The euro bulls have made quite a move so far today. Is it a flash in the pan, or does it have staying power? The charts provide us with valuable insights and sharpen our battle plan. This concerns other pairs, too. We've just identified another promising candidate for taking action. Let's see the rich details.

In our opinion, the following forex trading positions are justified - summary:

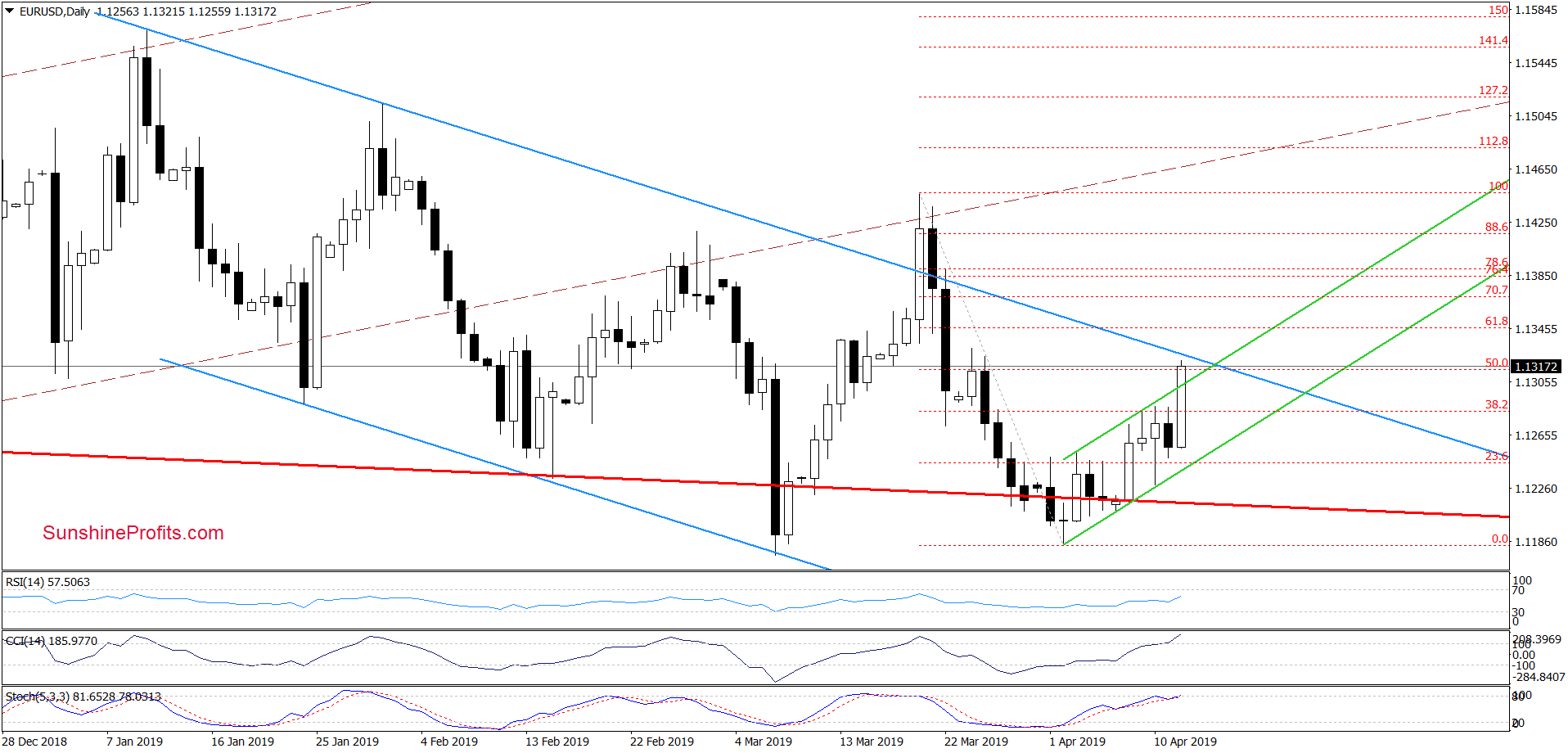

EUR/USD

As we speak, EUR/USD has just broken the upper border of the rising green trend channel. The earlier break of the 38.2% Fibonacci retracement encouraged the bulls to act.

The upper border of the blue declining trend channel is in the bulls' sights now. If they manage to close today's session above the upper border of the declining blue trend channel, a test of the 61.8% Fibonacci retracement can't be ruled out.

Looking at the position of the daily indicators however, we are of the opinion that a reversal might be in the cards. And we may see that at the beginning of the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

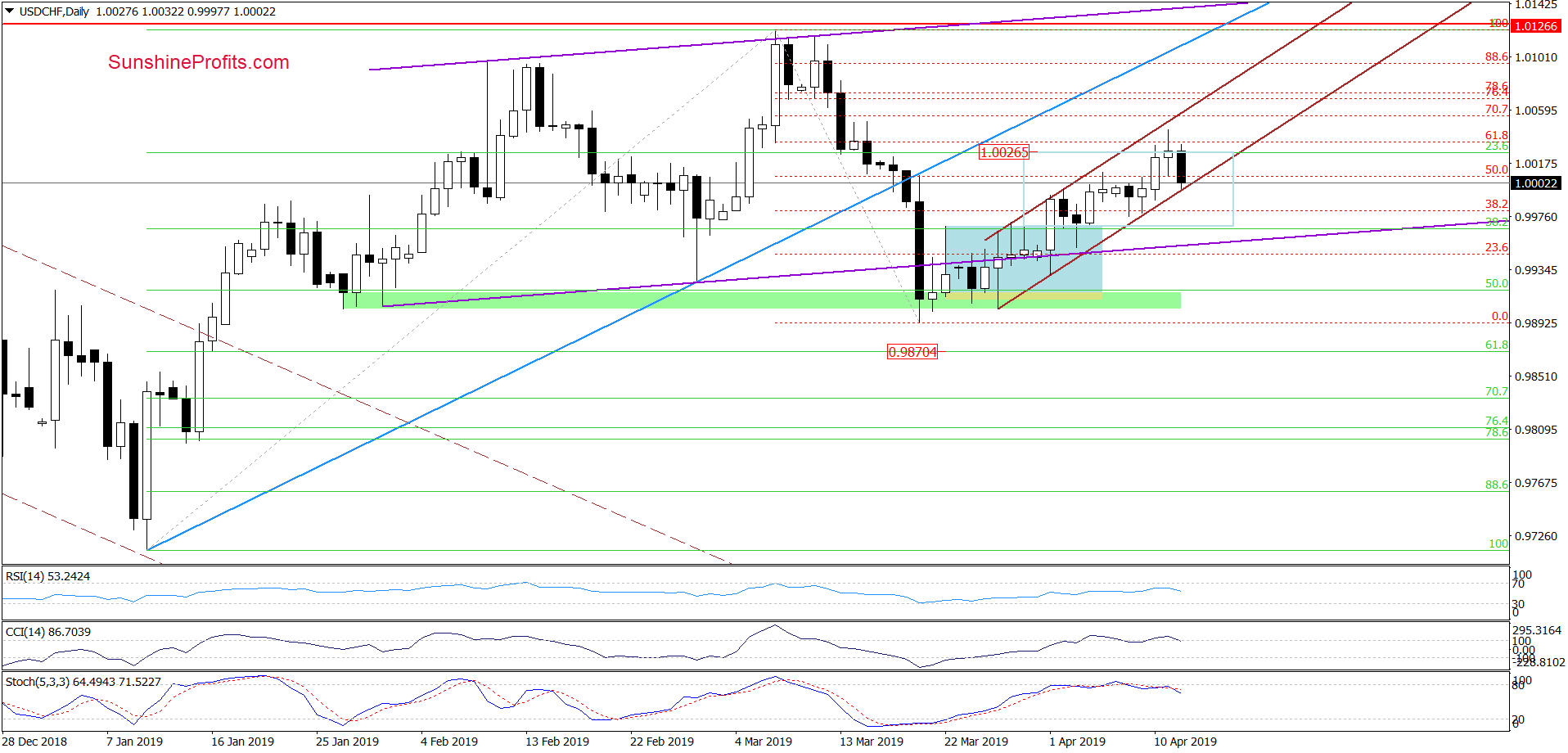

USD/CHF

USD/CHF has reached not only the target corresponding to the height of the blue consolidation (where also the green 23.6 Fibonacci retracement is), the pair has

also reached the 61.8% Fibonacci retracement.

The bulls didn't manage to hold on to their gains. The exchange rate has pulled back and closed the day below that 61.8% Fibonacci retracement. This way, the earlier breakout has been invalidated.

Earlier today, we're seeing follow-through selling action. The exchange rate has currently slipped to the lower border of the brown rising trend channel (roughly at both currencies' parity level).

The CCI and the Stochastic Oscillator just generated sell signals, suggesting that further deterioration may be on the way. Such price action will be more likely and reliable only if the sellers take the pair below the lower border of the brown rising trend channel. Should we see such price action, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

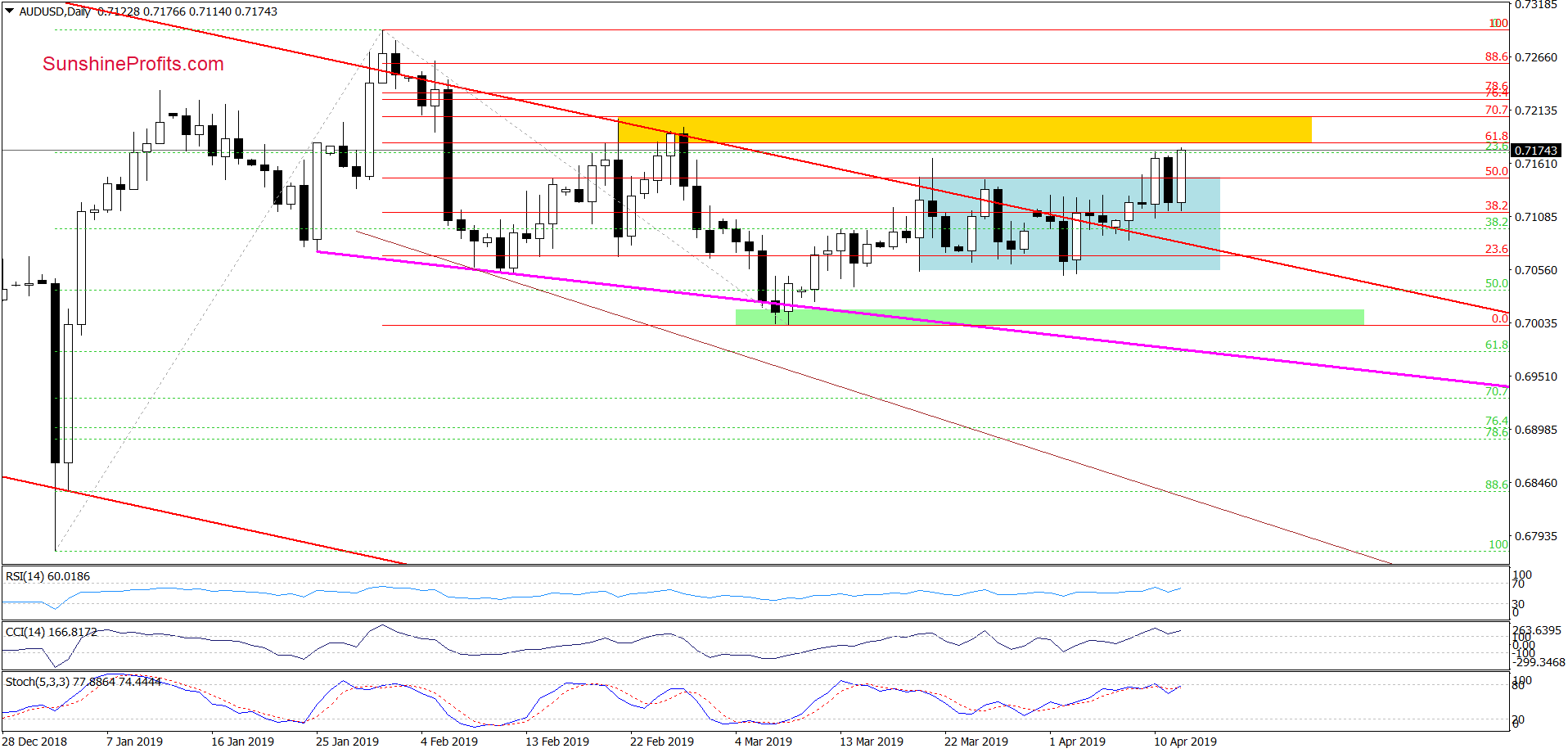

AUD/USD

Starting with the daily perspective, AUD/USD has broken above the upper border of the blue consolidation on Wednesday. Yesterday's session however erased almost the entire upswing.

Earlier today, the bulls pushed higher once again and the pair approached the 61.8% Fibonacci retracement and the yellow resistance zone. There's just one fly in the ointment.

It's the bearish divergences between the indicators and the exchange rate. They suggest that notwithstanding a possible test of the upper border of the yellow resistance zone (created by the February peak and the 70.7% Fibonacci retracement), a reversal in the coming week is very likely.

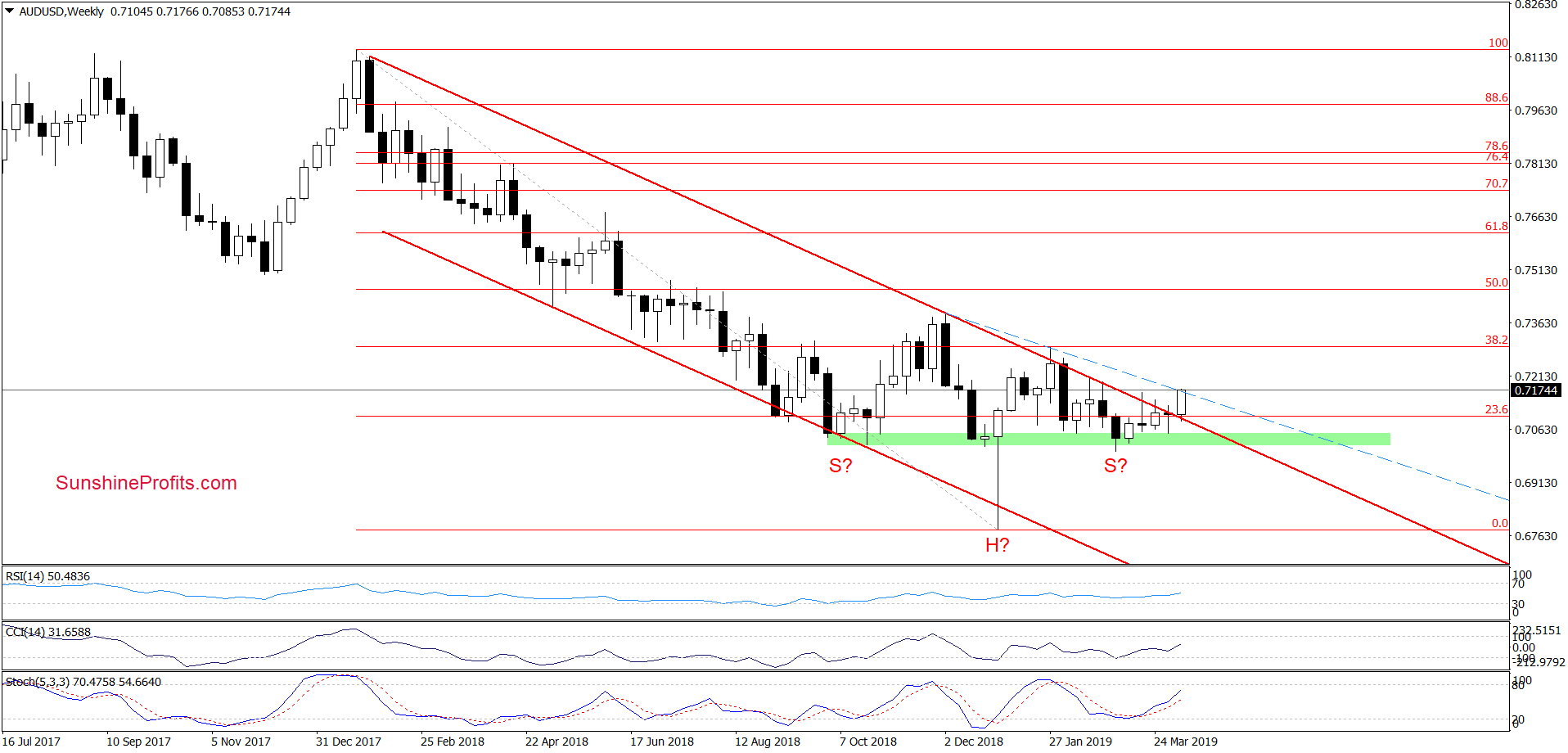

Especially so when we factor in the weekly picture.

Accounting for the recent upswing, AUD/USD has also reached the blue dashed resistance line based on the previous peaks (marked with the blue dashed line). Combined with the above-mentioned resistances, it could stop the buyers in the upcoming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, we may see the euro reversing early next week though no position is justified today from the risk-reward point of view. Within USD/CHF however, we may open short positions soon if we see stronger bearish price action. There're no opportunities worth acting on in the other currency pairs right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist