Earlier today, the USD Index gave up some gains, but the greenback remains close to a seven month high as hopes that the Federal Reserve will raise interest rates in Dec continued to support the U.S. currency. In this environment, USD/JPY climbed to the key resistance lines. Will we see a breakout in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1476; initial downside target around 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

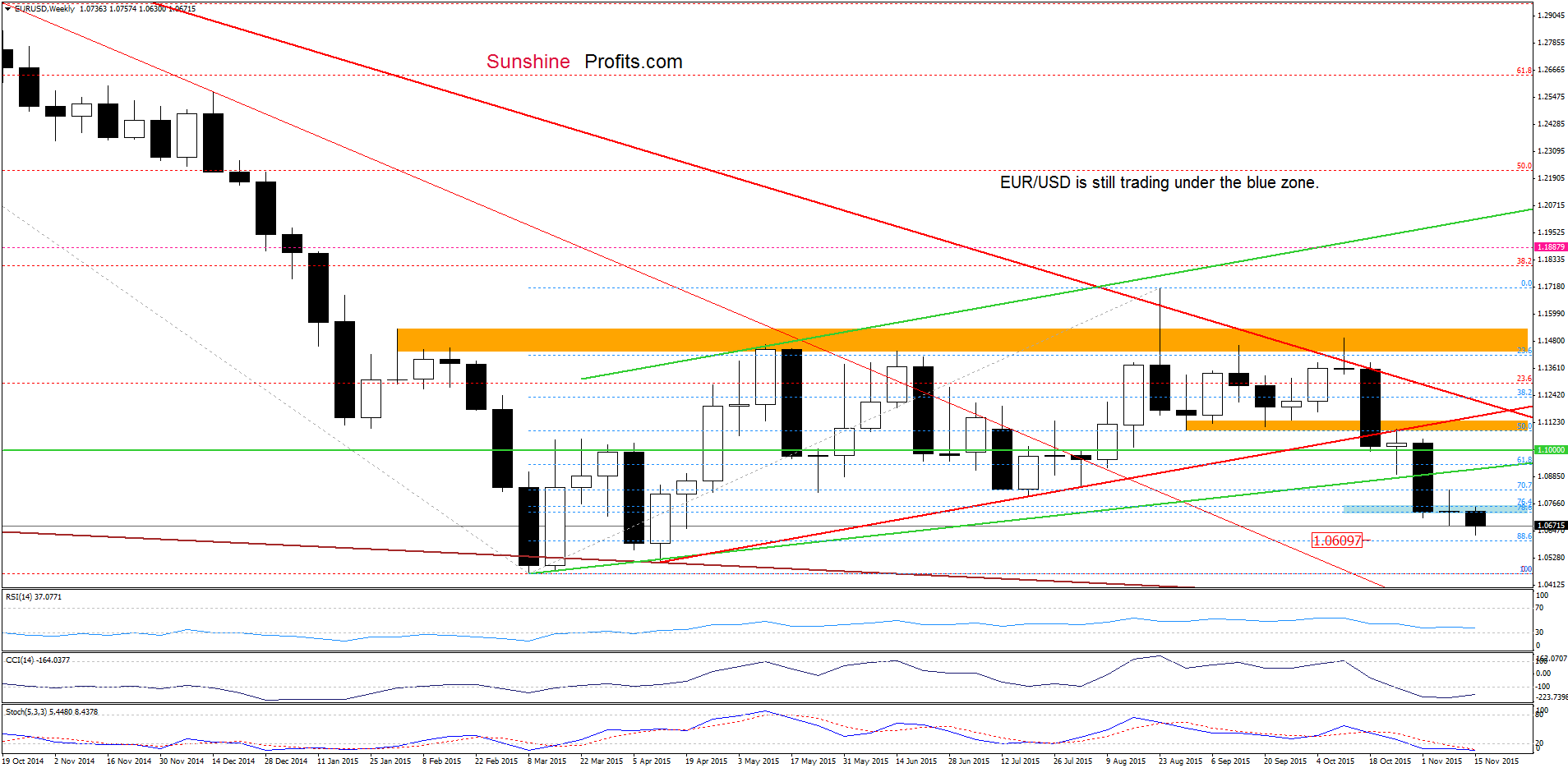

EUR/USD

The situation in the medium term hasn’t changed much as EUR/USD is still trading under the blue resistance zone (created by the 76.4% and 78.6% Fibonacci retracement levels) and last week’s low.

Having said that, let’s focus on the very short-term changes.

Looking at the daily chart, we see that although EUR/USD moved little higher earlier today, the pair remains under the last week’s lows, which suggests that today’s upswing was just a verification of earlier breakdown. If this is the case, currency bears will try to realize the scenario from our Friday’s alert:

(…) If (…) the pair extends losses, (…) we may see a decline to 1.0609, where the 88.6% Fibonacci retracement (marked on the weekly chart) is.

Please note that if this support is broken, the next downside target would be around 1.0562, where the 127.2% Fibonacci extension (based on the Jul-Aug rally) is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.1476 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

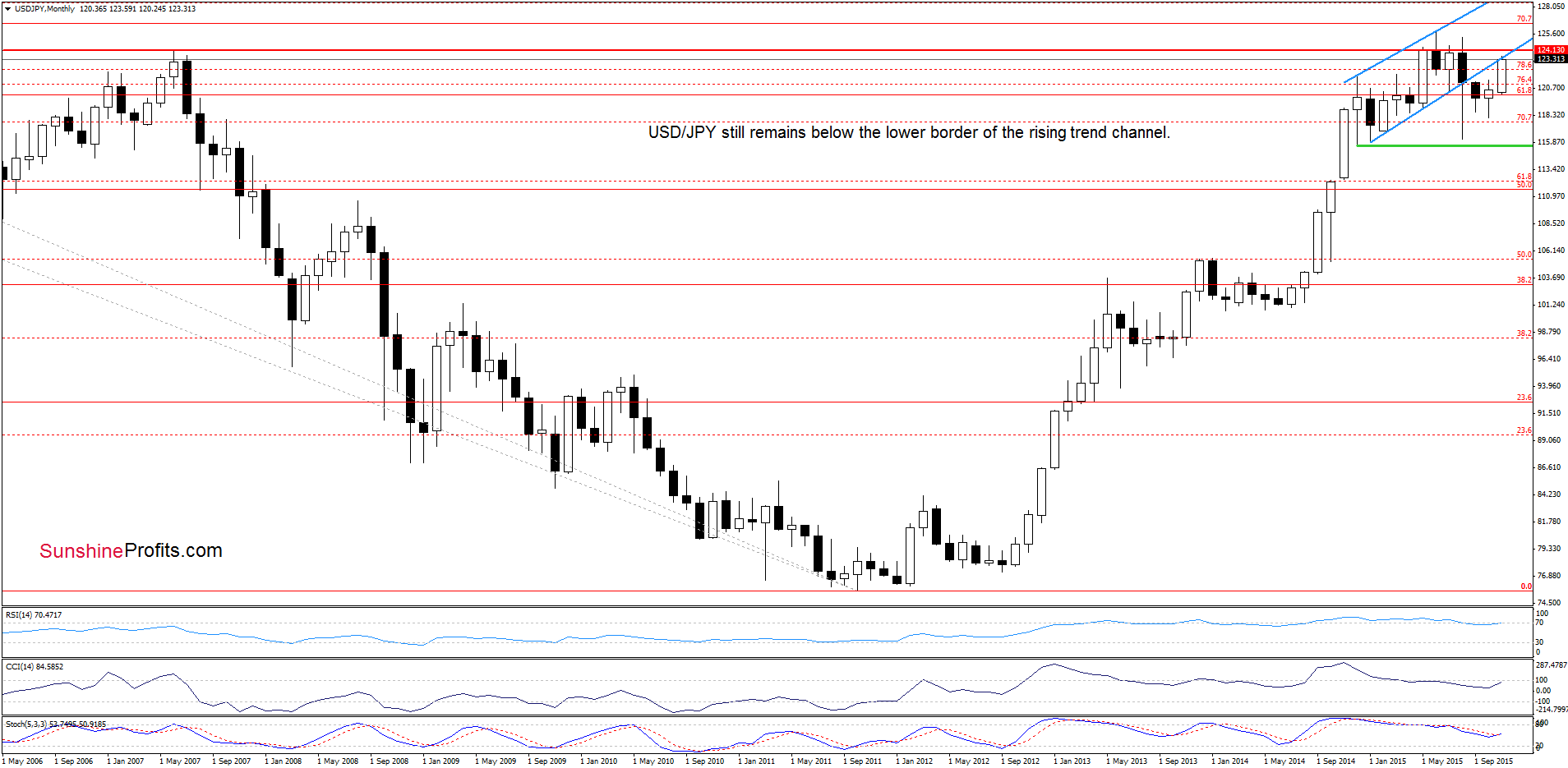

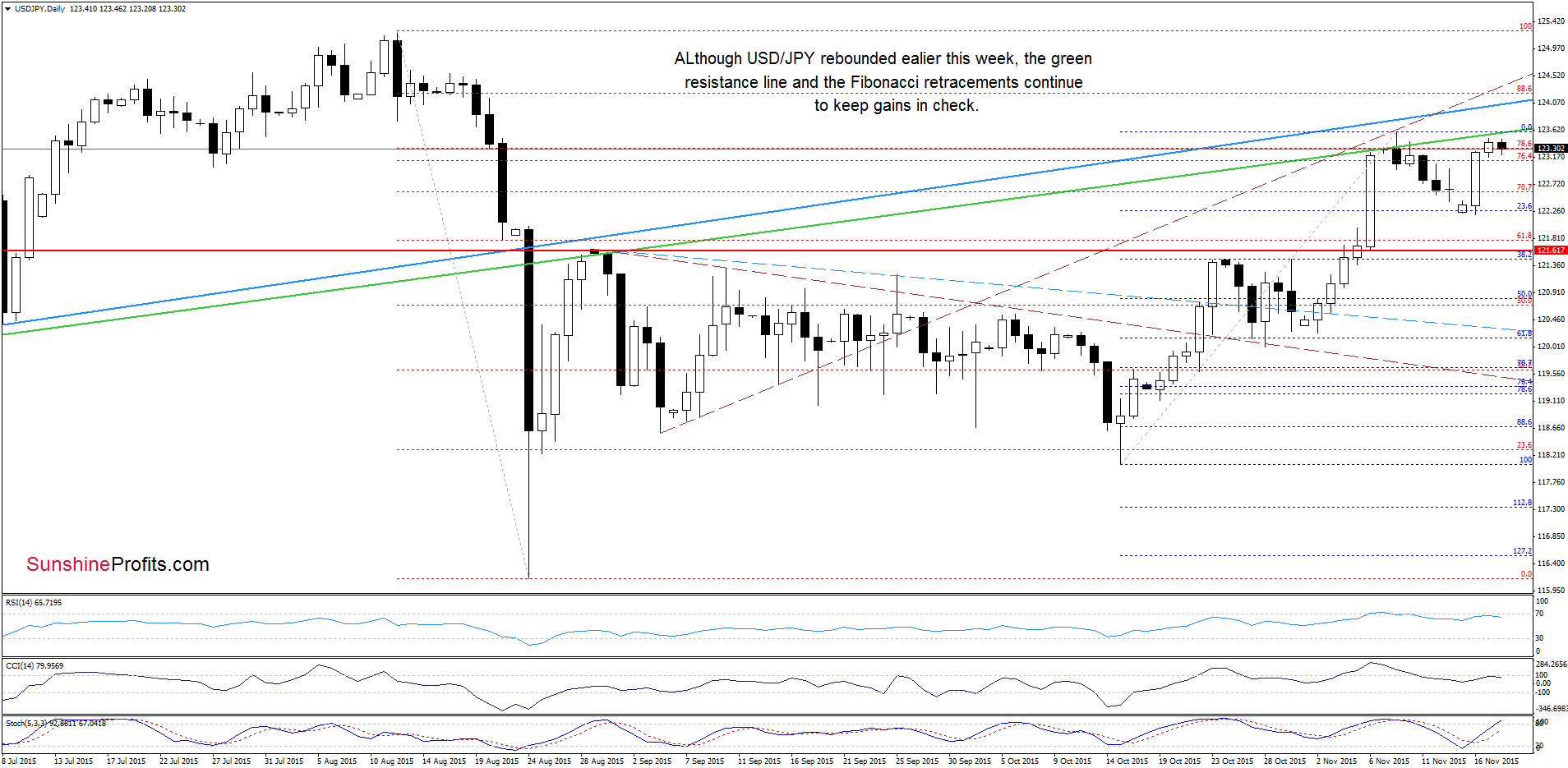

USD/JPY

As you see on the charts, the lower border of the rising trend channel (marked on the monthly chart) and the green resistance line (seen on the daily chart) continue to keep gains in check. Additionally, this area is reinforced by the 76.4% and 78.6% Fibonacci retracement levels, which means that as long as there is no breakout above these lines, further rally is questionable and another pullback should not surprise us. Nevertheless, lower values of the exchange rate will be more likely if all indicators generate sell signals (in his case, the initial downside target would be around 122.21, where the Monday’s low is). Until this time, another attempt t move higher can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

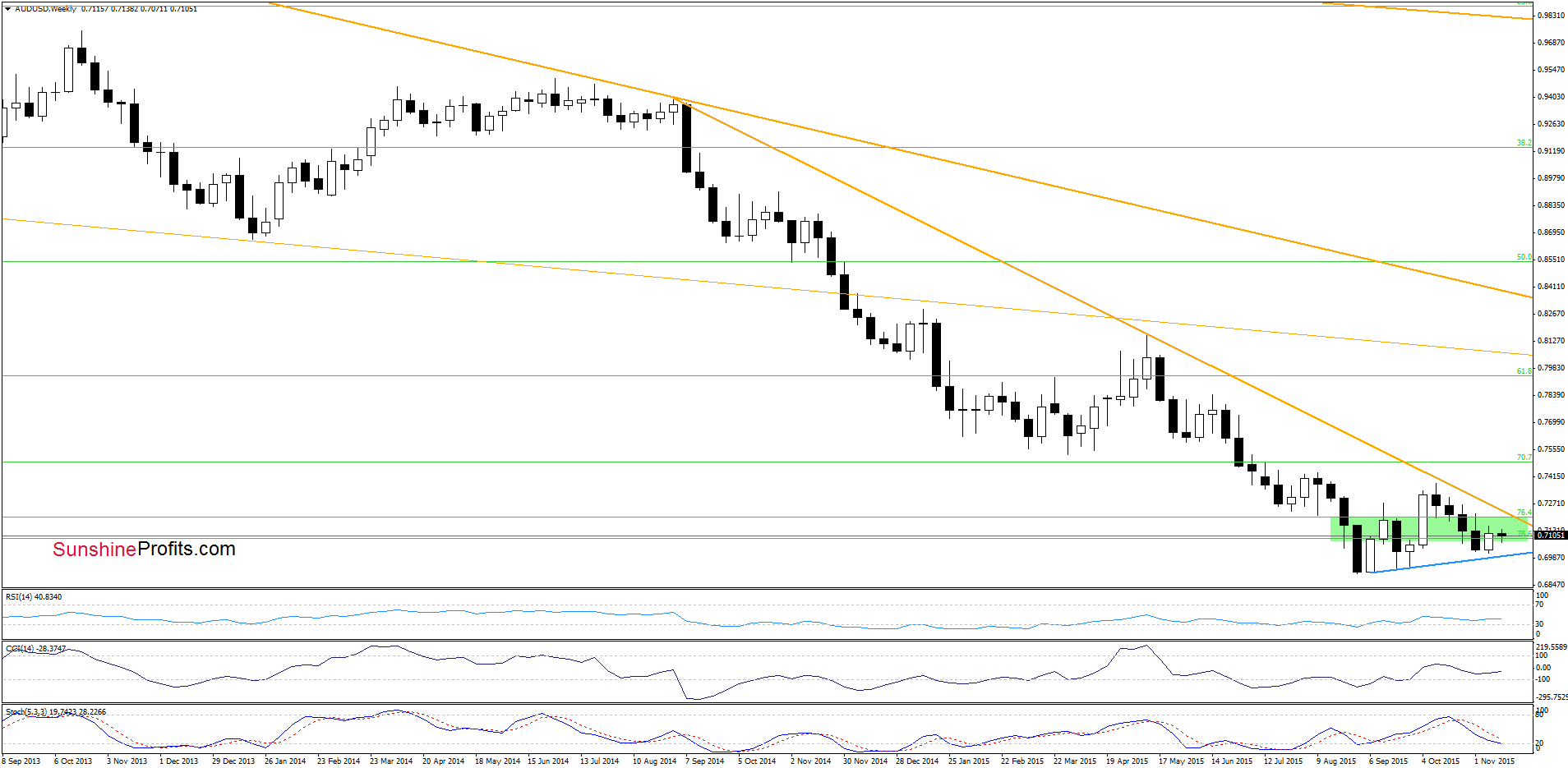

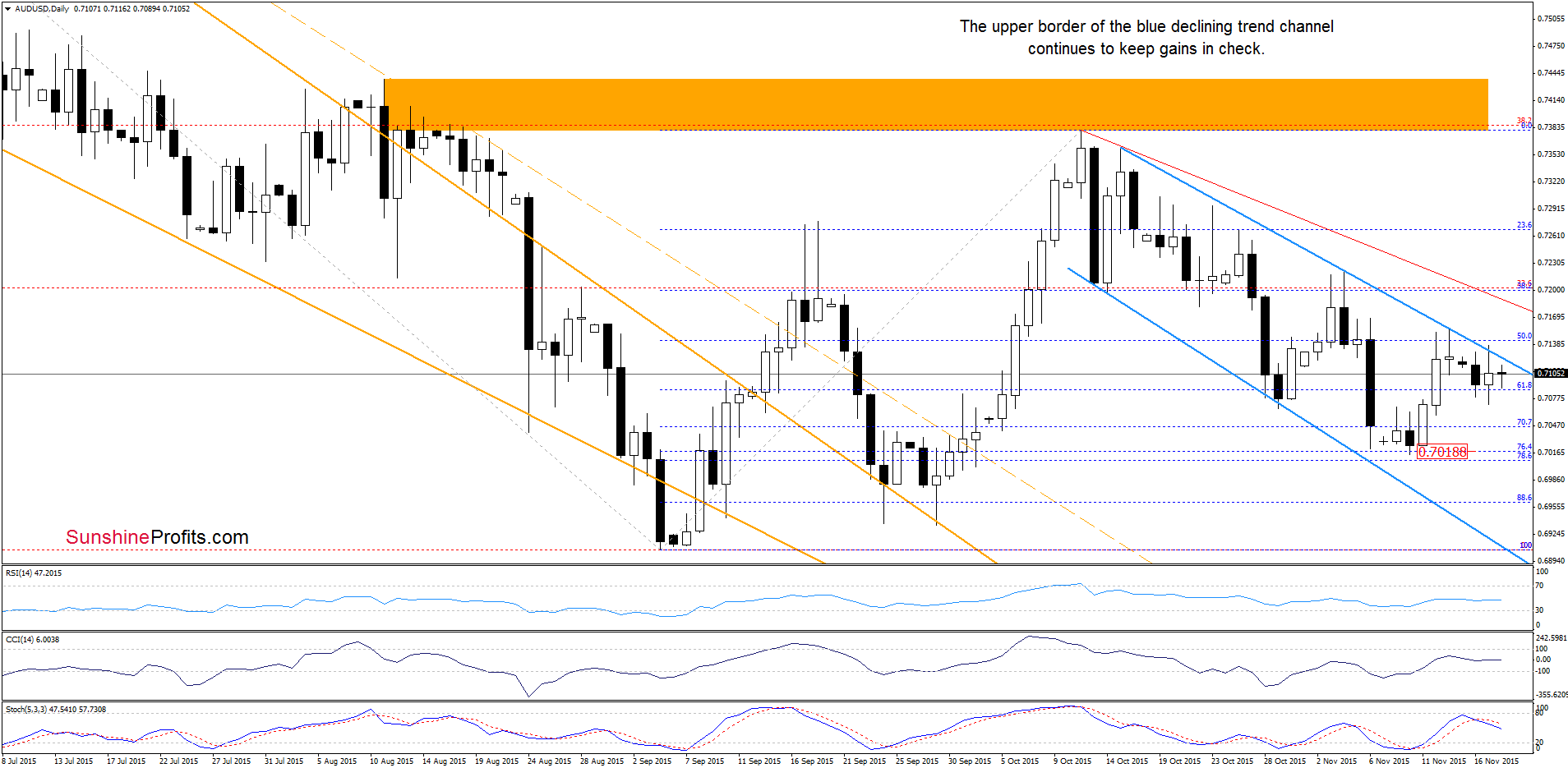

AUD/USD

From today’s point of view, we see that although AUD/USD moved little higher yesterday, the upper border of the declining blue trend channel stopped currency bulls once again, triggering a pullback. Additionally, the Stochastic Oscillator generated a sell signal, which suggests that lower values of the exchange rate in the coming days should not surprise us. In our opinion, if the pair extends losses, the initial downside target would be around 0.7020, where the recent lows and the support zone (created by the 76.4% and 78.6% Fibonacci retracement levels) is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts