On Wednesday, currency bulls closed their ranks and headed north. Despite the positive closure and support from the signals generated by the daily indicators, the buyers didn’t manage to continue yesterday’s rebound earlier today. What does it mean for EUR/USD?

- EUR/USD: half of the recent short positions (a stop-loss order at 1.1417; the next downside target at 1.1298)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7180; the initial downside target at 0.7064)

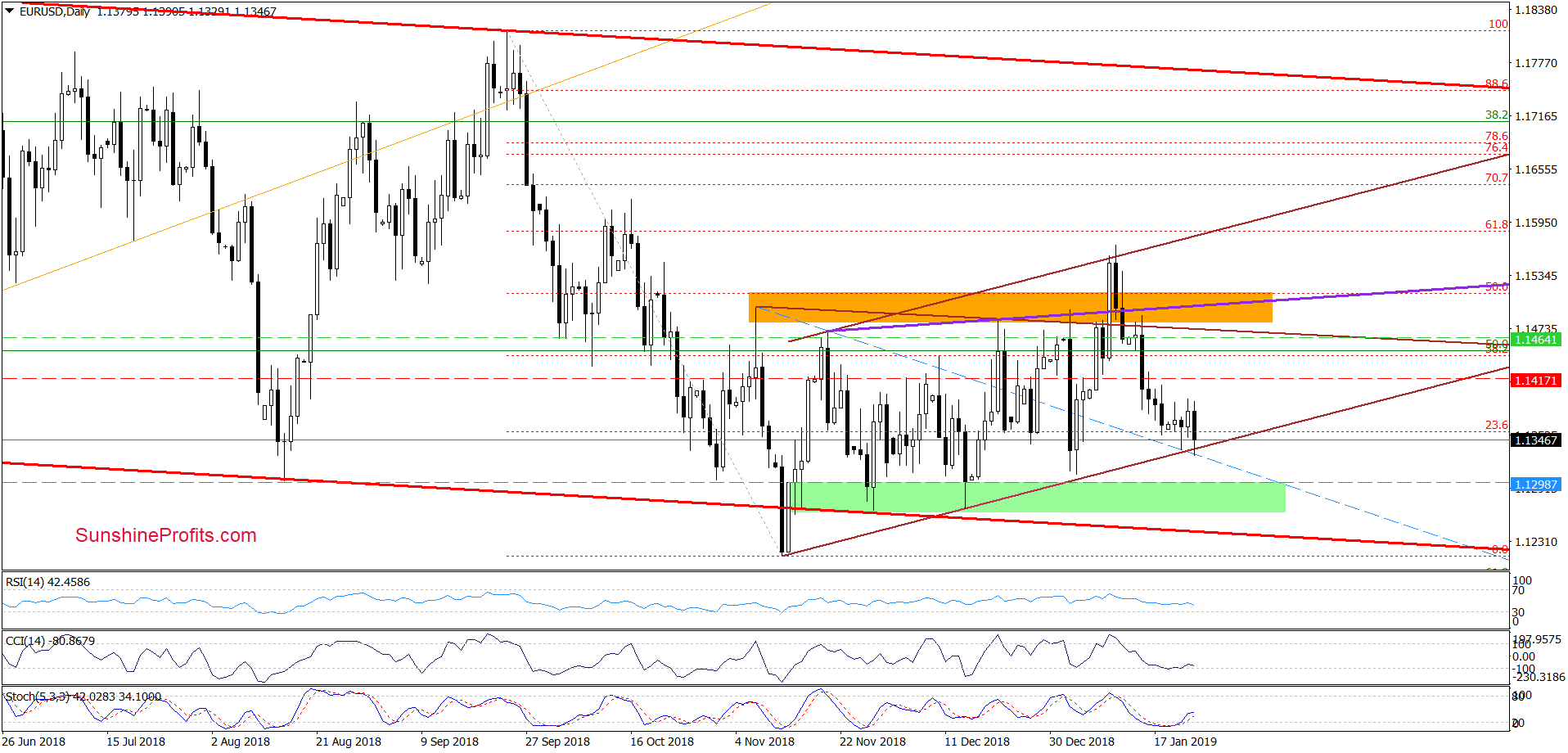

EUR/USD

On the daily chart, we see that although currency bulls pushed EUR/USD higher during Wednesday’s session, this improvement was very temporary, and the sellers returned to the trading floor earlier today.

Thanks to their attack, the pair erased entire yesterday’s upswing and hit a fresh January low, slipping a bit below the lower border of the brown rising trend channel. As you see this support line triggered a small rebound in the following hours, but in our opinion, as long as there is no breakout above the January 18 peak (it created the upper border of the consolidation that lasted for several next days) another attempts to move lower is likely and (profitable) short positions continue to be justified from the risk/reward perspective.

Trading position (short-term; our opinion): Half of recent profitable short positions with a stop-loss order at 1.1417 and the next downside target at 1.1298 are justified from the risk/reward perspective.

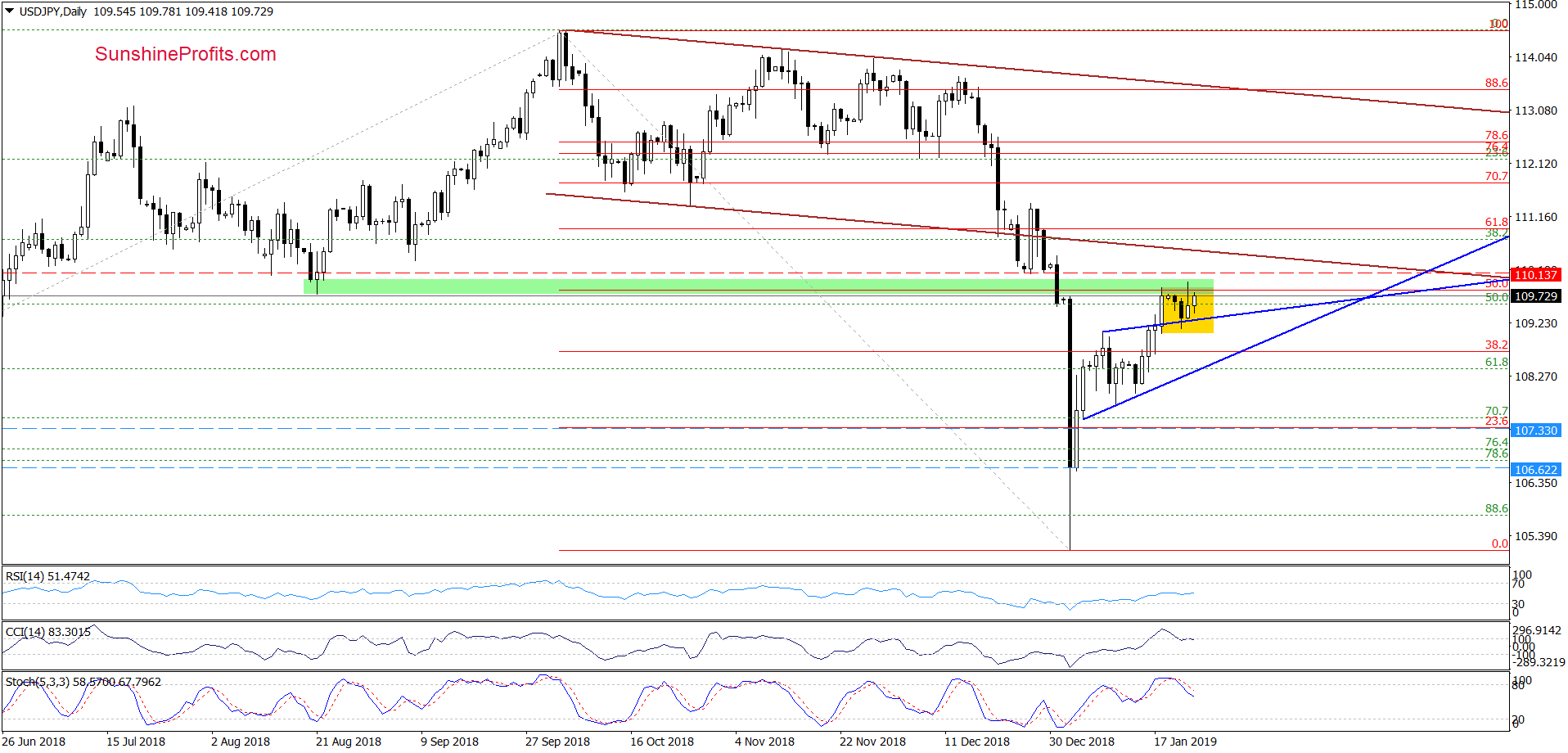

USD/JPY

From today’s point of view, we see that the buyers tried to take USD/JPY higher during yesterday’s session, but their efforts failed, and currency pair ended the day both below the green resistance zone and the 50% Fibonacci retracement.

Thanks to yesterday's price action the exchange rate also invalidated the earlier tiny breakout above the upper border of the yellow consolidation, which in combination with the above-mentioned factors and sell signals generated by the indicators increases the probability of reversal in the coming days.

Connecting the dots, we believe that our last commentary on this currency pair is up-to-date also today:

(…) the exchange rate is still trading inside the yellow consolidation, which has formed around the upper border of the blue triangle.

Additionally, the pair is still trading above this support line, which means that as long as there is no breakdown below it all downswings could be nothing more than a verification of the last week’s breakout.

Nevertheless, taking into account the proximity to the above-mentioned resistances (that stopped the buyers in the previous week) and the current position of the daily indicators (…), we think that another move to the downside is just around the corner.

Therefore, if we see an invalidation of the breakout above the blue triangle and a drop below the lower border of the yellow consolidation, we’ll likely open short positions, because USD/JPY would likely test at least the lower border of the triangle. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

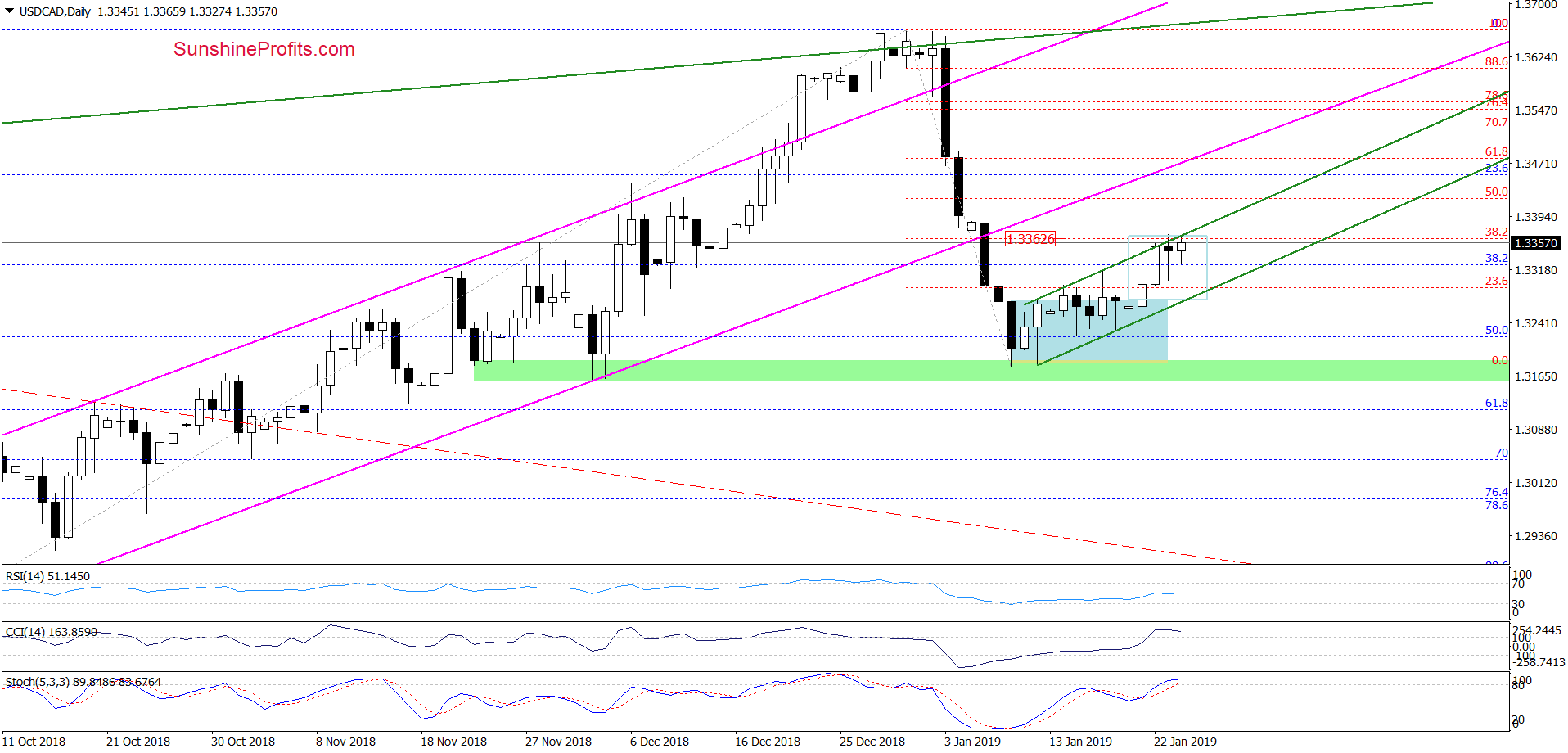

USD/CAD

In our Forex Trading Alert posted on January 17, 2019, we wrote the following:

(…) What could happen if the bulls win (…)? In our opinion, the likelihood of an upward move to around 1.3362 (where the size of the correction will be equal to the height of the blue consolidation (around the 38.2% Fibonacci retracement based on the entire recent decline)) will increase.

Looking at the daily chart, we see that the situation developed in tune with the above scenario and USD/CAD reached our upside targets on Wednesday. Despite this improvement, the combination of the 38.2% Fibonacci retracement and the upper border of the green rising trend channel stopped the buyers, triggering a pullback.

Earlier today, currency bulls pushed the exchange rate to the north, which caused a re-test of yesterday’s resistances. Although this is a positive sign and there are no sell signals, we think that as long as there is no daily closure above the above-mentioned levels higher values of USD/CAD are questionable.

Nevertheless, if we see a confirmed breakout, the way to the next retracement or even the previously-broken lower border of the pink rising trend channel will be open. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager