Earlier today, the euro moved higher against the greenback ahead of the European Central Bank’s policy meeting. Thanks to this increase EUR/USD climbed to the highest level since mid-Nov, but will we see higher values of the exchange rate?

In our opinion the following forex trading positions are justified - summary:

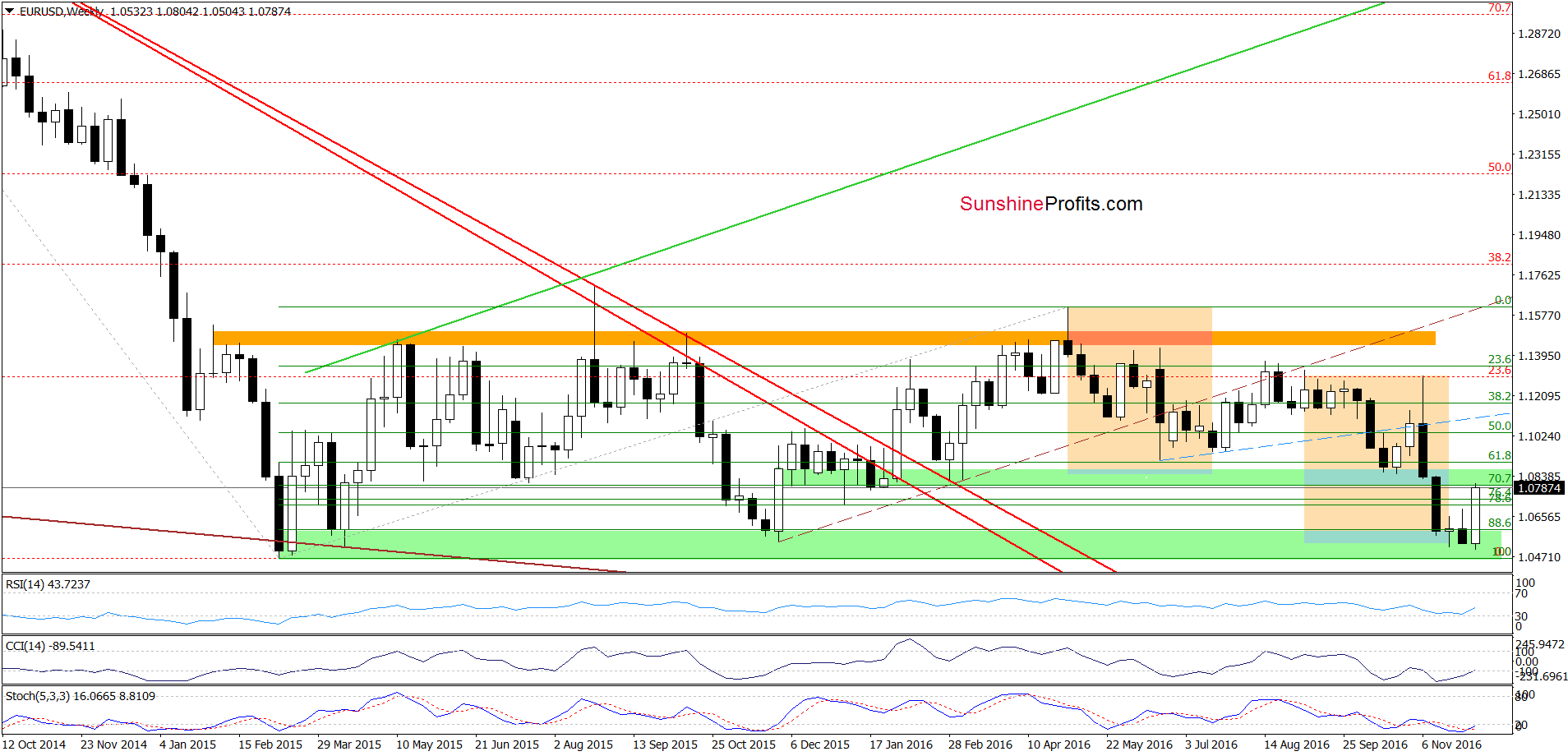

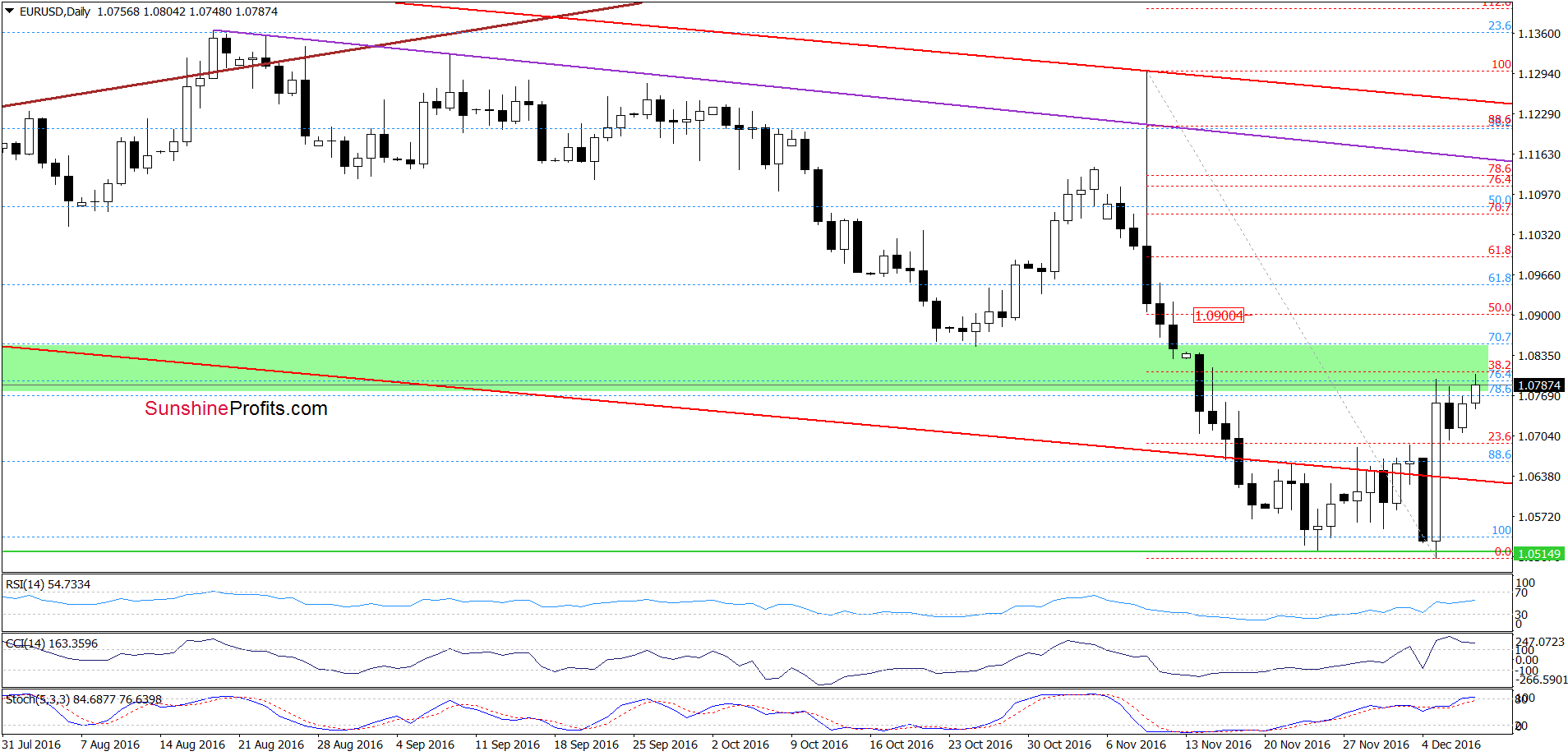

EUR/USD

On the daily chart, we see that EUR/USD increased earlier today, which means that our previous commentary on this currency pair is up-to-date:

(…) Additionally, as long as buy signals generated by the indicators remain in place another attempt to move higher and a test of the upper border of the green zone (around 1.0850) or even the next retracement (50% around 1.0900) can’t be ruled out. Nevertheless, such price action would be more likely only if we see a breakout above the 38.2% Fibonacci retracement. Therefore, if currency bulls fail, the exchange rate will reverse and correct yesterday’s rally in very near future.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

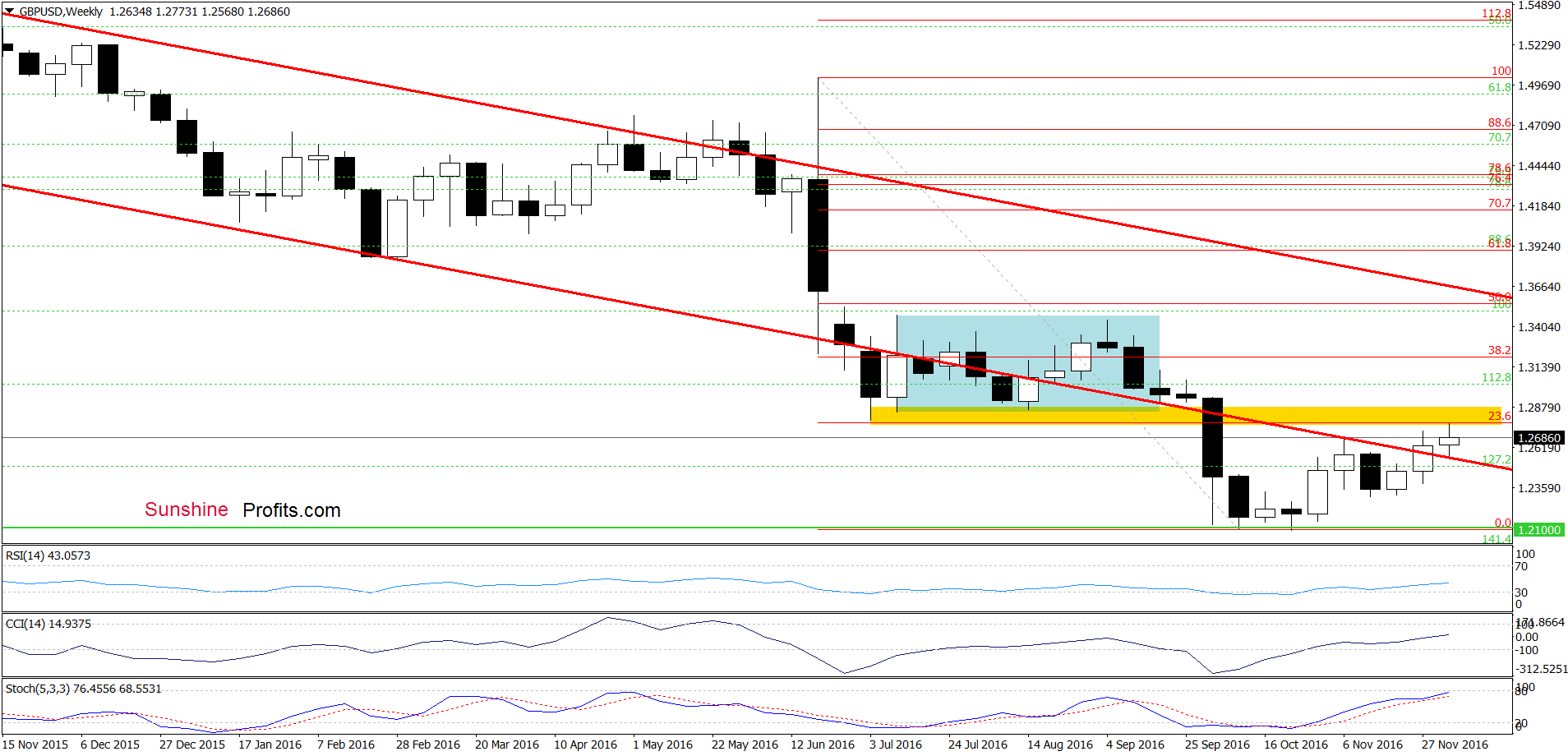

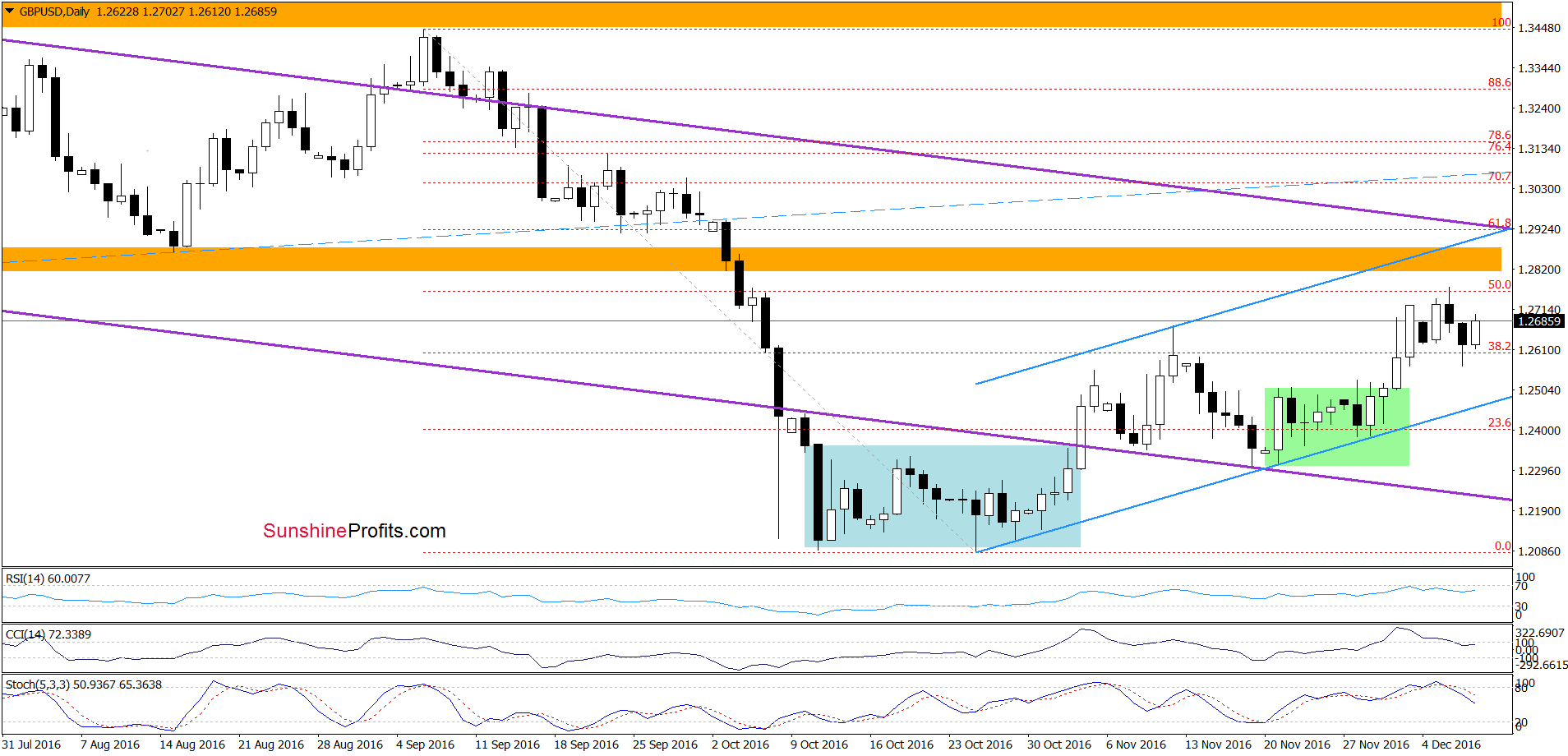

GBP/USD

Looking at the weekly chart, we see that GBP/USD moved higher and reached the yellow resistance zone. How did this event affect the very short-term chart? Let’s check.

From this perspective, we see that GBP/USD moved higher and climbed to the 50% Fibonacci retracement, which triggered a pullback in previous days. Additionally, the CCI and Stochastic Oscillator generated sell signals, which suggests that what we wrote on Tuesday remains up-to-date:

(…) we think that reversal is just around the corner. If this is the case, and the pair moves lower from current levels, the initial downside target would be the previously-broken upper border of the green consolidation (around 1.2510-1.2530). If this area is broken, the next target for currency bears would be around 1.2310, where the lower line of the formation is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

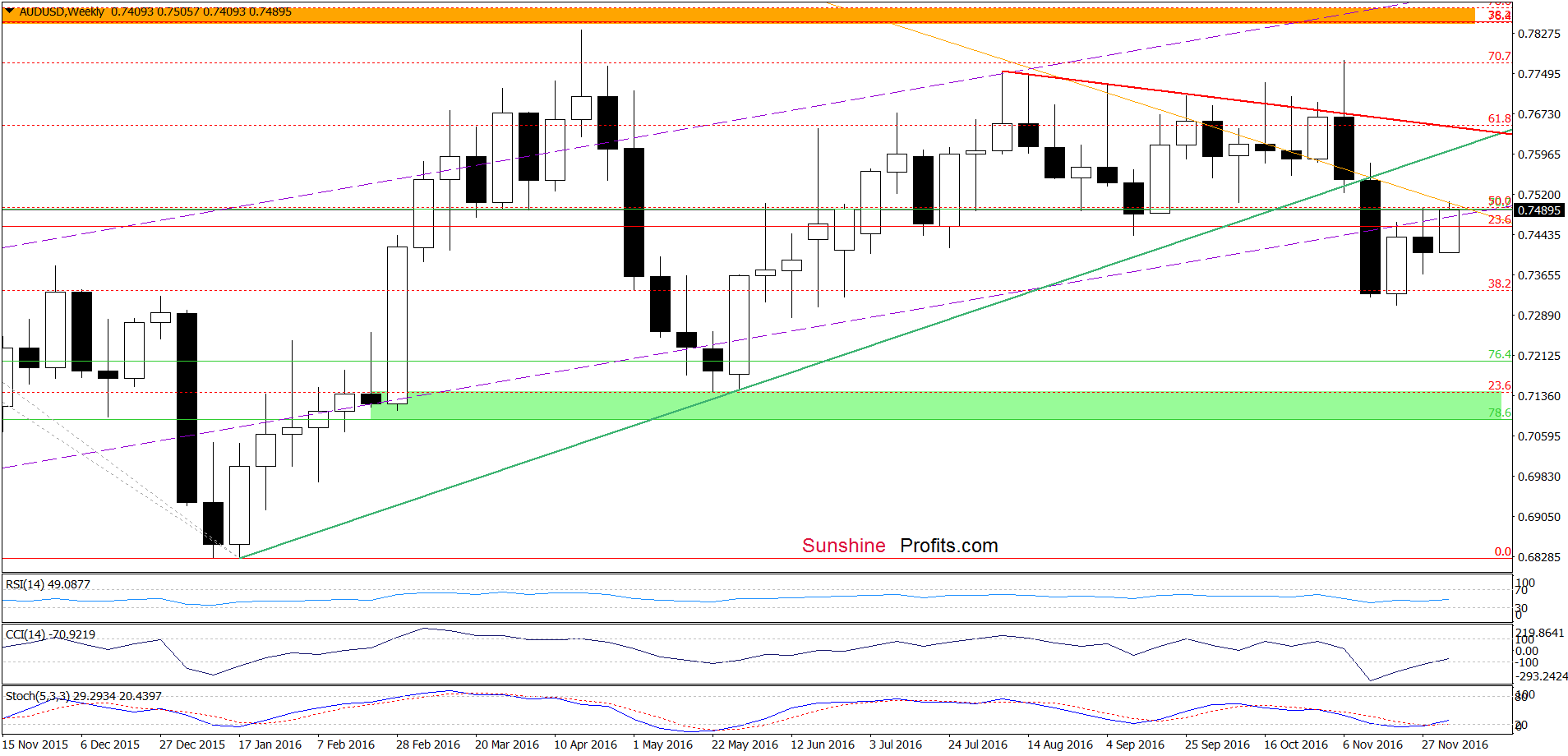

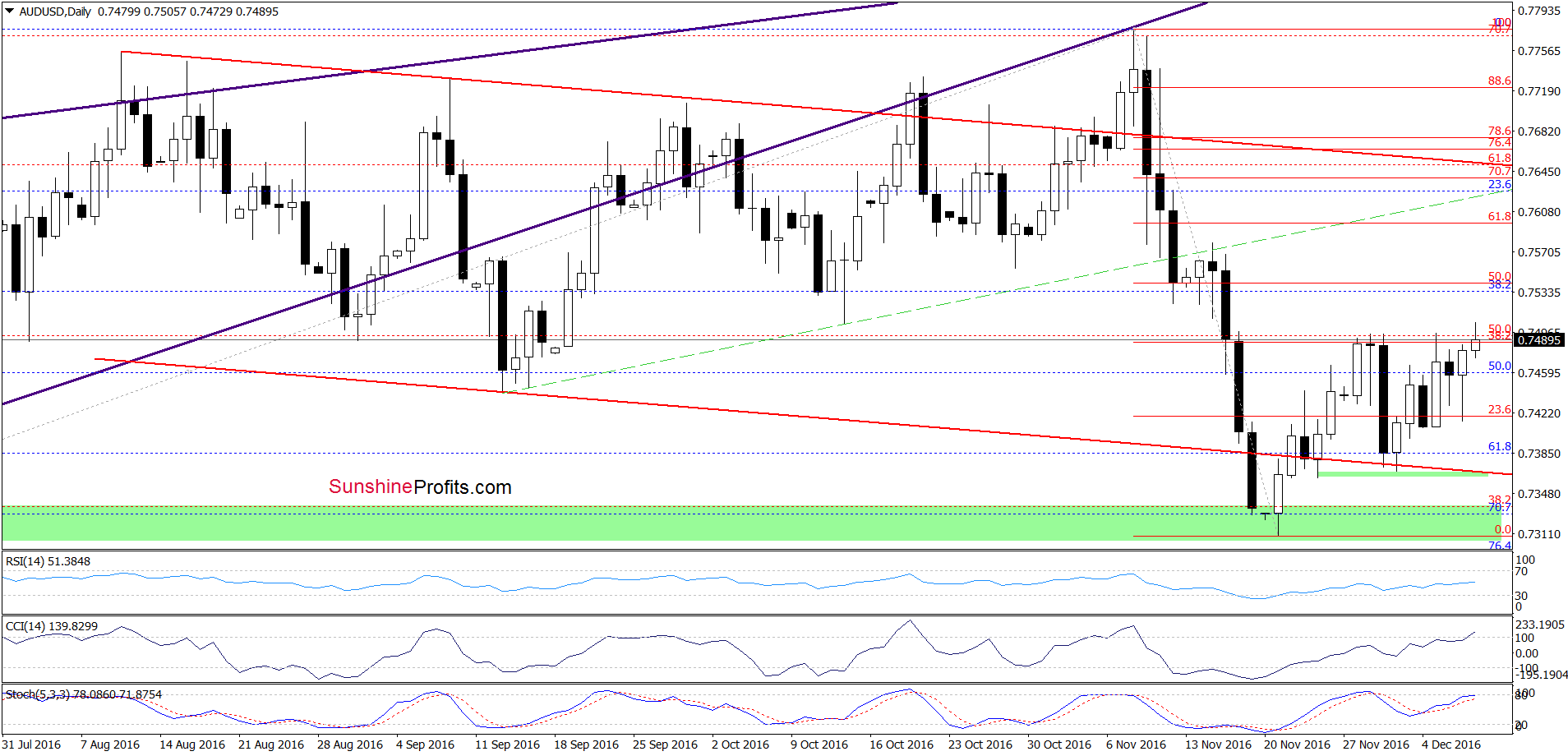

AUD/USD

Looking at the daily chart, we see that AUD/USD extended gains and reached the recent highs once again. Although this is a positive signal, the 38.2% Fibonacci retracement continues to keep gains in check, which suggests that we may see another attempt to move lower from here in very near future (especially if indicators generate sell signals). If we see such price action, AUD/USD will likely move lower once again and re-test the green support zone (based on the previous lows, which is currently reinforced by the red declining support line) in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to my travel plans, there will be no regular Forex Trading Alerts from Monday to Thursday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts