Uncertainties surrounding the Britain withdrawal from the European Union dominated Tuesday's session and ignited the emotions of investors. How yesterday’s price action affected the short-term picture of the exchange rate?

- EUR/USD: short (a stop-loss order at 1.1593; the initial downside target at 1.1337)

- GBP/USD: short (a stop-loss order at 1.2968; the initial downside target at 1.2630)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7288; the initial downside target at 0.7055)

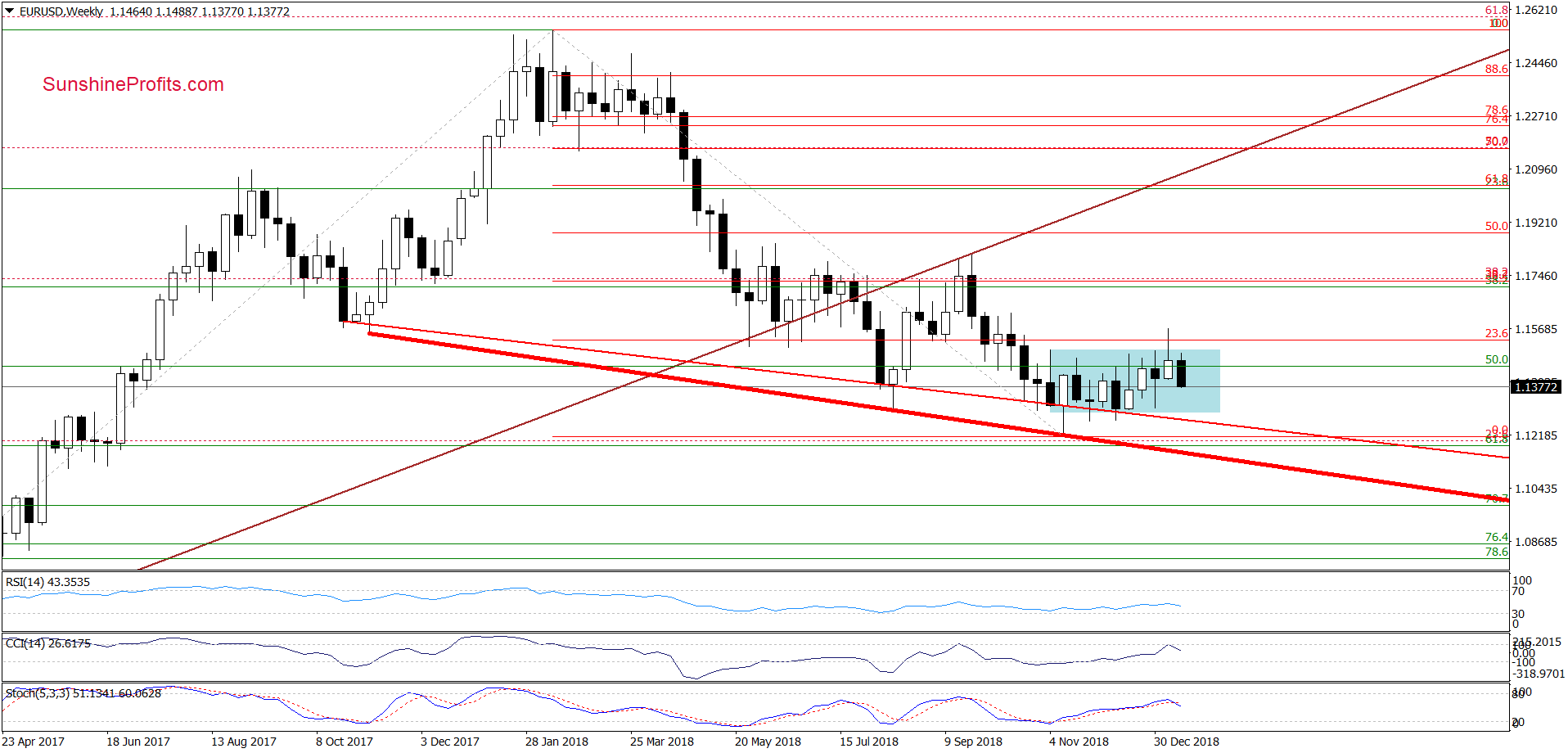

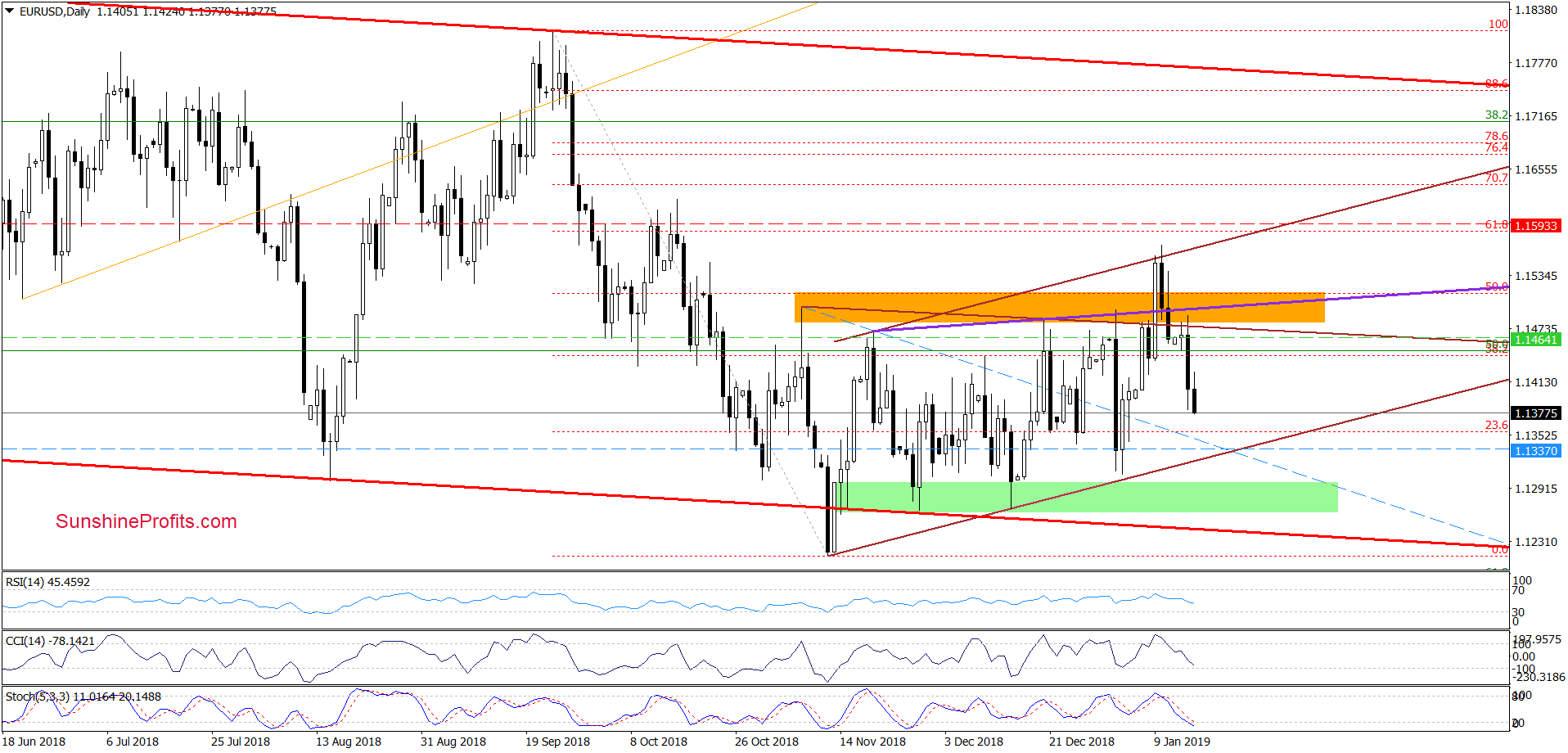

EUR/USD

Looking at the chart, we see that EUR/USD moved sharply lower during Tuesday’s session and slipped under 1.400. Although the pair rebounded slightly before yesterday’s candlestick closure, currency bears took the pair even lower earlier today.

Taking this fact into account and combining it with the sell signals generated by the indicators, we believe that we’ll see a realization of our Friday’s scenario in the very near future:

(…) currency bears could take the pair to around 1.1335 or even the lower border of the brown triangle in the following days (currently at 1.1316).

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.1593 and the initial downside target at 1.1337 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

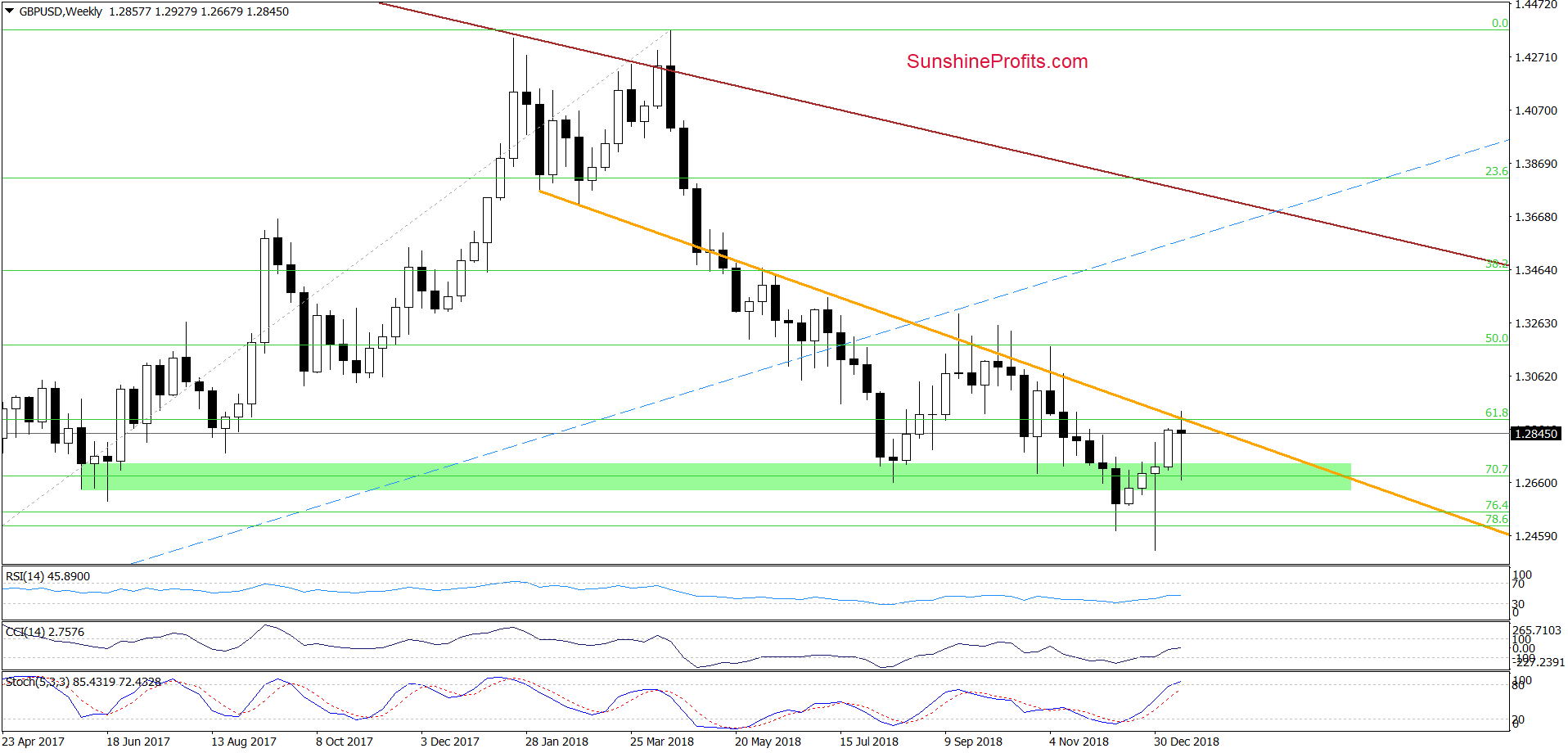

GBP/USD

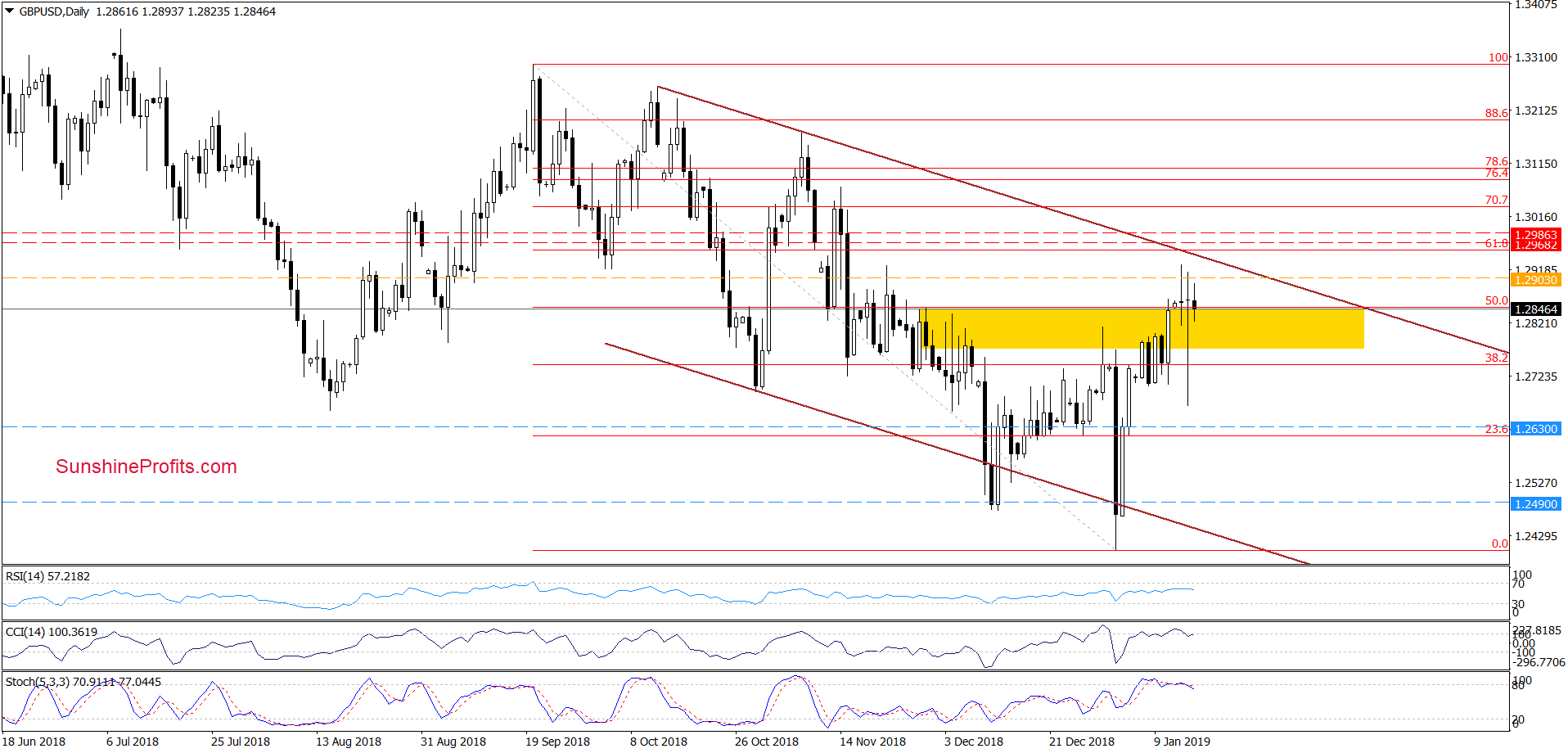

From the medium-term perspective, we see that although GBP/USD moved higher earlier this week, the major resistance line (marked with orange) stopped the buyers once again (we saw similar price actions many times in the previous months), triggering a pullback and a re-test of the green support area.

How did this drop affect the very short-term picture of the exchange rate?

On the daily chart, we see that yesterday’s unsuccessful attempt to move higher encouraged currency bears to act. As a result, the pair slipped under the previously-broken 50% Fibonacci retracement and the upper border of the yellow resistance zone, which triggered a sharp move to the downside and a test of the last week’s lows.

Despite this drop, currency bulls stopped the sellers and erased entire earlier decline (a positive development), creating a doji candlestick on the chart, which suggests that neither the bulls nor the bears show an advantage at the moment.

Nevertheless, in our opinion, it’s not true because yesterday's price action was exclusively dictated by emotions related to uncertainty around the Brexit negotiation. Therefore, all negative technical factors (an invalidation of a tiny breakout above the orange resistance zone marked on the weekly chart, two unsuccessful attempts to reach the upper border of the brown declining trend channel and the sell signal generated by the daily Stochastic Oscillator) remain in the cards also today, supporting lower values of GBP/USD in the coming days.

If this is the case and the pair moves lower once again, we’ll likely see not only a test of yesterday’s intraday low, but also a drop to (at least) our initial downside target or even to around 1.2514-1.2526, where the support area created by the 76.4% and the 78.6% Fibonacci retracements based on the entire recent upward move is.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.2968 and the initial downside target at 1.2630 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

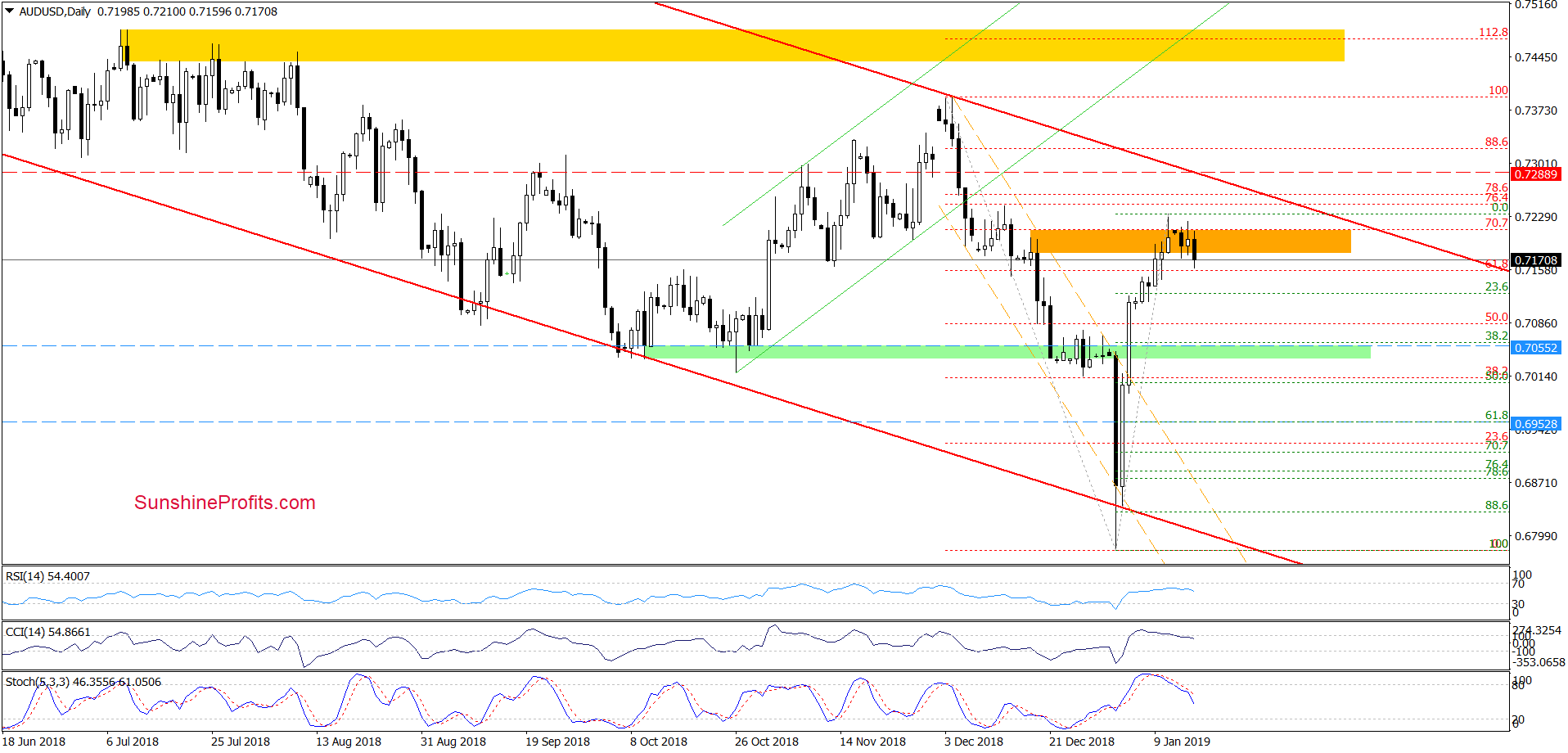

AUD/USD

From today’s point of view, we see that AUD/USD finally moved lower and slipped under the orange zone, which in combination with an additional sell signal generated by the Stochastic Oscillator means that our last commentary on this currency pair is up-to-date also today:

(…) we saw one more unsuccessful attempt to go higher, which together with the sell signal generated by the CCI suggests that lower values of AUD/USD are ahead of us. Therefore, if the pair extends losses from current levels, we’ll likely see (at least) a test of the previously-broken green support area.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 0.7288 and the initial downside target at 0.7055 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager