Earlier today, the Federal Reserve Bank of New York showed that its manufacturing index increased to 10.2 in November from a reading of 6.2 in the previous month. Additionally, a separate report showed that U.S. industrial production rose 0.2% last month. Thanks to these posivive numbers AUD/USD reversed and slipped to the key support line. Will it withstand another test?

In our opinion the following forex trading positions are justified - summary:

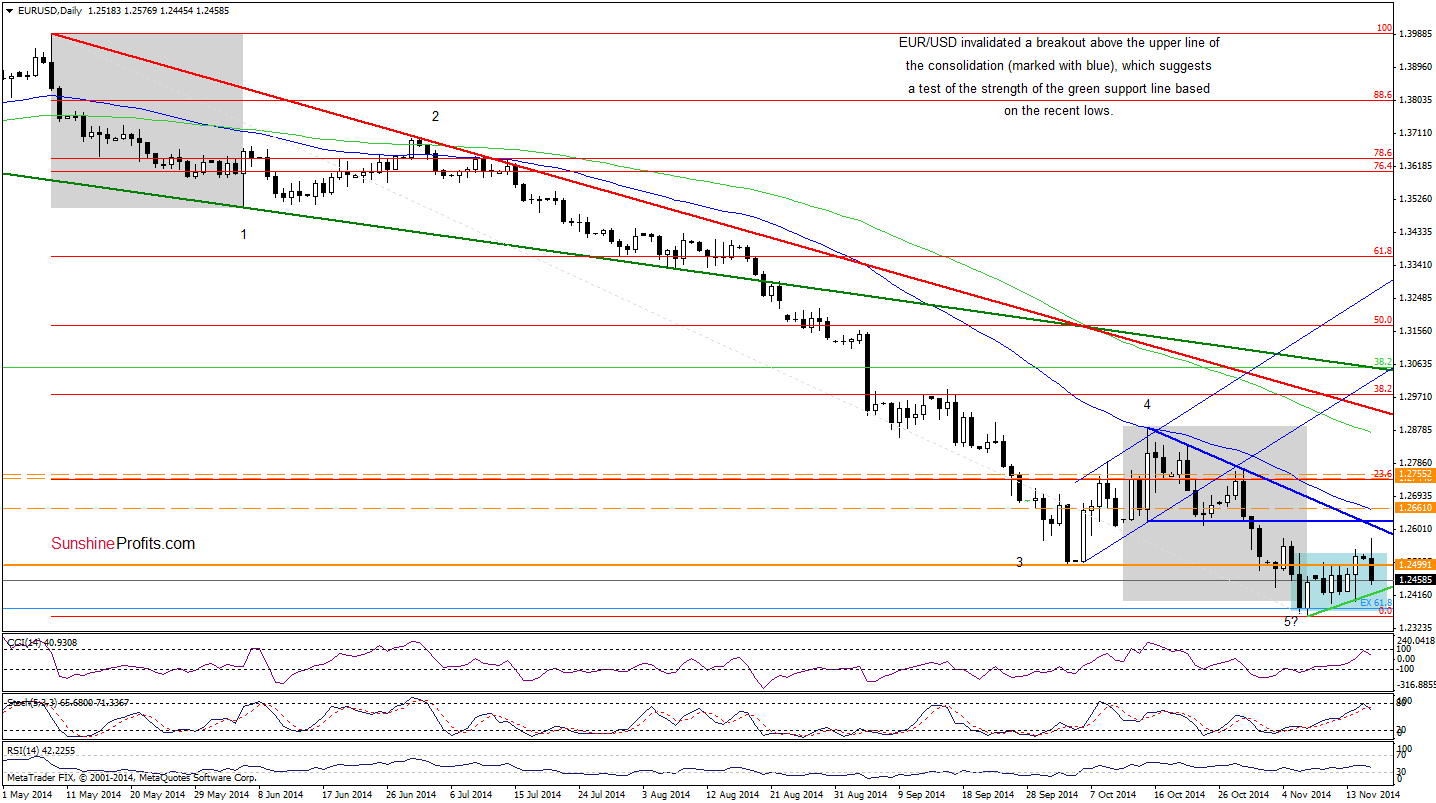

EUR/USD

The medium-term picture of EUR/USD hasn’t changed much as the exchange rate is still trading around the 127.2% Fibonacci extension. Will the daily chart show us where will the pair head next?

From this perspective, we see that although EUR/USD moved higher and broke above the upper line of the consolidation (marked with blue) earlier today, the pair reversed and slipped below the level of 1.2500 once again. This is a negative signal, which suggests further deterioration and a drop to the green support line based on the recent lows (currently around 1.2417) or even to the lower border of the consolidation (around 1.2364) in the coming days. Please note that this scenario is currently reinforced by the position of the indicators (the CCI reversed, while the Stochastic Oscillator generated a sell signal).

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

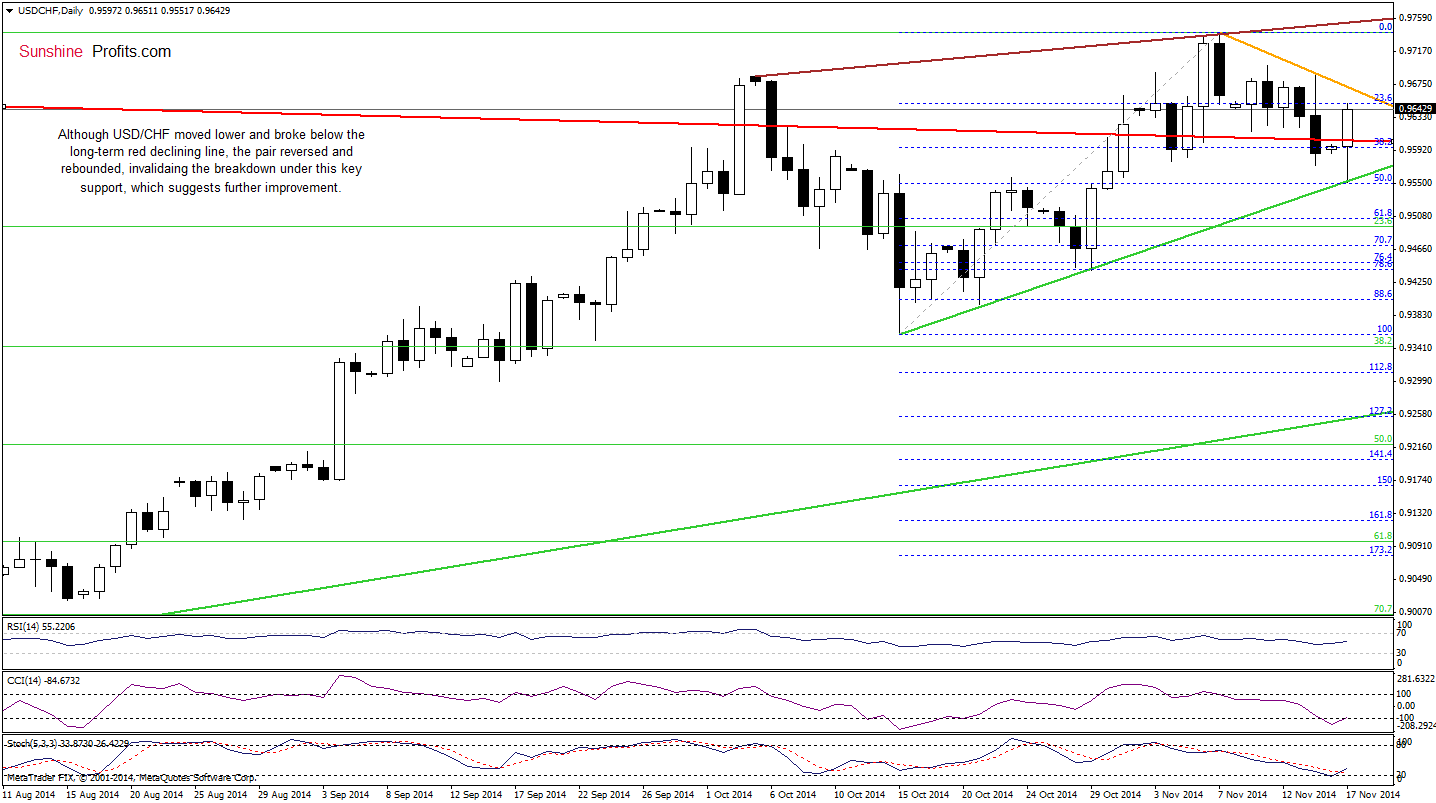

USD/CHF

On Friday, we wrote the following:

The overall situation has deteriorated earlier today as USD/CHF moved lower and broke below the key support – the long-term red line. This is a bearish signal (…), which suggests a test of the strength of the green support line seen on the daily chart (currently around 0.9555). Please note that the current position of the indicators supports the bearish case.

Looking at the daily chart, we see that the situation developed in line with the above-mentioned scenario as the exchange rate dropped to our downside target earlier today. As you see, this strong support encouraged currency bulls to act and resulted in a corrective upswing later in the day. With this move, the pair invalidated the breakdown below the long-term red line, which is a strong positive signal that suggests further improvement and an increase to at least the orange resistance line (currently around 0.9672). If it’s broken, we could see a rally to the recent high or even to the brown resistance line (around 0.9752). At this point, it’s worth noting that the CCI and Stochastic Oscillator generated buy signals, supporting the bullish case.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

On the above chart, we see that although AUD/USD extended gains earlier today, the proximity to the upper line of the very short-term rising trend channel (marked with blue) was enough to trigger a pullback. As a result, the exchange rate erased 38.2% of the recent rally and approached the previously-broken green support line. If it holds (similarly to what we saw last week), we’ll see another attempt to break above the upper line of the formation. However, taking into account the current position of the indicators, it seems that the pair will move lower and test the strength of the lower line of the trend channel (currently around 0.8665) in the coming days. Please note that this area is supported by the 50% Fibonacci retracement based on the recent upward move, which could pause or stop further deterioration.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts