Earlier today, the U.S. Department of Labor showed that non-farm payrolls increased by only 156,000 jobs in December. However, government payrolls rose by 12,000 last month, beating expectations. In this environment, the USD Index came back above the level of 102. What impact did this increase have on the euro and the Australian dollar?

In our opinion the following forex trading positions are justified - summary:

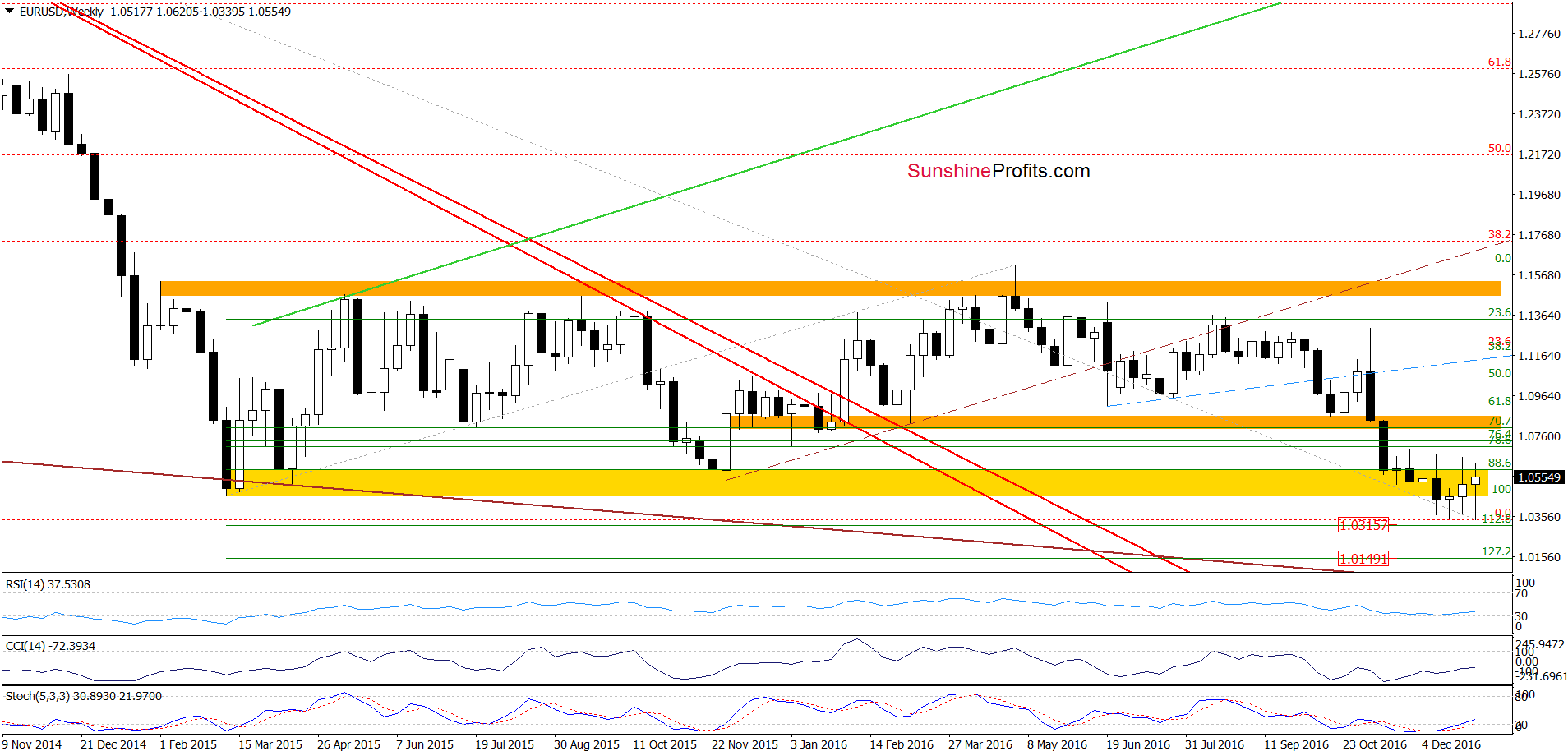

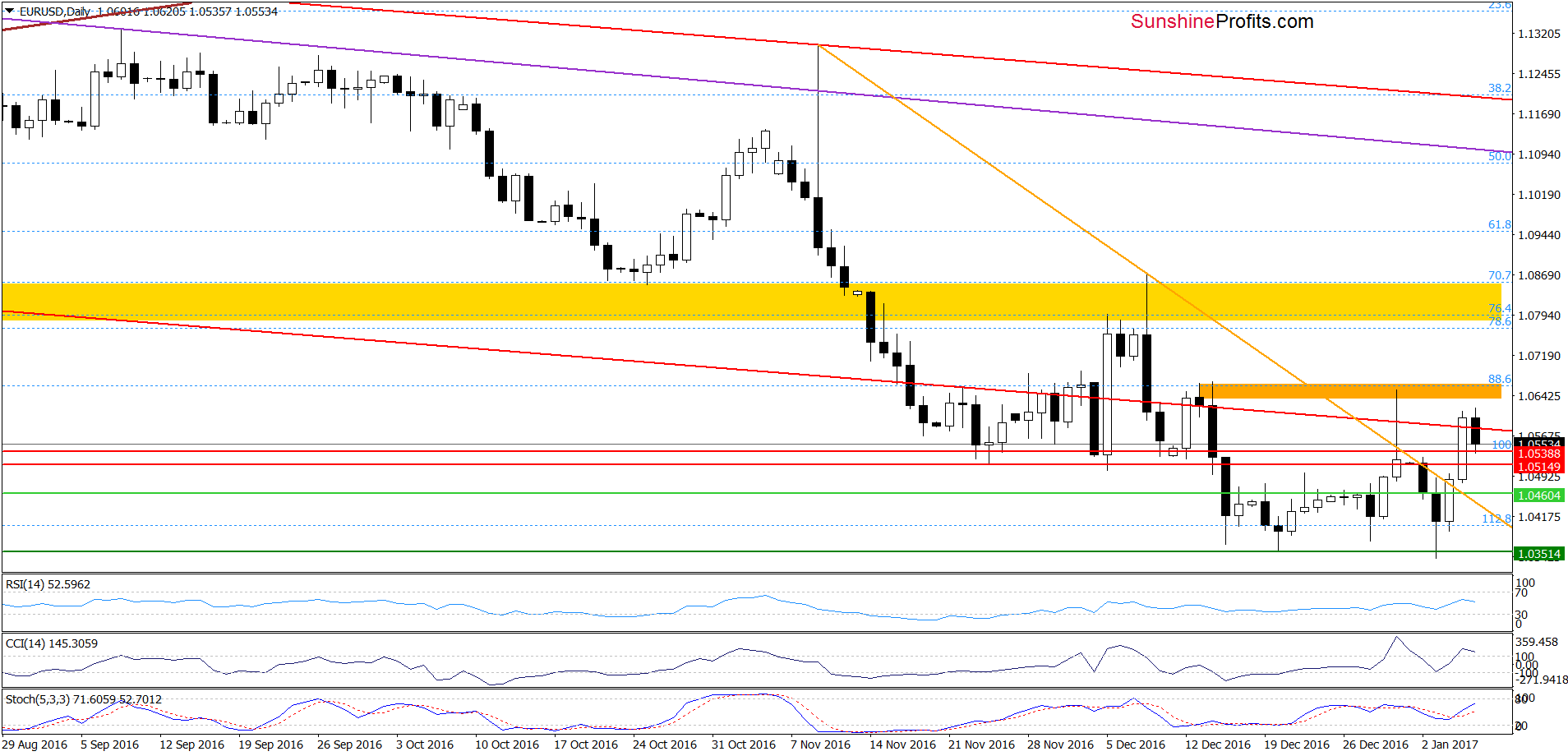

EUR/USD

Yesterday, EUR/USD broke above the lower border of the red declining trend channel (marked on the daily chart), invalidating an earlier breakdown. Although this positive event triggered a further improvement earlier today, the proximity to the orange resistance zone and the December highs encouraged currency bears to act, which resulted in a pullback. Thanks to this drop, the pair invalidated yesterday’s breakout, which is a negative event and suggests a test of the previously-broken orange declining line, which serves as the nearest important support at the moment.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

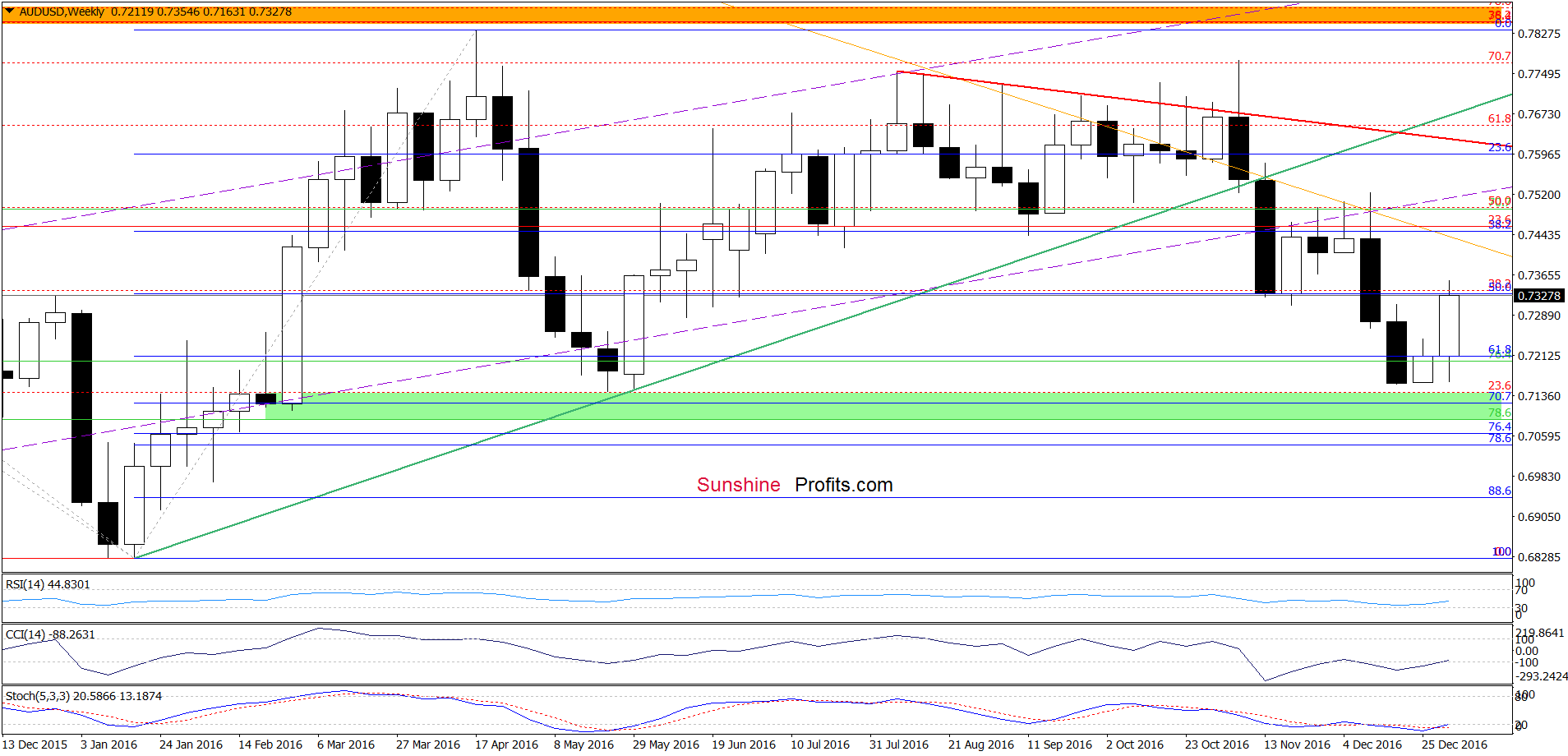

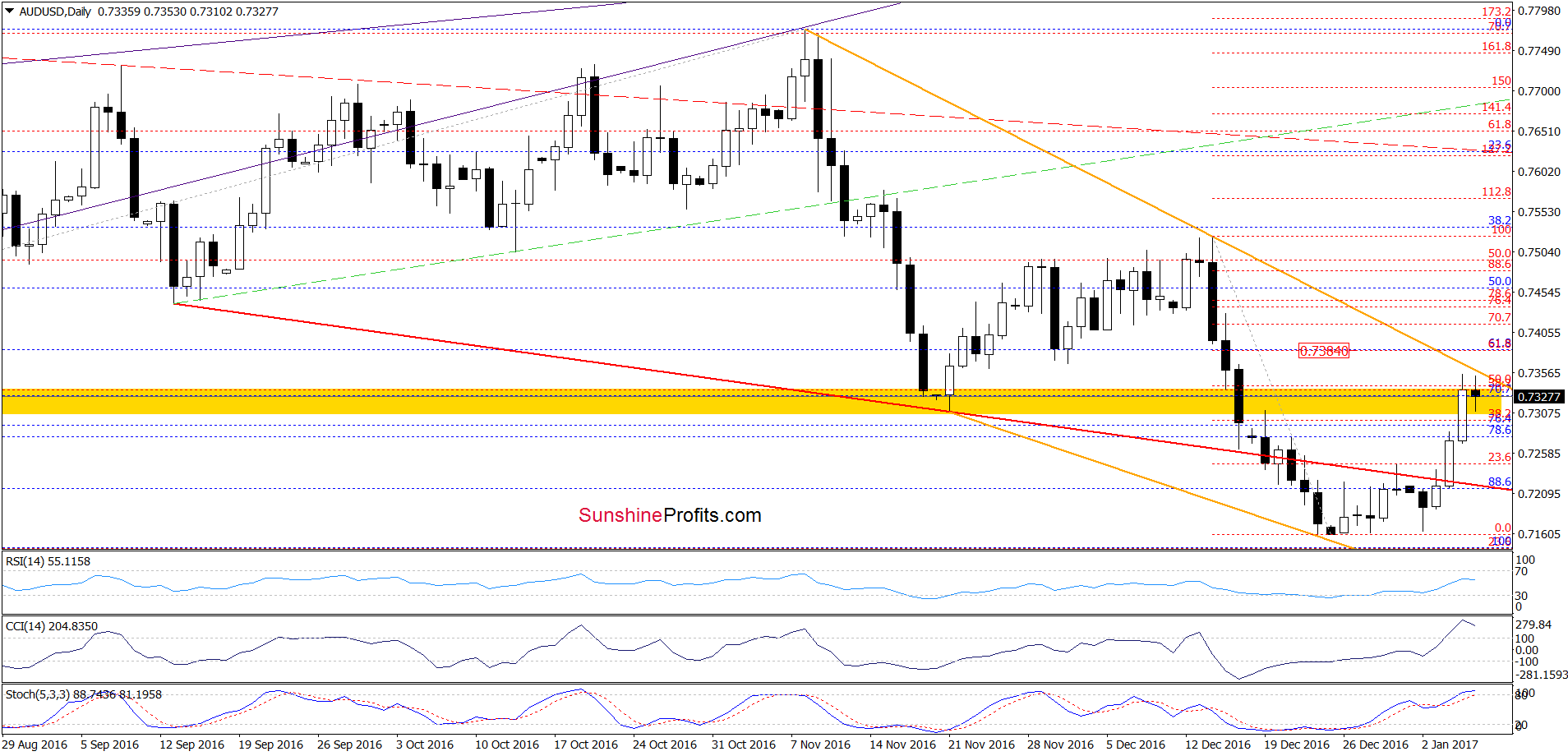

AUD/USD

On Wednesday, we wrote the following:

(…) AUD/USD climbed above the red resistance line (based on the mid-September and November lows) and the 23.6% Fibonacci retracement (based on the mid-late December downward move), which is a positive signal and suggests further improvement. Additionally, buy signals generated by the indicators remain in place, supporting currency bulls. How high could the exchange rate go? In our opinion, the initial upside target would be the yellow resistance zone and the 50% retracement (around 0.7309-07342).

From today’s point of view, we see that the situation developed in tune with the above scenario and AUD/USD reached our initial upside target yesterday. With this upswing the pair also climbed to the orange declining resistance line based on the November and December highs, which together with the yellow resistance zone could trigger a reversal and a decline in the coming week. However, this scenario would be more likely if the CCI and Stochastic Oscillator generated sell signals. In this case, currency bears could push AUD/USD even to the previously-broken red support line based on the September and November lows (currently around 0.7219).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts