In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a fresh stop-loss order at 1.0983; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 109.66; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the initial upside target at 1.3300)

- USD/CHF: none

- AUD/USD: none

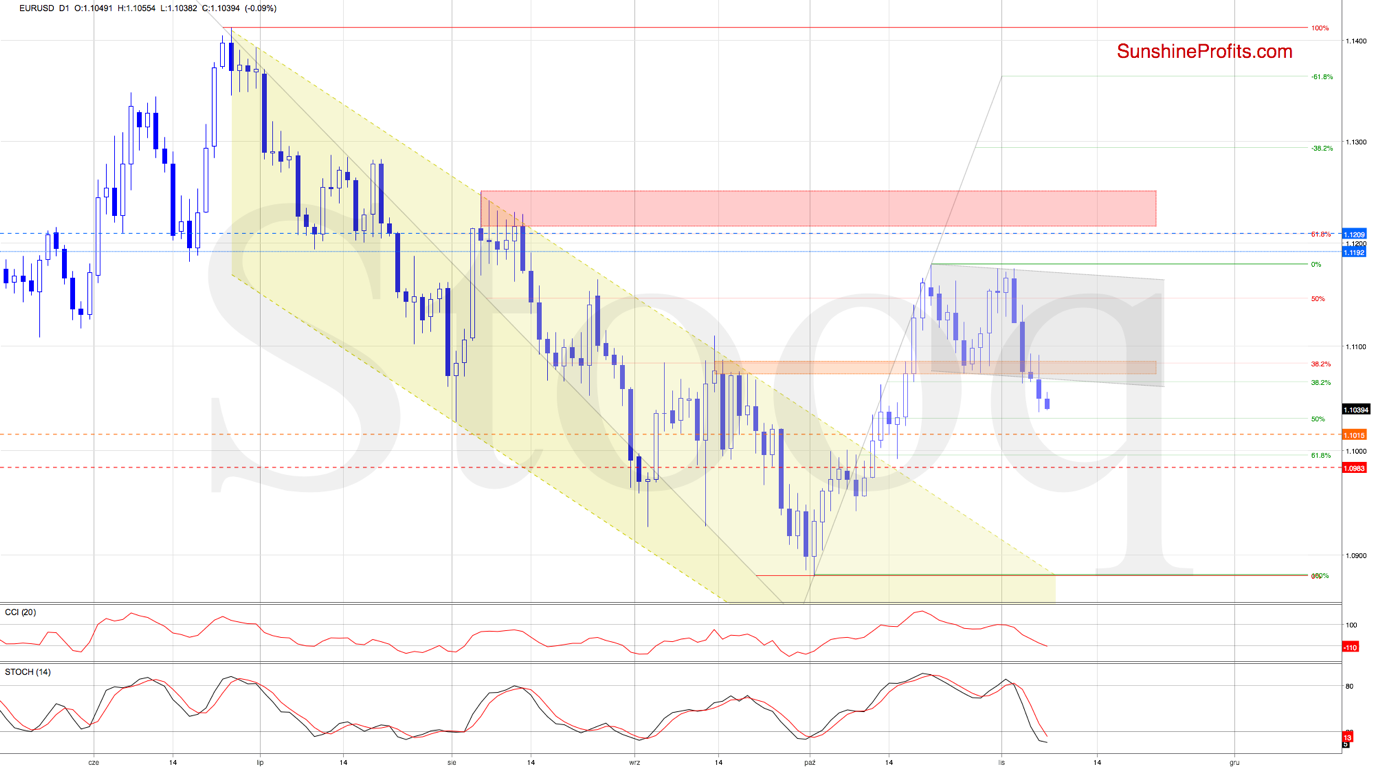

EUR/USD

During yesterday's session, EUR/USD broke below the 38.2% Fibonacci retracement and the lower border of the declining grey trend channel, encouraging the sellers.

Earlier today, the bears followed through with one more downswing, which suggests a test of the 50% Fibonacci retracement in the very near future.

Trading position (short-term; our opinion): long positions with a fresh stop-loss order at 1.0983 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

GBP/USD

While GBP/USD moved lower, the overall short-term situation remains again almost unchanged: the pair is still trading inside the purple consolidation and well above the Oct 24 low.

Therefore, as long as there is no daily close below these supports, a bigger move to the downside is not likely to be seen. An upside reversal in the very near future should not surprise us.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the initial upside target at 1.2976are justified from the risk/reward perspective.

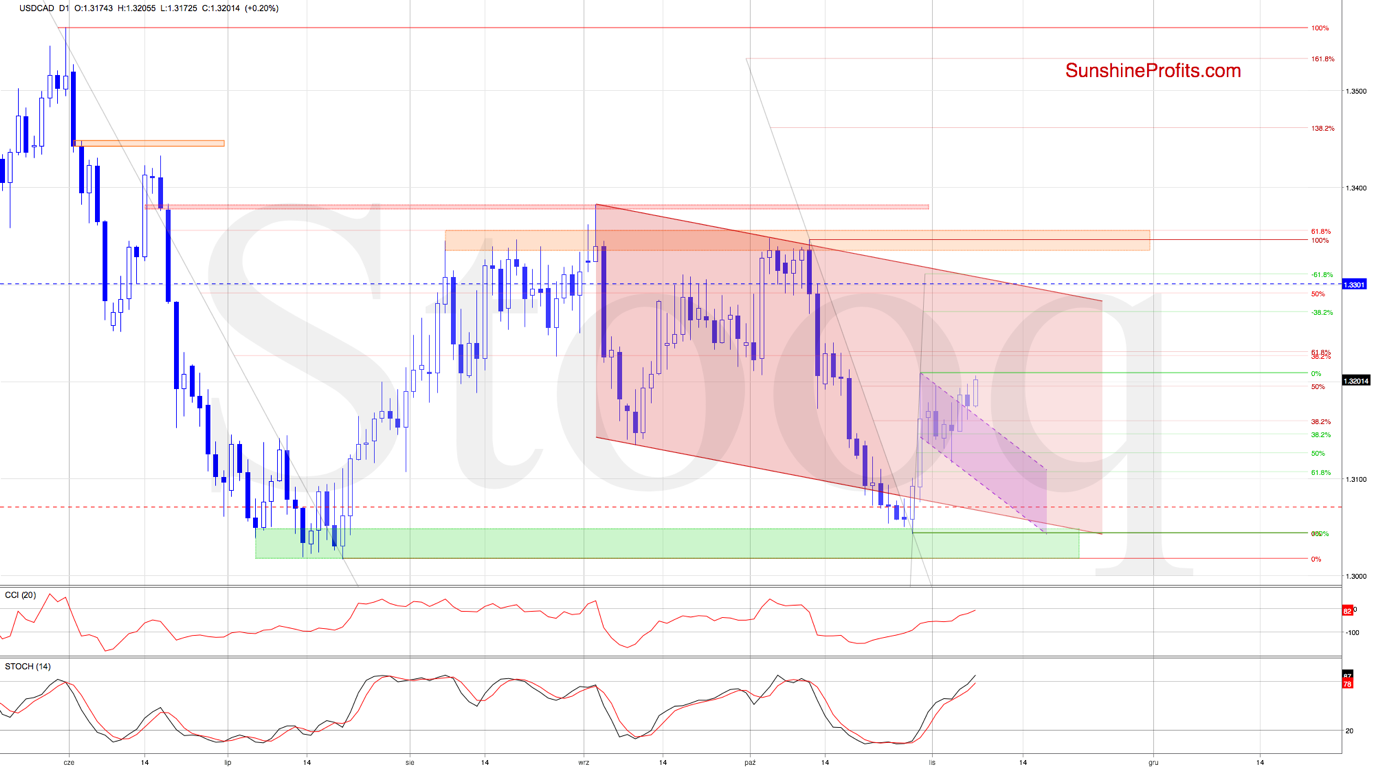

USD/CAD

Since rising from its lows in late October, the pair has been consolidating with a downward bias. Attempts to push higher were rejected, but in recent days, the exchange rate spiked higher. Can the bulls sustain their gains?

On Tuesday, we wrote that USD/CAD:

(...) remains trading inside the very short-term declining purple trend channel. It suggests that the next target for the sellers may be the lower border of the formation and the 50% Fibonacci retracement slightly below.

As long as there is no daily close below these supports, a reversal and another attempt to move higher should not surprise us.

The situation developed in tune with the above, and the exchange rate sharply erased almost the entire preceding decline. Yesterday brought us verification of the breakout above the declining purple trend channel, suggesting that higher values of USD/CAD are just around the corner.

Should we see the pair rise from here, the first target for the bulls will be the last week's peak and then the 61.8% Fibonacci retracement (at around 1.3232).

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and GBP/USD. The full Alert includes more details about our current positions and levels to watch before deciding to open any new ones. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3070 and the initial upside target at 1.3300are justified from the risk/reward perspective.

Before signing off, please note that there won’t be a regular Alert issued on Monday – the service will resume again on Tuesday, Nov 12.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist