Earlier today, the USD Index extended gains, which approached the greenback to the late Jun highs. Thanks to this increase AUD/USD reversed and declined under previously-broken upper border of the short-term rising trend channel. What does it mean for the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss at 1.1236; initial downside target at 1.0708)

- GBP/USD: short (a stop-loss at 1.3579; initial downside target at 1.2519)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

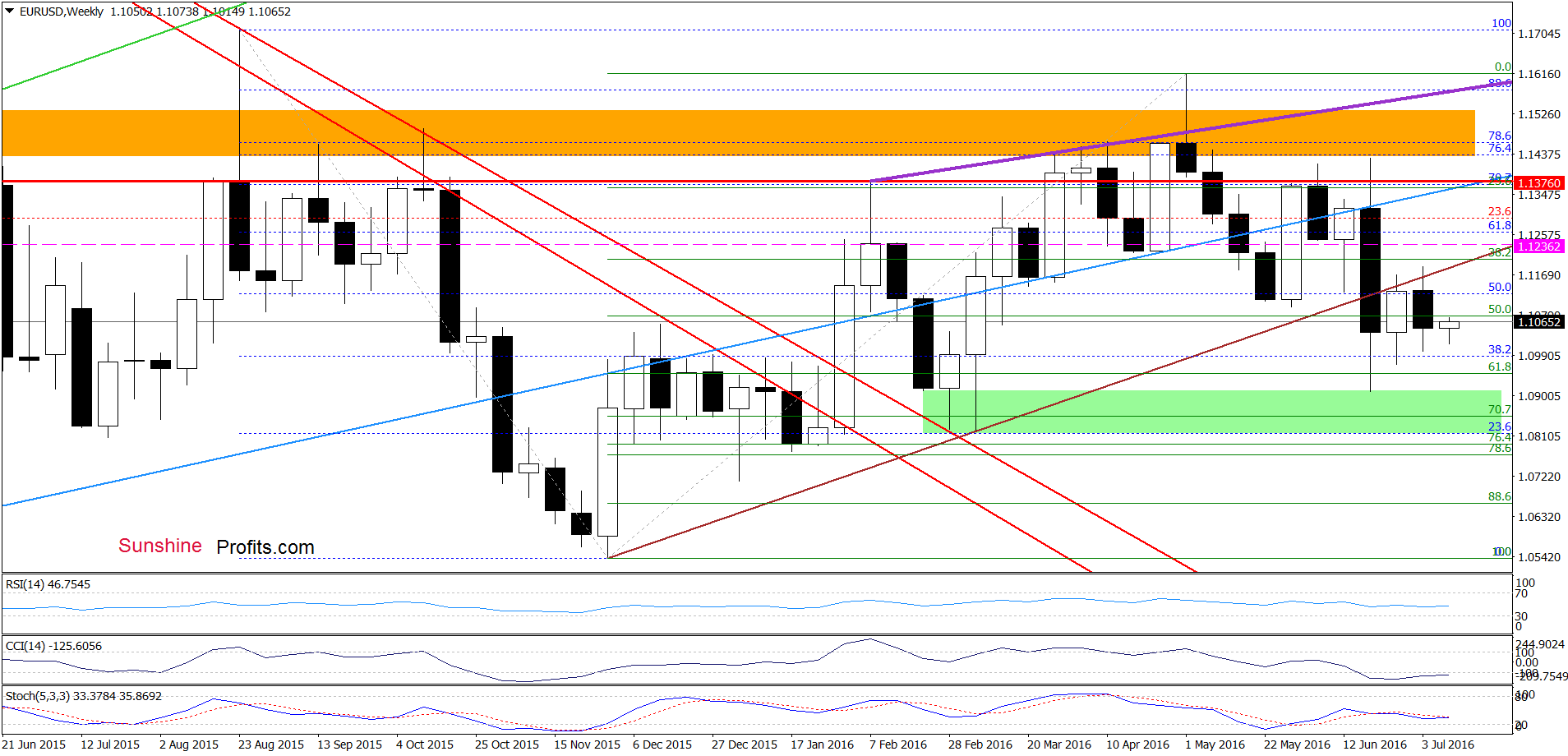

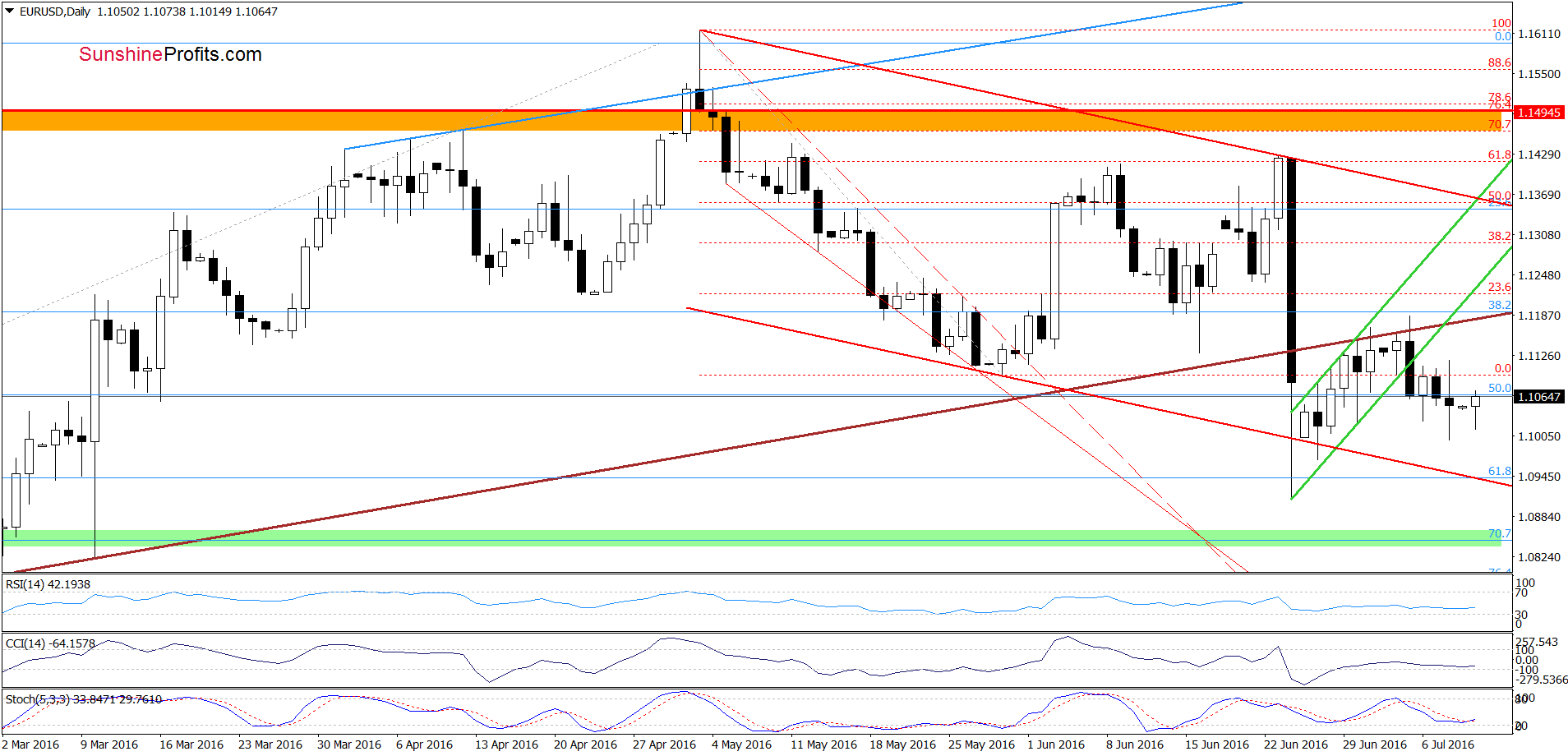

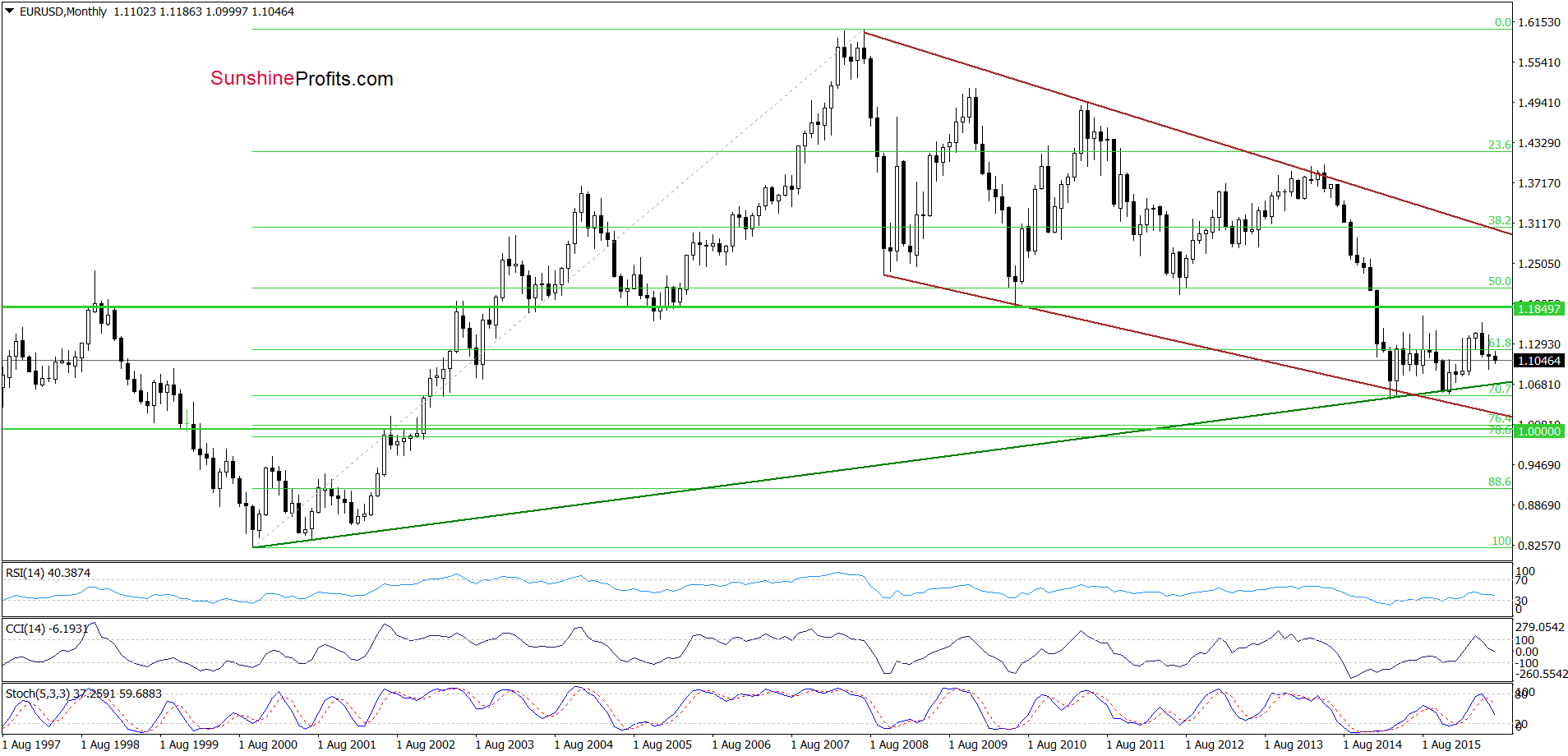

EUR/USD

Looking at the above charts, we see that the overall situation hasn’t changed much as EUR/USD remains under the previously-broken long-term brown resistance line, which suggests that as long as there won’t be invalidation f the breakdown under this important line another attempt to move lower is likely. Therefore, if the pair extends losses, the initial downside target would be the lower border of the red declining trend channel (currently around 1.0942).

Finishing today’s commentary on his currency pair, please keep in mind what we wrote on Friday:

On the monthly chart, we see that sell signals generated by the indicators remain in place, supporting further deterioration and a re-test of the strength of the long-term green support line (currently around 1.0708) in the coming week(s).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1236 and initial downside target at 1.0708 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

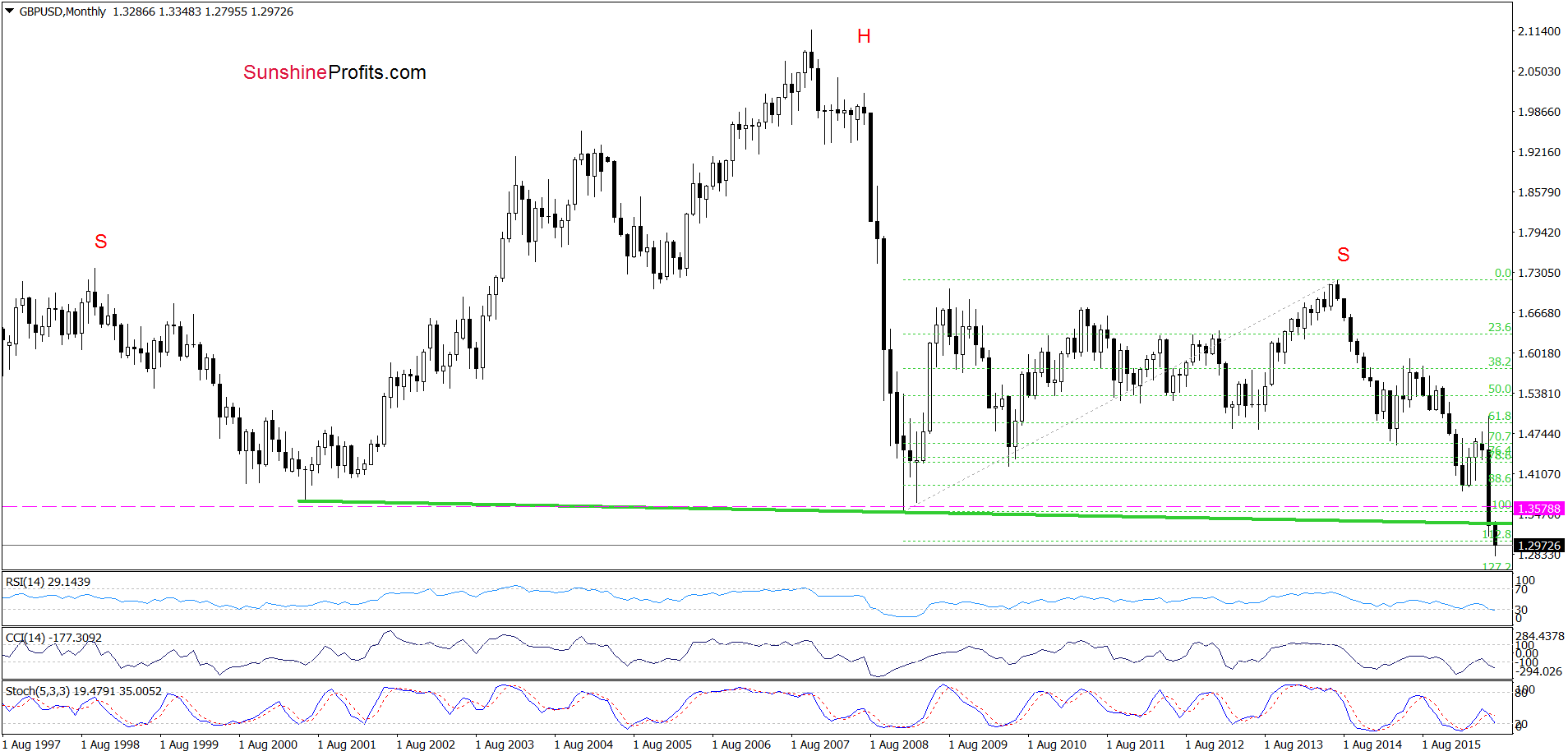

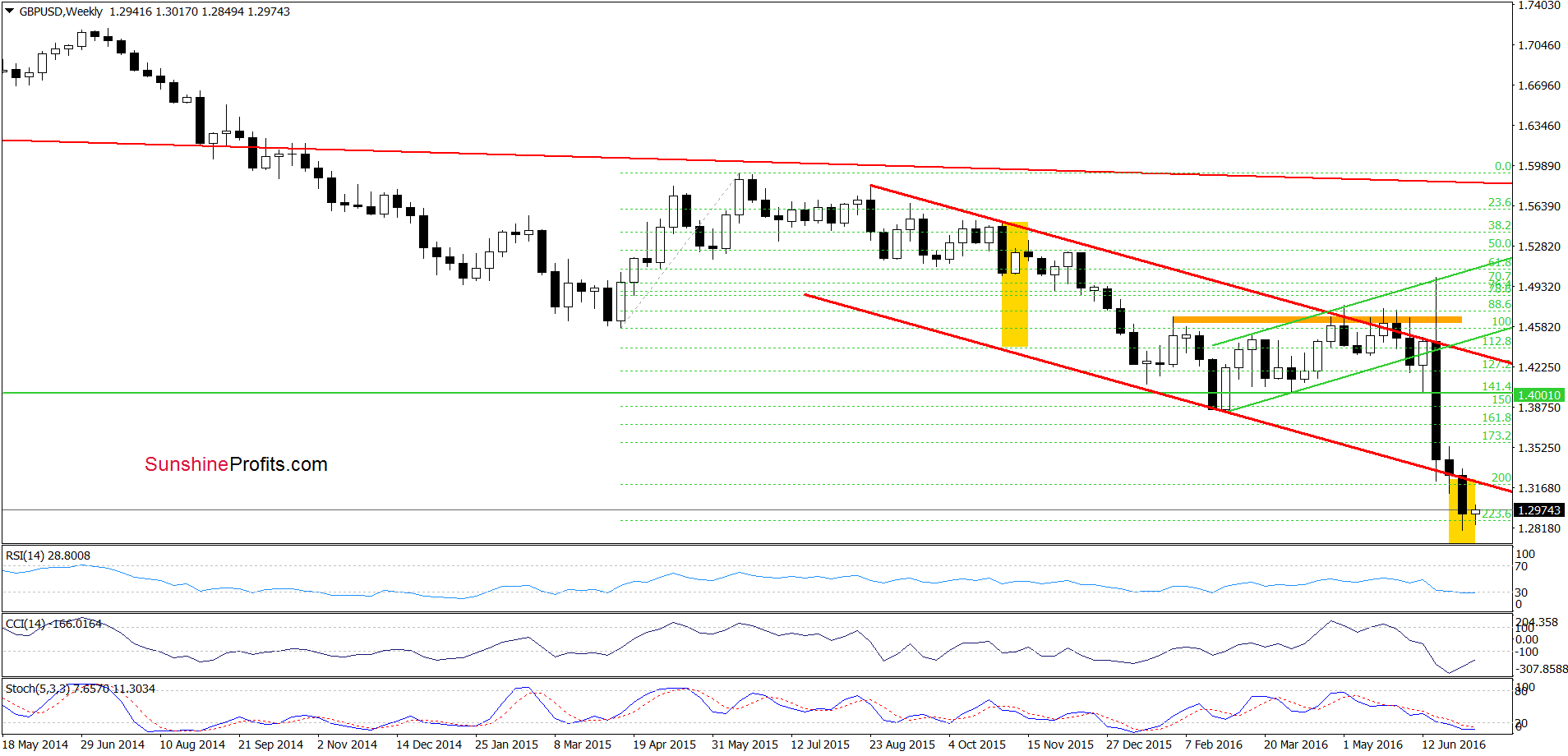

GBP/USD

On the above charts, we see that although GBP/USD moved slightly higher, the exchange rate is still trading under the neck line of the head and shoulders formation and the lower border of the red declining trend channel, which means that what we wrote in our previous commentary on this currency pair is up-to date also today:

(…) GBP/USD dropped under the lower border of the red declining trend channel and hit a fresh multi-year low. This is a strong bearish signal, which suggests further deterioration and a drop even to around 1.2161, where the size of the downward move will correspond to the height of the formation.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss at 1.3579 and the initial downside target at 1.2519 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

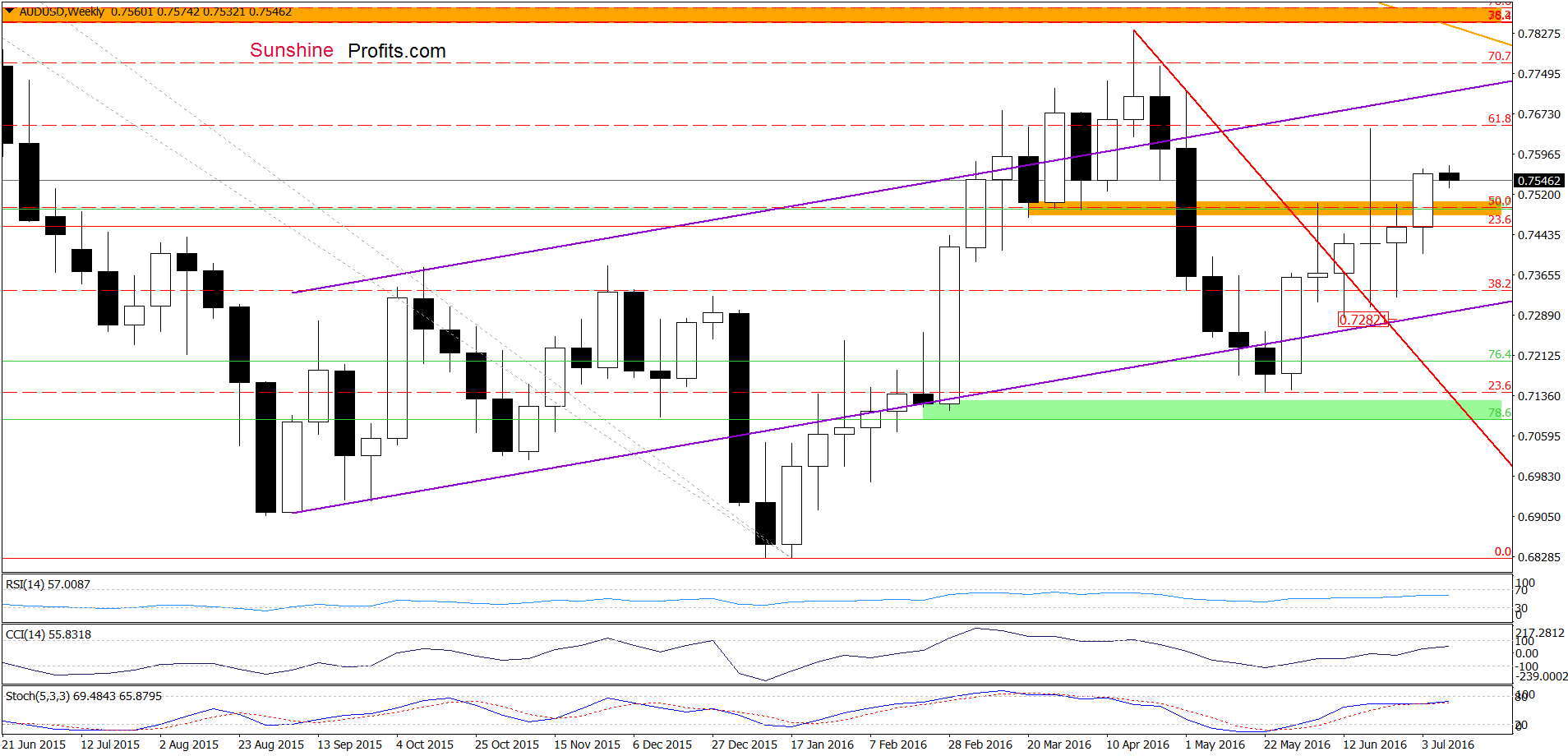

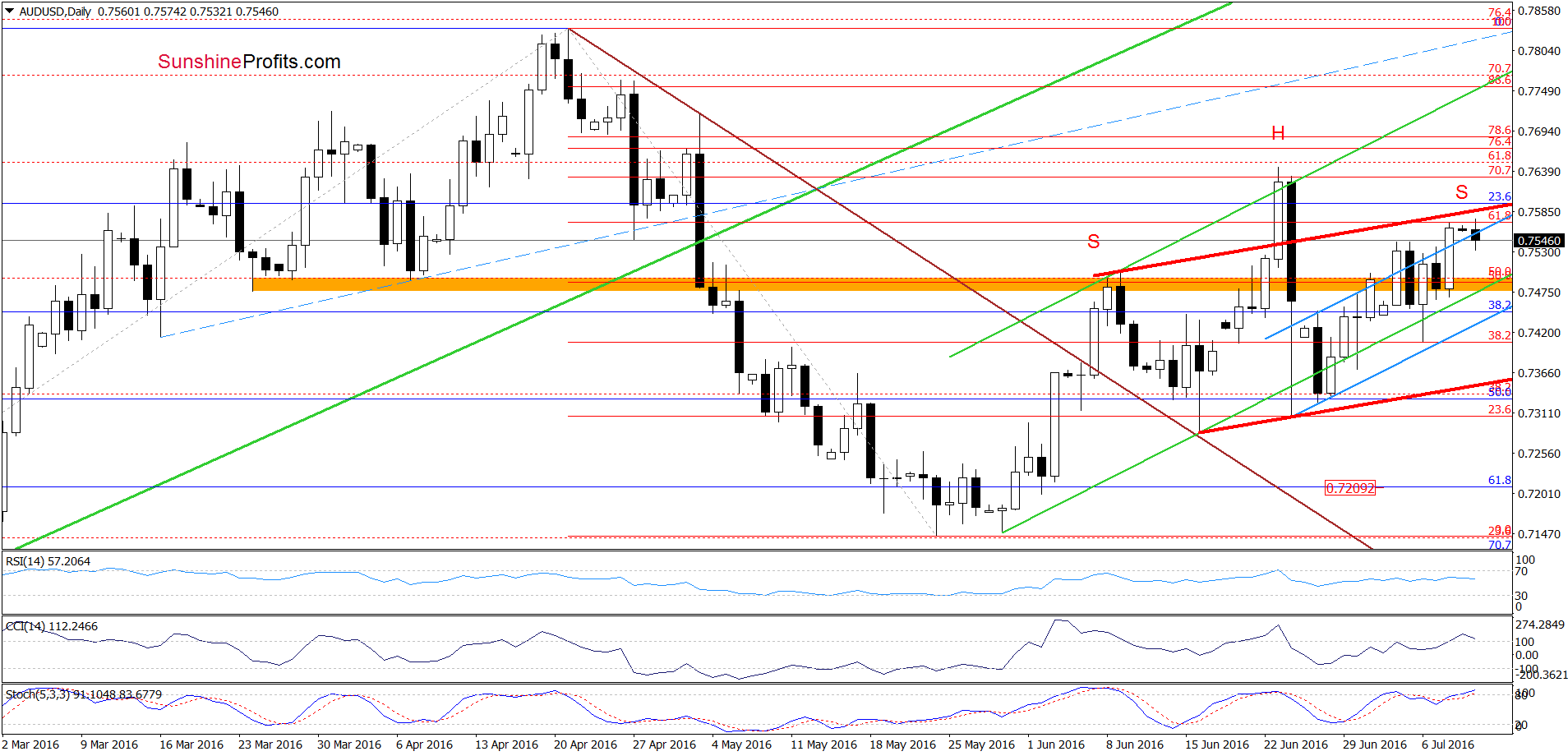

AUD/USD

On Friday, AUD/USD moved sharply higher and broke not only above the orange resistance zone, but also climbed above the upper border of the blue rising trend channel. Despite this improvement the red resistance line (parallel to the neck line of a potential head and shoulders formation) triggered a reversal, which resulted in a decline earlier today. With today’s drop the exchange rate slipped under the previously-broken upper border of the blue rising trend channel, invalidating Friday’s breakout. This is a bearish signal, which suggests further deterioration in the coming days – especially when we factor in the current position of the indicators (the CCI and Stochastic Oscillator are very close to generating sell signals). Therefore, if the pair closes today’s session under this line, we’ll likely see declines to around 0.7429, where the lower border of the trend channel currently is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts