Earlier today, the euro extended losses against the greenback as yesterday’s comments by Federal Reserve Chair Janet Yellen suggesting a near-term rate hike supported the U.S. currency. How low could EUR/USD go in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.0957; the initial downside target at 1.0538)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: long (a stop-loss order at 1.2949; the initial upside target at 1.3302)

- USD/CHF: long (a stop-loss order at 0.9879; the next upside target at 1.0100)

- AUD/USD: short (a stop-loss order at 0.7723; the initial downside target at 0.7520)

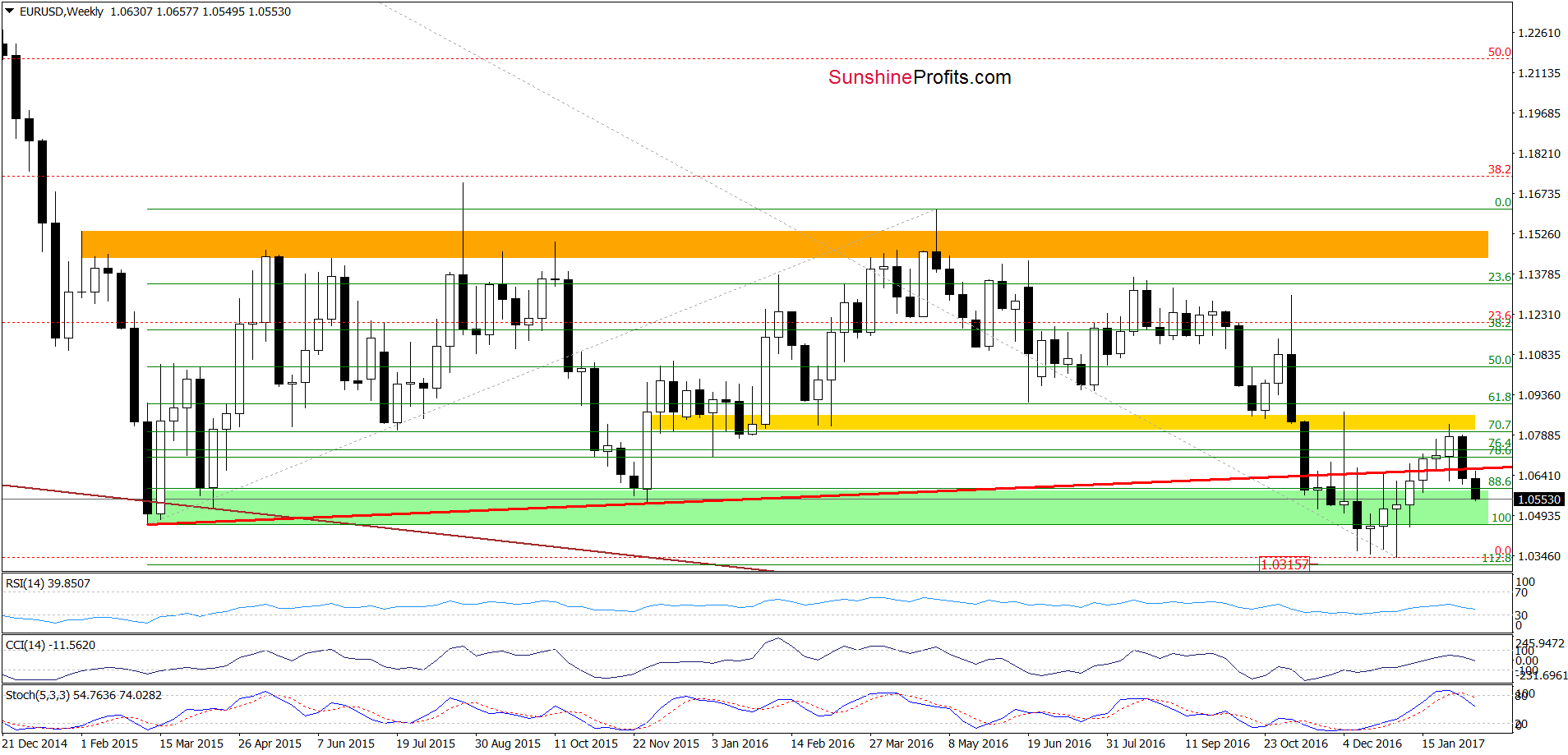

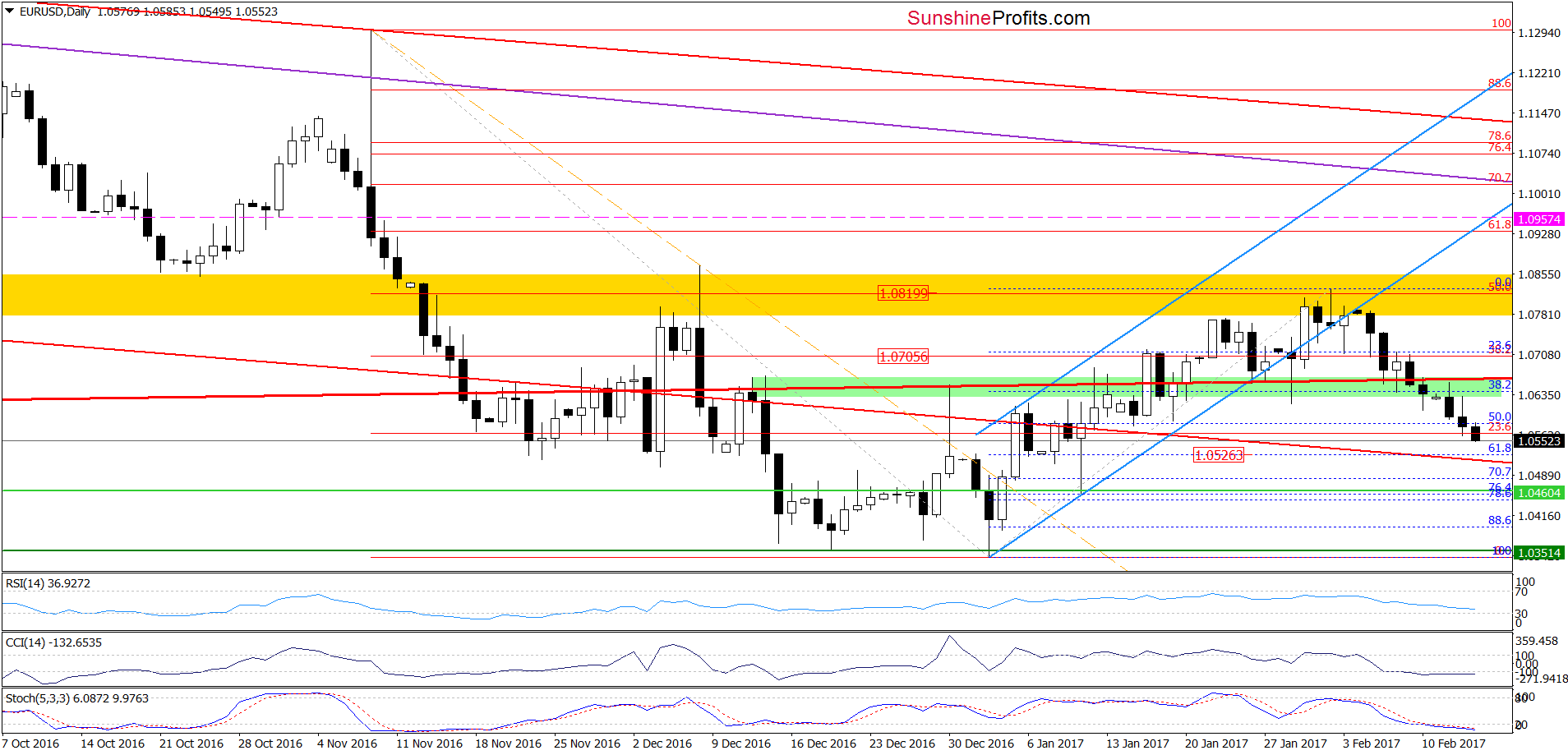

EUR/USD

Quoting our previous commentary:

(…) the proximity to the January 19 low and the 50% Fibonacci retracement (based on the January-February upward move) triggered a rebound earlier today, but despite this increase the exchange rate is still trading below the long-term red support line and the green zone, which serves now as a resistance. This looks like another verification of the breakdown and suggests lower values of EUR/USD in the coming days.

Looking at the charts, we see that the situation developed in line with the above scenario and EUR/USD moved lower, closing yesterday’ session under the January 19 low and the 50% Fibonacci retracement. This negative event triggered further deterioration earlier today, which means that our next downside target from yesterday’s alert will be in play in very near future:

(…) If (…) the pair drops under yesterday’s lows, the next target for currency bears will be the 61.8% Fibonacci retracement based on the January-February upward move around1.0526.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short (already profitable positions with a stop-loss order at 1.0957 and the initial downside target at 1.0538) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

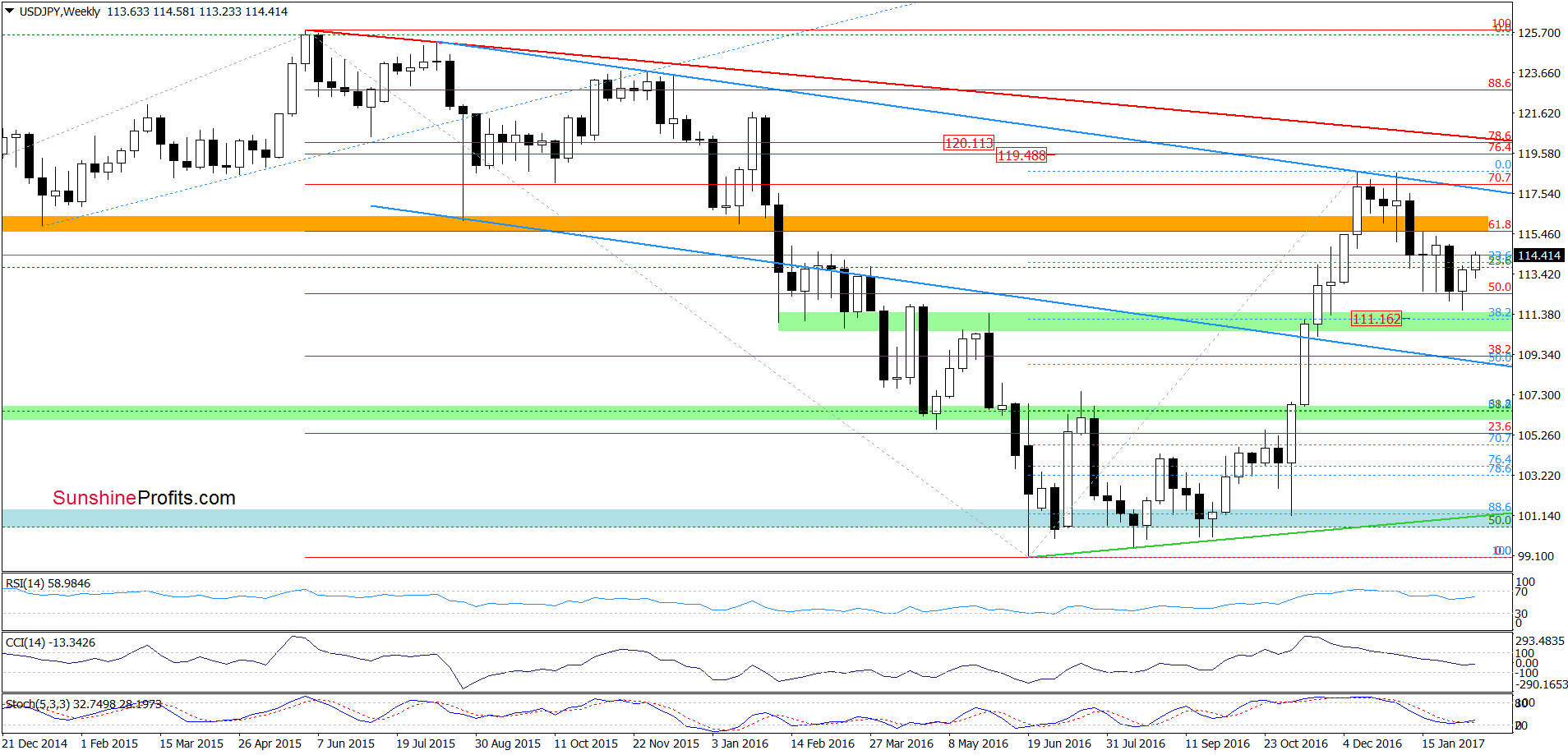

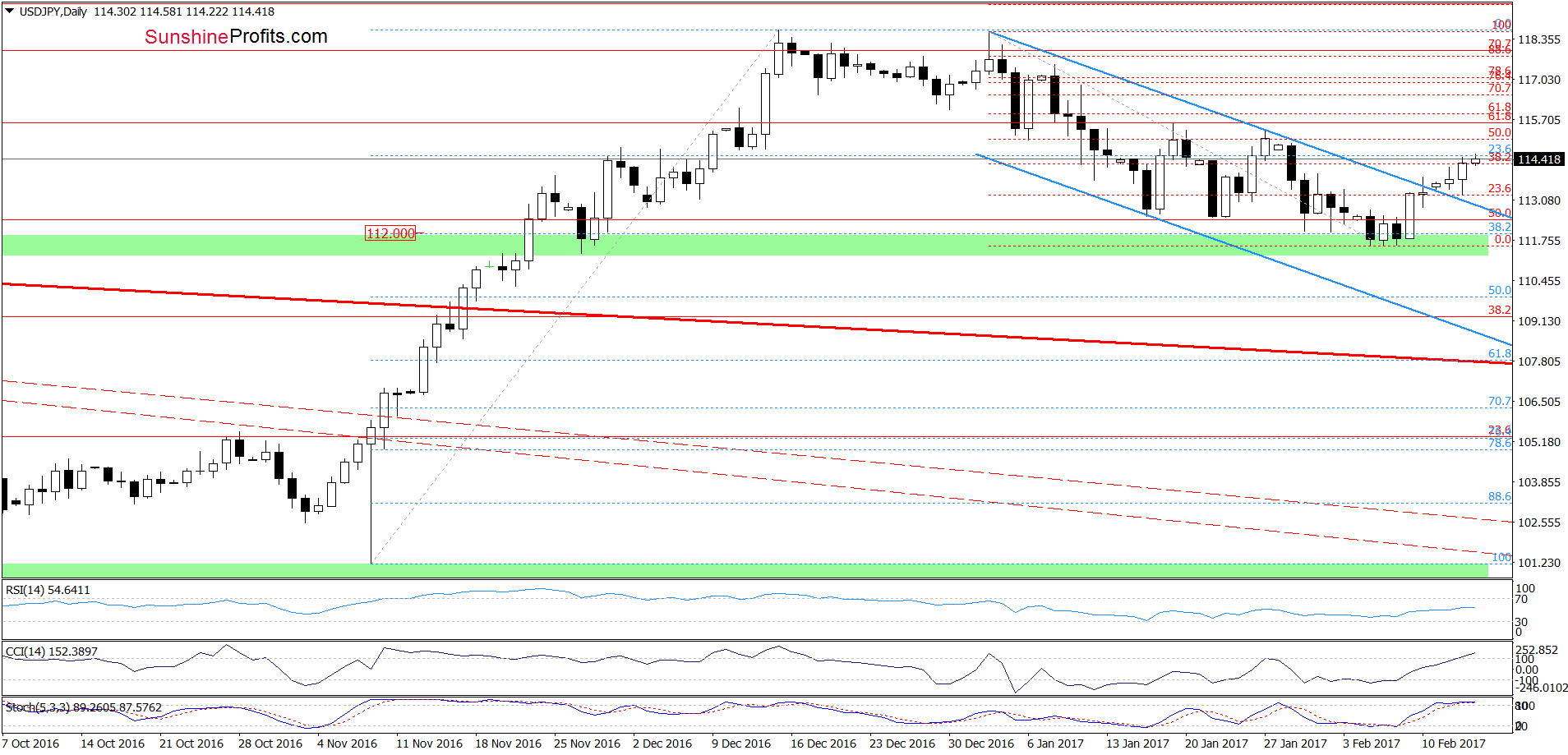

USD/JPY

On the daily chart, we see that USD/JPY moved a bit lower and verified the earlier breakout above the upper border of the blue declining trend channel. Additionally, the exchange rate closed yesterday’ session above the blue line, which suggests further improvement and an increase to at least 115.36-115.60, where the January 19 and 27 highs are.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

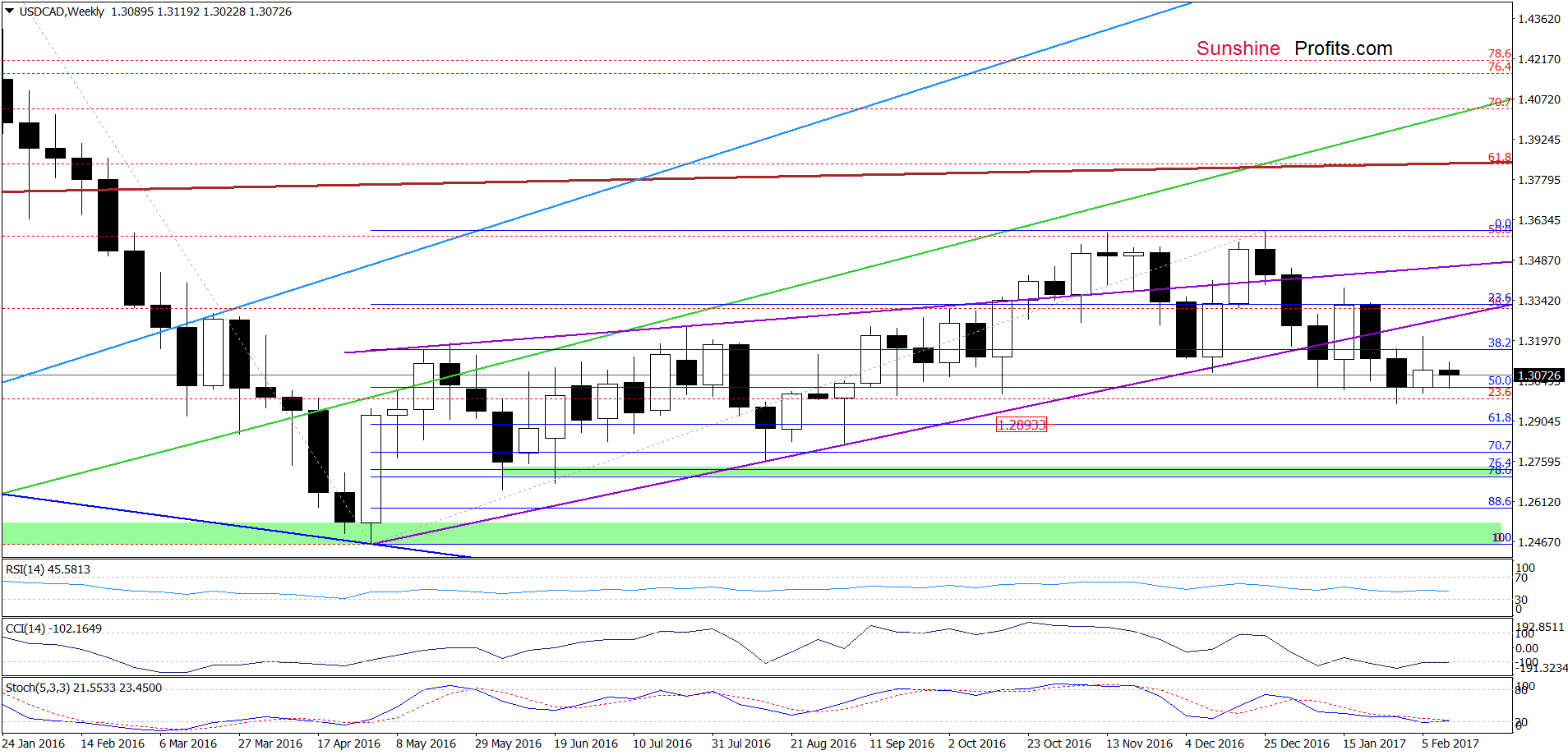

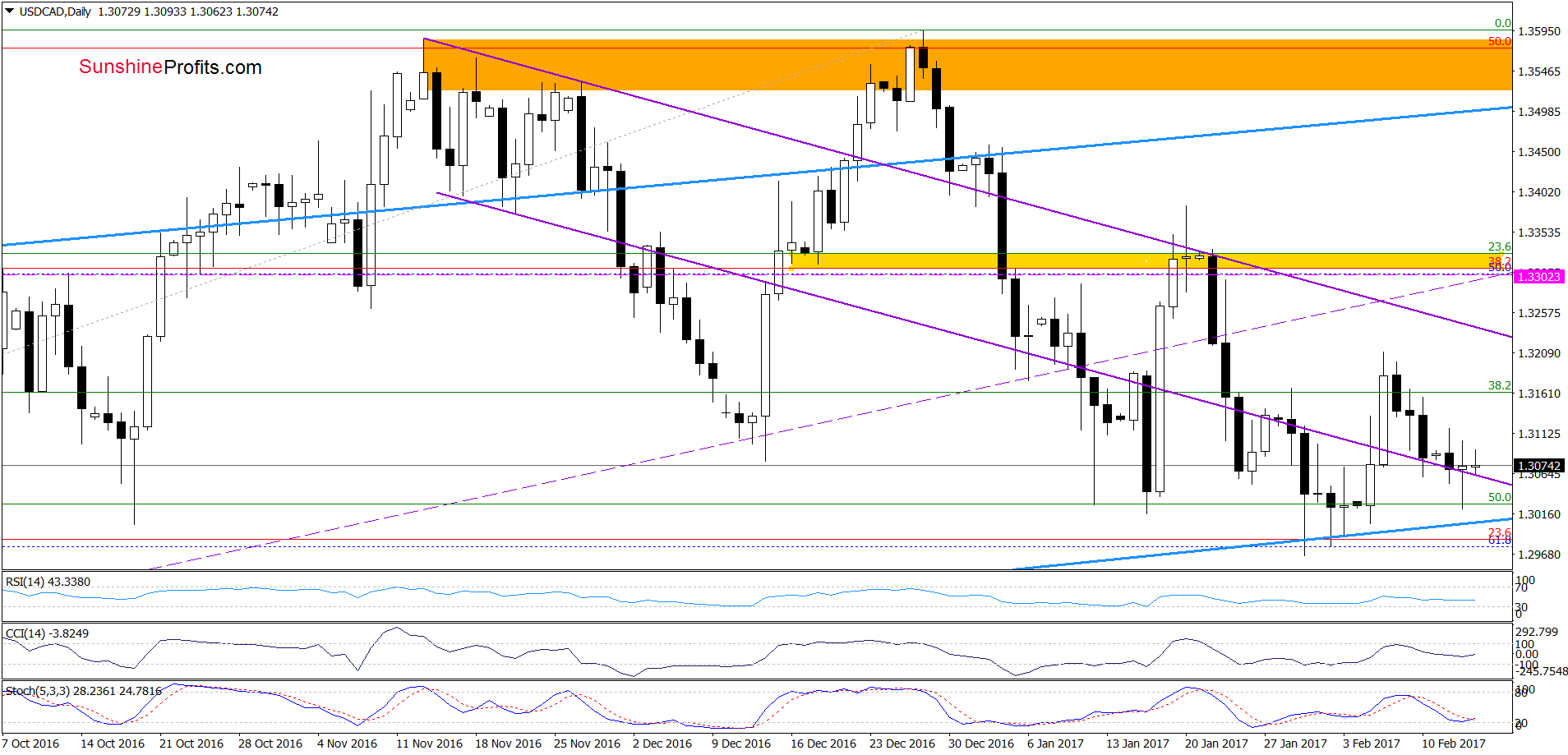

USD/CAD

From today’s point of view, we see that although USD/CAD moved lower and slipped under the previously-broken lower border of the purple declining trend channel, currency bulls didn’t give up and pushed the exchange rate higher. As a result, the pair rebounded and invalidated the earlier breakdown, which suggests further improvement in the coming days. If this is the case, the exchange rate will likely test not only the last week’s high, but also the upper border of the purple trend channel or even the yellow resistance zone and the January 20 high of 1.3385.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 1.2949 and the initial upside target at 1.3302) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts