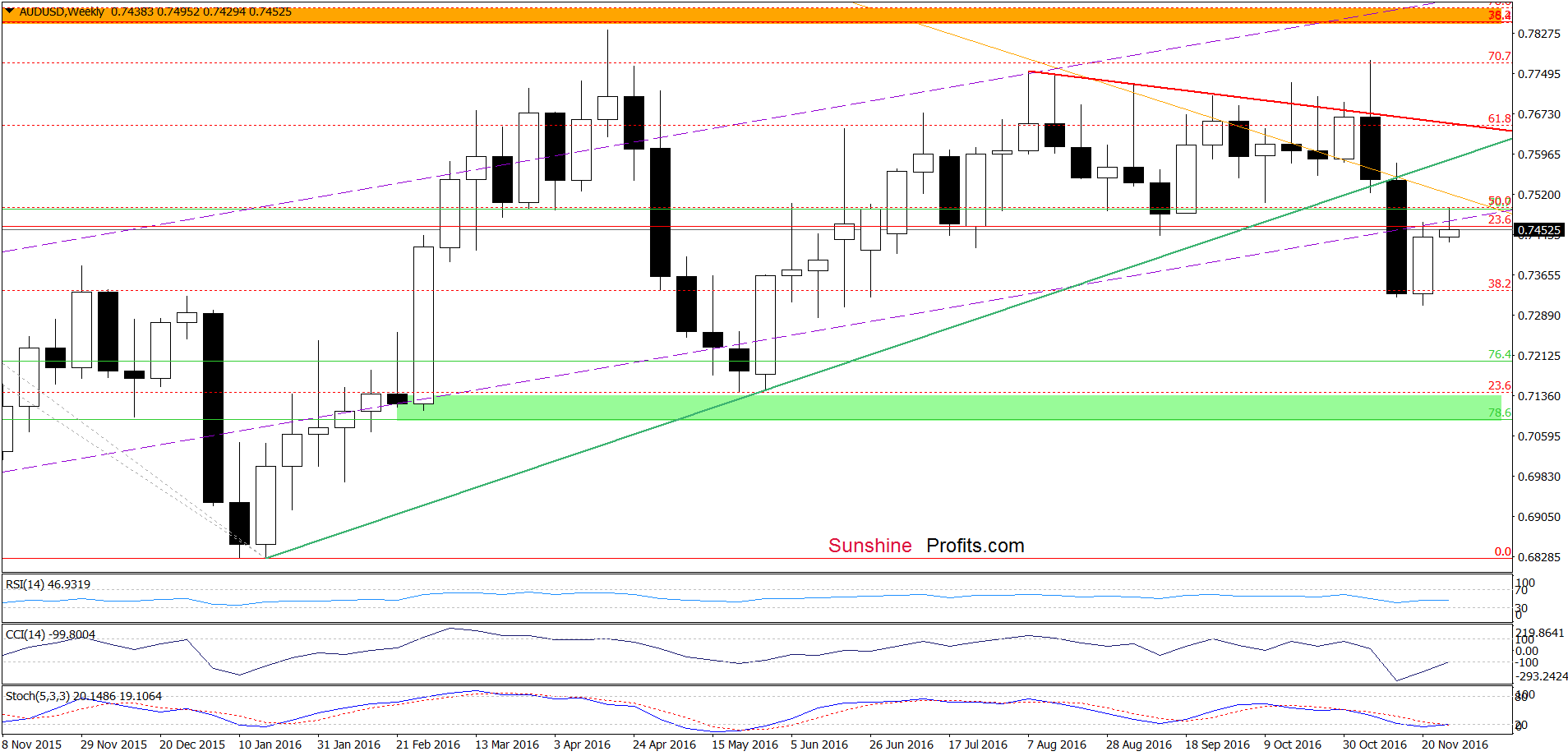

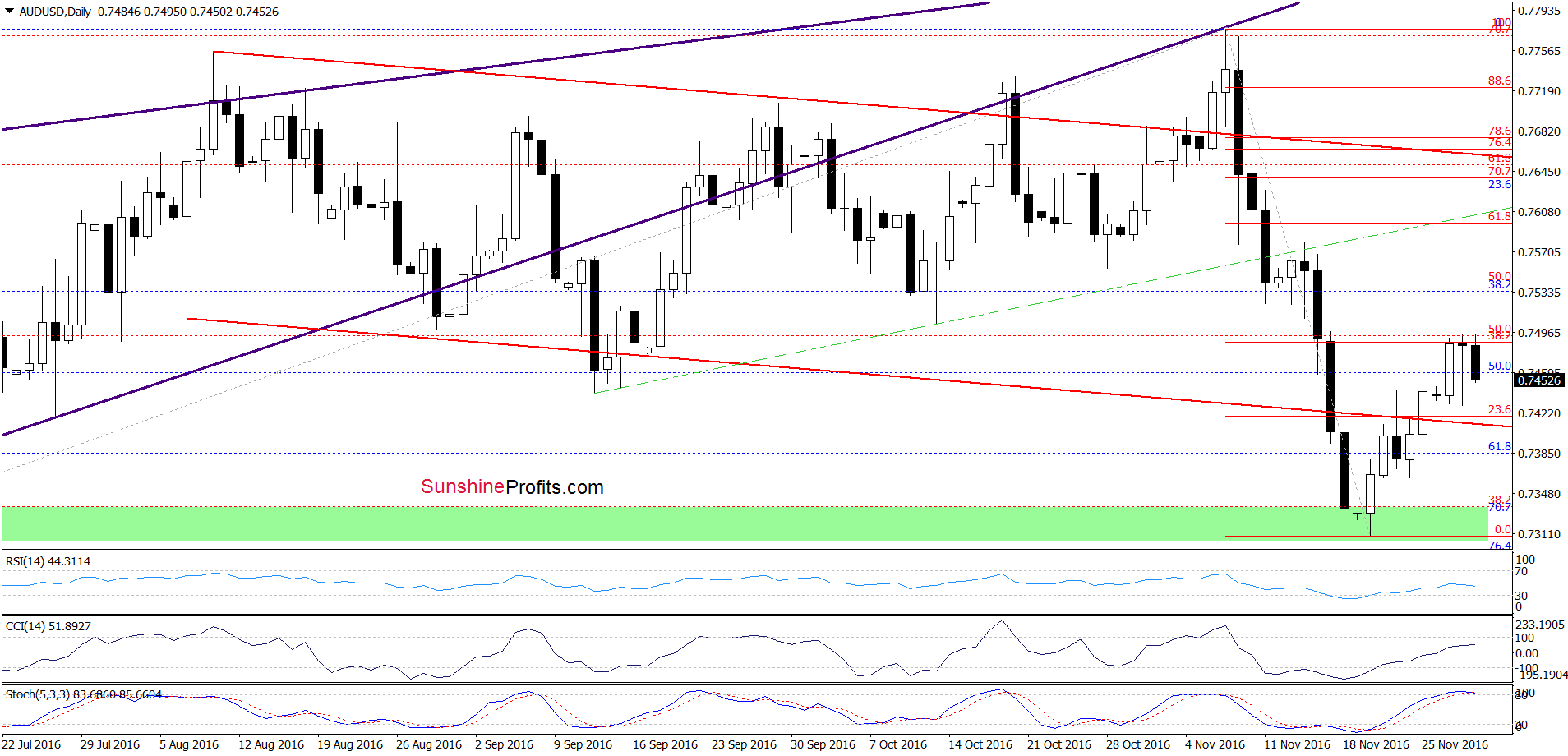

Earlier today, official data showed that Australian building approvals dropped by 12.6%, missing expectations of a 1.5% gain. Additionally, private sector credit declined 3.4%, compared to a gain seen in the previous month. Thanks to these disappointing numbers, the Australian dollar moved lower against its U.S. counterpart. What impact did this move have on the technical picture of AUD/USD?

In our opinion the following forex trading positions are justified - summary:

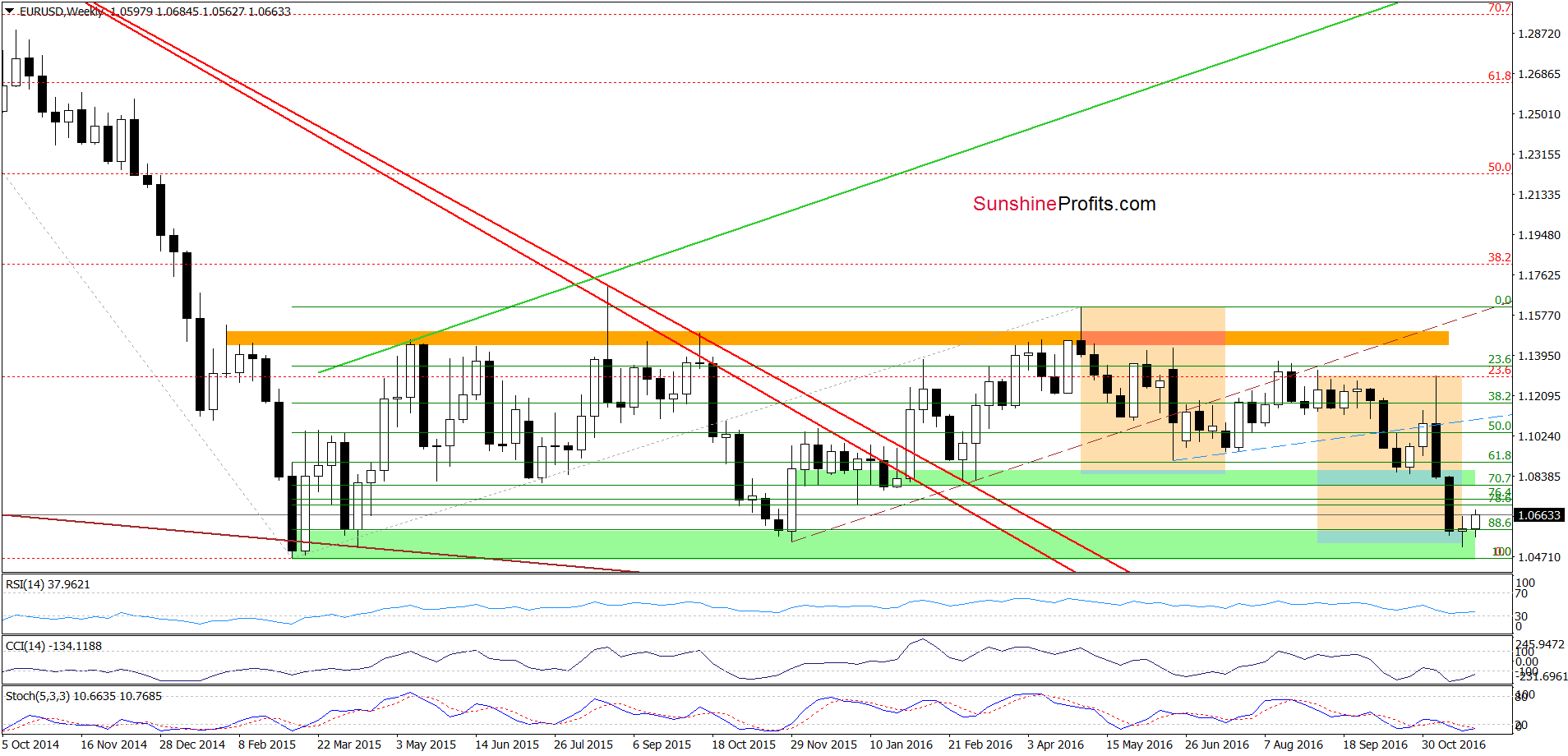

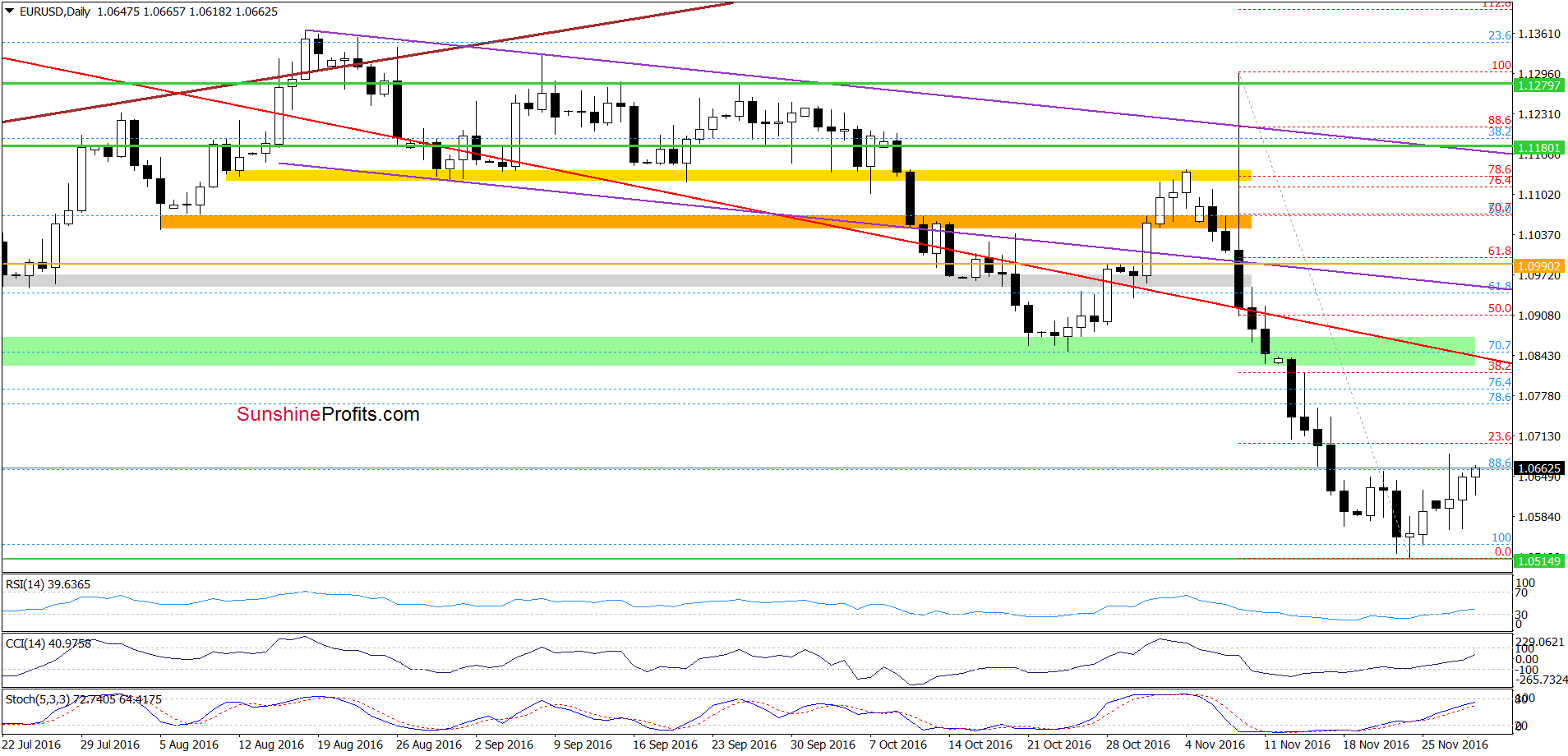

EUR/USD

On Monday, we wrote the following:

(…) buy signals generated by the CCI and Stochastic Oscillator remain in place, suggesting that another attempt to move higher is just around the corner. Additionally, the size of the downward move between the May high and the Oct 23 low is very similar to the decline between the Nov high and the last week low, which increases the probability of reversal in the coming week – especially when we factor in the fact that the green support zone (marked on the weekly chart below) continues to keep declines in check.

From today’s point of view, we see that currency bulls pushed EUR/USD higher as we had expected. However, despite today’s upswing, the exchange rate remains under the Monday’s high and the 23.6% Fibonacci retracement, which means that further improvement would be more likely and reliable only if the pair climbs and closes today’s session (or one of the following) above these levels. In this case, the next target for currency bulls would be the previously-broken green zone (around Nov low), which serves as the nearest stronger resistance.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

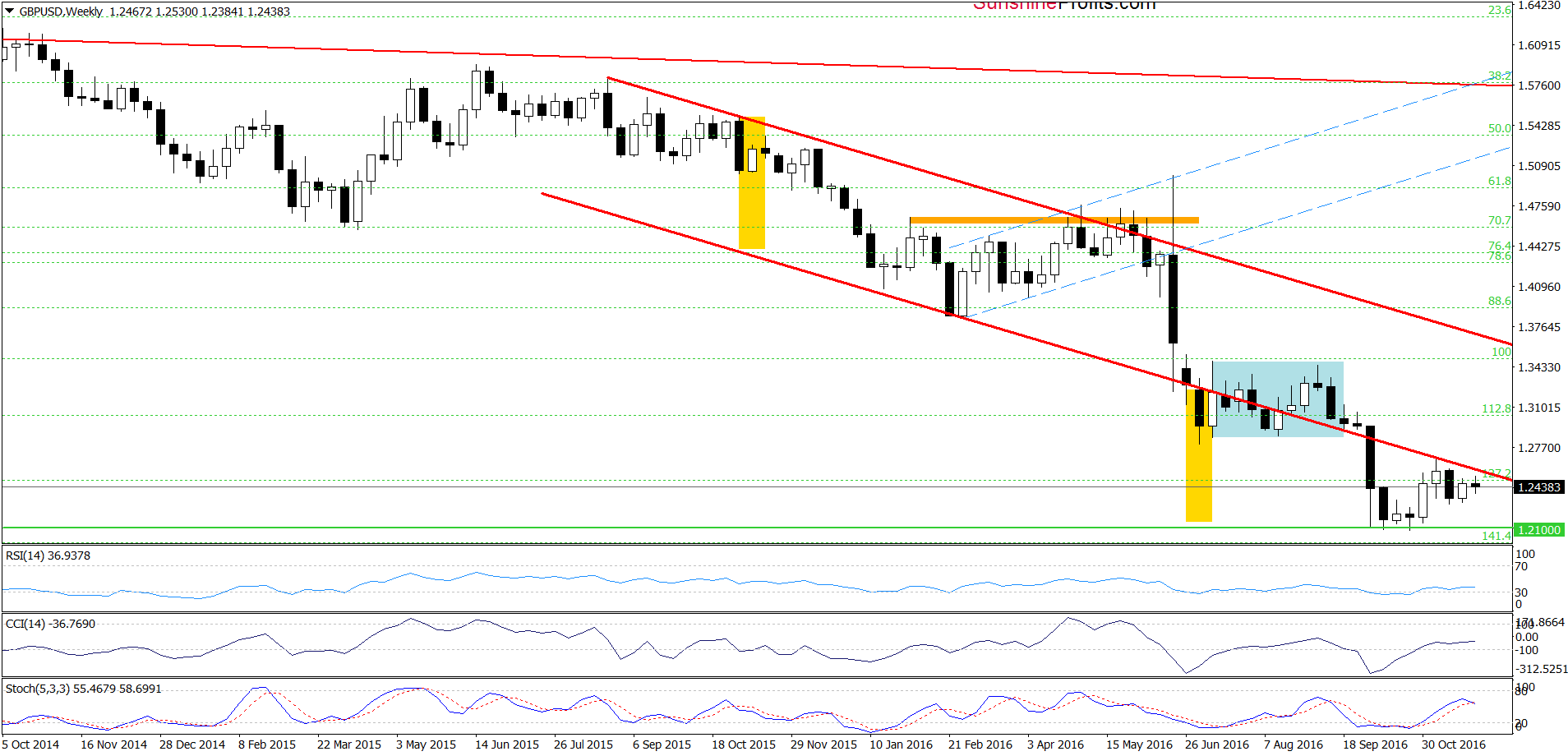

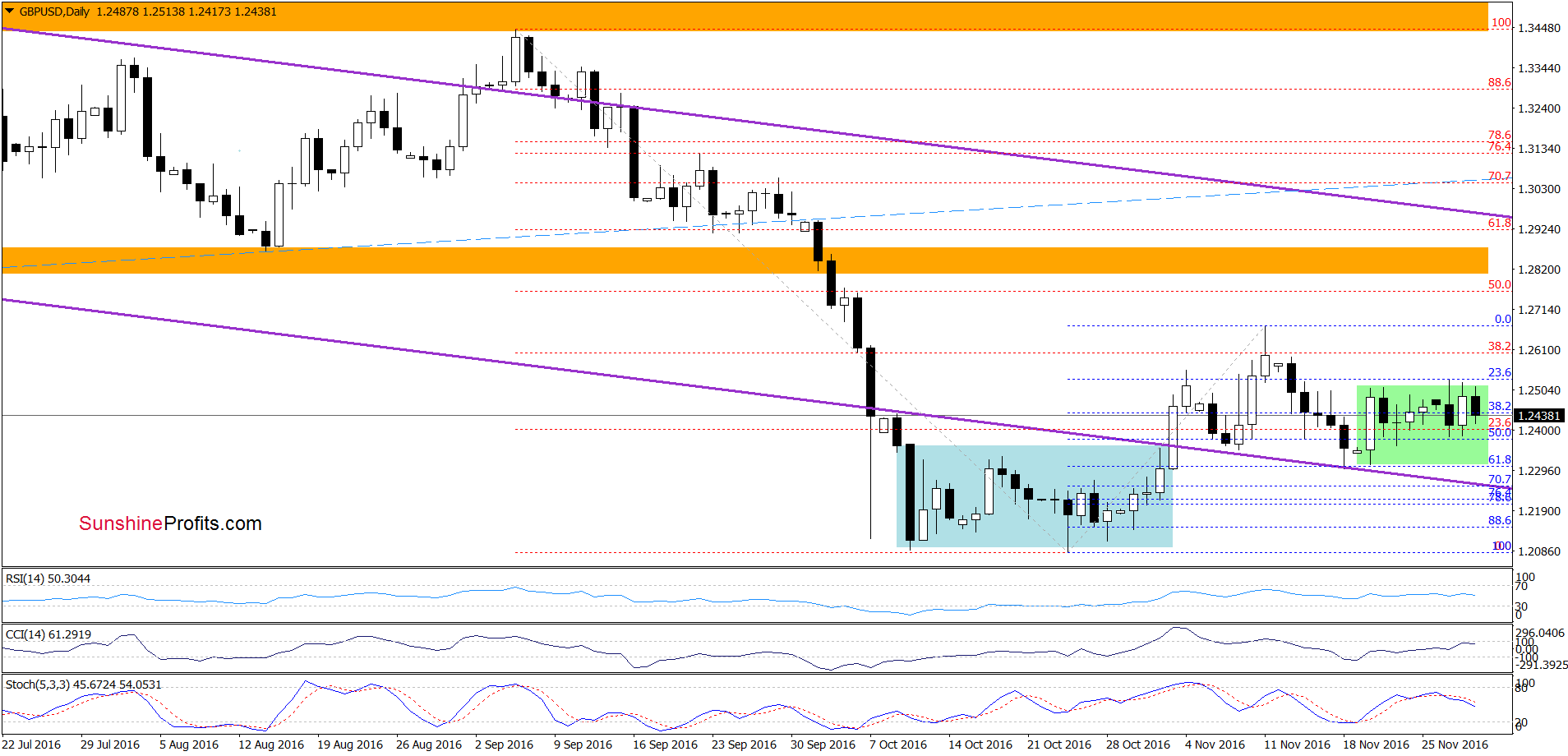

GBP/USD

Looking at the above charts, we see that although GBP/USD increased yesterday, the proximity to the upper line of the green consolidation and the lower border of the red declining trend channel encouraged currency bears to act once again, which resulted in a pullback earlier today. Taking this negative event into account and combining it with a sell signal generated by the Stochastic Oscillator, we think that another attempt to move lower and a test of the lower line of the green consolidation or even a drop to the purple support line in the coming days should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

On the daily chart, we see that AUD/USD extended gains in recent days, which took the pair to the 50% Fibonacci retracement based on the Nov downward move. As you see this resistance level in combination with the proximity to the mid-Nov low triggered a drop earlier today. Additionally, the Stochastic Oscillator is very close to generating a sell signal, which suggests that further deterioration may be just around the corner. If this is the case and the exchange rate extends losses, we may see a test of the Nov 24 low of 0.7362 in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts