The bearish forces against the euro and the pound seem to have the upper hand. Quite a nice movement is also afoot in the Australian dollar. In short, this has been far from a slow week. Actually, it leads us to make an important trading decision right now. It never hurts to take profits off the table when the market is offering them with both hands, does it?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1398; the initial downside target at 1.1221)

- GBP/USD: short (a stop-loss order at 1.2824; the initial downside target at 1.2602)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7041; the exit downside target at 0.6887)

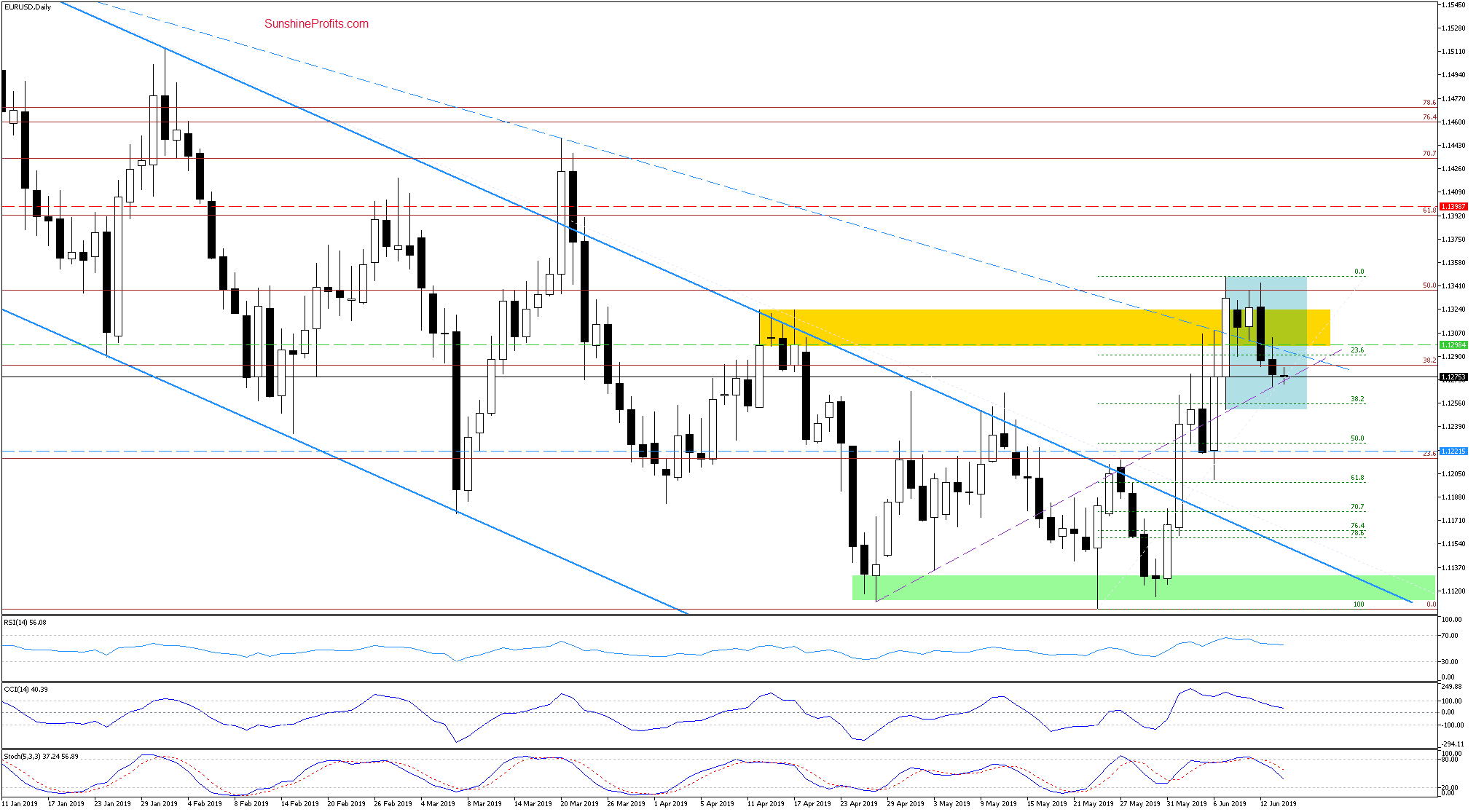

EUR/USD

The blue consolidation shows that EUR/USD hasn't been able to overcome the confines of last Friday's price action either on the upside, or on the downside. Any moves higher have been soundly rejected however, and the proximity to the upper border has kept bullish spirits at bay.

Earlier today, we're looking at another continuation of the downside move as the pair trades at around 1.1270 as we speak. Coupled with the sell signals of all daily indicators, the probability of a larger upcoming move to the downside remains high and the profitable short position is therefore justified.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1398 and the initial downside target at 1.1221 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

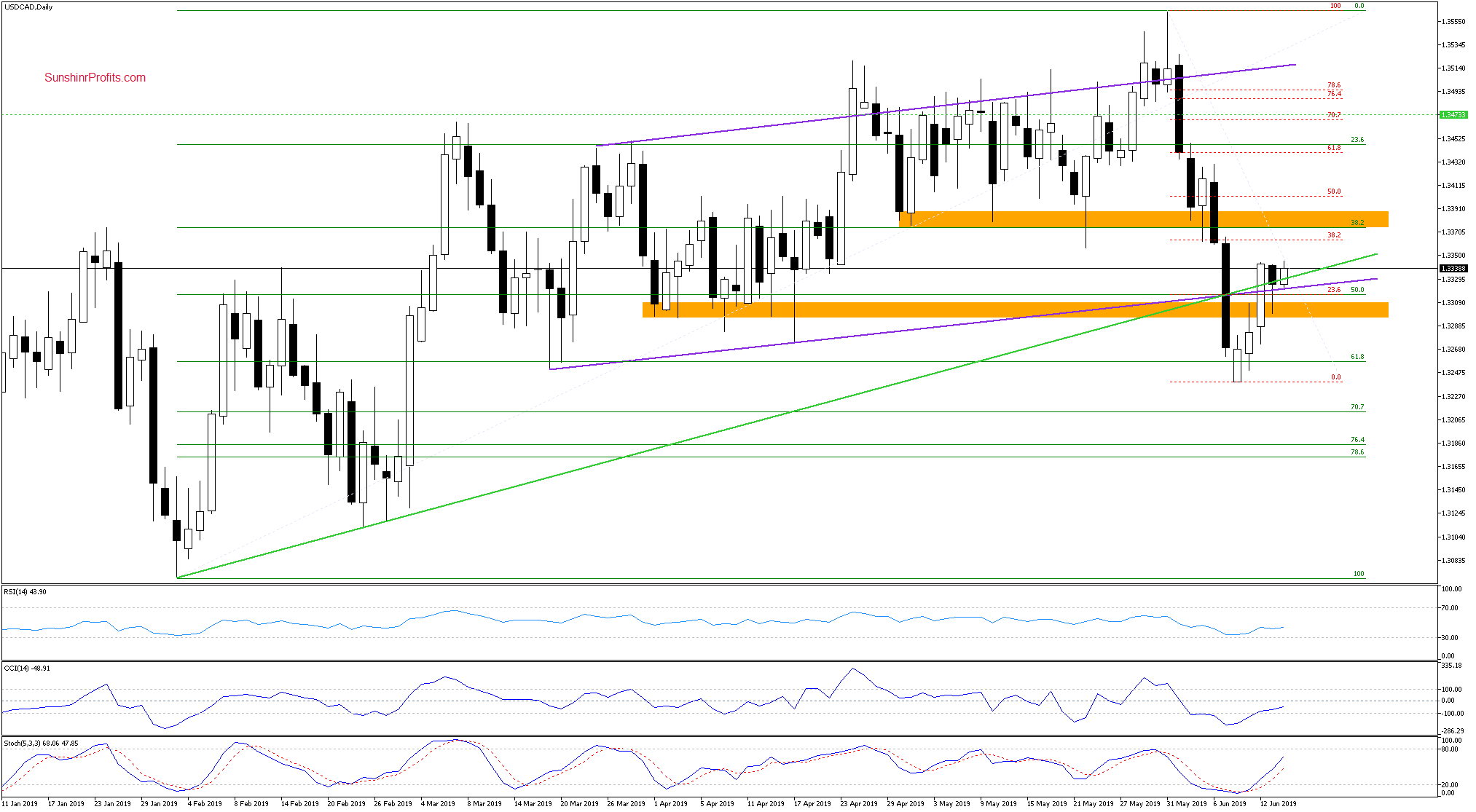

USD/CAD

USD/CAD rose sharply on Wednesday and overcame two important resistances: the lower border of the rising purple trend channel and the medium-term rising green support line based on the February lows.

This way, the earlier breakdown below these supports has been invalidated. Coupled with the buy signals of the daily indicators, the likelihood of one more upswing aiming to test the upper orange resistance zone has risen. Especially if the pair closes today's session above both the previously mentioned support lines.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

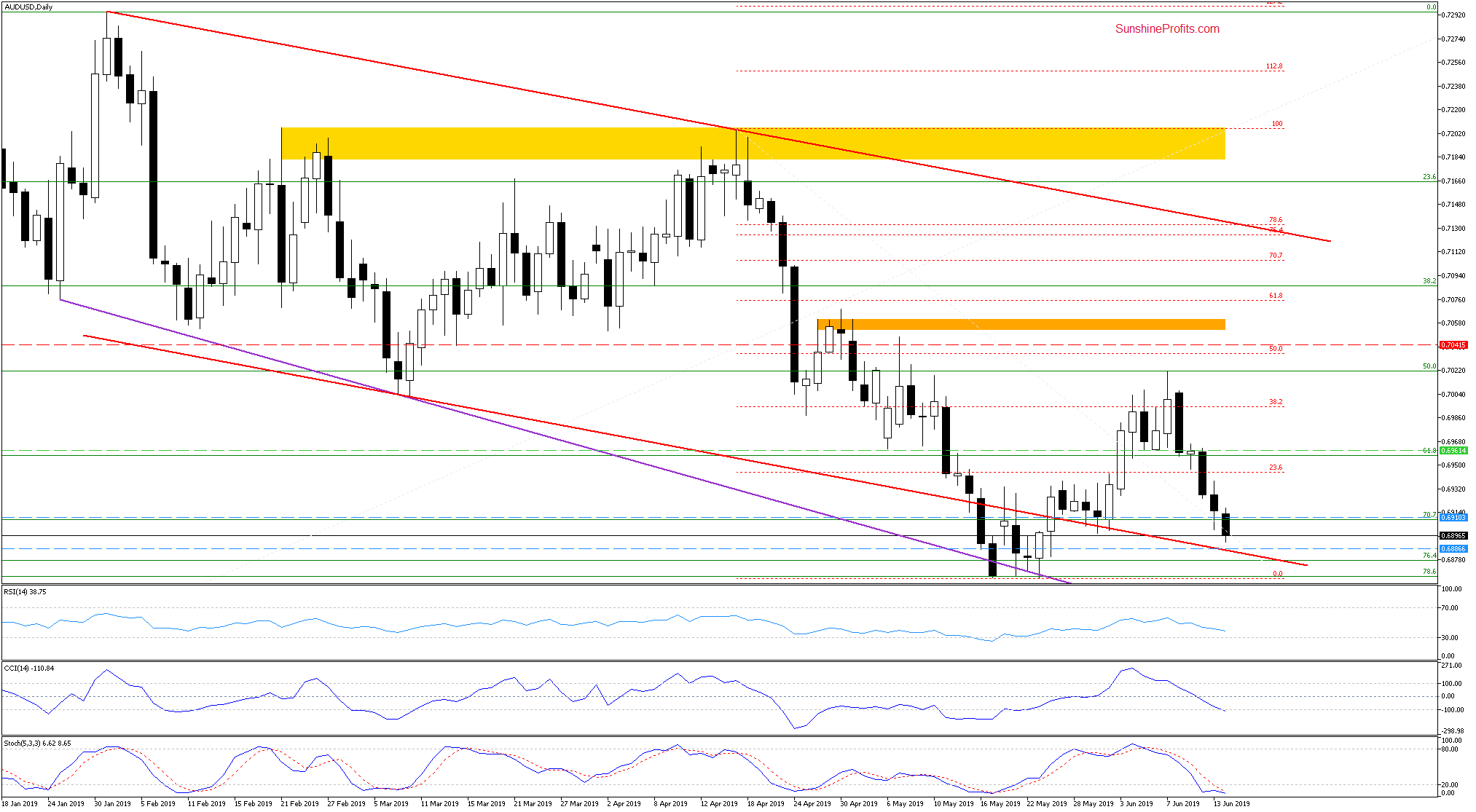

AUD/USD

AUD/USD has been on a losing streak for many recent sessions and our short position has been turning more and more profitable as a result. Today's drop has brought the pair to the vicinity of the lower border of the declining red trend channel and the support area created by previous lows.

This could encourage the bulls to act in the coming week. The CCI and Stochastic Oscillator are at their oversold levels, hinting at the probability of reversal in the following days.

To preempt that possibility, we judge it prudent to close our short positions and take profits off the table should AUD/USD hit our next downside target (full details below) that is slightly above the lower line of the trend channel.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.7041 and the exit downside target at 0.6887 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD continues with its downswing. GBP/USD has finally rolled over and the bears appear fit to push the pair even lower. AUD/USD keeps experiencing lower and lower values, yet the proximity of nearest supports and the oversold position of the CCI and Stochastic Oscillators warrant caution and taking profits off the table once our downside target is reached. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist