Yesterday, Federal Reserve Chair Janet Yellen indicated during her testimony to the Senate Banking Committee that the bank would no hurry to raise interest rates for “at least the next couple of FOMC meetings”. This news pushed the U.S. dollar lower against its Canadian counterpart, which resulted in another breakdown under the long-term support/resistance line. Third time lucky?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: long (stop loss order at 1.1056)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (stop loss order at 1.2876)

- USD/CHF: none

- AUD/USD: none

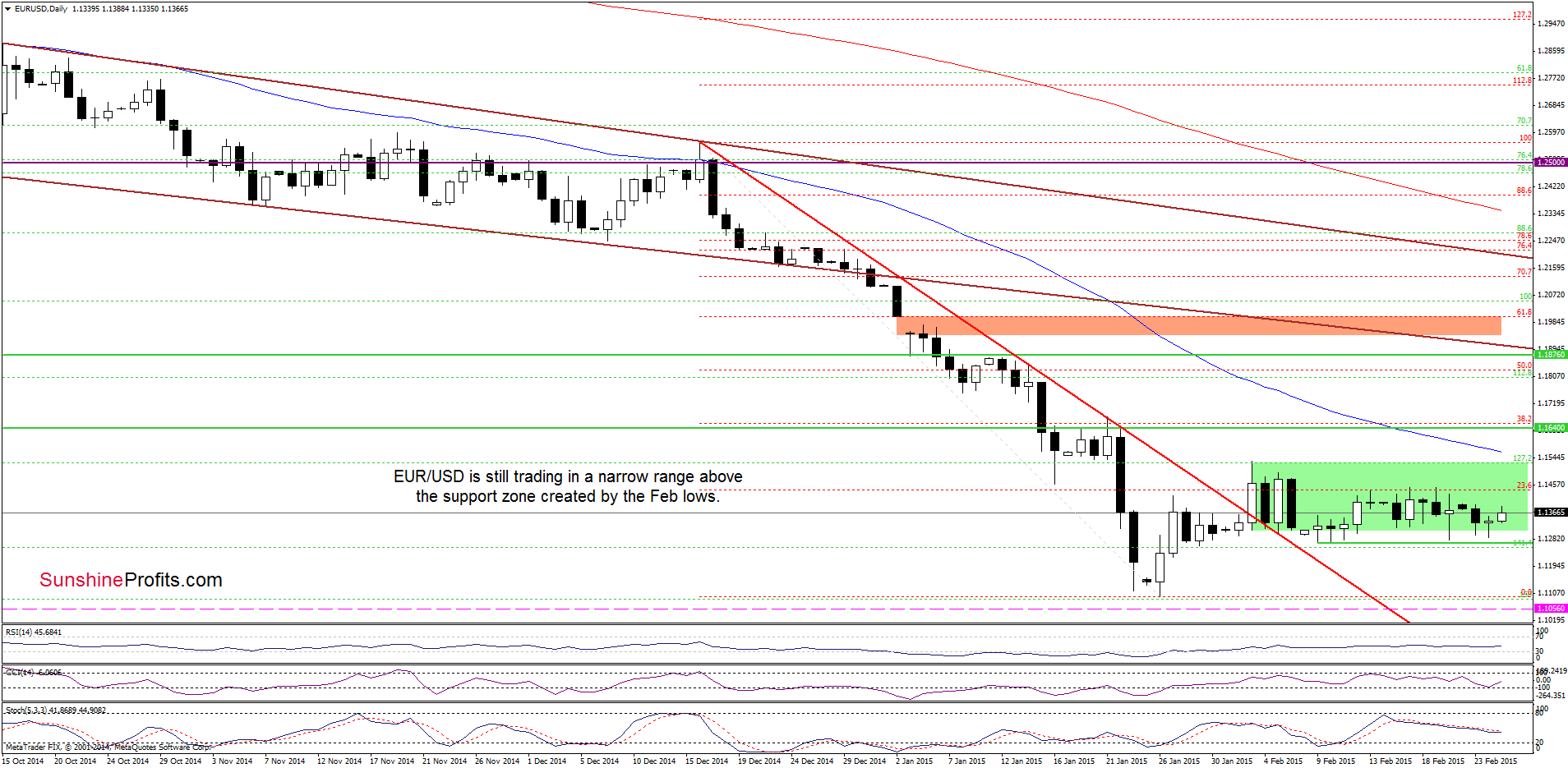

EUR/USD

The medium-term term picture remains almost unchanged as EUR/USD still remains above the support zone created by the 61.8% Fibonacci retracement (based on the entire 2000-2008 rally) and the 100% Fibonacci price projection, which means that an invalidation of the breakdown below these levels and its positive impact on the exchange rate are still in effect.

Once we know the above, let’s focus on the very short-term changes.

As you see on the daily chart, the support zone created by the Feb lows withstood the selling pressure, which triggered a rebound and a comeback to the consolidation (marked with green). This is a positive sign, which suggests that another upswing or a post double-bottom rally is still likely (especially when we factor in the medium-term picture). Nevertheless, in our opinion, this scenario will be more likely if we see a breakout above the last week’s highs around 1.450.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Long positions with a stop loss order at 1.1056 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

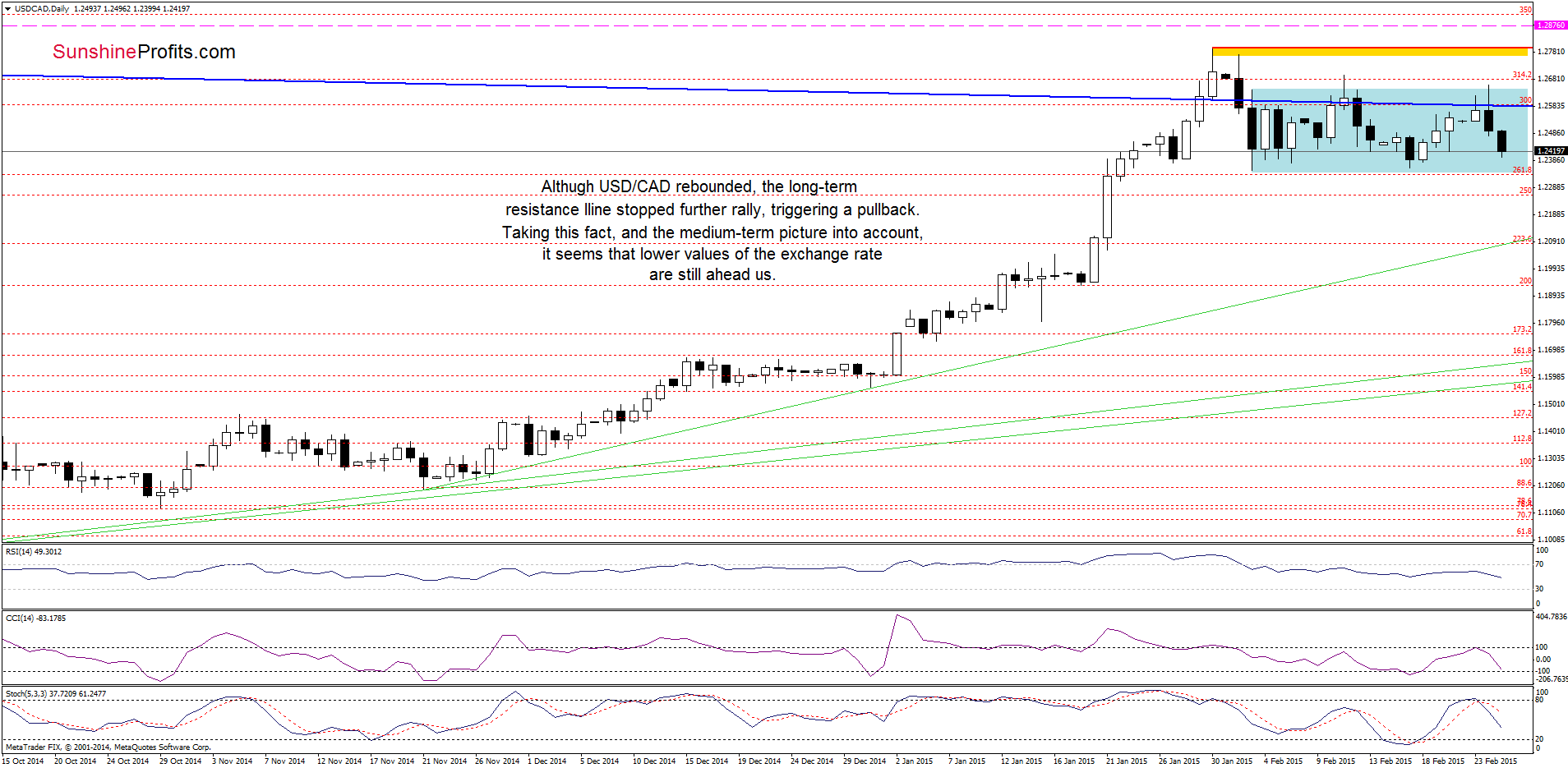

USD/CAD

The situation in the medium-term has deteriorated as USD/CAD invalidated the breakout above the 88.6% Fibonacci retracement once again. This is a bearish signal, which suggests further deterioration and a drop to the 23.6% (around 1.2275) or even 38.2% (at 1.1973) Fibonacci retracement based on the entire Jun-Jan rally in the coming week. Additionally, the CCI and Stochastic Oscillator generated sell signals, supporting the bearish case.

Having said that, let’s check what can we infer from the daily chart.

The first thing that catches the eye on the above chart is another invalidation of the breakout above the blue long-term resistance line. We saw similar situations in the previous weeks. In all previous cases, such price action triggered pullbacks to around 1.2351-1.2361. Taking this fact into account, and combining it with the medium-term picture and the current position of the indicators (the CCI and Stochastic Oscillator generated sell signals), we think that the next move will be to the downside and the initial downside target will be the above-mentioned support area.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop loss order at 1.2876 are still justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

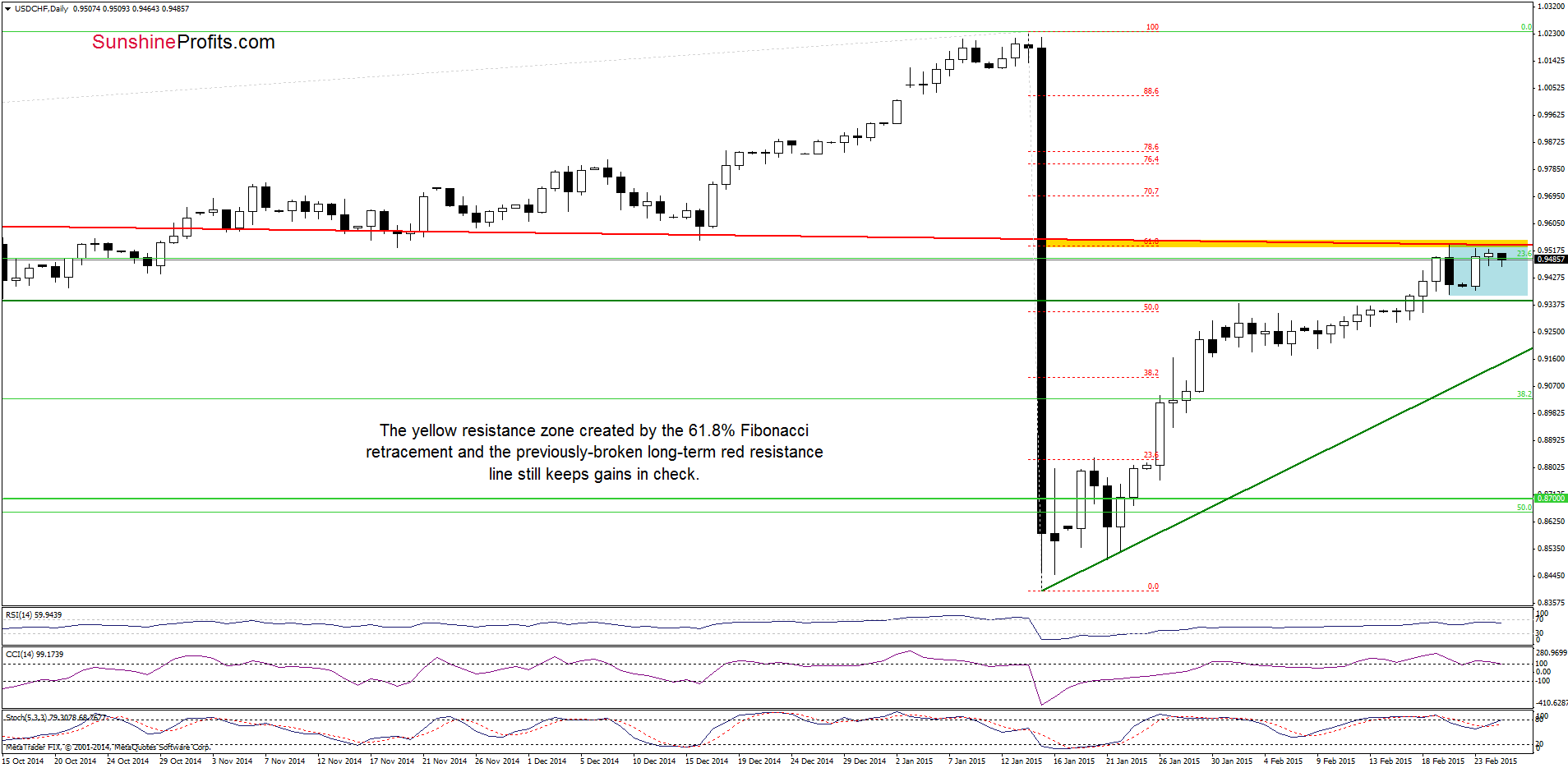

USD/CHF

Looking at the above chart, we see that USD/CHF remains in a consolidation (marked with blue), which means that a breakout/breakdown will indicate the direction of future moves. Nevertheless, taking into account the yellow resistance zone (created by the previously-broken long-term red declining resistance line and the 61.8% Fibonacci retracement) and the current position of the indicators, it seems that lower values of the exchange rate are just around the corner. In our opinion, the bearish scenario will be more likely if the exchange rate drops under 0.9374 in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts