Earlier today, GBP/USD moved lower and approached the last week’s low as worries over next year's Brexit negotiations continued to weigh on the exchange rate. How low could the pair go in the coming days?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

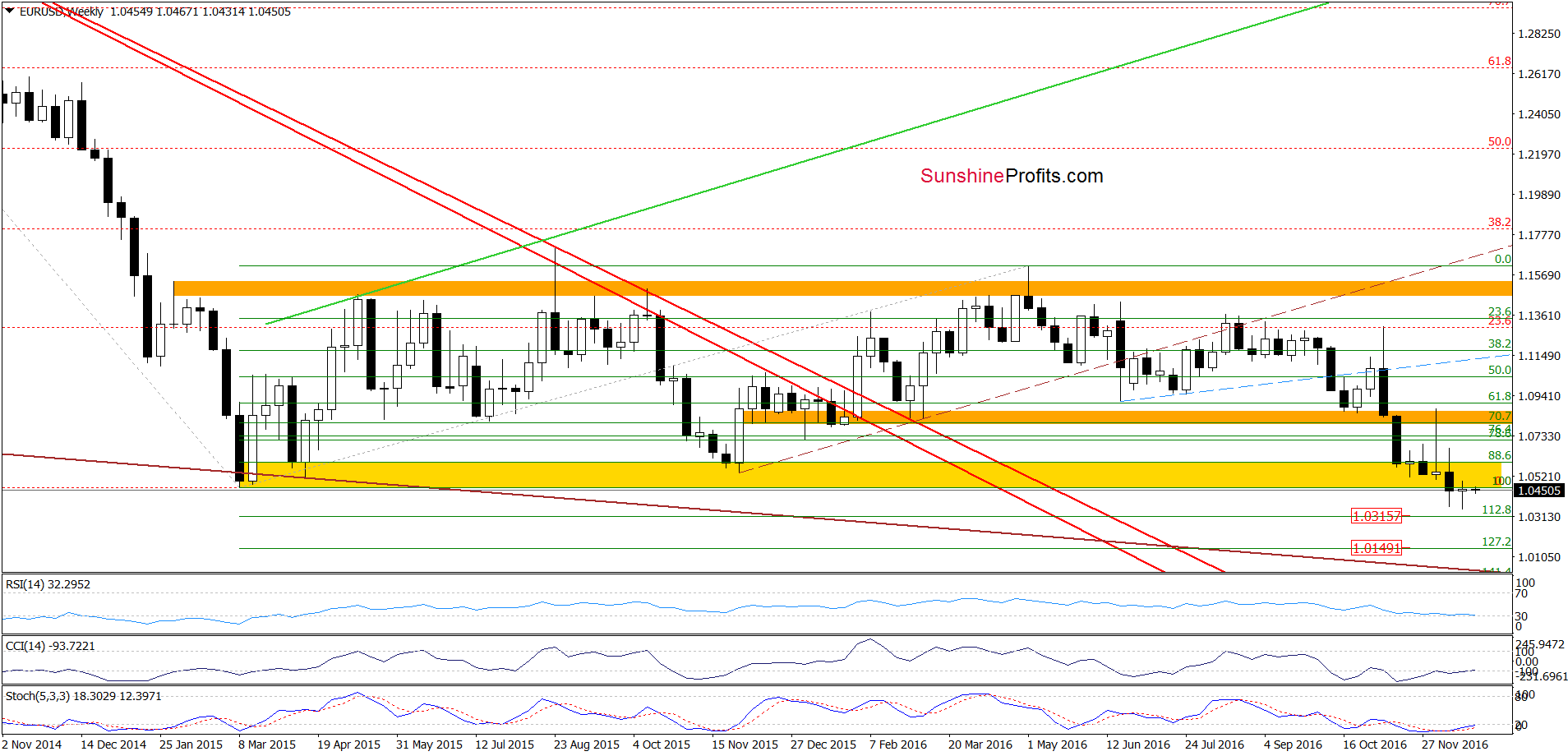

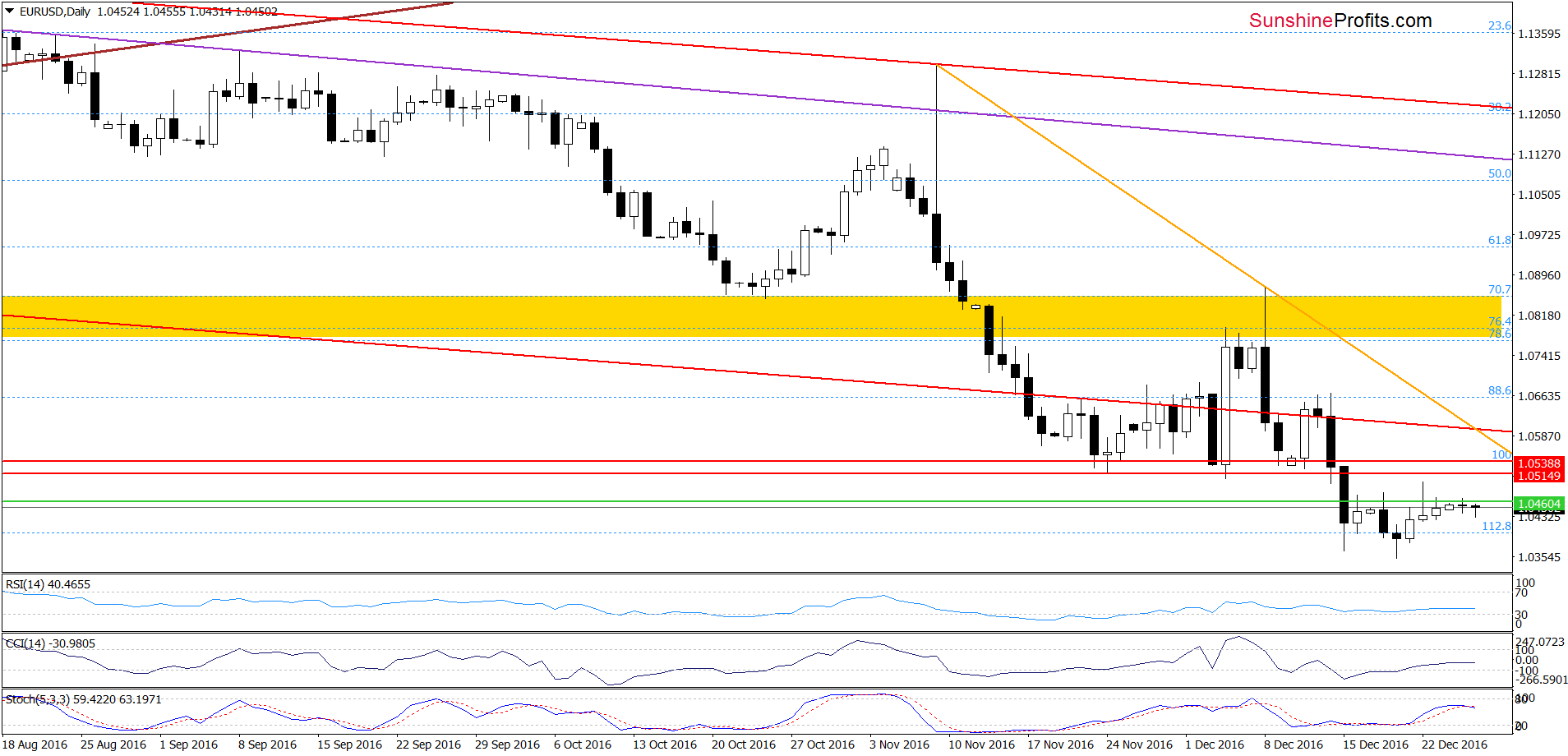

On the above charts, we that the overall situation hasn’t changed much as EUR/USD is still trading in a consolidation under the last weeks high, which means that what we wrote on Thursday is up-to-date also today:

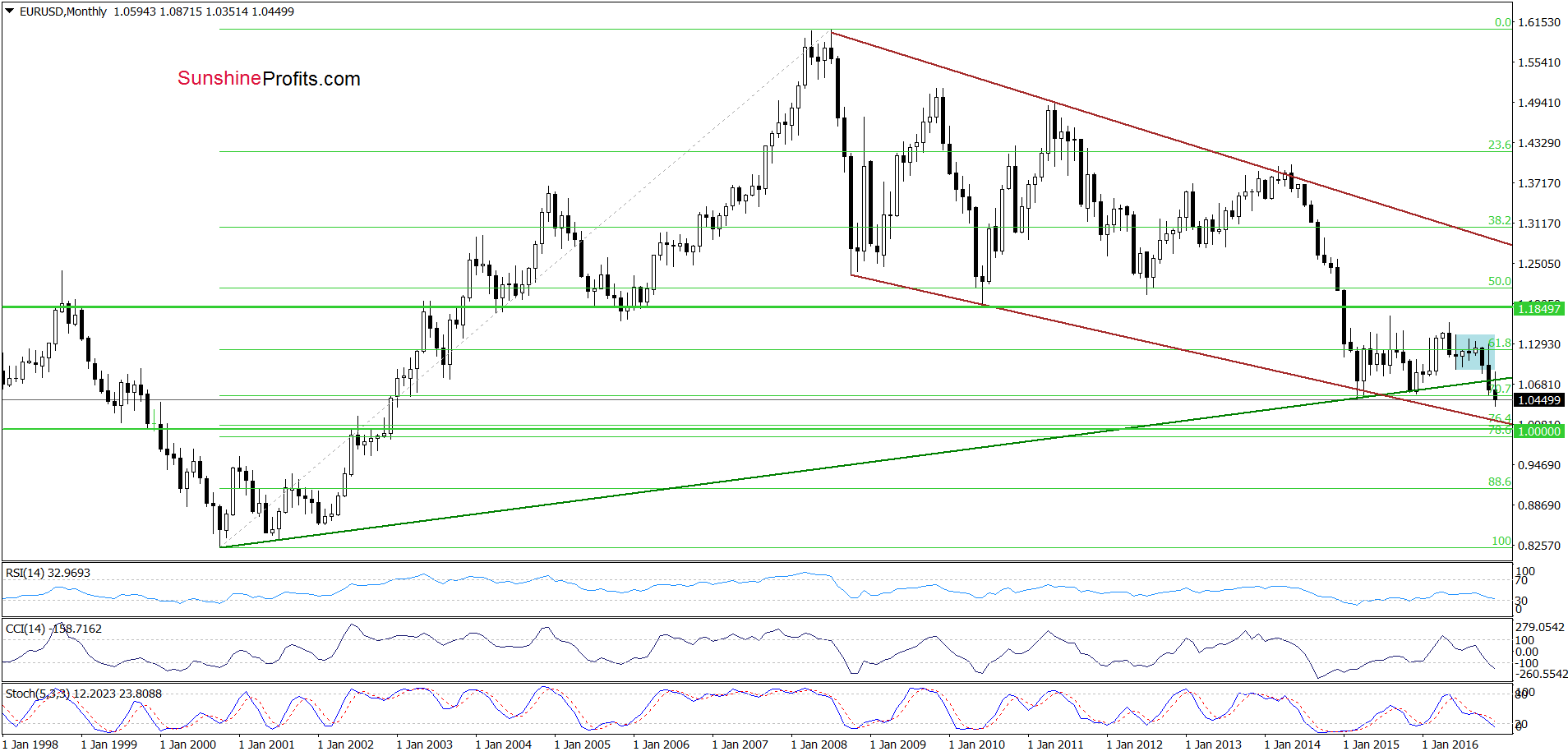

(…) in our opinion, as long as there won’t be an invalidation of the breakdown under the green support zone marked on the weekly chart (created by the Apr and Nov 2015 lows) another bigger move to the upside is not likely to be seen and another attempt to move lower can’t be ruled out.

If we see a decline, downside targets from our previous alert would be in play:

(…) a verification of a breakdown under the previously-broken Nov and early-Dec lows (…) suggests further deterioration to the 112.8%, 127.2% Fibonacci extension (both marked on the weekly chart) or even a test of the lower border of the long-term brown declining trend channel and the barrier of 1.0000 seen on the long-term chart below.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

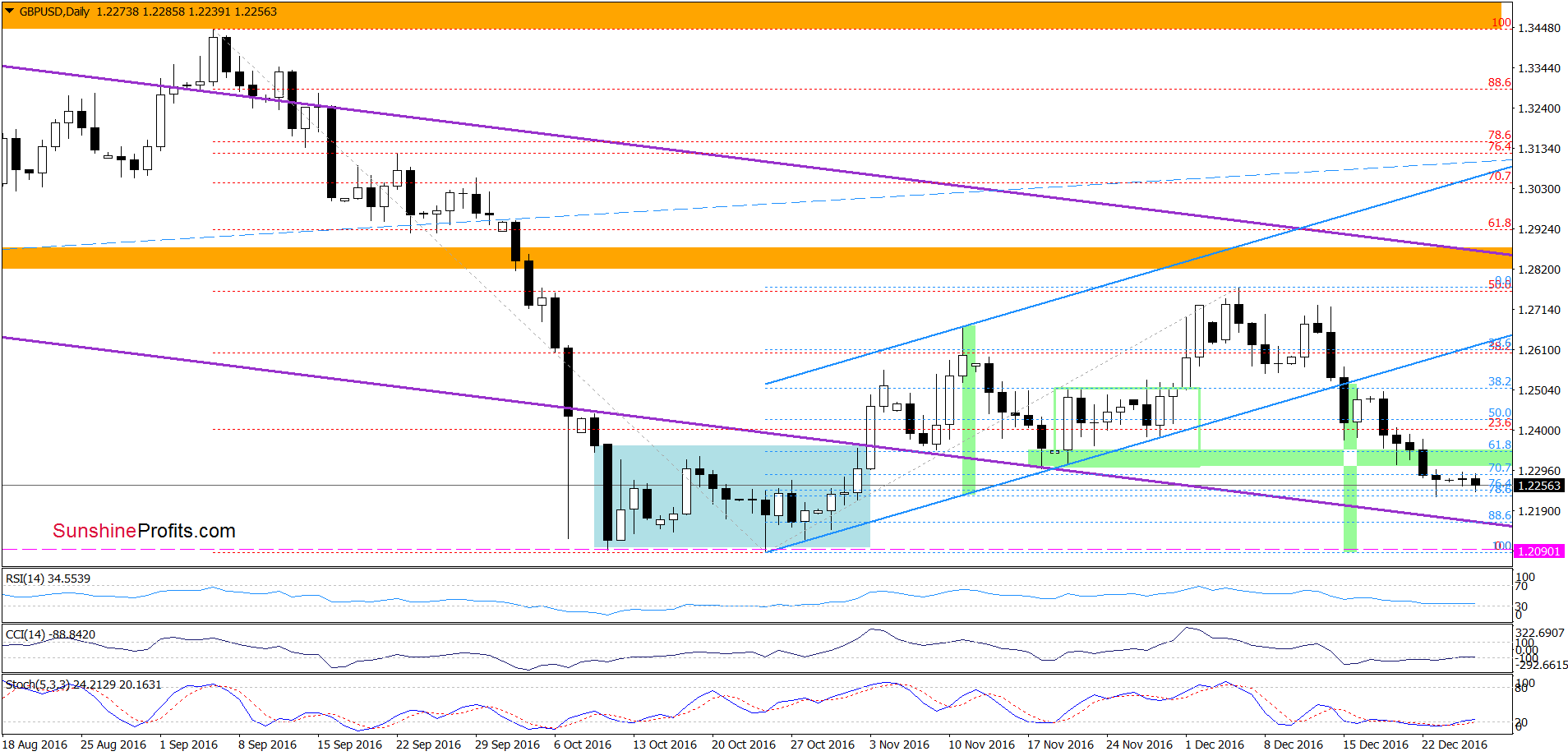

GBP/USD

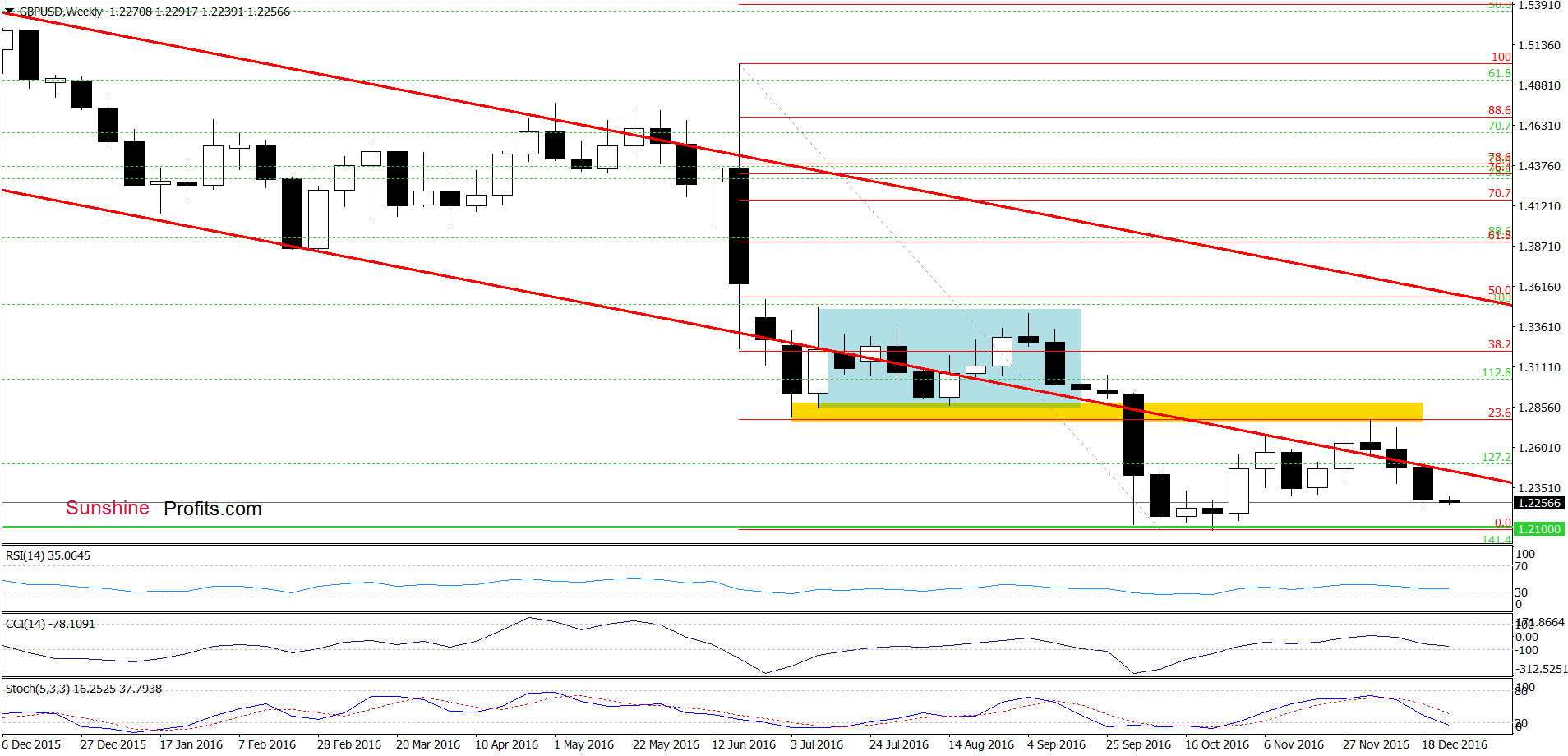

Form today’s point of view, we see GBP/USD broke below the green support zone, which means that our previous commentary on this currency pair is still valid:

(…) GBP/USD moved lower and invalidated earlier breakout above the lower border of the red declining trend channel – similarly to what we saw at the beginning of Oct. Such price action doesn’t bode well for currency bulls and suggests further deterioration. This scenario is also reinforced by a sell signal generated by the Stochastic Oscillator.

How low could the exchange rate go?

(…) we should keep in mind that the last week’s decline pushed the pair below the lower border of the blue rising trend channel, which is a negative signal that suggests a drop to around 1.2090, where the size of the move would correspond to the height of the channel. In this area is also the Oct low and the barrier of 1.2000, which together could stop further deterioration once again.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: ixed with bearish bias

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

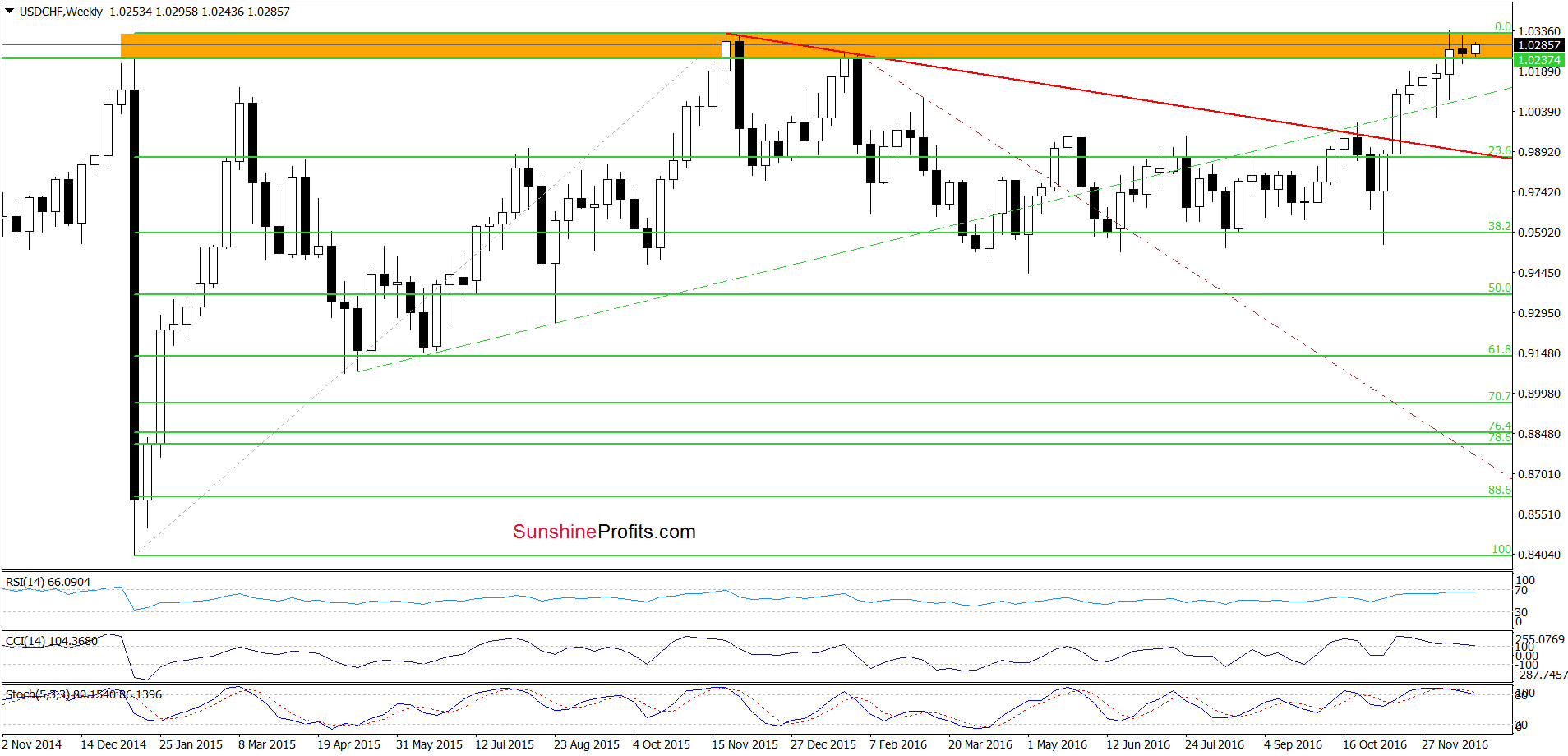

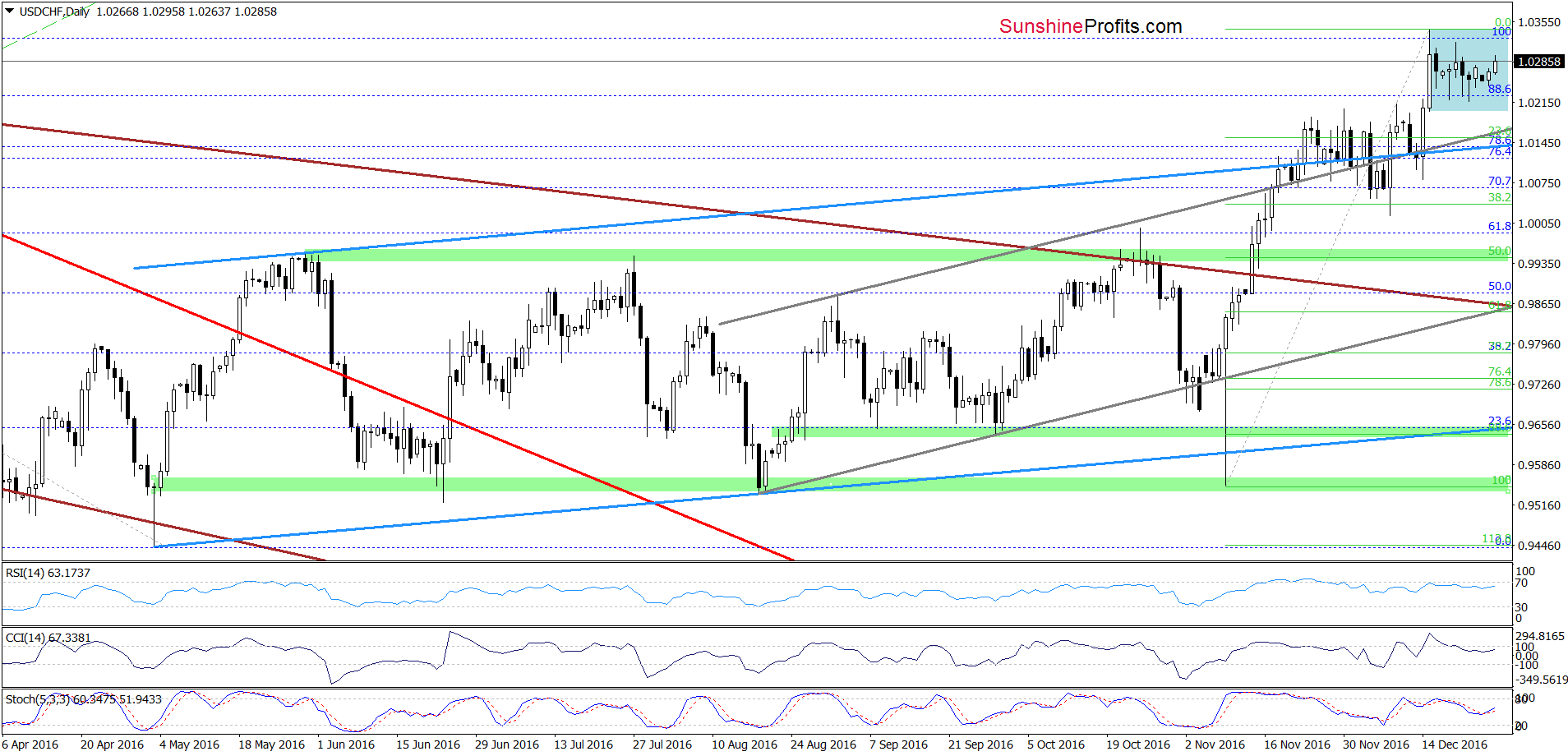

USD/CHF

On the above charts, we see that USD/CHF is consolidating under the mid-Dec high, which makes the very short-term picture a bit unclear. Nevertheless, taking into account the fact that the daily Stochastic Oscillator generated a buy signal, it seems that the pair will test the recent high in the coming days. On the other hand, we should keep in mind that the exchange rate remains under the Nov 2015 peak and weekly indicators are very close to generating sell signals, which suggests that reversal may be just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts