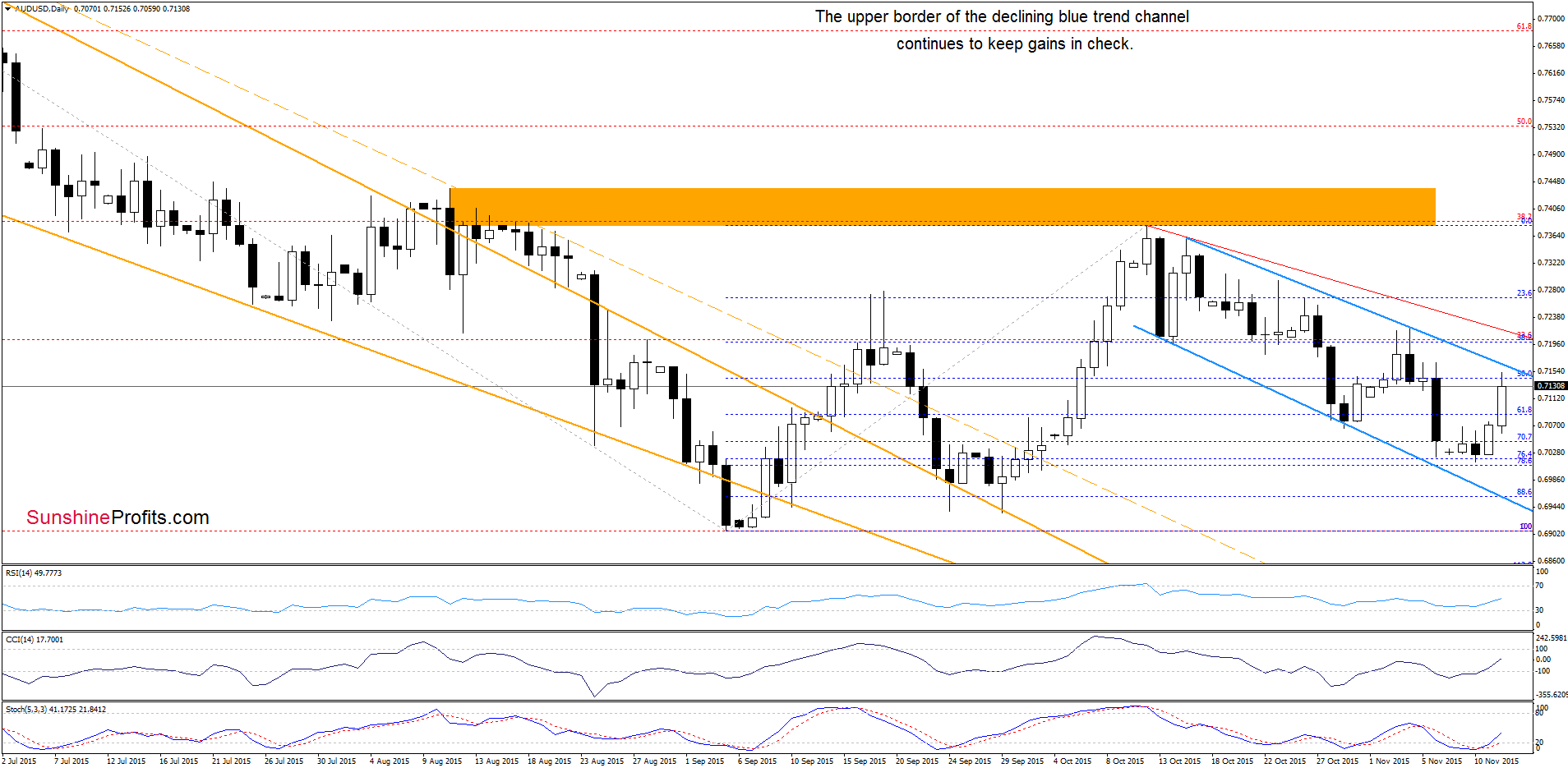

Earlier today, the Australian Bureau of Statistics reported that the number of employed people increased by 58.600 in the previous month, beating analysts’ expectations for a 15.000 rise. Thanks to these bullish numbers, AUD/USD extended gains and re-approached the resistance line. Will we see a breakout in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1476; initial downside target around 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

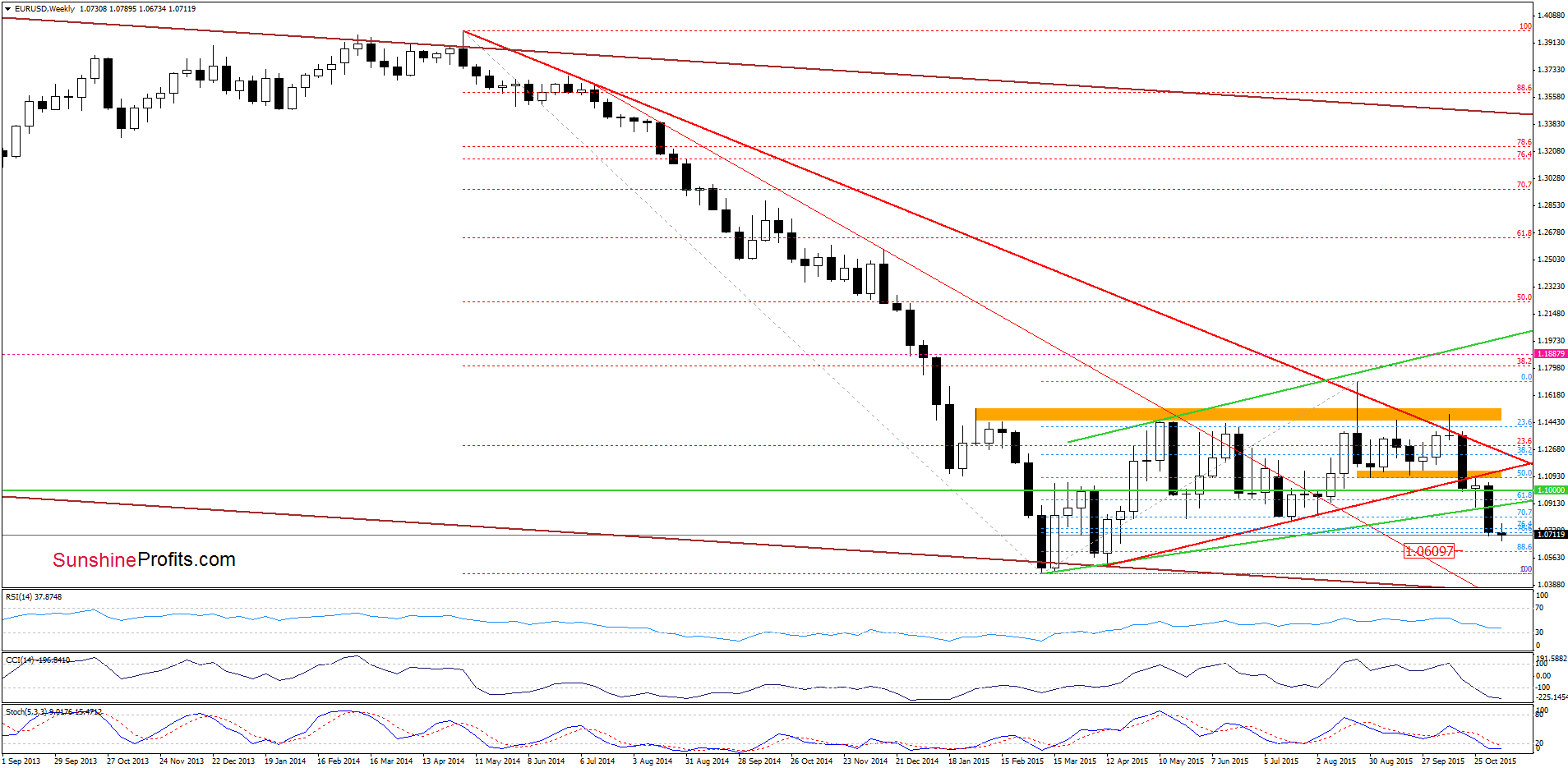

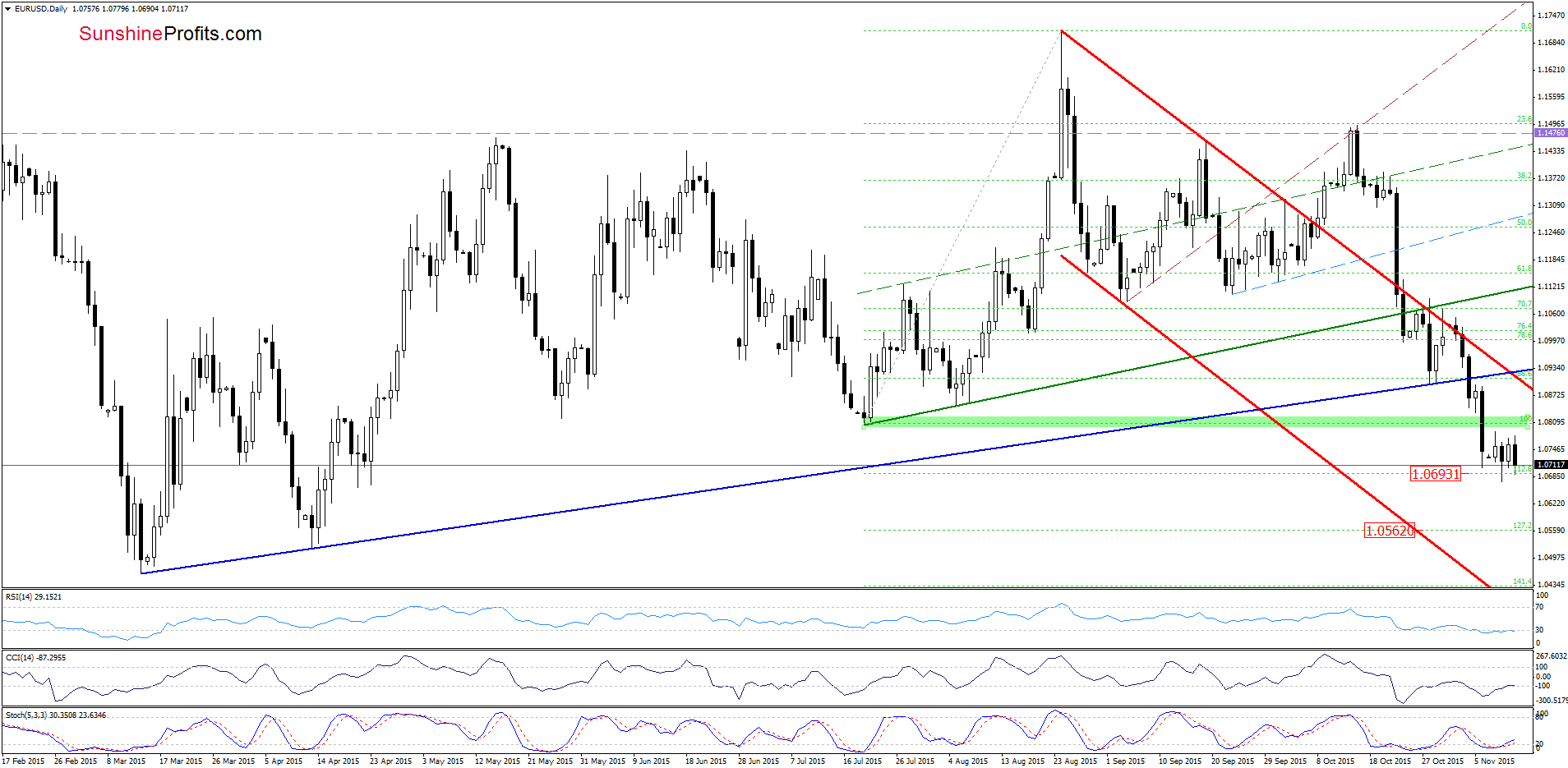

EUR/USD

Quoting our Monday’s alert:

(…) the pair gave up the gains and reversed, which suggests that today’s increase could be a verification of the breakdown under the Jul lows. If this is the case, and the pair extends losses, the first target for currency bears would be around 1.0693, where the 112.8% Fibonacci extension (based on the Jul-Aug rally) is. If this support is broken, we may see a decline to 1.0609, where the 88.6% Fibonacci retracement (marked on the weekly chart) is.

Looking at the charts, we see that the situation developed in line with the above scenario and EUR/USD reached our first downside target. As you see, this support level triggered a small rebound yesterday, but the pair gave up the gains earlier today, which means that we’ll likely see a test f the recent low in the coming day. If is withstands the selling pressure, we’ll see another attempt to climb to the green zone. However if it is broken, the next downside target from our Monday’s alert would be in play.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are profitable) with a stop-loss order at 1.1476 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

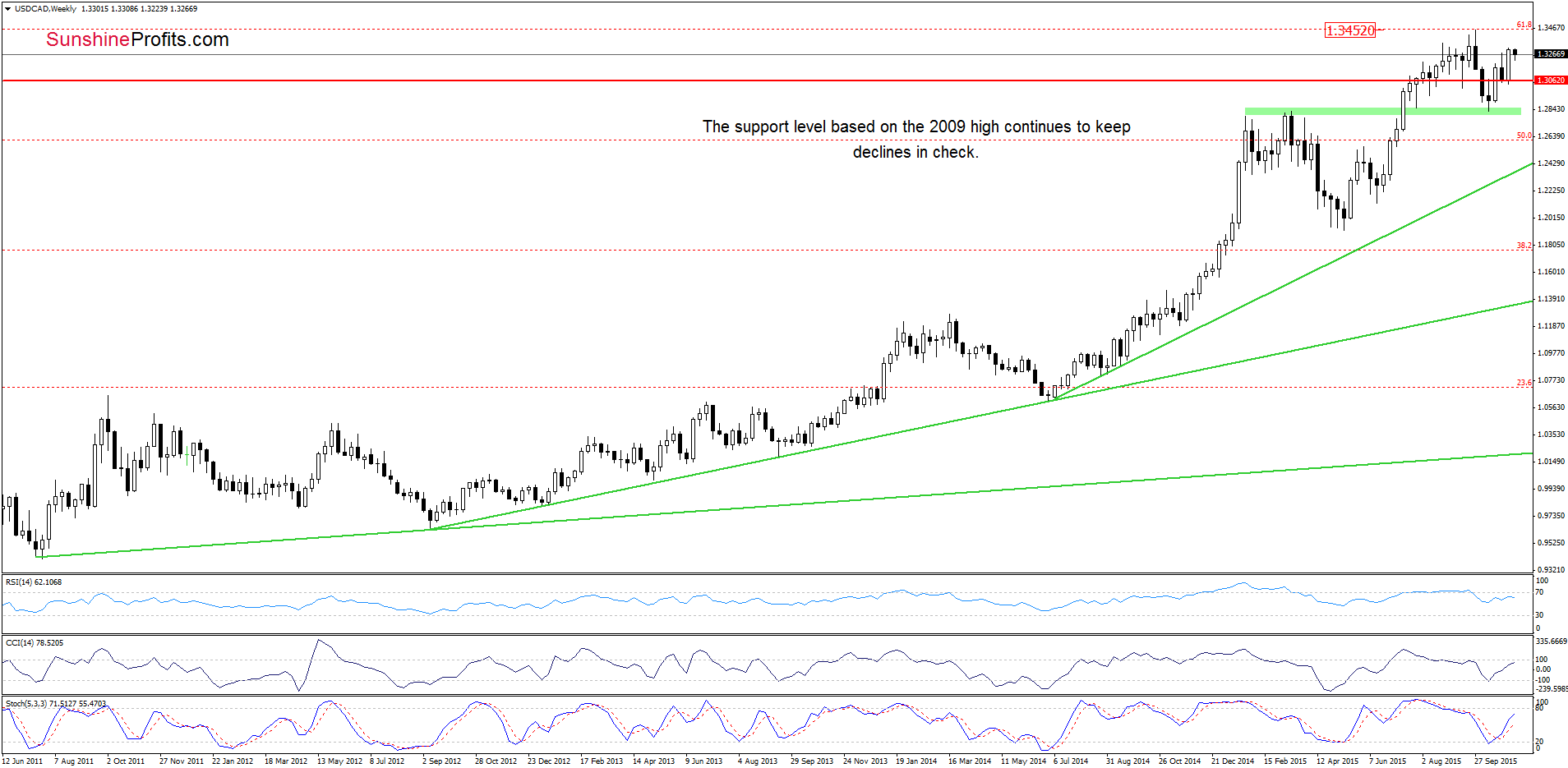

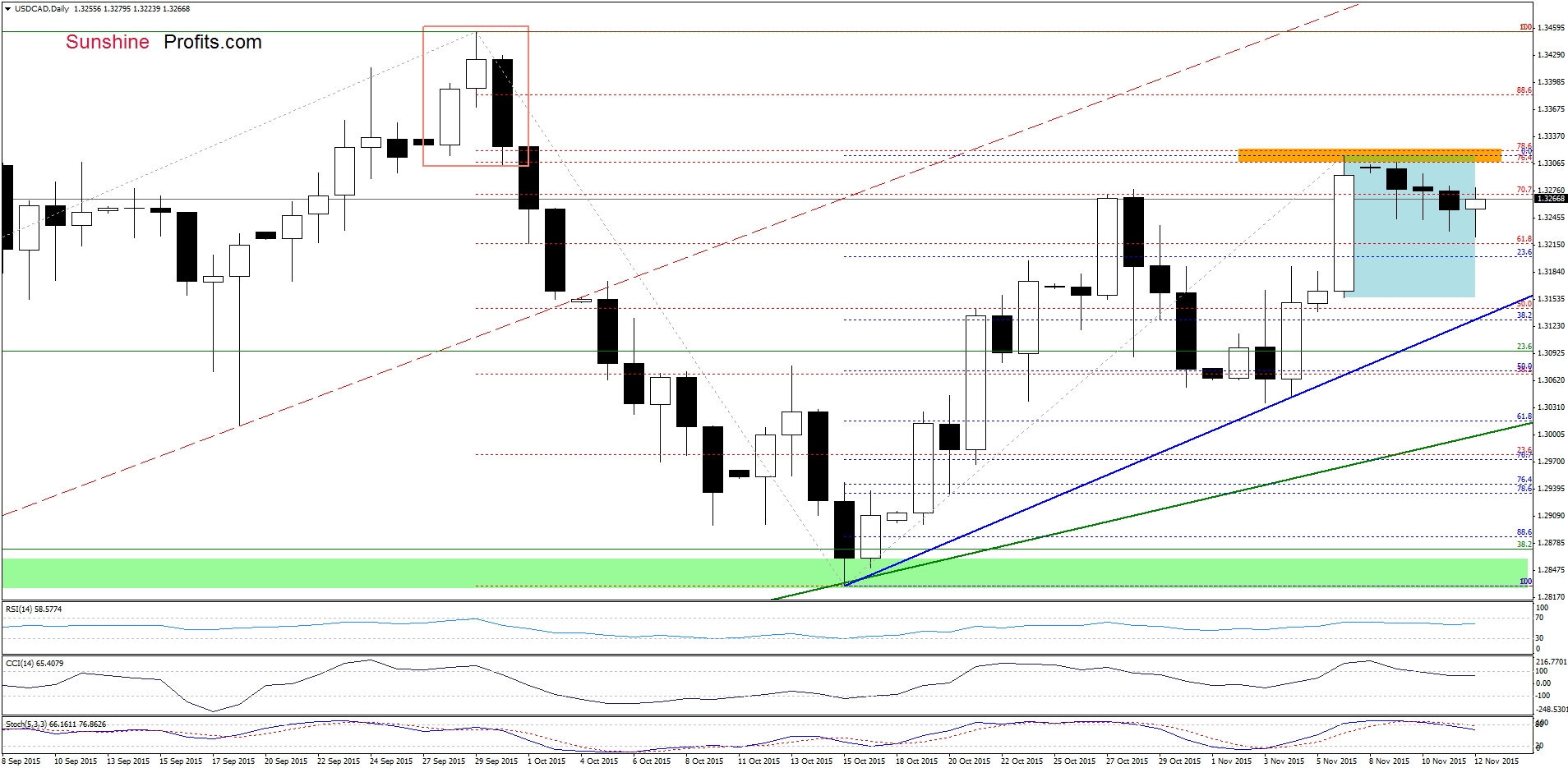

USD/CAD

A week ago, we wrote the following:

(…) the current position of the indicators suggests that currency bulls will try to push the pair higher in the coming days. If we see such price action, the initial upside target would be the barrier of 1.3300 (reinforced by the 70.7% retracement), which stopped the last week’s rally.

Looking at the above charts, we see that currency bulls not only took USD/CAD to our upside target, but also managed to push the pair higher. With this upward move, the exchange rate reached the orange resistance zone (created by the 74.6% and 78.6% Fibonacci retracement levels), which triggered a pullback. Despite this move, USD/CAD remains in the blue consolidation, which means that a breakout above the upper line or a breakdown under the lower border will indicate the direction of future moves.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

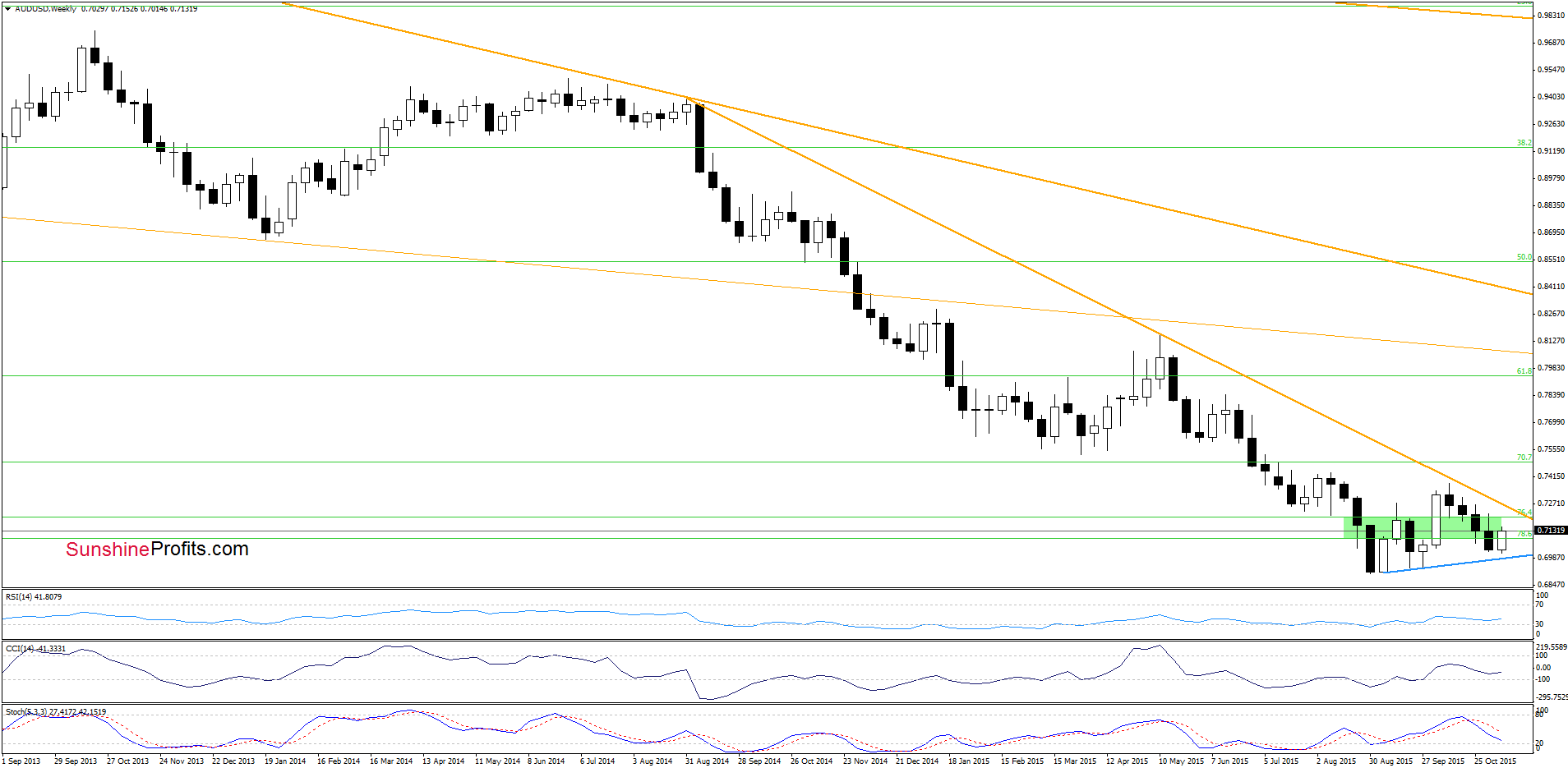

The proximity to the blue support line based on the previous lows encouraged currency bulls to act. As a result, AUD/USD reversed and invalidated earlier breakdown under the lower border of the green support zone, which is a positive signal that suggests further improvement.

But will we see such price action in the coming days? Let’s examine the daily chart and find out.

From this perspective, we see that the proximity to the lower border of the blue trend channel in combination with the support zone created by the Fibonacci retracement levels triggered a rebound in recent days. Despite this improvement, AUD/USD remains under the upper border of the blue declining trend channel, which means that as long as there is no breakout above it further rally is questionable. Nevertheless, the current position of the indicators suggests that currency bulls will try to push the pair higher in the coming day(s).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts