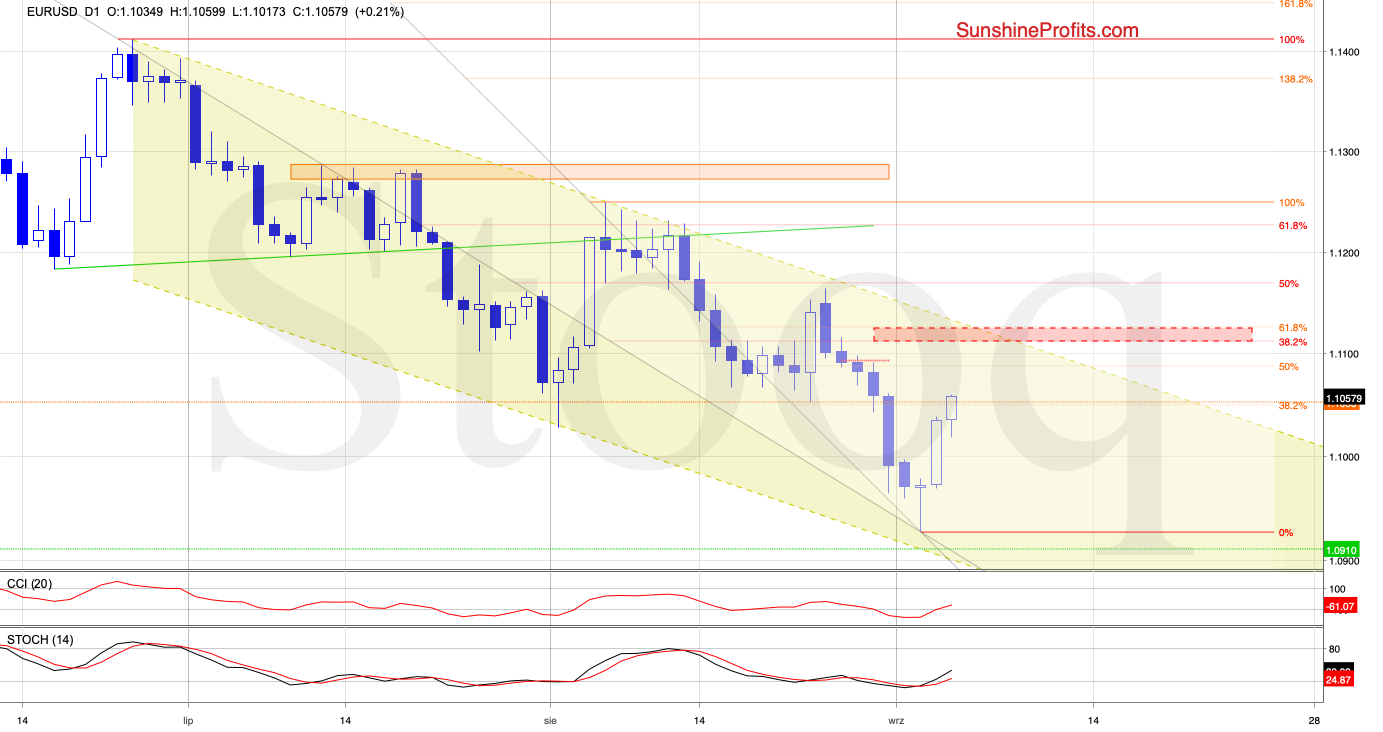

We wrote these words regarding EUR/USD closing prices yesterday:

(...) Should the price improvement last, we'll see a bullish reversal formation - the morning star. This three-candlestick pattern would be complete should the pair close today's session comfortably above 1.1000.

Looking at the daily indicators, we see that now both the CCI and the Stochastic Oscillator are on their buy signals. And earlier today, the pair is breaking above the 38.2% Fibonacci retracement.

All the above suggests further improvement and at least a test of the red resistance zone created by two important retracements: the 61.8% Fibonacci retracement and the 38.2% Fibonacci retracement based on the entire June-September downward move.

Therefore, we think that opening long positions is justified from the risk/reward perspective at the moment. All details below.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0963 and the initial upside target at 1.1112 are justified from the risk/reward perspective.

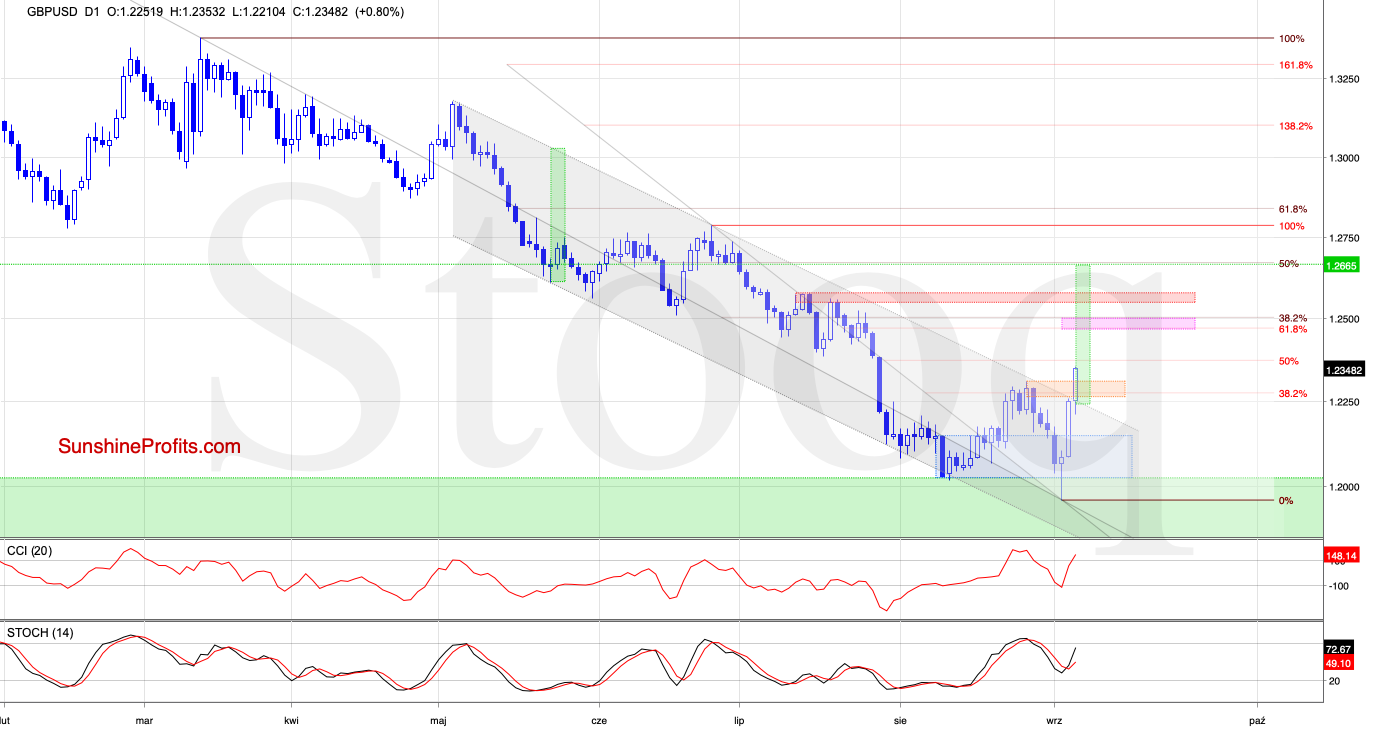

GBP/USD

GBP/USD has broken above the upper border of the declining grey trend channel and the 38.2% Fibonacci retracement. The daily indicators have generated their buy signals as the pair has broken above the late-August peaks.

All the above suggests upswing continuation to at least the pink resistance zone created by the 61.8% Fibonacci retracement and the 38.2% Fibonacci retracement based on the entire May-September downward move.

Connecting the dots, opening long positions is justified from the risk/reward perspective at the moment. More details you will find below.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2139 and the initial downside target at 1.2467 are justified from the risk/reward perspective.

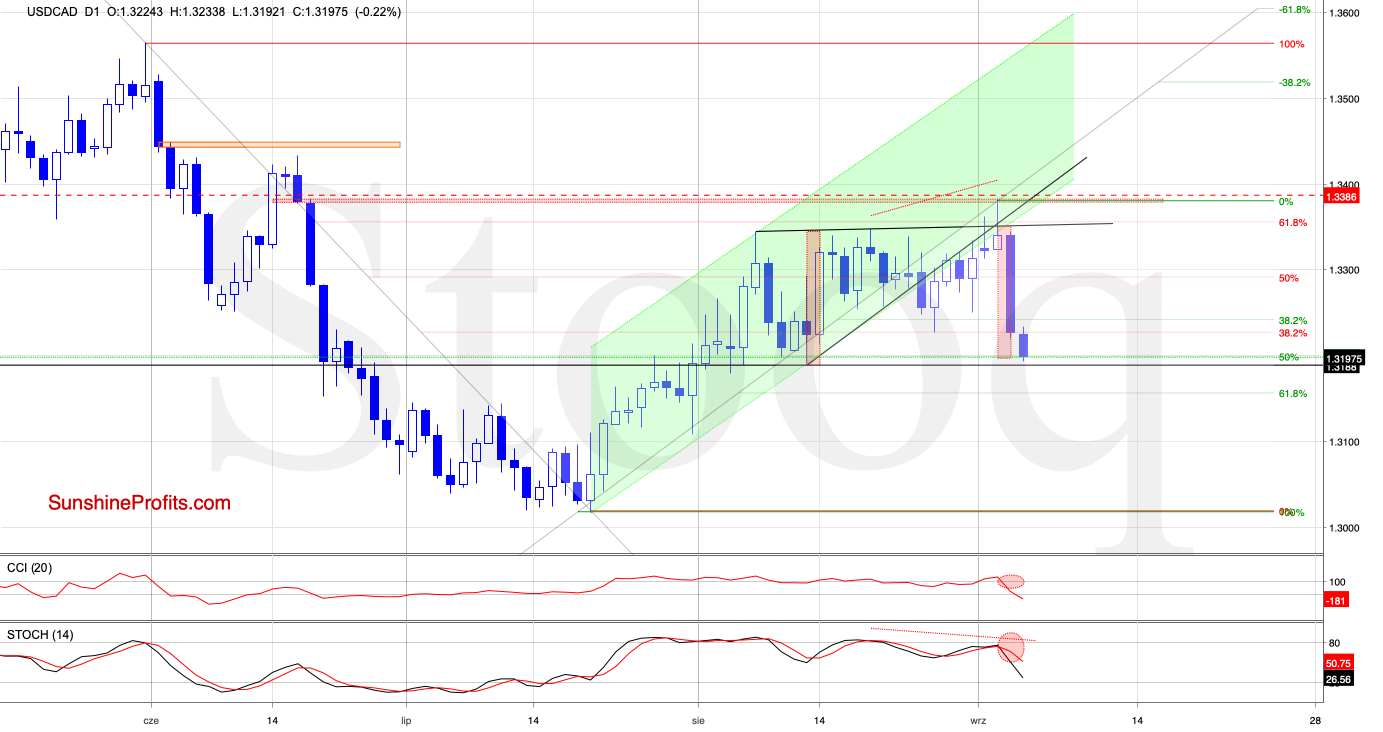

USD/CAD

These are our yesterday's observations:

(...) Should the exchange rate go on to decline from here, the initial downside target will be at around 1.3198, where the size of the downward move would correspond to the height of the triangle the pair has broken down from.

USD/CAD has indeed slipped to our downside target earlier today. This decline took the pair to the 50% Fibonacci retracement and the support area created by the August lows. This suggests that we could see a rebound from here in the very near future - especially when we factor in some profit-taking of the bears here.

Taking the above into account, closing short positions and taking profits off the table is justified from the risk/reward perspective. But should we see the bulls' weakness, no rebound from this support area or a potential breakdown below it, we'll consider re-opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Summing up the Alert, EUR/USD made a strong close yesterday, completing the morning star formation. It looks set to target at red resistance zone north of 1.1100. Opening a long position is justified from the risk-reward perspective. GBP/USD has similarly broken above nearest resistances, and the daily indicators support further upside move - again, opening a log position is justified. USD/CAD has reached our downside target, and taking into account the possibility of a reversal, we've decided to take all profits off the table. Today, USD/CHF is attempting a rebound after yesterday's rout, but the short position remains justified due to earlier breakouts' invalidations. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist