Earlier today, official data showed that building permits declined by 7.7% in the previous month, missing analysts’ forecasts. On top of that, U.S. housing starts dropped by 8.8% in March, which also disappointed market participants. Thanks to these numbers, the USD Index dropped under the level of 94, approaching last week’s lows. Double bottom or further declines?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

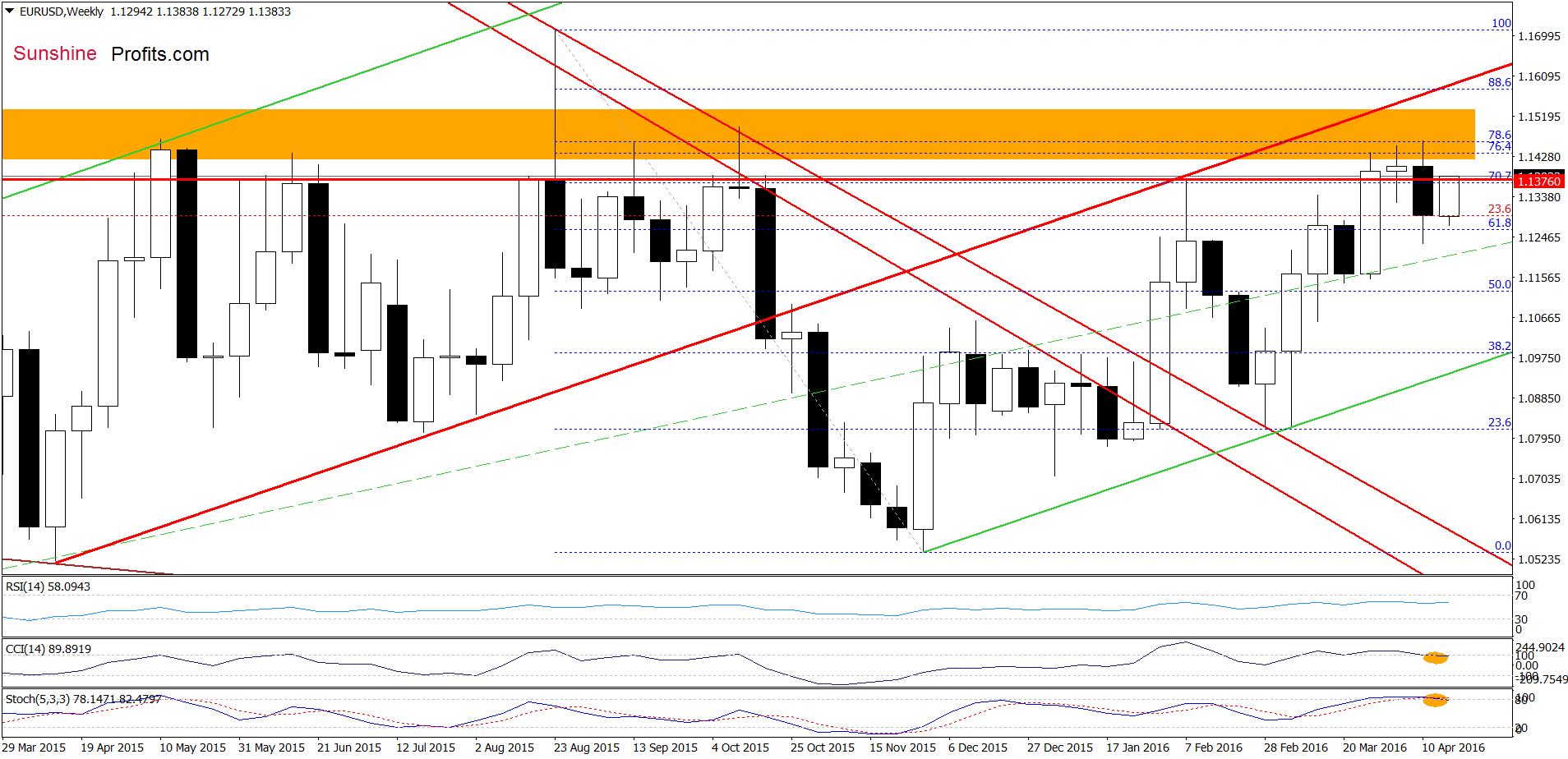

EUR/USD

The situation in the medium term hasn’t changed much as EUR/USD still remains under the orange resistance zone, which continues to keep gains in check since Aug. Additionally, the CCI and Stochastic Oscillator generated sell signals, which increases the probability of another downswing.

Can we infer something more from the very short-term picture? Let’s check.

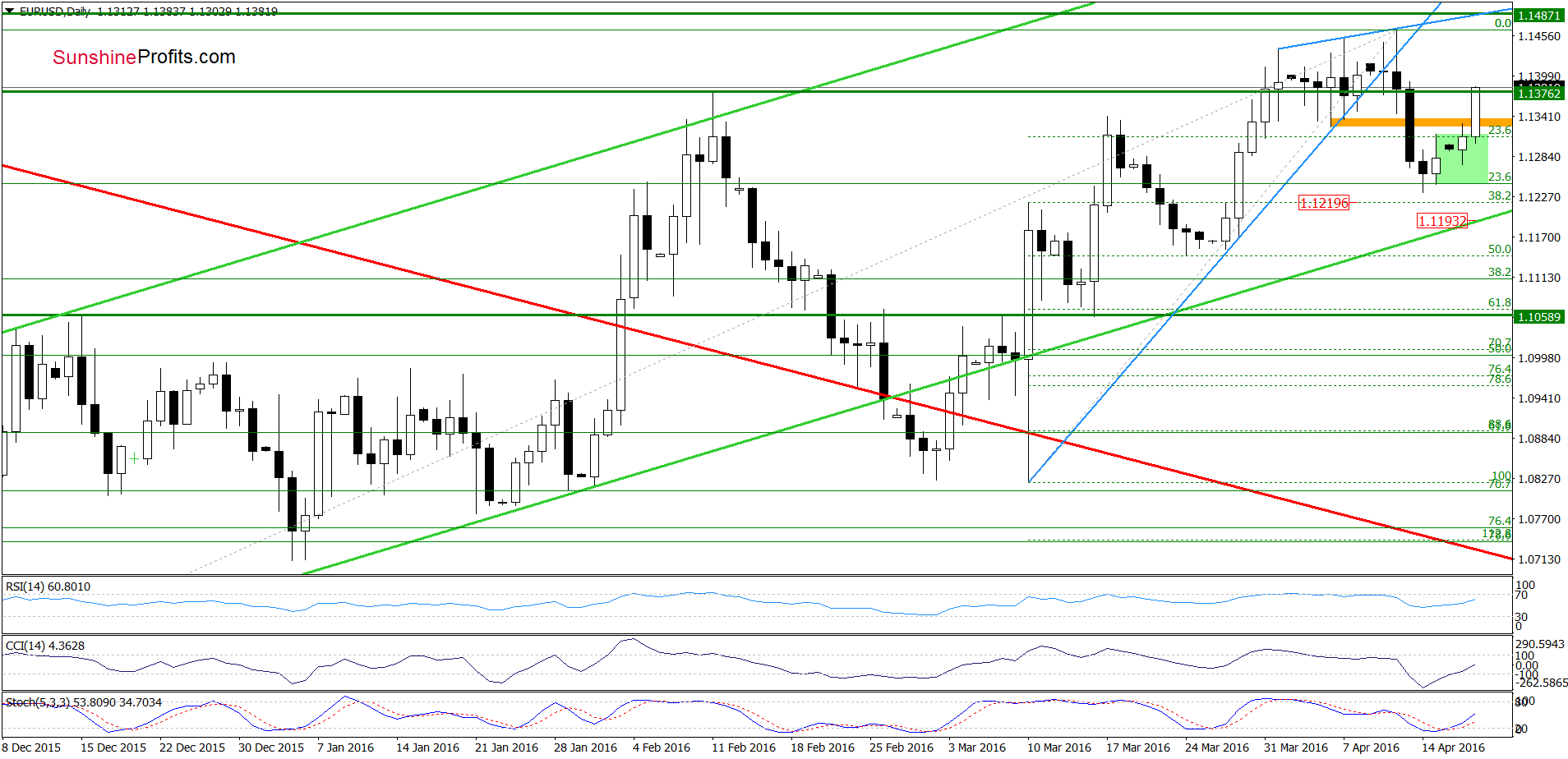

From this perspective, we see that EUR/USD extended gains earlier today, which resulted in a climb above the orange resistance zone created by early-Apr lows. Additionally, the CCI and Stochastic Oscillator generated buy signals, which suggests further improvement and a test of recent highs (especially if the pair closes the day above the Feb high). Nevertheless, as long as EUR/USD remains under the orange zone marked on the weekly chart, further declines are just a matter of time.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

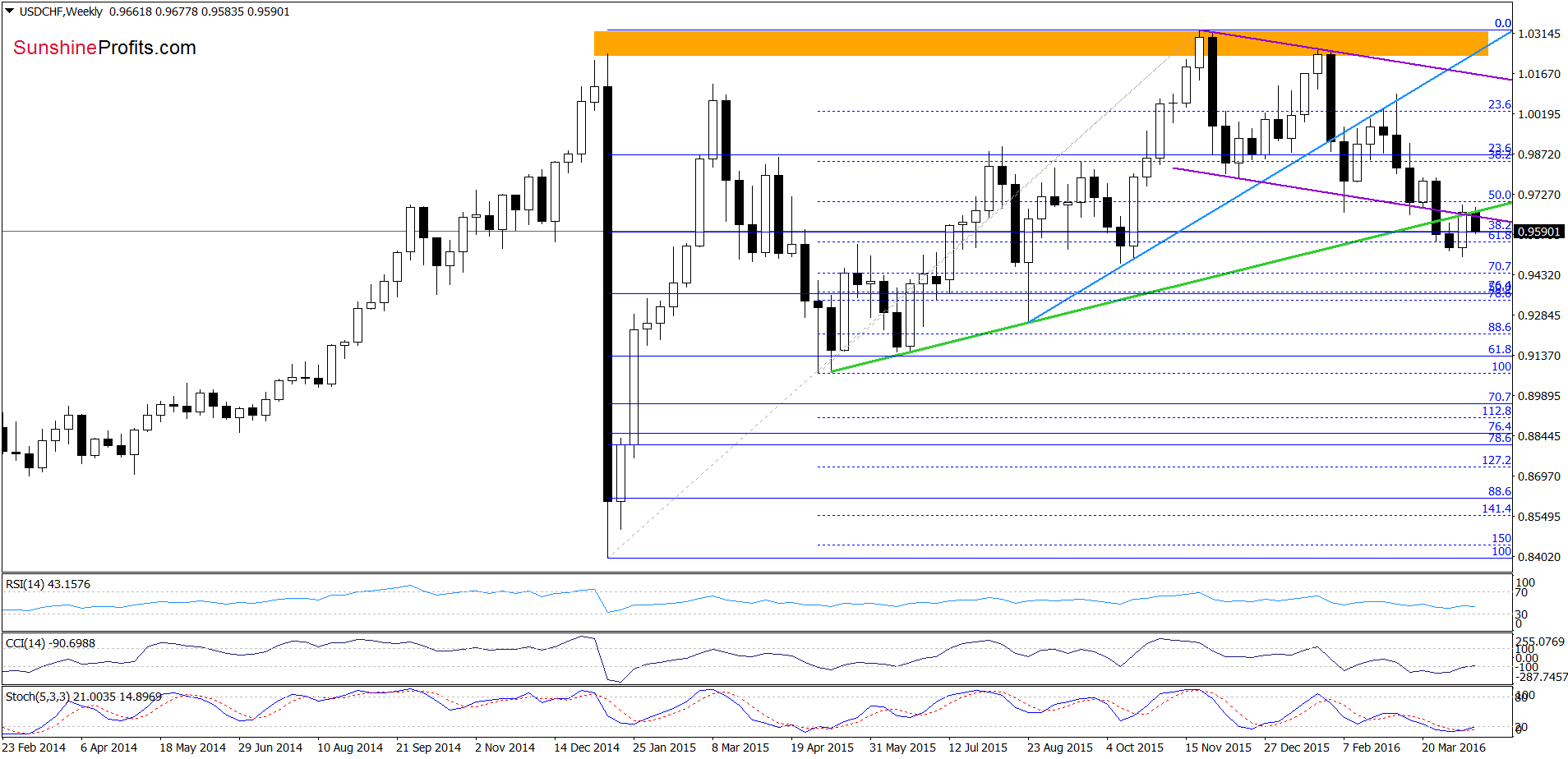

USD/CHF

The first thing that catches the eye on the weekly chart is a comeback under the green support line, which encouraged currency bulls to act. How did this drop affect the very short-term picture? Let’s check.

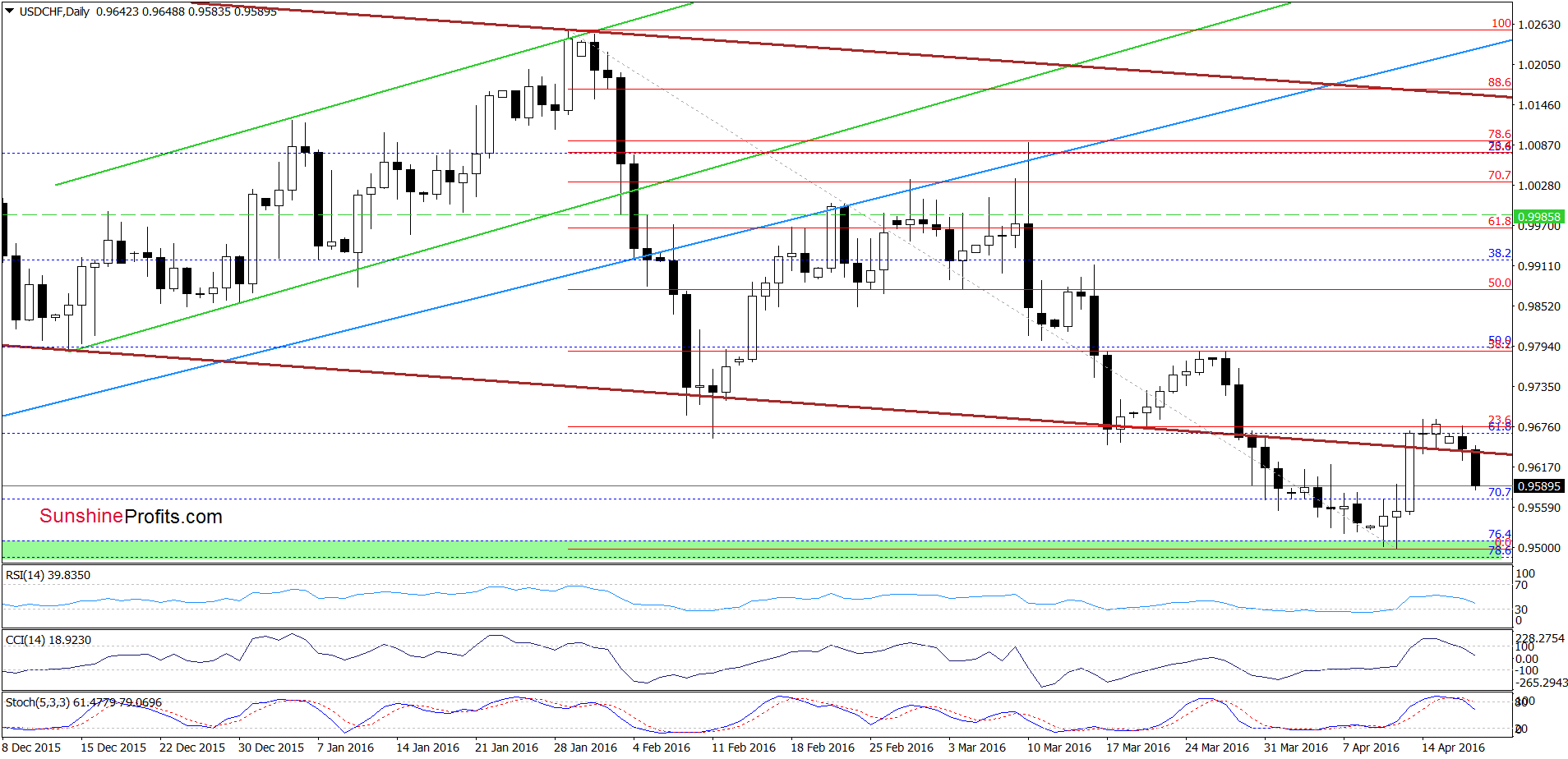

Quoting our previous commentary on this currency pair:

(…) USD/CHF moved little lower, slipping to the previously-broken lower border of the brown declining trend channel. Nevertheless, the CCI and Stochastic Oscillator generated sell signals, which suggests that further deterioration is just around the corner.

From today’s point of view we see that the situation developed in line with the above scenario and the pair declined earlier today. With this move the exchange rate came back below the lower border of the brown declining trend channel, which doesn’t bode well for USD/CHF. Taking this fact into account, and combining t with the medium-term picture and sell signals generated by the indicators, we think that the pair will re-test the strength of the green support zone in the coming days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

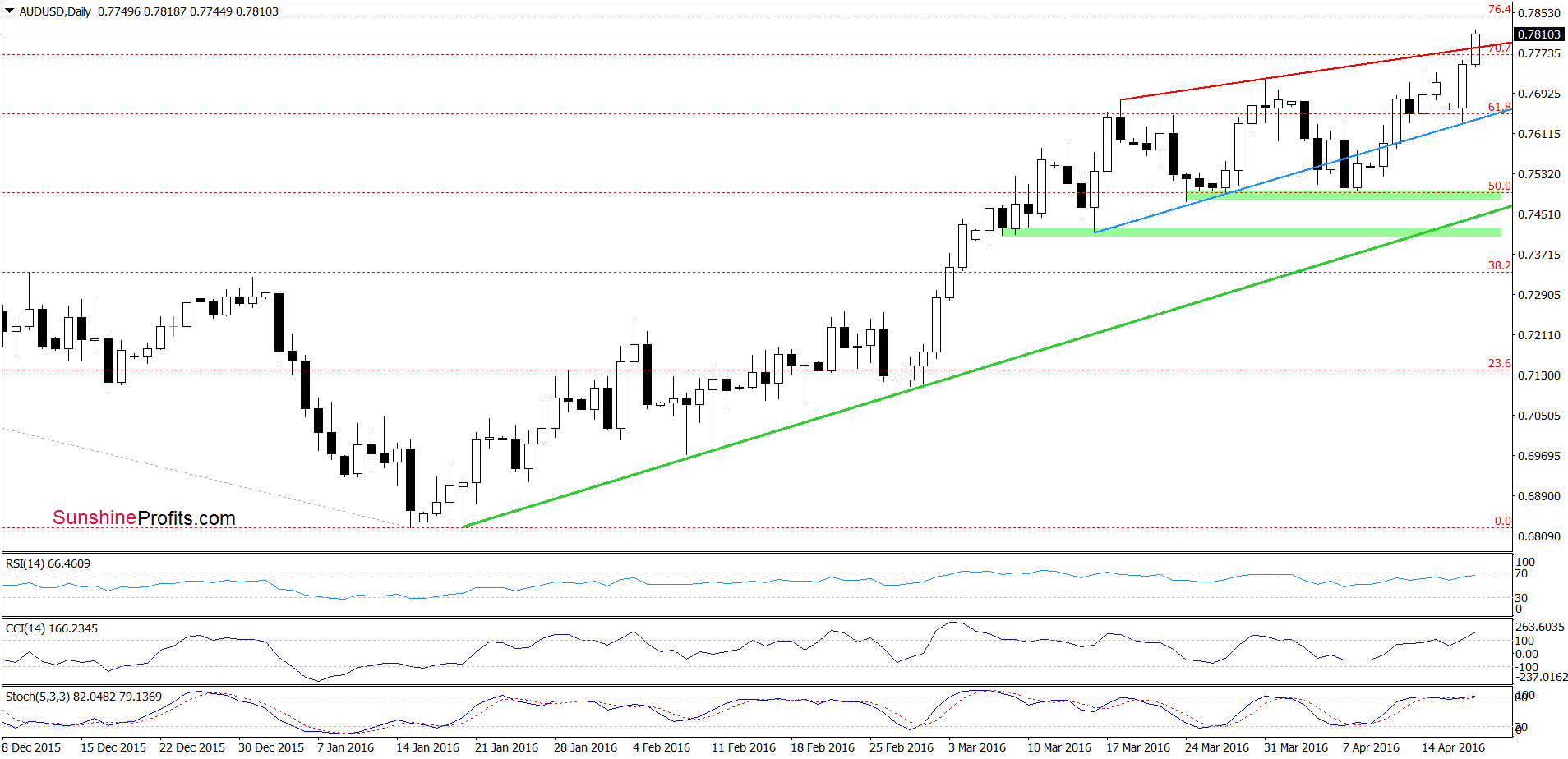

Looking at the daily chart, we see that AUD/USD broke above the red resistance line based on the previous highs, which opened the way to higher levels earlier today. How high could the pair go? Let’s examine the weekly chart and find out.

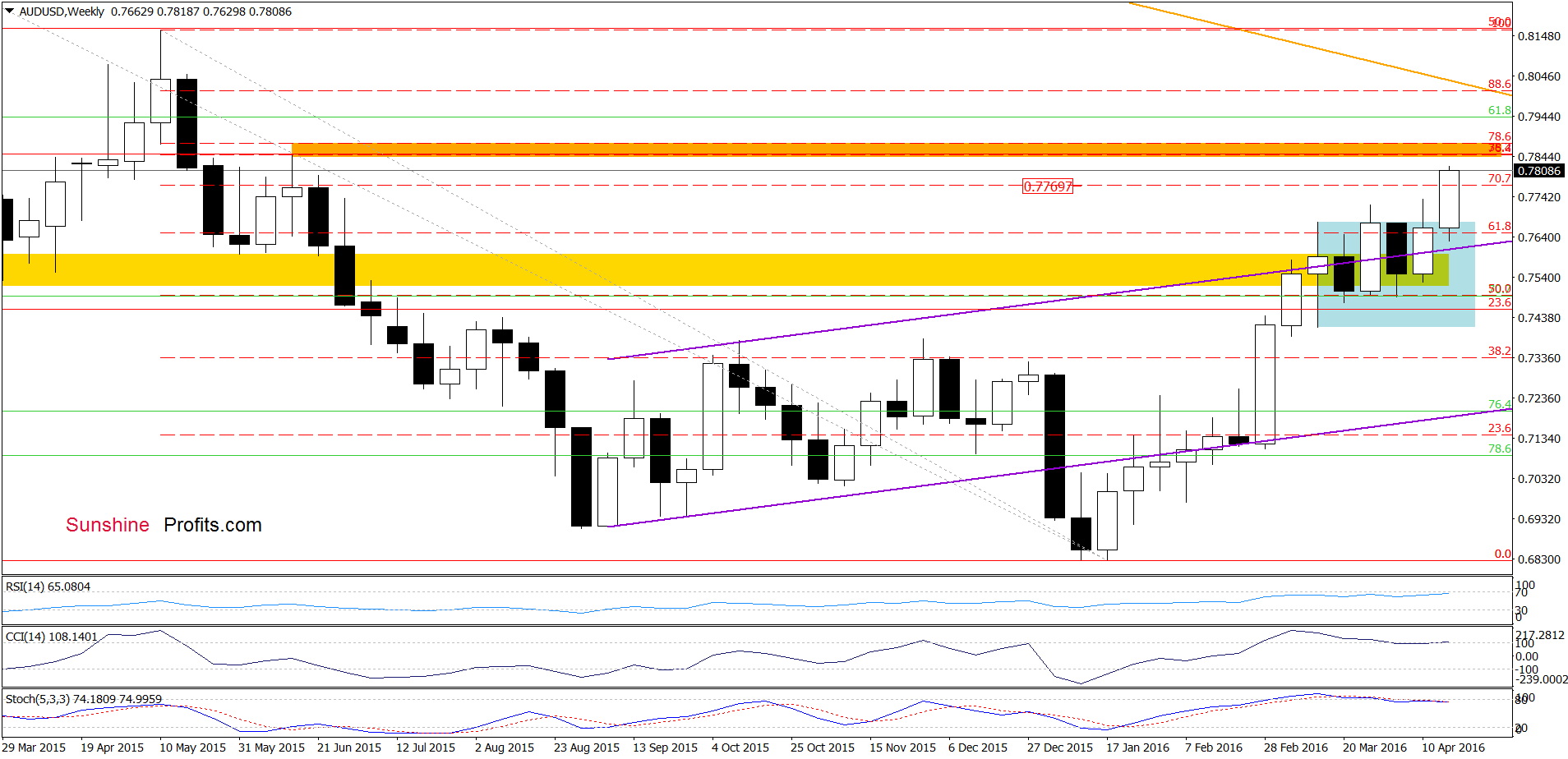

From this perspective, we see that AUD/USD moved sharply higher above the upper line of the blue consolidation, which suggests a test of the orange resistance zone (created by the 76.4% and 78.6% Fibonacci retracement levels based on the May-Jan downward move) in the coming week.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts